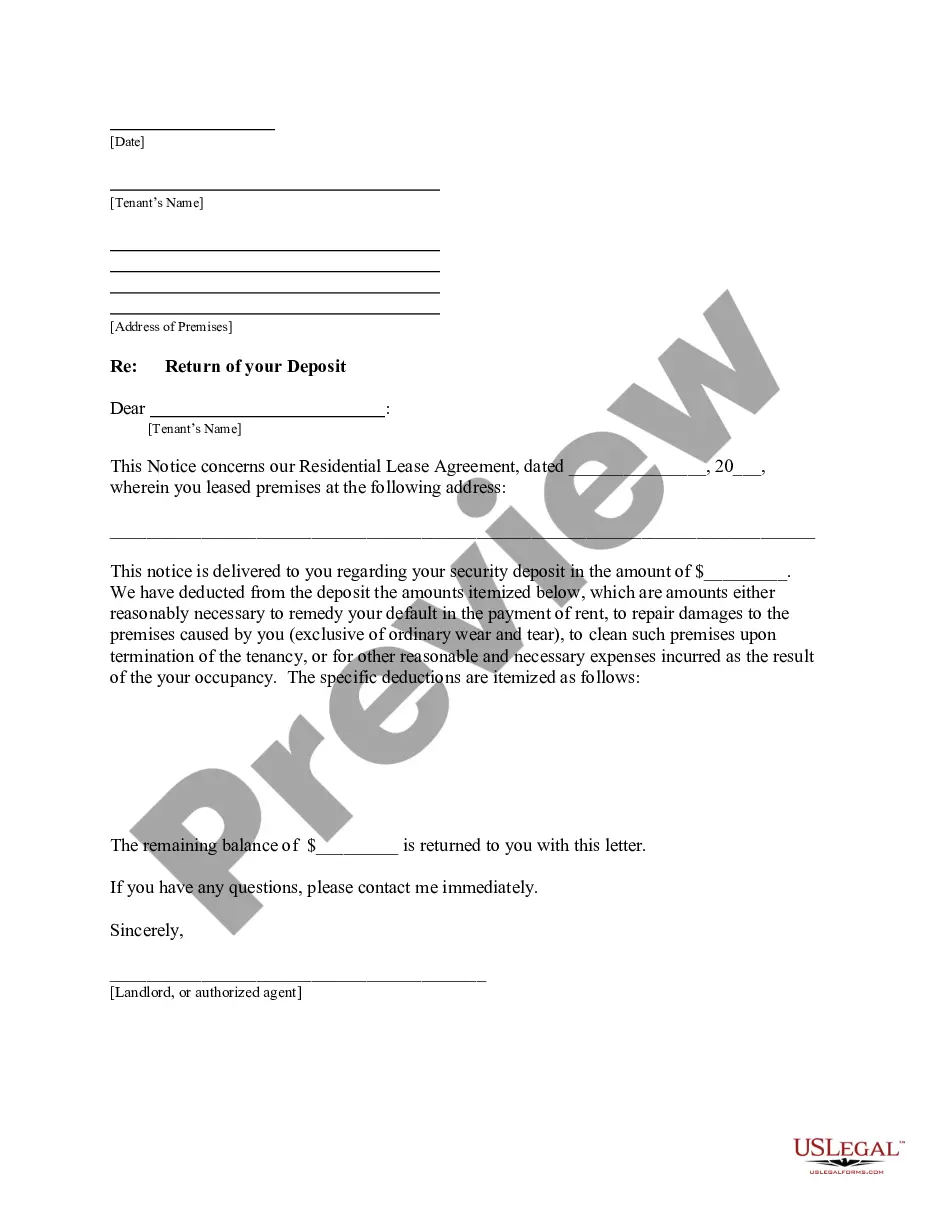

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: A Comprehensive Guide to the Spokane Valley, Washington Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: As a landlord in Spokane Valley, Washington, it is essential to maintain transparent and professional communication with your tenants. One crucial aspect of this process is the return of the security deposit at the end of the tenancy. This guide will provide you with a detailed description of the different types of letters used in Spokane Valley, specifically addressing the return of the security deposit, along with relevant keywords. 1. Standard Security Deposit Return Letter: A standard security deposit return letter is used when returning the full security deposit amount to the tenant without any deductions. This letter ensures a smooth transition and concludes the tenancy on a positive note, providing a sense of trust between the landlord and tenant. 2. Itemized Deduction Letter: In cases where the landlord needs to deduct certain expenses from the security deposit, such as repairs or unpaid bills, an itemized deduction letter is necessary. This letter provides an item-by-item breakdown of the deducted charges along with corresponding receipts or invoices, ensuring transparency and accountability. 3. Late Rent Deduction Letter: If the tenant has outstanding rent payments at the end of the tenancy, a late rent deduction letter addresses this situation. This letter outlines the amount owed, highlighting the specific deductions made from the security deposit to cover the outstanding rent. It is crucial to include rent payment history and any contractual provisions regarding late rent fees to support the letter's validity. 4. Cleaning and Maintenance Deduction Letter: Landlords may occasionally need to deduct a portion of the security deposit to cover cleaning costs or repairs caused by tenant negligence. A cleaning and maintenance deduction letter explains the reasons for these deductions and provides a breakdown of associated expenses. It is advisable to include before and after photos or videos to reinforce the necessity for deductions and justify the charges. 5. Unpaid Utility Bills Deduction Letter: In situations where the tenant has unpaid utility bills before moving out, a deduction letter addressing this issue is required. The letter specifies the utility companies involved, the outstanding balances, and the corresponding deductions made from the security deposit. Include copies of the utility bills and any communication between the utility provider and tenant to substantiate the deductions. Conclusion: In Spokane Valley, Washington, landlords must handle the return of security deposits with utmost care and adherence to the law. By understanding the different types of letters used when returning security deposit less deductions, landlords can maintain a transparent and professional relationship with their tenants. Remember to personalize each letter to the specific circumstances, always providing supporting