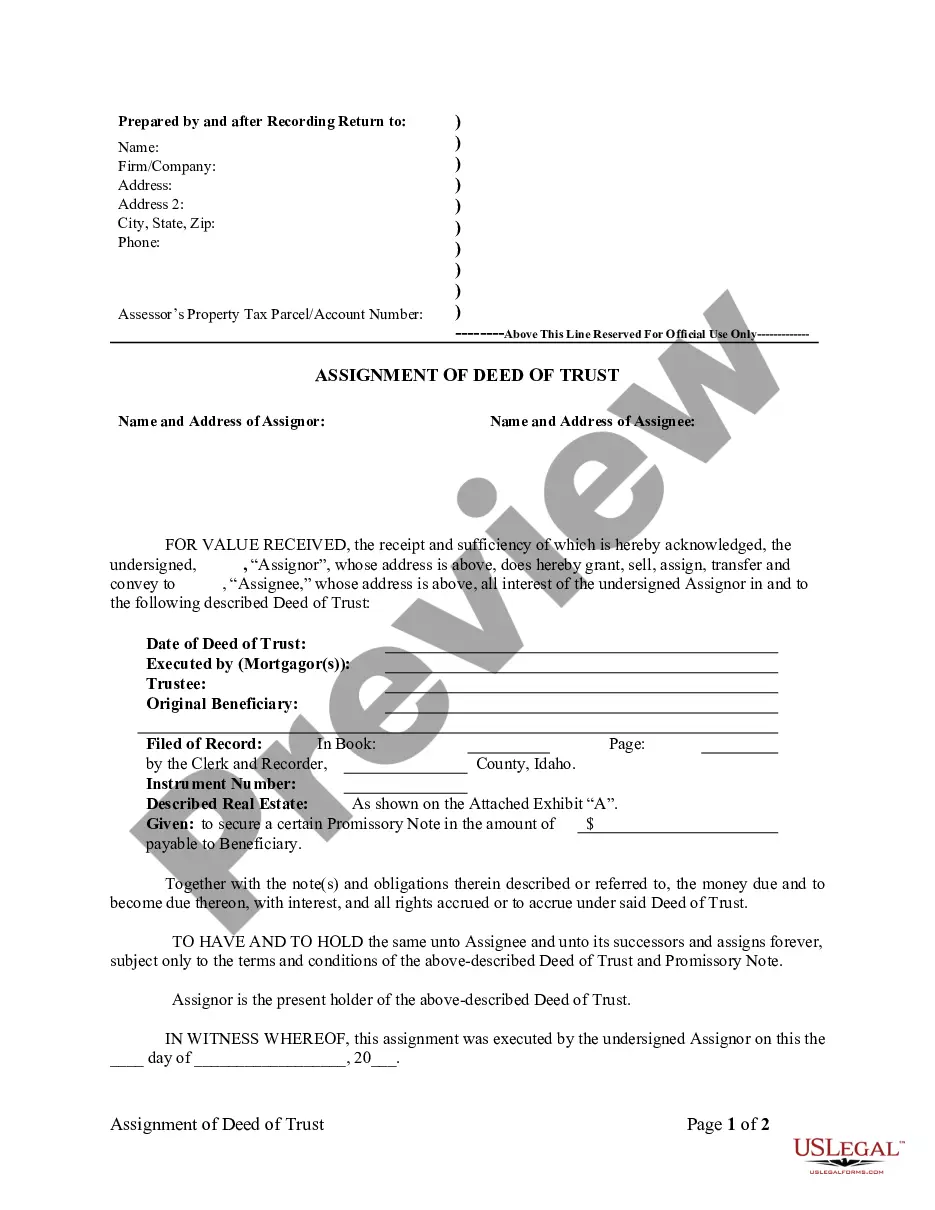

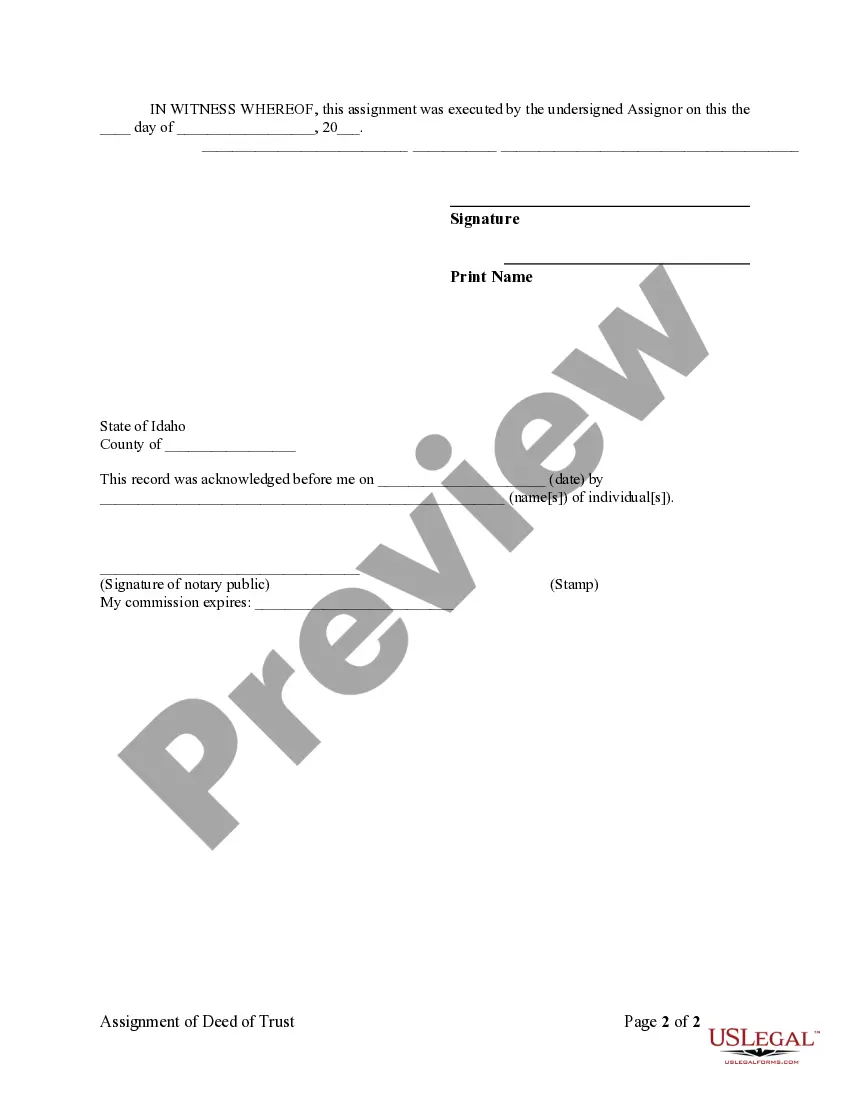

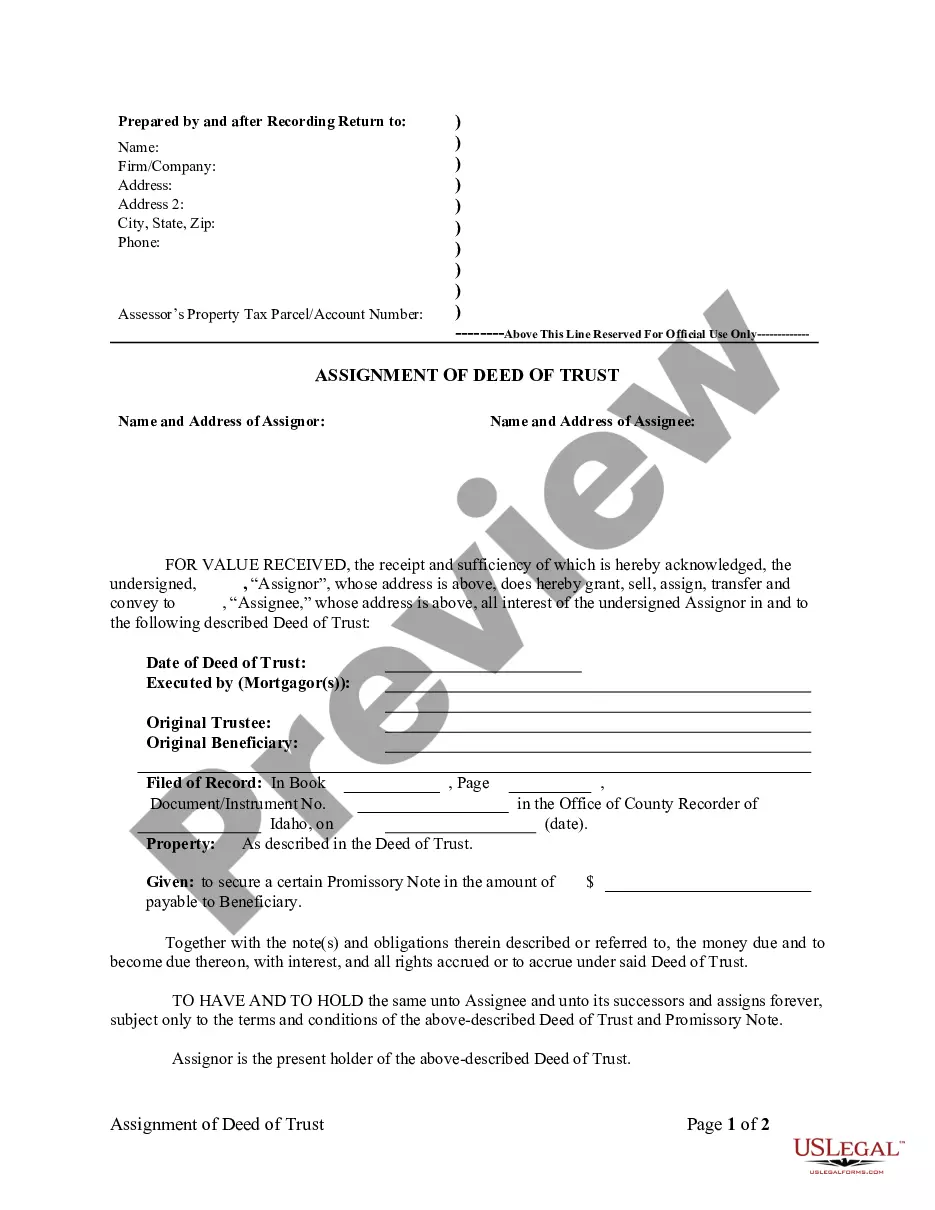

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Idaho Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Idaho Assignment Of Deed Of Trust By Individual Mortgage Holder?

Obtain one of the most comprehensive collections of approved documents.

US Legal Forms is a service where you can discover any state-specific paperwork in just a few clicks, including Idaho Assignment of Deed of Trust by Individual Mortgage Holder illustrations.

No need to squander several hours searching for a court-acceptable document.

Take advantage of the Preview feature if it’s available to examine the document's contents. If everything is accurate, click on the Buy Now button. After selecting a payment plan, set up an account. Pay using a card or PayPal. Download the document to your device by clicking Download. That's it! You should submit the Idaho Assignment of Deed of Trust by Individual Mortgage Holder form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Register and effortlessly discover over 85,000 useful documents.

- Our certified professionals guarantee you receive current samples continuously.

- To utilize the forms library, select a subscription, and create an account.

- If you're already registered, simply Log In and then click Download.

- The Idaho Assignment of Deed of Trust by Individual Mortgage Holder template will be automatically saved in the My documents section (a section for all documents you save on US Legal Forms).

- To create a new profile, adhere to the quick steps outlined below.

- If you plan to utilize a state-specific template, ensure you select the appropriate state.

- If possible, review the description to understand all details of the document.

Form popularity

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Idaho is one of a handful of states that use deeds of trust as the primary form of financing purchases of real property. A deed of trust, similar to a mortgage, is a security instrument that, along with a promissory note, sets out the terms for repaying the loan used to purchase the property.

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

Key Takeaways. A deed of trust is a type of security for a loan that names a third party called the trustee to hold the legal title until you pay it off. The trustee is typically an entity such as a title company with "power of sale" in the event that you default on your loan payment.