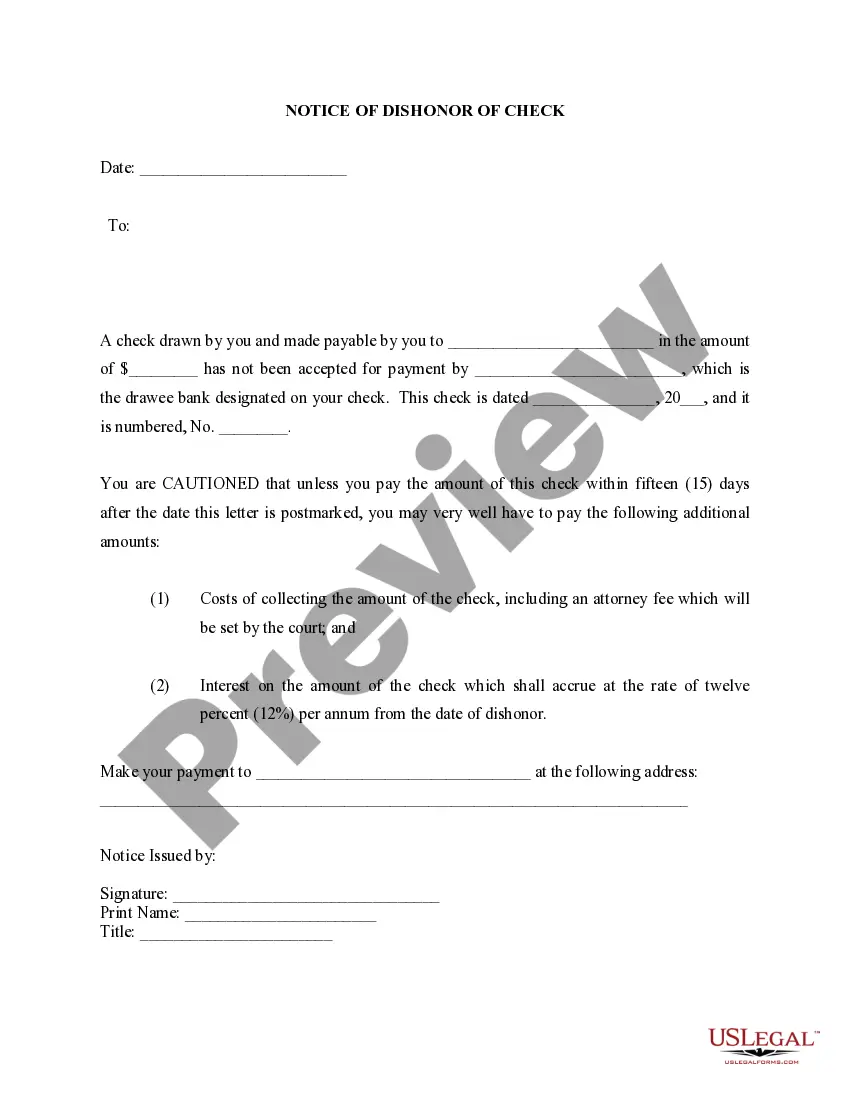

Idaho Notice of Dishonored Check - Civil - Notice regarding bad check or bounced check