documentation to justify deductions made.Title: A Comprehensive Guide to the Spokane Valley, Washington Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: As a landlord in Spokane Valley, Washington, it is essential to maintain transparent and professional communication with your tenants. One crucial aspect of this process is the return of the security deposit at the end of the tenancy. This guide will provide you with a detailed description of the different types of letters used in Spokane Valley, specifically addressing the return of the security deposit, along with relevant keywords. 1. Standard Security Deposit Return Letter: A standard security deposit return letter is used when returning the full security deposit amount to the tenant without any deductions. This letter ensures a smooth transition and concludes the tenancy on a positive note, providing a sense of trust between the landlord and tenant. 2. Itemized Deduction Letter: In cases where the landlord needs to deduct certain expenses from the security deposit, such as repairs or unpaid bills, an itemized deduction letter is necessary. This letter provides an item-by-item breakdown of the deducted charges along with corresponding receipts or invoices, ensuring transparency and accountability. 3. Late Rent Deduction Letter: If the tenant has outstanding rent payments at the end of the tenancy, a late rent deduction letter addresses this situation. This letter outlines the amount owed, highlighting the specific deductions made from the security deposit to cover the outstanding rent. It is crucial to include rent payment history and any contractual provisions regarding late rent fees to support the letter's validity. 4. Cleaning and Maintenance Deduction Letter: Landlords may occasionally need to deduct a portion of the security deposit to cover cleaning costs or repairs caused by tenant negligence. A cleaning and maintenance deduction letter explains the reasons for these deductions and provides a breakdown of associated expenses. It is advisable to include before and after photos or videos to reinforce the necessity for deductions and justify the charges. 5. Unpaid Utility Bills Deduction Letter: In situations where the tenant has unpaid utility bills before moving out, a deduction letter addressing this issue is required. The letter specifies the utility companies involved, the outstanding balances, and the corresponding deductions made from the security deposit. Include copies of the utility bills and any communication between the utility provider and tenant to substantiate the deductions. Conclusion: In Spokane Valley, Washington, landlords must handle the return of security deposits with utmost care and adherence to the law. By understanding the different types of letters used when returning security deposit less deductions, landlords can maintain a transparent and professional relationship with their tenants. Remember to personalize each letter to the specific circumstances, always providing supporting documentation to justify deductions made.