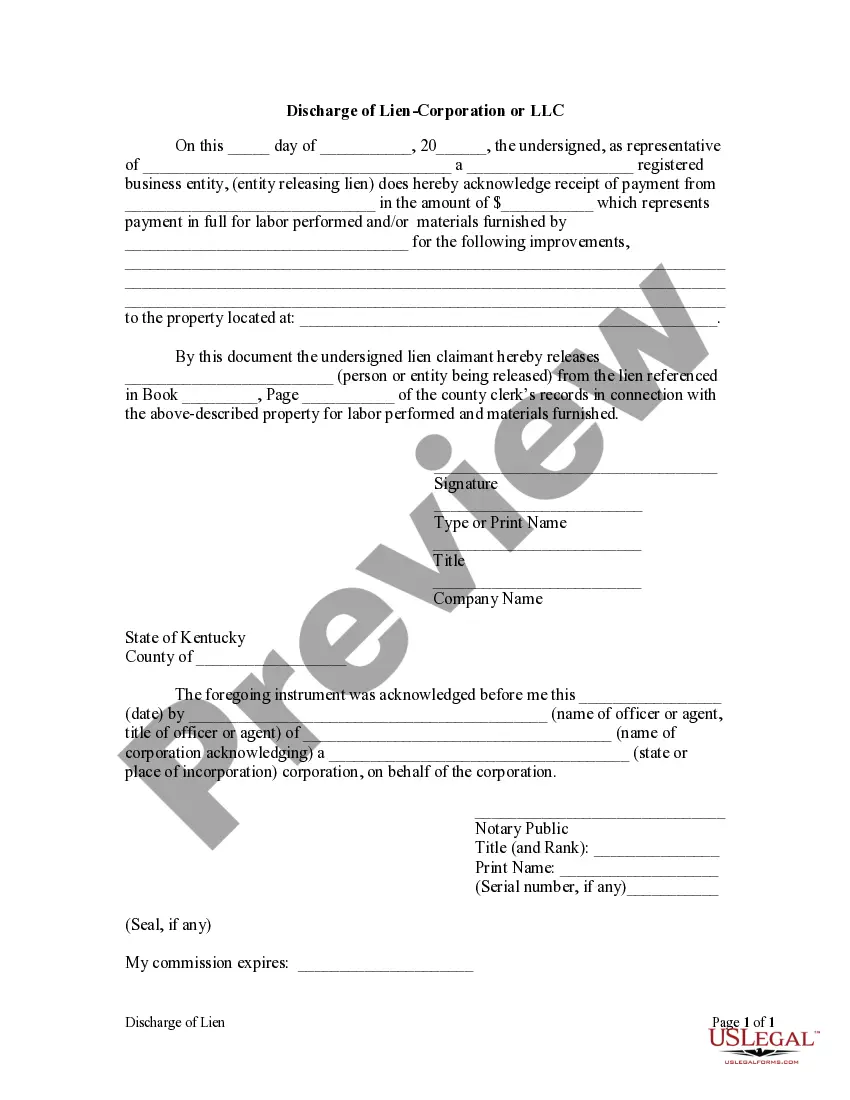

Kentucky construction lien law does not contain a specific provision for the discharge of a lien. However, this form allows a lien holder to provide a property owner with a standard release upon payment in full.

Kentucky Discharge of Lien by Corporation or LLC

Description

How to fill out Kentucky Discharge Of Lien By Corporation Or LLC?

Trying to find Kentucky Discharge of Lien by Corporation or LLC forms and filling out them can be a challenge. To save lots of time, costs and energy, use US Legal Forms and choose the right sample specifically for your state within a couple of clicks. Our legal professionals draft every document, so you just need to fill them out. It really is so easy.

Log in to your account and return to the form's web page and save the document. All your downloaded samples are saved in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our thorough guidelines on how to get the Kentucky Discharge of Lien by Corporation or LLC sample in a couple of minutes:

- To get an qualified example, check out its validity for your state.

- Take a look at the form utilizing the Preview option (if it’s available).

- If there's a description, read it to know the details.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and create an account.

- Choose you want to pay by way of a card or by PayPal.

- Download the file in the preferred file format.

Now you can print the Kentucky Discharge of Lien by Corporation or LLC template or fill it out utilizing any web-based editor. Don’t worry about making typos because your sample can be utilized and sent away, and printed out as often as you wish. Try out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

If you have unpaid debt of any kind, this can lead the creditors that you owe money to place a lien on your assets.In other cases, liens may be placed on property by a court order as a result of legal action.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

A: The Kentucky County Clerk's Association voted to only accept one of the following forms to release vehicle liens: Original Clerk's Filing Receipt, Title Lien Statement (Form TC96-187), or a UCC-3 Financing Statement Amendment. The KCCA also voted NOT to accept terminations on company letterhead.

Life of a judgment - A judgment is good for 15 years and may be renewed.

According to the Kentucky law on oral contracts, or verbal agreements, debt collection agencies have five years since the last action on the debt to put forward a suit (KRS 413.120). However, the Kentucky law on written contracts allows creditors fifteen years to sue a Kentucky resident.

How much does it cost to file a mechanics lien in Kentucky? As of January 1, 2020, the cost to file a mechanics lien with a county recorder in Kentucky is $46 for the first 5 pages, and $3 for each page thereafter.

To attach a lien, the creditor records the judgment with the county clerk for the Kentucky county where the debtor has property now or may have any property in the future.