Description

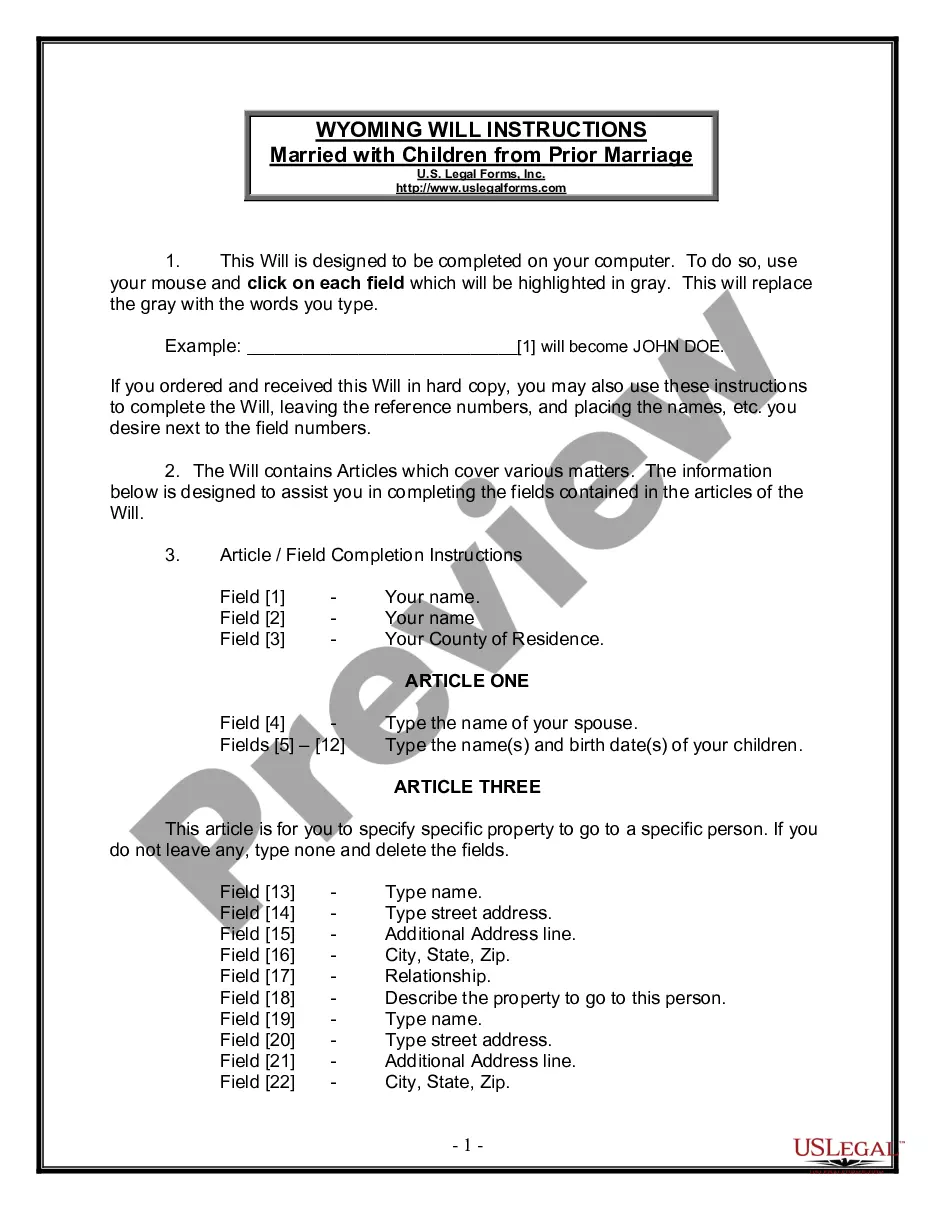

How to fill out Idaho Notice Of Dishonored Check - Civil - Notice Regarding Bad Check Or Bounced Check?

Access one of the most comprehensive collections of authorized templates.

US Legal Forms serves as a platform to discover any state-specific document within a few clicks, including Idaho Notice of Dishonored Check - Civil - Notice regarding insufficient funds or bounced check examples.

There's no need to spend hours trying to locate a court-admissible template. Our expert team guarantees you receive up-to-date samples consistently.

After selecting a pricing plan, establish your account. Pay via card or PayPal. Download the document to your device by clicking the Download button. That's all! You need to fill out the Idaho Notice of Dishonored Check - Civil - Notice regarding insufficient funds or bounced check form and check it. To ensure accuracy, consult your local legal advisor for assistance. Register and effortlessly find over 85,000 valuable samples.

- To utilize the document library, choose a subscription and create your account.

- If you've already set it up, just Log In and click Download.

- The Idaho Notice of Dishonored Check - Civil - Notice regarding insufficient funds or bounced check file will be promptly saved in the My documents section (a section for every form you download on US Legal Forms).

- To create a new profile, refer to the quick instructions provided below.

- If you need a state-specific document, ensure you specify the correct state.

- If possible, review the description to comprehend all nuances of the document.

- Utilize the Preview option if it’s available to examine the document's details.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

If the bad check writer does not honor the check, you may proceed by going to small claims court to pursue the case yourself. States determine the total value of damages that fall under this type of court, which is usually $5,000. Instead, you may pursue a civil lawsuit.

Legal TroubleIf you don't clear things up quickly, you may face civil (you have to pay fines) or criminal (you face potential jail time) penalties. Criminal charges can go on your criminal record, might eventually result in jail time, and are likely to come with higher fines.

If the check writer doesn't respond or refuses to pay, you can go to small claims court.The clerk's office can tell you what damages you can recover in addition to the original amount of the bounced check plus court fees. In some states you can sue the person for up to three times the amount of the check.

Under criminal penalties, you can be prosecuted and even arrested for writing a bad check. A bounced check typically becomes a criminal matter when the person who wrote it did so intending to commit fraud, such as writing several bad checks in a short time frame knowing there is no money to cover them.

Knowingly writing a bad check is an act of fraud, and is punishable by law. Writing bad checks is a crime.Civil penalties apply in all cases, with a common penalty amount equivalent to the check's face value, a multiple of the check amount with a cap, or the check amount plus court and attorney fees.

Dispute The Debt: Ask the debt collector to verify the debt in question. Send a certified letter (and request a return receipt) asking for verification. Keep a copy for your records. The bad check restitution program must respond to you within 30 days or drop the case.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

The bad check writer may have between 10 and 30 days to honor the check without facing additional civil or criminal liability. If the bad check writer honors the check, he or she must usually pay the amount of the check plus a reasonable processing fee and the cost that the bank may have charged you for the bad check.

Writing a bad check is considered a wobbler crime in California, meaning it can be charged as either a misdemeanor or felony depending on circumstances of the crime. If the value of the check was under $450, the offense is generally charged as a misdemeanor. If the amount is over $450, you can be charged with a felony.