Pennsylvania Limited Liability Company LLC Formation Package

Description

How to fill out Pennsylvania Limited Liability Company LLC Formation Package?

Creating documents isn't the most easy task, especially for those who rarely deal with legal paperwork. That's why we advise utilizing accurate Pennsylvania Limited Liability Company LLC Formation Package templates made by professional attorneys. It allows you to prevent difficulties when in court or handling official institutions. Find the documents you need on our website for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the file page. Soon after getting the sample, it will be stored in the My Forms menu.

Customers with no a subscription can quickly create an account. Look at this brief step-by-step guide to get your Pennsylvania Limited Liability Company LLC Formation Package:

- Make certain that the document you found is eligible for use in the state it is necessary in.

- Confirm the file. Use the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or return to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these easy steps, you can complete the sample in a preferred editor. Recheck completed info and consider requesting an attorney to review your Pennsylvania Limited Liability Company LLC Formation Package for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

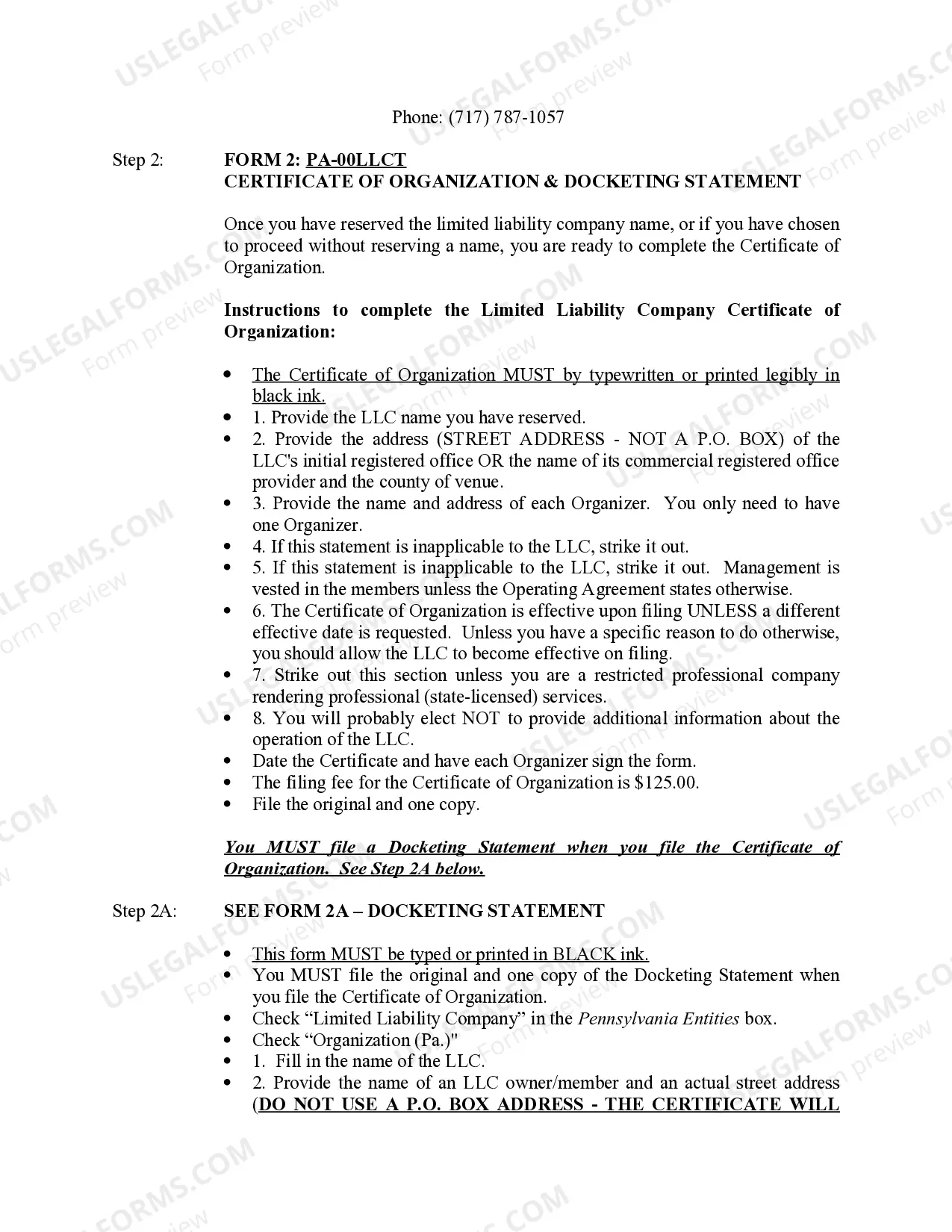

LLCs are formed by filing articles of organization with the secretary of state's office.Depending on the state, the filing fee varies, and the articles of organization may be referred to as a different name, like the certificate of formation.

