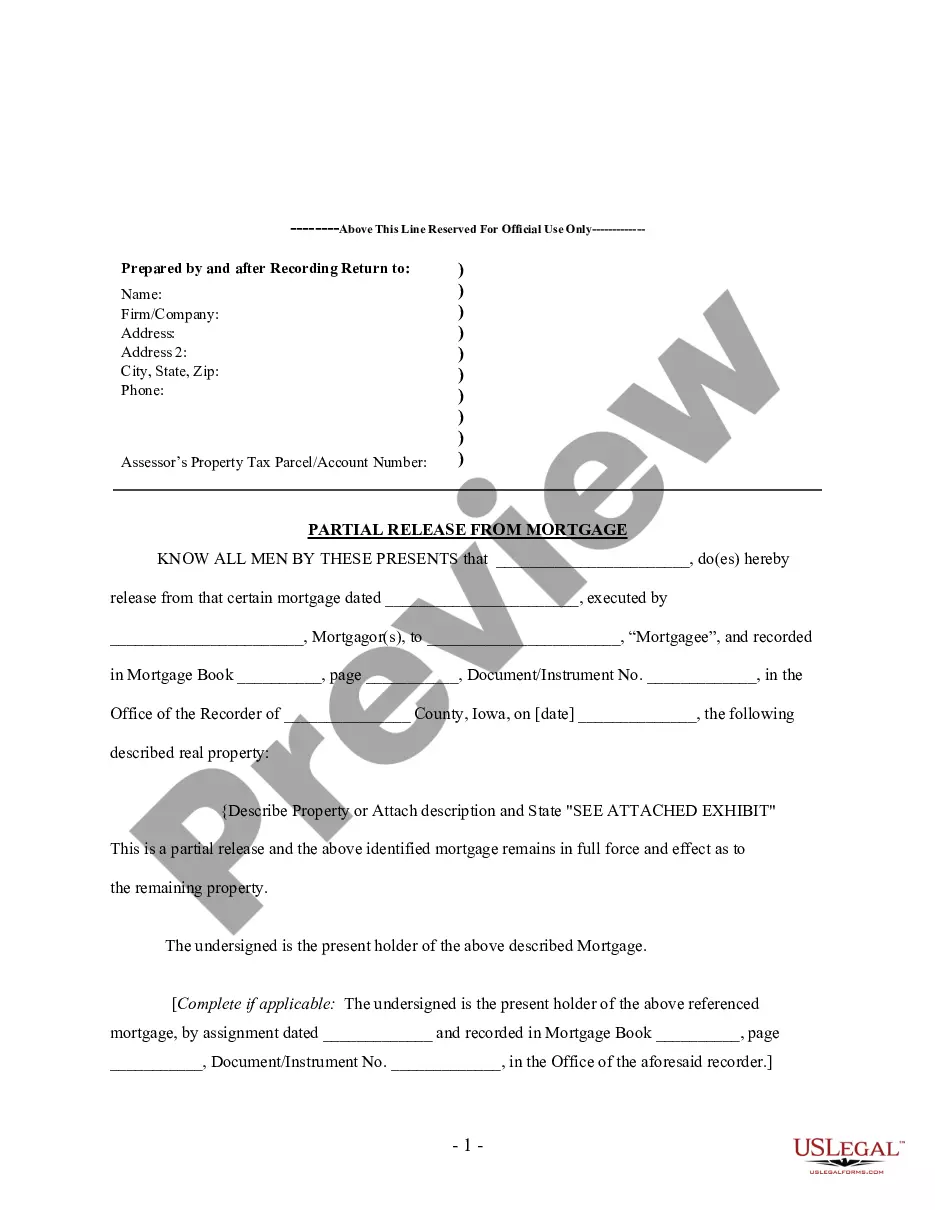

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified an referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Iowa Partial Release of Property From Mortgage by Individual Holder

Description

Definition and meaning

The Iowa Partial Release of Property From Mortgage by Individual Holder is a legal document that allows a property owner to release a portion of their property from a mortgage agreement. This partial release does not extinguish the mortgage on the remaining property; it simply provides clarity on which parts of the property are now free from the liens imposed by the mortgage.

Who should use this form

This form is primarily for property owners in Iowa who wish to release a part of their mortgaged property while retaining a mortgage on the rest. It is suitable for individual holders of a mortgage looking to modify their mortgage obligations without completely discharging the mortgage. This could be relevant in scenarios like property sales or restructuring ownership among co-owners.

How to complete a form

To complete the Iowa Partial Release of Property From Mortgage, you need to follow these steps:

- Fill in the names of the mortgagor (the property owner) and mortgagee (the lender).

- Provide the details of the original mortgage including the date it was executed and its recording information.

