Satisfaction - Release of Mortgage by Mortgagee - by Corporate Lender

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

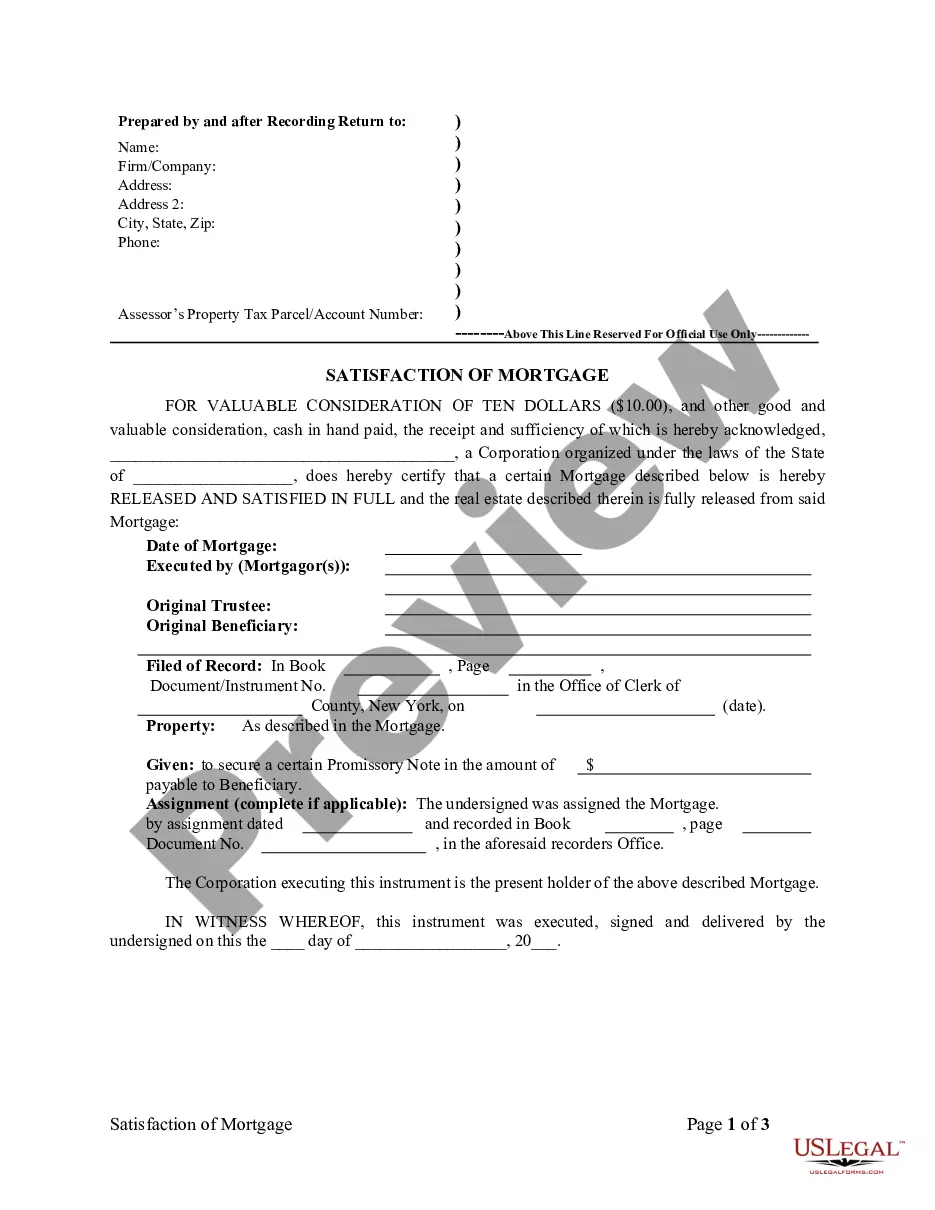

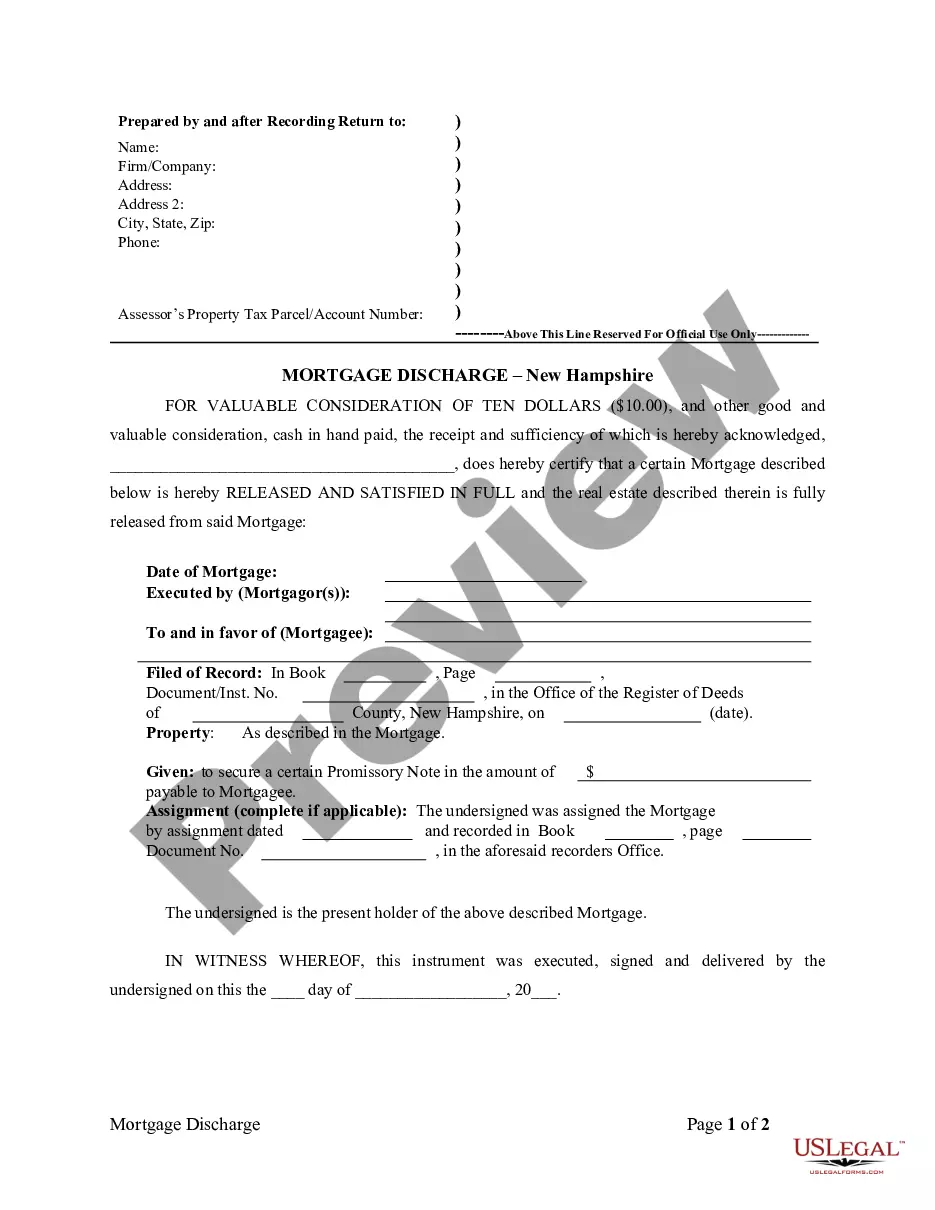

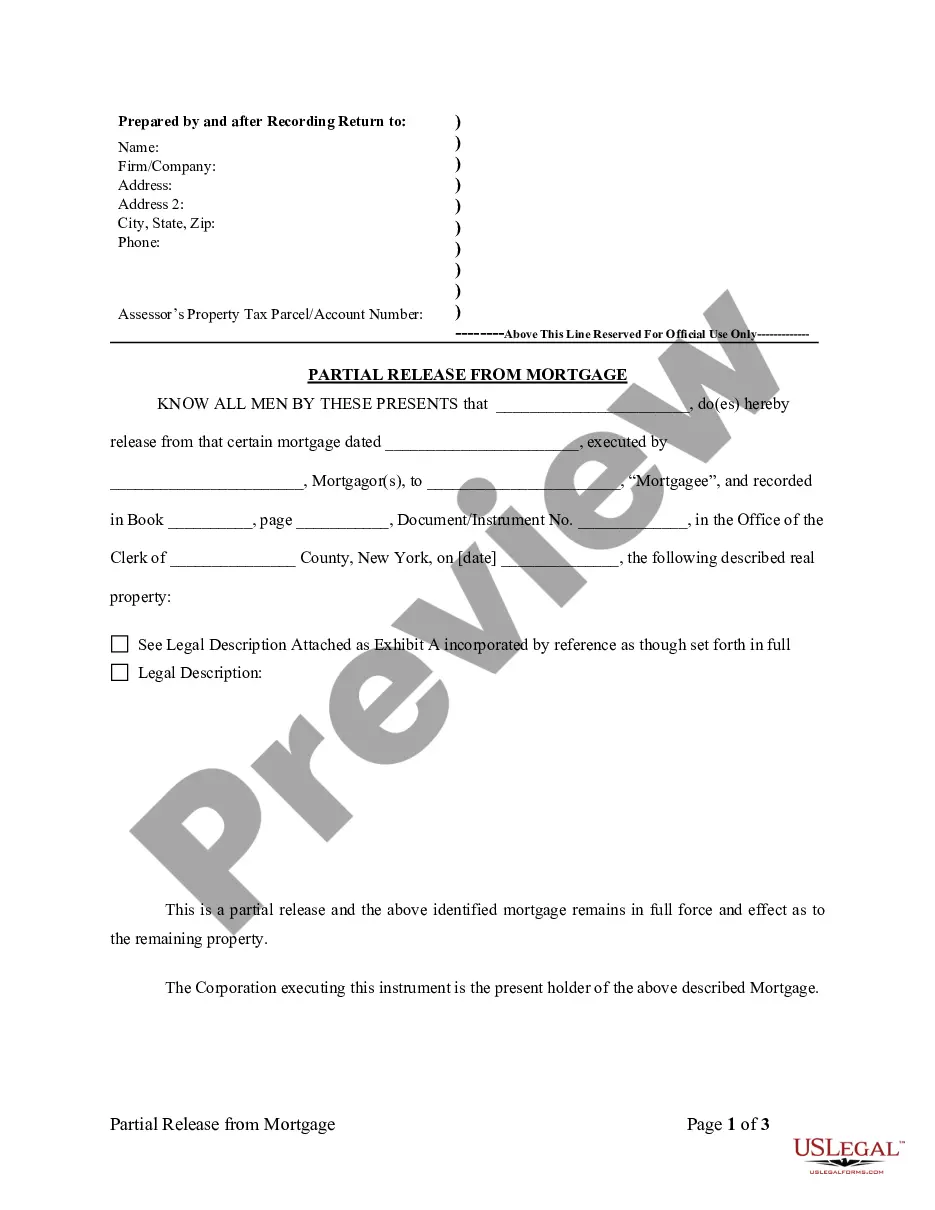

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

New York Law

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Not required.

Recording Satisfaction: After full payoff, mortgagee, unless otherwise requested in writing by mortgagor, must execute and acknowledge before a proper officer a satisfaction of mortgage, and thereupon within forty-five days arrange to have the satisfaction of mortgage either presented for recording to the recording officer of the county where the mortgage is recorded, or, if so requested,to the mortgagor.

Marginal Satisfaction: Not allowed. Mortgage must be satisfied by recording of separate instrument of release.

Penalty: The Court shall award costs and reasonable attorney's fees to the debtor, in the absence of the showing of a valid reason for the failure or refusal by the mortgagee to execute the satisfaction of mortgage and deliver the same.

Acknowledgment: An assignment or satisfaction must contain a proper New York acknowledgment, or other acknowledgment approved by Statute.

New York Statutes

Sec. 275. Certificate of discharge of mortgage required. [But see also, sec. 1921, below.]

1. Whenever a mortgage upon real property is due and payable, and the full amount of principal and interest due on the mortgage is paid, a certificate of discharge of mortgage shall be given to the mortgagor or person designated by him or her, signed by the person or persons specified in section three hundred