A limited liability company (LLC) is a hybrid unincorporated business structure that combines the pass-through tax model of partnerships and sole proprietorships with the protection of individual assets provided by the C corporation.Unlike a corporation, the LCC is not considered a separate entity.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. Expedited Processing will reduce that time to about 10 business days or less with the exception of just a few states.

200bThe LLC filing fee is a one-time fee paid to the state to form your LLC. What's the LLC Annual Fee? 200bThe LLC annual fee is an ongoing fee paid to the state to keep your LLC in compliance and in good standing. It's usually paid every 1 or 2 years, depending on the state.

Unlike most states, Pennsylvania does not require LLCs to file an annual report.An annual fee of $520 times the number of members of the LLC must be paid.

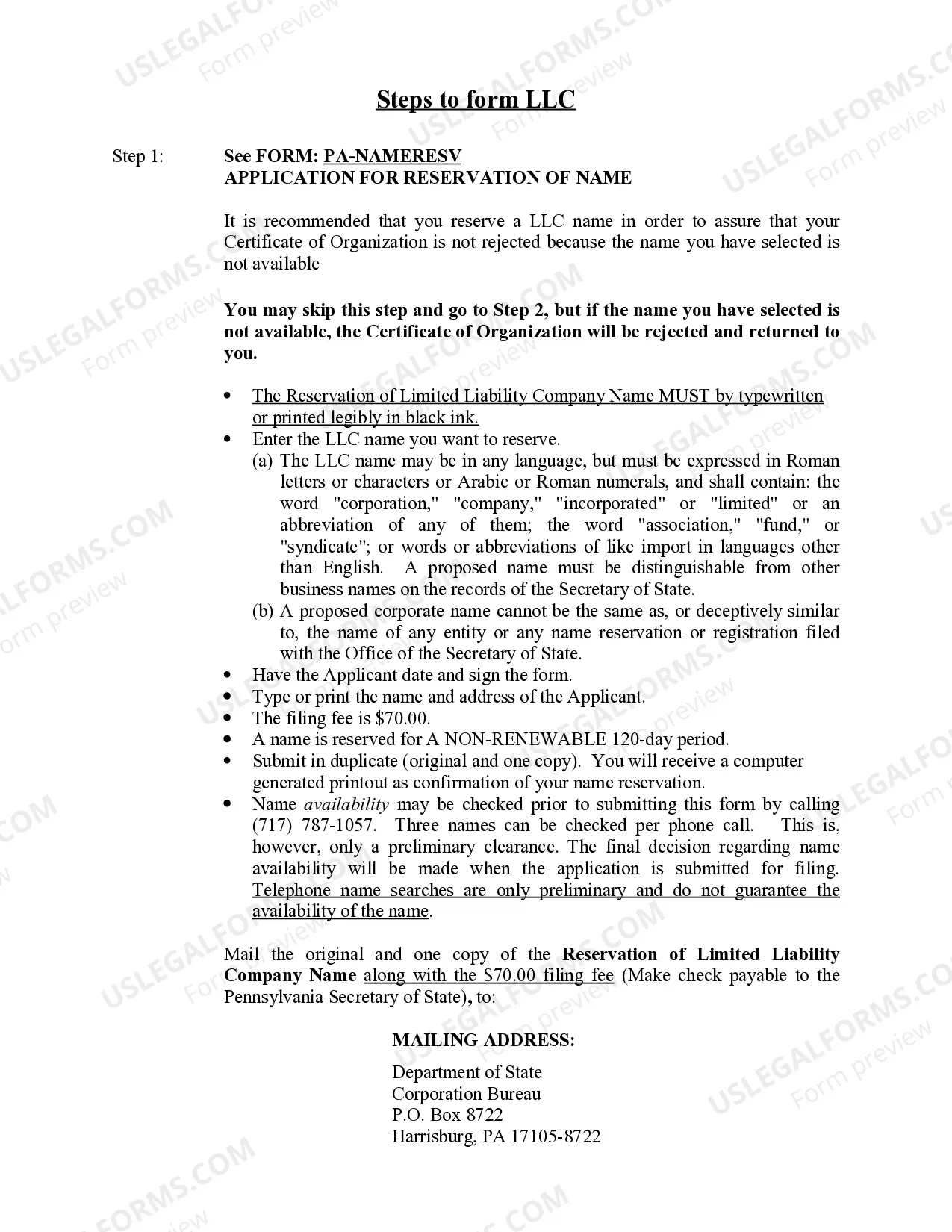

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

Obtain the LLC Articles of Organization. Assign or be the Erie Registered Agent. An Operating Agreement is Required in addition to the Articles of Organization. Register for Other Licensing and Tax Registrations. Registering as a Foreign LLC.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

After filing your PA LLC online, the state will approve it in 7-10 business days. The state will send you an email with two download links. One will be your Acknowledgement Letter and the other will be your stamped and approved Certificate of Organization (Filing).