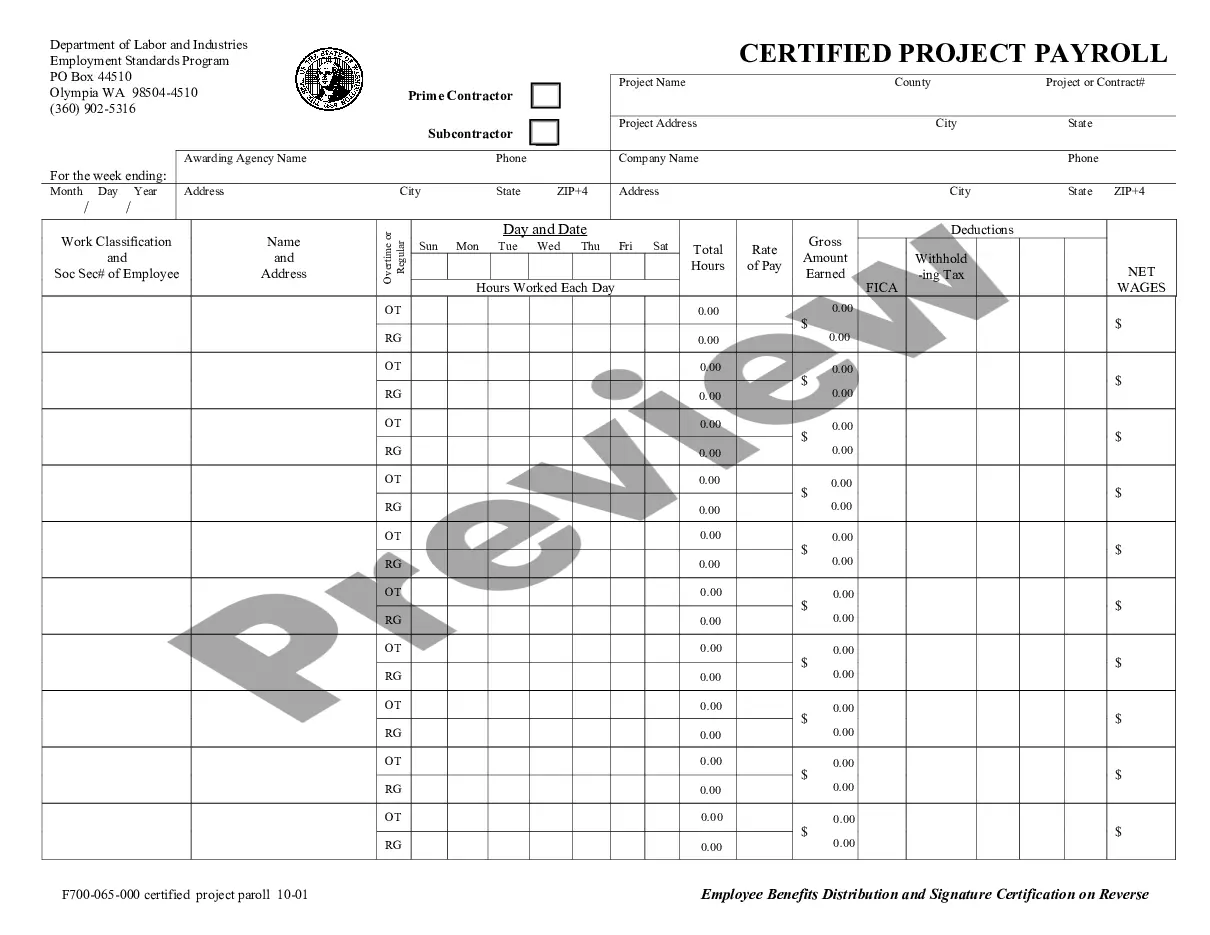

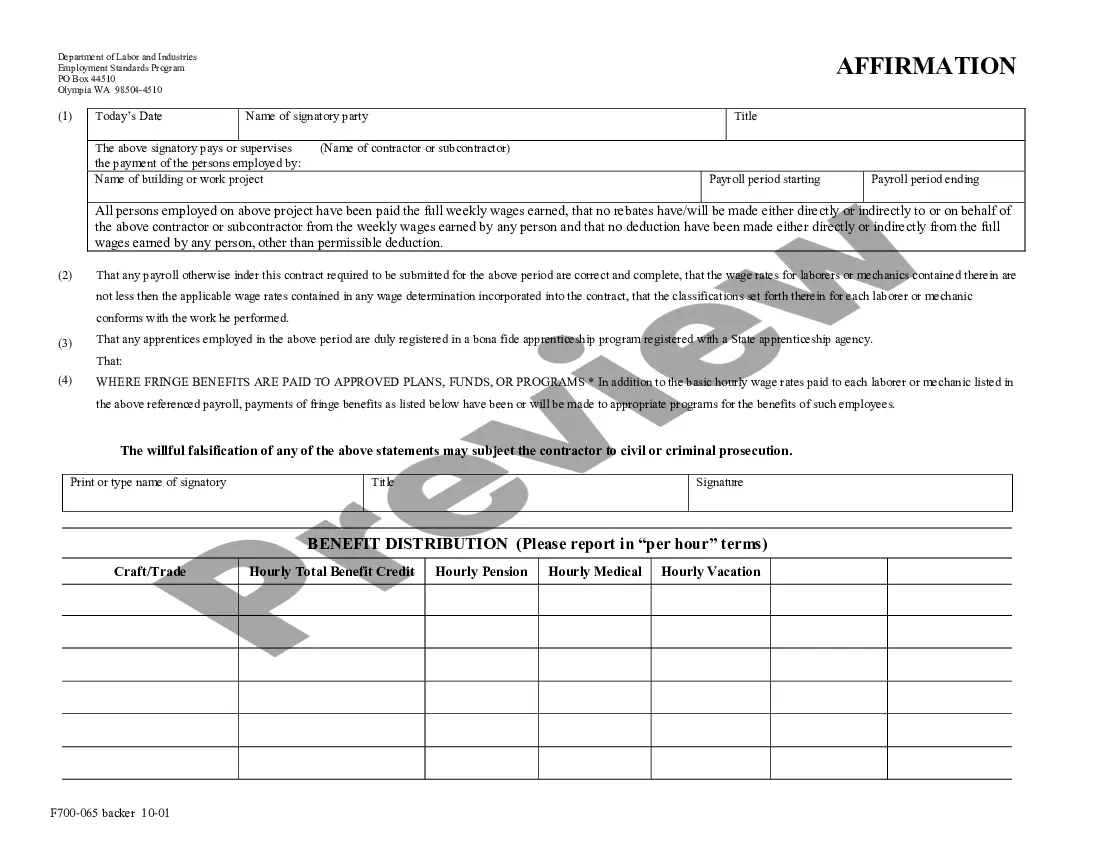

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

Renton Washington Weekly Payroll Record is a comprehensive and essential document that meticulously records the details of employee wages and compensation on a weekly basis in Renton, Washington. This payroll record serves as a crucial tool for businesses and employers in accurately tracking and managing employee wages, tax deductions, and other benefits. Keywords: Renton Washington, Weekly Payroll Record, employee wages, compensation, tax deductions, benefits. The Renton Washington Weekly Payroll Record encompasses various important information, including the employee's name, identification number, employment status, work hours, hourly wage rate, overtime hours and rates, special allowances, bonuses, and any deductions made from the employee's earnings. This meticulously detailed record ensures that employees are paid accurately and in compliance with labor laws and regulations. In addition to these key details, Renton Washington Weekly Payroll Record also keeps track of various payroll-related elements, such as federal and state tax withholding, Social Security contributions, Medicare deductions, retirement plan contributions, health insurance premiums, and any other miscellaneous deductions. It ensures that all necessary deductions and contributions are accounted for, guaranteeing accurate wage disbursements and payroll tax reporting. Furthermore, Renton Washington Weekly Payroll Record provides vital insights for businesses to evaluate their labor costs, monitor employee productivity, compare wages and compensations across different periods, and generate reports for financial analysis. It plays a crucial role in budgeting, forecasting, and ensuring regulatory compliance. Types of Renton Washington Weekly Payroll Record can include specialized records for different departments or employee categories within an organization. For instance, there may be separate payroll records for full-time employees, part-time employees, temporary staff, contractors, or employees working in specialized roles. These different records cater to the unique payroll requirements and terms of employment for each category of workers. In conclusion, the Renton Washington Weekly Payroll Record is a detailed and indispensable record-keeping document that accurately documents employee wages, deductions, and benefits. This information is crucial for ensuring fair compensation, labor cost management, and compliance with tax regulations and employment laws. It serves as an essential tool for businesses in Renton, Washington, to effectively manage their