twenty-one of this chapter. The person signing the certificate shall, within thirty days thereafter, arrange to have the certificate presented for recording to the recording officer of the county where the mortgage is recorded. Failure by a mortgagee to present a certificate of discharge for recording shall result in the mortgagee being liable to the mortgagor in the amount of five hundred dollars if he or she fails to present such certificate within thirty days, shall result in the mortgagee being liable to the mortgagor in the amount of one thousand dollars if he or she fails to present a certificate of discharge for recording within sixty days and shall result in the mortgagee being liable to the mortgagor in the amount of one thousand five hundred dollars if he or she fails to present a certificate of discharge for recording within ninety days. For the purposes of such liability under this subdivision, the term "mortgagee" shall not include a person, partnership, association, corporation or other entity which makes less than five mortgage loans in any calendar year. The provisions of this section shall not apply to any mortgage granted to or made by the state of New York, or any agency or instrumentality thereof or any political subdivision of the state or any agency or instrumentality thereof.

2. For purposes of this section, the full amount of principal and interest due on a mortgage shall not be considered to be paid whenever such mortgage continues to secure a bona fide debt and an enforceable lien continues to exist, such as may occur in the following situations:

(a) the commercial practice of lenders trading or selling mortgages on the secondary market;

(b) the replacement of a construction loan with permanent financing;

(c) the refinancing of an existing loan with a new lender, such as where the original lender assigns a note and the mortgage securing its payment to another lender in return for consideration and such mortgage is consolidated with another mortgage which secures any funds advanced by the new lender to the mortgagor;

(d) the modification of the terms of a loan by a mortgagor and mortgagee in order to avoid foreclosure; and

(e) a refinancing that occurs in conjunction with the sale of property such that the seller conveys property to the purchaser subject to the lien of the mortgage and the original lender assigns its note and mortgage on the property to the purchaser's lender.

3. Except with respect to the assignment of a mortgage in connection with a transaction described in paragraph (a) of subdivision two of this section, in order to record an assignment of a mortgage there must be set forth in the assignment document or attached thereto and recorded as part thereof a statement under oath signed by the mortgagor or any other party to the transaction having knowledge of the facts (provided such other party asserts such knowledge), that the assignee is not acting as a nominee of the mortgagor and that the mortgage continues to secure a bona fide obligation. With respect to the assignment of a mortgage in connection with a transaction described in paragraph (a) of subdivision two of this section, such assignment shall contain the following statement:

"This assignment is not subject to the requirements of section two hundred seventy-five of the Real Property Law because it is an assignment within the secondary mortgage market."

