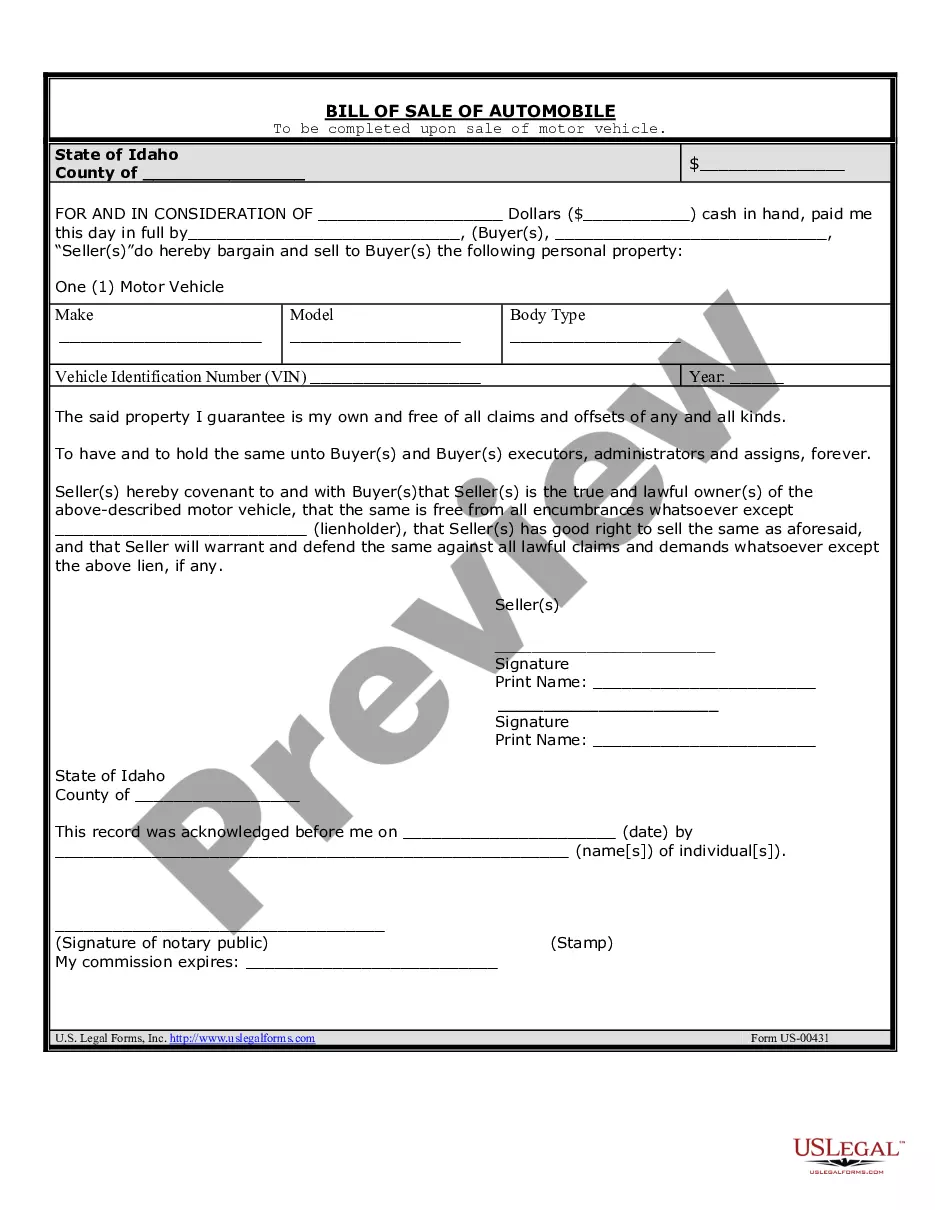

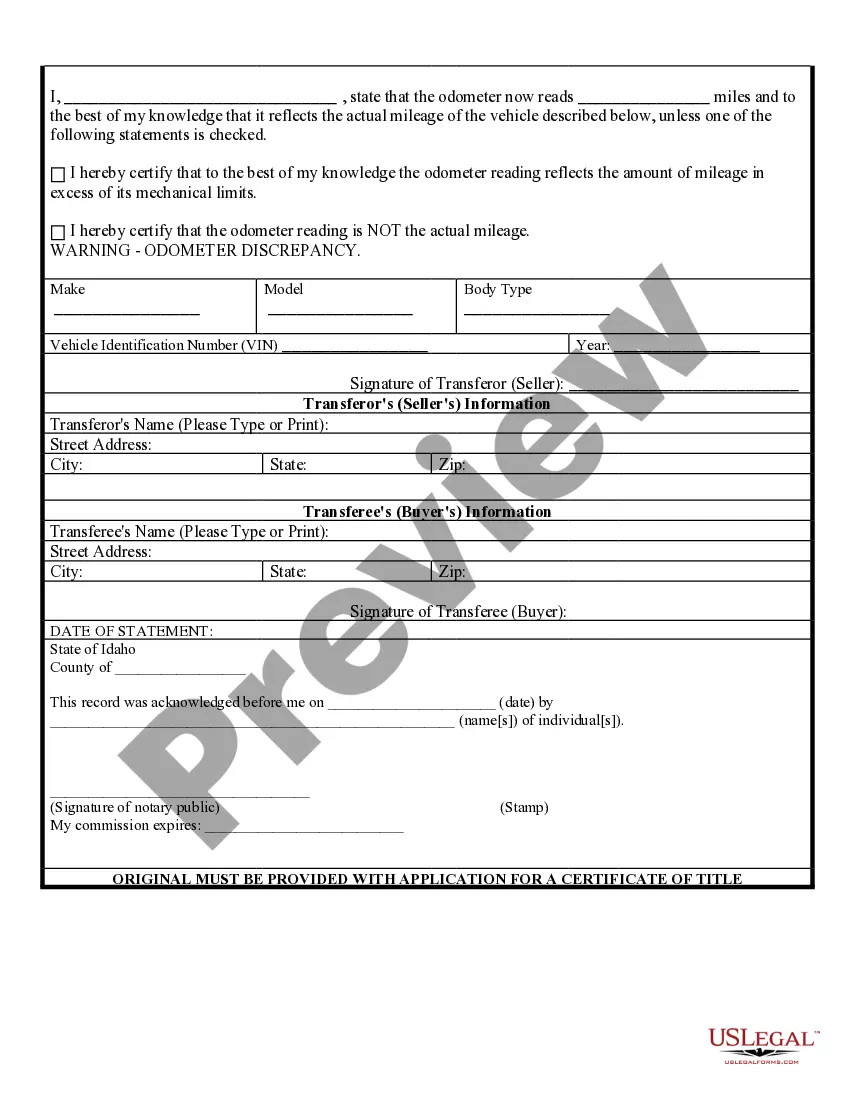

This Bill of Sale of Automobile contains the following information: the make/model of the car, VIN number and other information. Seller guarantees that the property is his/her own and is free of all claims and offsets of any kind. The form also contains the Odometer Disclosure Statement required by Federal Law and State Law, where applicable, which must be signed in the presence of a notary public.

Bill Sale Automobile

Description Id Bill Automobile

How to fill out Idaho Dmv Bill Of Sale?

Get access to the most expansive library of legal forms. US Legal Forms is actually a platform to find any state-specific file in couple of clicks, such as Idaho Bill of Sale of Automobile and Odometer Statement samples. No need to waste hours of your time looking for a court-admissible example. Our licensed professionals make sure that you get updated documents all the time.

To leverage the forms library, select a subscription, and create an account. If you already did it, just log in and click on Download button. The Idaho Bill of Sale of Automobile and Odometer Statement template will immediately get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, follow the quick instructions listed below:

- If you're having to utilize a state-specific sample, be sure to indicate the appropriate state.

- If it’s possible, review the description to learn all of the nuances of the form.

- Take advantage of the Preview function if it’s available to look for the document's information.

- If everything’s appropriate, click Buy Now.

- Right after selecting a pricing plan, make an account.

- Pay by credit card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You need to complete the Idaho Bill of Sale of Automobile and Odometer Statement template and check out it. To make sure that everything is precise, call your local legal counsel for assist. Join and easily look through above 85,000 useful forms.