- Clearly describe the property being released or attach an exhibit if necessary.

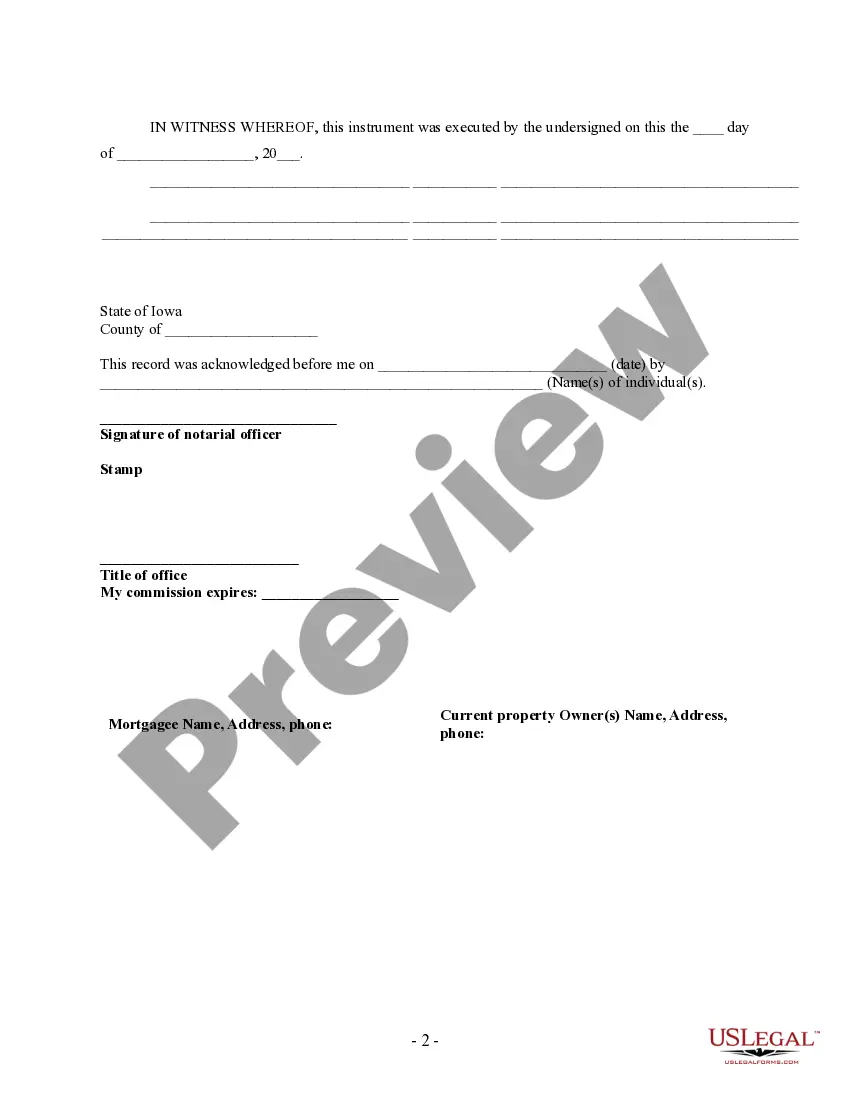

- Sign the document in the presence of a notary public.

Key components of the form

Essential elements of the Iowa Partial Release of Property From Mortgage include:

- The names and addresses of the mortgagor and mortgagee.

- The date of the original mortgage and its recording information.

- A clear description of the property being released.

- The signature(s) of the property owner(s) and notary verification.

How to fill out Iowa Partial Release Of Property From Mortgage By Individual Holder?

Utilize the most comprehensive collection of legal documents.

US Legal Forms is a platform to locate any state-specific file with just a few clicks, including Iowa Partial Release of Property From Mortgage by Individual Holder samples.

There's no need to squander your time searching for a court-admissible sample.

After selecting a pricing option, create your account. Make payment via credit card or PayPal. Download the sample to your computer by clicking on the Download button. That's it! You need to complete the Iowa Partial Release of Property From Mortgage by Individual Holder template and check out. To confirm that everything is correct, consult your local legal advisor for assistance. Sign up and easily browse over 85,000 useful templates.

- To access the library of forms, select a subscription and set up an account.

- If you are already registered, simply Log In and click on the Download button.

- The Iowa Partial Release of Property From Mortgage by Individual Holder template will be immediately saved in the My documents section (a section for all documents you download on US Legal Forms).

- To create a new profile, refer to the quick instructions listed below.

- If you're going to use a state-specific sample, ensure you select the correct state.

- If possible, read the description to understand all the details of the document.

- Make use of the Preview feature if it's available to review the document's content.

- If everything’s accurate, click Buy Now.

Form popularity

FAQ

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.