§ 1921 Real Prop. Acts. Discharge of mortgage.

1. After payment of authorized principal, interest and any other amounts due thereunder or otherwise owed by law has actually been made, and in the case of a credit line mortgage as defined in section two hundred eighty-one of the real property law on written request, a mortgagee of real property situate in this state, unless otherwise requested in writing by the mortgagor or the assignee of such mortgage, must execute and acknowledge before a proper officer, in like manner as to entitle a conveyance to be recorded, a satisfaction of mortgage, and thereupon within thirty days arrange to have the satisfaction of mortgage: (a) presented for recording to the recording officer of the county where the mortgage is recorded, or (b) if so requested by the mortgagor or the mortgagor’s designee, to the mortgagor or the mortgagor’s designee. Failure by a mortgagee to present a certificate of discharge for recording shall result in the mortgagee being liable to the mortgagor in the amount of five hundred dollars if he or she fails to present such certificate within thirty days, shall result in the mortgagee being liable to the mortgagor in the amount of one thousand dollars if he or she fails to present a certificate of discharge for recording within sixty days or shall result in the mortgagee being liable to the mortgagor in the amount of one thousand five hundred dollars if he or she fails to present a certificate of discharge for recording within ninety days. For the purposes of such liability under this subdivision, the term “mortgagee” shall not include a person, partnership, association, corporation or other entity which makes less than five mortgage loans in any calendar year. The mortgagee shall within forty-five days deliver the note and the mortgage and where a title is registered under article twelve of the real property law, the registration copy of the mortgage and any registration certificates in the mortgagee’s possession to the mortgagor or the mortgagor’s designee making such payment and request if required as aforesaid. Delivery of a satisfaction of mortgage in accordance with the terms of section two hundred seventy-five of the real property law shall be deemed to satisfy the requirements of this section regarding the satisfaction of mortgage.<br />

<br />

2. Upon the failure or refusal of any such mortgagee to comply with the foregoing provisions of this section any person having an interest in the mortgage or the debt or obligation secured thereby or in the mortgaged premises may apply to the supreme court or a justice thereof, or to the county court or a judge thereof, in or of any county in which the mortgaged premises or any part thereof are situated in whole or in part, upon a petition, for an order to show cause why an order should not be made by such court canceling and discharging the mortgage of record, and directing the register or clerk of any county in whose office the same may have been recorded to mark the same upon his records as canceled and discharged, and further ordering and directing that the debt or other obligation secured by the mortgage be canceled, upon condition that in the event such mortgage is not paid, the sums tendered pursuant to the foregoing provisions of this section be paid to the officer specified by law to hold court funds and moneys deposited in court in the county wherein the mortgaged premises are situated in whole or in part. Said petition must be verified in like manner as a verified pleading in an action in the supreme court and it must set forth the grounds of the application.<br />

<br />

3. In any case where an actual tender, as provided in subdivision one of this section, cannot with due diligence be made within this state, any person having an interest in the mortgage or the debt or obligation secured thereby, or in the mortgaged premises, may apply to the supreme court or a justice thereof, or to the county court or a judge thereof, in or of any county in which the mortgaged premises, or any part thereof are situated in whole or in part, upon petition setting forth the grounds of the application and verified as aforesaid, for an order to show cause why an order should not be made by said court canceling and discharging the mortgage of record, and directing the register or clerk of any county in whose office the same may have been recorded to mark the same upon his records as canceled and discharged and further ordering and directing that the debt or other obligation secured by the mortgage be canceled, upon condition that the principal sum of the mortgage or any unpaid balance thereof, with interest up to the date when said order shall be entered and the aforesaid fees allowed by law, be paid to the officer specified by law to hold court funds and moneys deposited in court in the county wherein the mortgaged premises are situated in whole or in part.<br />

<br />

4. In the case of a mortgage secured by property improved by a one-to-six family, owner occupied, residential structure or residential condominium unit, if the mortgagee fails within ninety days to deliver the satisfaction of mortgage and/or fails within ninety days to deliver the note and the mortgage and any other documents as required by subdivision one of this section and if the mortgage is not otherwise satisfied the mortgagee shall be liable to such person in the amount of five hundred dollars or the economic loss to such person, whichever is greater. If the mortgagee has delivered such satisfaction of mortgage in a timely manner and has certified that the note and/or mortgage are not in its possession as of such date, the mortgagee shall not be liable under this section if the mortgagee agrees to defend and hold harmless the mortgagor by reason of the inability or failure of the mortgagee to furnish the note or mortgage within the time period prescribed in this subdivision; provided that in connection with mortgage loans purchased prior to July twenty-seven, nineteen hundred ninety-one by the state of New York mortgage agency pursuant to section two thousand four hundred five or two thousand four hundred-five-b of the public authorities law, the state of New York mortgage agency, its successors or assigns shall not be liable under this section if it does not defend and hold harmless the mortgagor by reason of the inability or failure of the state of New York mortgage agency, its successors or assigns to furnish the note or mortgage within the time period prescribed in this subdivision. Damages imposed by this subdivision shall be in addition to the other costs and fees allowed in this section.<br />