payroll processes and ensure financial transparency and accountability.Renton Washington Weekly Payroll Record is a comprehensive and essential document that meticulously records the details of employee wages and compensation on a weekly basis in Renton, Washington. This payroll record serves as a crucial tool for businesses and employers in accurately tracking and managing employee wages, tax deductions, and other benefits. Keywords: Renton Washington, Weekly Payroll Record, employee wages, compensation, tax deductions, benefits. The Renton Washington Weekly Payroll Record encompasses various important information, including the employee's name, identification number, employment status, work hours, hourly wage rate, overtime hours and rates, special allowances, bonuses, and any deductions made from the employee's earnings. This meticulously detailed record ensures that employees are paid accurately and in compliance with labor laws and regulations. In addition to these key details, Renton Washington Weekly Payroll Record also keeps track of various payroll-related elements, such as federal and state tax withholding, Social Security contributions, Medicare deductions, retirement plan contributions, health insurance premiums, and any other miscellaneous deductions. It ensures that all necessary deductions and contributions are accounted for, guaranteeing accurate wage disbursements and payroll tax reporting. Furthermore, Renton Washington Weekly Payroll Record provides vital insights for businesses to evaluate their labor costs, monitor employee productivity, compare wages and compensations across different periods, and generate reports for financial analysis. It plays a crucial role in budgeting, forecasting, and ensuring regulatory compliance. Types of Renton Washington Weekly Payroll Record can include specialized records for different departments or employee categories within an organization. For instance, there may be separate payroll records for full-time employees, part-time employees, temporary staff, contractors, or employees working in specialized roles. These different records cater to the unique payroll requirements and terms of employment for each category of workers. In conclusion, the Renton Washington Weekly Payroll Record is a detailed and indispensable record-keeping document that accurately documents employee wages, deductions, and benefits. This information is crucial for ensuring fair compensation, labor cost management, and compliance with tax regulations and employment laws. It serves as an essential tool for businesses in Renton, Washington, to effectively manage their payroll processes and ensure financial transparency and accountability.