<br />

5. (a) In the case of a mortgage secured by property improved by a one-to-six family, owner occupied, residential structure or residential condominium unit, if within ninety days of receipt of payment, and request if required, the mortgagee fails to deliver to the mortgagor or the mortgagor’s designee the satisfaction of mortgage, the note and the mortgage and any other documents as required by subdivision one of this section, any attorney-at-law may execute, acknowledge and upon payment of an additional filing fee of fifty dollars cause to be filed with the recording officer of the county where the mortgage is recorded, an affidavit which complies with this section. Unless the mortgagee shall file a verified objection to such affidavit within thirty-five days of being filed, as of the date thirty-five days subsequent to its filing, such affidavit shall be recorded and satisfy the lien of such mortgage on the mortgaged premises.<br />

<br />

(b) The affidavit shall state that:<br />

<br />

(i) The affiant is an attorney-at-law and that the affidavit is made on behalf of and at the request of the mortgagor or any person who has acquired title to the mortgaged premises;<br />

<br />

(ii) The mortgagor made a proper request of the mortgagee for the execution of the satisfaction of mortgage pursuant to subdivision one of this section;<br />

<br />

(iii) The mortgagor has received a payoff statement for the loan secured by the mortgage, and shall annex as evidence a copy of the payoff statement;<br />

<br />

(iv) The affiant has ascertained that the mortgagee received payment of the loan in accordance with the payoff statement, and shall annex as evidence, copies of the check negotiated by the mortgagee or documentary evidence of such payment;<br />

<br />

(v) The affiant, at least thirty days after the mortgagee received payment, has given the mortgagee written notice together with a copy of the proposed affidavit, delivered by certified or registered mail, return receipt requested, to the attention of the person or department set forth in the payoff statement, of the affiant’s intention to execute and record an affidavit in accordance with this section; and<br />

<br />

(vi) The mortgagee has not responded in writing to such notification or all requests by the mortgagee for payment have been complied with at least fifteen days prior to the date of the affidavit.<br />

<br />

(c) Such affidavit shall identify the mortgagor and the mortgagee, state the date of the mortgage, the liber and page of the land records where the mortgage is recorded and give similar information with respect to any recorded assignment of the mortgage.<br />

<br />

(d) The affiant shall attach to the affidavit photostatic copies of the documentary evidence that payment has been received by the mortgagee, including mortgagee’s endorsement of any check, and a photostatic copy of the payoff statement and certify each to be a copy of the original document.<br />

<br />

(e) Within five days of the filing of such affidavit the register or clerk of every county in whose office said mortgage has been recorded shall give the mortgagee written notice, delivered by certified or registered mail, return receipt requested, to the attention of the person or department set forth in the payoff statement, as annexed to the affidavit filed hereunder, of the filing of such affidavit, which notice shall include the following notice in capital letters:<br />

<br />

“THIS NOTICE IS MADE UNDER SECTION 1921 OF THE REAL PROPERTY ACTIONS AND PROCEEDINGS LAW. FAILURE TO FILE WITH THIS OFFICE WITHIN THIRTY DAYS OF THIS NOTICE A VERIFIED OBJECTION TO THE DISCHARGE OF THE MORTGAGE DESCRIBED IN THIS NOTICE WILL RESULT IN SUCH MORTGAGE BEING CANCELED AND DISCHARGED OF RECORD.”<br />

<br />

Unless the register or clerk of such county shall receive from the mortgagee, within thirty-five days of the date of filing of such affidavit, a verified objection by the mortgagee to the discharge of said mortgage, the register or clerk shall record the affidavit and supporting documents and mark the mortgage described in the affidavit canceled and discharged of record and such recorded affidavit shall have the same force and effect as a duly executed satisfaction of mortgage recorded in accordance with section three hundred twenty-one of the real property law. If the register or clerk of such county shall receive from the mortgagee, within thirty-five days of the date of filing of such affidavit, a verified objection by the mortgagee to the discharge of said mortgage, the register or clerk shall return the original affidavit and the verified objection to the attorney filing such affidavit without marking the mortgage described in the affidavit canceled or discharged of record. The clerk or register of such county shall additionally transmit a copy of the affidavit and the verified objection to its applicable appellate division of the supreme court, committee on professional standards, for such further proceedings as determined appropriate by such committee.<br />

<br />

(f) The county clerk or register shall index the affidavit in the same manner as a satisfaction of mortgage and shall record such instrument upon payment of the same fees as for a satisfaction of mortgage.<br />

<br />

(g) (i) Any attorney who prepares an affidavit and negligently causes the affidavit to contain false information shall be liable to the mortgagee for any monetary damages and subject to other applicable sanctions under law.<br />

(ii) Any person who supplies false information for the affidavit shall be liable to the mortgagee for any monetary damages and subject to other applicable sanctions under law.<br />

<br />

(h) A banking or other organization having the original or copies thereof, shall furnish, within sixty days of receiving a written request, a copy of the front and reverse sides of a check issued to satisfy the mortgage obligation by such banking or other organization, needed for completion of an affidavit in accordance with this subdivi- sion.<br />

<br />

6. Eight days’ notice of the application for either of the orders provided for in subdivisions two and three of this section shall be given to the then mortgagee of record and also, if the petition show that there is a mortgage not of record, to such mortgagee. Such notice shall be given in such manner as the court or the judge or justice thereof to whom the petition is presented may direct, and said court or judge or justice may require such longer notice to be given as may seem proper. If sufficient cause be shown the court or judge or justice thereof may issue such order to show cause returnable in less than eight days.<br />

<br />

7. Upon the return day of such order to show cause, the court, upon proof of due service thereof and on proof of the identity of the mortgagee and of the person presenting the petition, shall inquire in such manner as it may deem advisable, into the truth of the facts set forth in the petition, and in case it shall appear that said principal sum or any unpaid balance thereof and interest and the said fees allowed by law have been duly paid or tendered but not accepted and said satisfaction of mortgage has been duly presented for execution, or that such tender and presentation could not have been made within this state with due diligence, then, in the event such mortgage is not paid, the court shall make an order directing the sums so tendered, or in a case where such tender could not have been made as aforesaid, directing the principal sum or any unpaid balance thereof, with interest thereon to the date of entry of said order together with all other amounts due thereunder pursuant to subdivision three of this section and the aforesaid fees allowed by law, to be paid to the officer specified by law to hold court funds and moneys deposited in court in the county wherein the application herein is made, and directing and ordering that upon such payment the debt or other obligation secured by the mortgage be canceled and further directing the register or clerk of any and every county in whose office said mortgage shall have been recorded to mark said mortgage canceled and discharged of record upon the production and delivery to such register or clerk of a certified copy of the order and the receipt of such officer, showing that the amount required by said order has been deposited with him, which certified copy of said order and which receipt shall be recorded, filed and indexed by any such register or clerk in the same manner as a certificate of discharge of a mortgage. Said receipt need not be acknowledged to entitle it to be recorded. The court in its discretion, when granting any such order after application therefor pursuant to subdivision two of this section, may award costs and reasonable attorney’s fees to the person making the application, in the absence of the showing of a valid reason for the failure or refusal to execute the satisfaction of mortgage and deliver the same, the note and mortgage and any other documents required under subdivision one of this section. The money deposited shall be payable to the mortgagee, his personal representative or assigns, upon an order of the supreme court or county court, directing the payment thereof to him upon such evidence as to his right to receive the same as shall be satisfactory to the court.<br />

<br />

8. Wherever any register or clerk shall record any order and receipt as hereinbefore specified, he shall mark the record of said mortgage as follows:<br />

“Canceled and discharged by order of the ……………………..<br />

Court, County of ………………….., dated ……………… and<br />

filed …………………..,” and thereupon the lien of such mortgage<br />

shall be deemed to be discharged and the debt secured thereby shall be<br />

deemed to be canceled. Said register or clerk shall be permitted to<br />

charge for recording and filing said order and receipt, the same fees to<br />

which he is now entitled for recording and filing a certificate of<br />

satisfaction of a mortgage.<br />

<br />

9. When used in this section:<br />

<br />

(a) “Mortgagee” means (i) the current holder of the mortgage of record or the current holder of the mortgage, or (ii) any person to whom payments are required to be made or (iii) their personal representatives, agents, successors, or assigns.<br />

<br />

(b) “Attorney-at-law” means any person admitted to practice law in this state and in good standing.<br />

<br />

(c) “Payoff statement” means a statement setting forth the unpaid balance of the mortgage, including principal, interest and other charges pursuant to the loan documents, together with a per diem rate for interest accruing after the date to which the unpaid balance has been calculated. The payoff statement furnished by a banking organization or corporate mortgagee shall include a name of an individual employed by such banking organization or corporate mortgagee or department of such banking organization or corporate mortgagee to whom inquiry concerning the payoff statements are to be addressed in addition to the address of the banking organization or corporation for use in connection with the affidavit under subdivision five of this section.<br />

<br />

(d) “Banking organization” shall have the same meaning as provided in subdivision eleven of section two of the banking law and shall include any institution chartered or licensed by the United States or any state.<br />

<br />

(e) “Note” shall include any written evidence of indebtedness.<br />

<br />

§ 321 Real Prop. Recording discharge of mortgage.<br />

<br />

1. The recording officer shall mark on the record of a mortgage the word “discharged” when there is presented to him a certificate or certificates signed as hereinafter provided, and acknowledged or proved and certified in like manner as to entitle a conveyance to be recorded, specifying that the mortgage has been paid or otherwise satisfied and discharged.<br />

<br />

(a) When it does not appear from the record that any interest in the mortgage has been assigned, the discharge shall be signed by the mortgagee or by his personal representative.<br />

<br />

(b) When it appears from the record that the mortgage has been assigned, whether or not the assignment was made as collateral security, the discharge shall be signed by the person who appears from the record to be the last assignee thereof or by his personal representative.<br />

<br />

(c) When the mortgage or an assignment thereof names two or more persons as mortgagees or assignees, the discharge shall be signed by the person or persons designated by the mortgage or assignment to receive payment of the mortgage debt or to give full acquittance and discharge therefor. When no such person or persons are designated by the mortgage or assignment, the certificate of discharge shall be signed by all of the persons named, in the mortgage or assignment, as mortgagees or assignees, as the case may be, or by their personal representatives, if the mortgage or assignment (i) specifies their respective interest in terms of a sum of money, or in terms of a fraction or percentage, or (ii) states that such persons shall share equally in, or shall have equal shares in the mortgage, or (iii) describes such persons as tenants in common of the mortgage. When it appears from the record that the mortgage is held by trustees, the certificate of discharge shall be signed by a majority of such trustees or of the survivors of them or by the survivors or survivor of them, unless the instrument creating the trust provides otherwise. Except as required above, the discharge may be signed by any one of the persons named in the mortgage or assignment, as mortgagees or assignees, as the case may be, or by the personal representative of the last survivor of them. If the mortgage or assignment states that the persons named therein as mortgagees or assignees shall hold the mortgage jointly, or describes such persons as joint tenants or tenants by the entirety of the mortgage, or expressly creates a right of survivorship among them, the discharge may be signed by any one of such persons or by the personal representative of the last survivor of them notwithstanding that the mortgage or assignment specifies their respective interests in the mortgage or states that they shall share equally or have equal shares therein.<br />

<br />

(d) When the mortgage has been partially assigned, the certificate of discharge shall be signed by all of the persons, or their personal representatives, who in the aggregate are the holders of all portions of the mortgage, including each partial assignee, and the assignor in case any portion of the mortgage has not been assigned; provided, however, that if any partial assignment names two or more persons as assignees, the person or persons who may sign the certificate discharging such partial interest shall be determined in accordance with the provisions of paragraph (c) of this subdivision.<br />

<br />

(e) Whenever two or more persons are required to execute a certificate of discharge as provided in this subdivision, there may be presented in lieu of such certificate, separately executed certificates of discharge as to the respective interests of each in the mortgage so that together<br />

the several certificates purport to discharge the entire mortgage.<br />

<br />

(f) In place of any of the persons specified in paragraphs (a), (b), (c) or (d) of this subdivision, a certificate of discharge of the mortgage or of any interest therein may be signed (i) by an agent who has been authorized by any such person to demand or receive payment or to give a certificate of discharge of the mortgage by a power of attorney, provided such power of attorney is of record in the office where the mortgage is recorded, and no instrument of revocation has been recorded; or (ii) by any person in whom title to such mortgage or to such interest, or authority to act on behalf of or in exercise of the right or power of the holder of such mortgage or of such interest is vested, in a fiduciary capacity, by virtue of an order or decree of a court having jurisdiction thereof, including, but not limited to, the guardian of a minor, the committee of an incompetent person, or the conservator of a conservatee, whether domestic or foreign, and a receiver in bankruptcy or trustee in bankruptcy. A certificate executed by any person specified in clause (ii) of this paragraph shall recite the name of the court and the venue of the proceedings in which his appointment was made, or the order or decree vesting him with such title or authority was entered.<br />

<br />

(g) If the mortgage is stated in the certificate of discharge to have been taken by the alien property custodian under and pursuant to the trading with the enemy act adopted by the United States congress, and approved October sixth, nineteen hundred sixteen, or any act amendatory thereof, or supplemental thereto, such certificate may be executed by such alien property custodian or such person as the president may appoint to give full acquittance and discharge for money or property belonging to an enemy or ally of an enemy which may be conveyed, assigned, delivered or transferred to said alien property custodian, with like effect as if the same had been executed by the mortgagee, his personal representative or assignee. Such certificate may be recorded, and such certificate, the record thereof and a certified copy of such record may be introduced in evidence in all courts of this state.<br />

<br />

2. (a) The recording officer shall record and file such certificate or certificates together with the certificates of acknowledgment or proof, and shall note on the record of the mortgage the book and page containing such record of such certificate or certificates or the serial number of such record in the minute of the discharge of such mortgage, made by the officer upon the record thereof. The provisions of this paragraph shall not apply to the county of Suffolk, if the block method of index is in use, or a separate index of satisfactions recorded is maintained.<br />

<br />

(b) The recording officer shall also record every other instrument relating to a mortgage which is presented to him, acknowledged or proved in like manner as to entitle a conveyance to be recorded, including certificates purporting to discharge a mortgage or an interest therein which are signed by persons other than those specified in the first subdivision of this section, and also including, but not limited to, assignments, releases, partial discharges, reductions, estoppel certificates, extensions, discharges of partial interest and partial discharges of partial interest, regardless by whom any such instrument has been executed. When any such instrument has been recorded, the recording officer, except in counties where the block method of indexing is in use, or in Suffolk county, if a separate index of said instruments is maintained, shall enter a minute upon the record of the mortgage to which such instrument relates, indicating the nature of such instrument and the book and page where it has been recorded or the serial number of such record.<br />

<br />

3. Every certificate presented to the recording officer shall be executed and acknowledged or proved in like manner as to entitle a conveyance to be recorded. If the mortgage has been assigned, in whole or in part, the certificate shall set forth the date of each assignment in the chain of title of the person or persons signing the certificate, the names of the assignor and assignee, the interest assigned, and, if the assignment has been recorded, the book and page where it has been recorded or the serial number of such record; or if the assignment is being recorded simultaneously with the certificate of discharge, the certificate of discharge shall so state. If the mortgage has not been assigned of record, the certificate shall so state. No certificate presented to the recording officer shall purport to discharge more than one mortgage, except that one certificate may purport to discharge two or more mortgages where the certificate states that one of such mortgages corrects, perfects or modifies the other mortgage or mortgages, or spreads the lien of the other mortgage or mortgages over the property subject to the lien of such mortgage, or consolidates the lien of the other mortgage or mortgages with the lien of such mortgage to constitute a single lien, or where the certificate states that the liens of the mortgages which the certificate purports to discharge have been so spread or so consolidated by a separate instrument and such instrument has been recorded; provided that in such case the certificate of discharge shall identify and describe each mortgage which it purports to discharge, in a separate paragraph, in the same manner and with the same particularity, and setting forth the same information with respect to assignments thereof, as would be required for a separate certificate discharging that mortgage, and shall also state, in a separate paragraph for each instrument, the date of any such separate instrument by which the liens of the mortgages have been spread or consolidated, the names of the parties thereto, and the book and page where it has been recorded or the serial number of such record. In any such case, except where otherwise expressly provided by law, the fee or fees which the recording officer is entitled to receive for filing and entering a certificate of discharge of a mortgage and examining assignments of such mortgage shall be payable with respect to each mortgage which the certificate purports to discharge, to the same extent as if a separate certificate of discharge had been filed for such mortgage.<br />

<br />

4. After the record of the mortgage has been marked with the word “discharged,” the recording officer shall make and deliver to any person tendering the lawful fees therefor, his certificate setting forth the names of the mortgagor and the mortgagee, the book and page at which, the date when such mortgage was recorded, and the date on which the record of such mortgage was so marked, except in a county where recording is done by microphotography or photostating in the manner permitted by law, in which case, after microphotography or photostating, such certificate of discharge and the certificates of its acknowledgment or proof shall, in lieu of filing as provided in paragraph (a) of subdivision two of this section, be returned to the party leaving same for record.<br />

<br />

5. The term “personal representative” as used in this section shall include the following:<br />

<br />

(a) An executor, administrator or voluntary administrator or one of two or more executors, administrators or voluntary administrators, whether domestic or foreign, including the public administrator, and an ancillary administrator appointed in this state. A certificate executed by any such personal representative shall recite the name of the court and the venue of the proceedings in which his letters testamentary or of administration were issued.<br />

<br />

(b) All of the distributees of a person dying intestate for whom no administrator shall have been appointed, provided that two years shall have elapsed since the date of death of such intestate. A certificate executed by such distributees shall recite the date of death of the<br />

intestate, his place of residence at the time of death, the fact that he died intestate, that no administrator has been appointed and that they constitute all the distributees of the intestate.<br />

<br />

6. The provisions of this section authorizing the recording officer to mark on the record of a mortgage the word “discharged” shall not be deemed to enlarge, diminish or alter the legal effect which a certificate executed by any person or persons, or any payment made by the mortgagor or other transaction with respect to the mortgage or the mortgage debt, would otherwise have upon the rights of the mortgagor or of any person claiming a right or interest in the mortgage, the mortgage debt or the property subject to the mortgage.<br />

<br />

7. In a county in which recording is accomplished by microfilm process and in which a block index of mortgages is also maintained it will not be necessary to mark the record of the mortgage “discharged”, but it will be deemed sufficient compliance with this section if there is entered upon the block index of such mortgage the date of filing and the serial number of the certificate effecting the discharge.<br />

<br />

7-a. If in any county, recording is accomplished by microfilm process and a separate index for satisfactions recorded is maintained or in which a block index of mortgages is also maintained it will not be necessary to mark the record of the mortgage “discharged”, but it will be deemed sufficient compliance with this section if there is entered upon the index of such mortgage the date of filing and the serial number of the certificate effecting the discharge.<br />

<br />

8. Certificates of discharge of mortgage and certificates of their acknowledgment or proof heretofore or hereafter recorded and filed, may be returned personally or by mail to the party leaving same for record or destroyed after microfilming or photostating where proper indices are maintained.