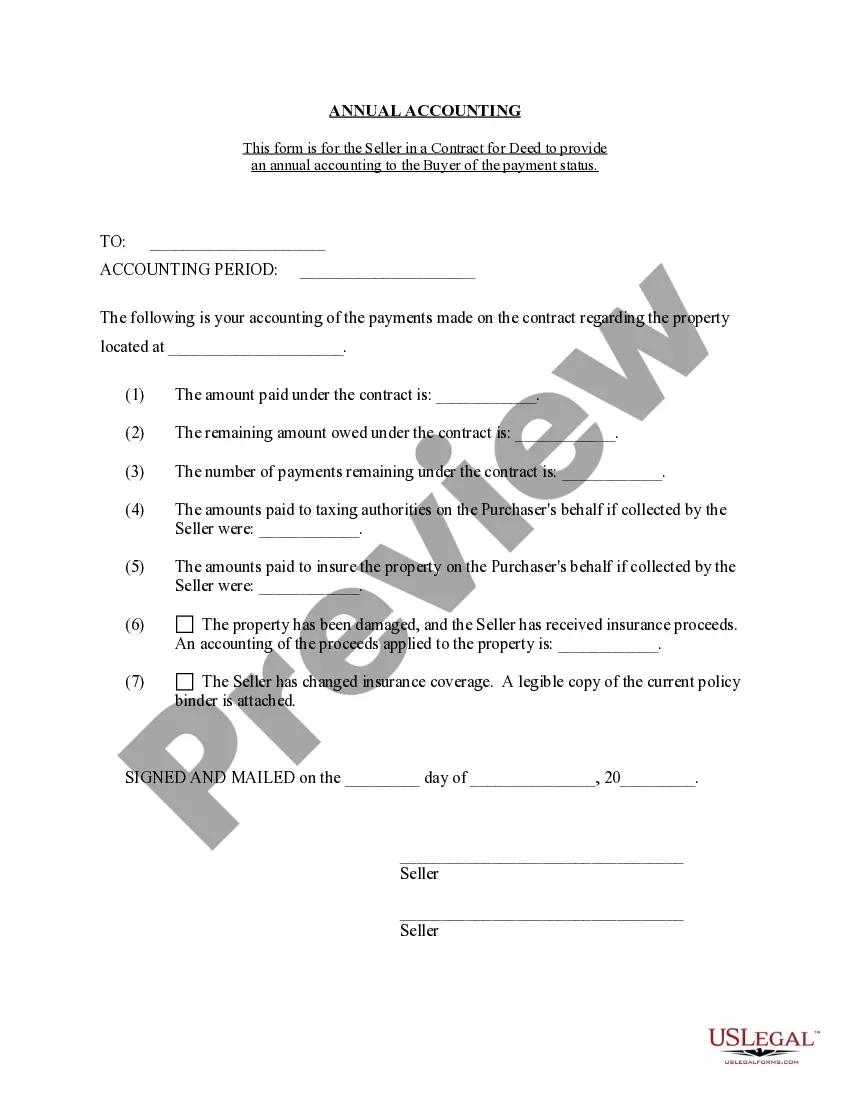

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The King Washington Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of financial transactions and obligations related to contract for deed arrangements in the state of Washington. This statement is typically prepared by the seller and serves as an essential tool for keeping track of income, expenses, and financial obligations associated with contract for deed transactions. Keywords: King Washington, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, income, expenses. Different types of King Washington Contract for Deed Seller's Annual Accounting Statements: 1. Basic Seller's Annual Accounting Statement: This standard statement encompasses the essential information regarding the financial aspects of the contract for deed arrangement. It includes details about the income received from the buyer, expenses incurred by the seller, and any additional financial obligations. 2. Detailed Income and Expense Statement: This specific type of accounting statement provides a more detailed breakdown of the income and expenses incurred throughout the year. It may include specific line items such as property taxes, homeowner's insurance, maintenance costs, and any other relevant expenses, offering a comprehensive overview of the financial picture of the contract for deed transaction. 3. Transaction-Specific Accounting Statement: In some cases, multiple contract for deed arrangements may be in progress simultaneously. This type of statement offers a transaction-specific breakdown of income, expenses, and financial obligations for each separate contract for deed agreement. It helps sellers keep track of individual financial transactions effectively. 4. Annual Tax Planning Statement: This type of accounting statement focuses on the tax-related aspects of contract for deed arrangements. It provides a detailed analysis of tax implications, deductibles, potential tax benefits, and tax planning strategies connected to the seller's income and expenses related to the contract for deed transactions. 5. Buyer Payment Schedule Statement: Although not strictly an accounting statement, this document complements the overall understanding of the financial aspects of the contract for deed arrangement. It outlines the payment schedule agreed upon by the buyer and seller, specifying principal, interest, and any additional costs, facilitating accurate tracking of income and outgoing payments. In summary, the King Washington Contract for Deed Seller's Annual Accounting Statement is an essential document that enables sellers to monitor their income, expenses, and various financial obligations associated with contract for deed transactions. Whether opting for a basic statement or a more detailed breakdown, these statements help sellers maintain accurate records and make informed financial decisions throughout the year.The King Washington Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of financial transactions and obligations related to contract for deed arrangements in the state of Washington. This statement is typically prepared by the seller and serves as an essential tool for keeping track of income, expenses, and financial obligations associated with contract for deed transactions. Keywords: King Washington, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, income, expenses. Different types of King Washington Contract for Deed Seller's Annual Accounting Statements: 1. Basic Seller's Annual Accounting Statement: This standard statement encompasses the essential information regarding the financial aspects of the contract for deed arrangement. It includes details about the income received from the buyer, expenses incurred by the seller, and any additional financial obligations. 2. Detailed Income and Expense Statement: This specific type of accounting statement provides a more detailed breakdown of the income and expenses incurred throughout the year. It may include specific line items such as property taxes, homeowner's insurance, maintenance costs, and any other relevant expenses, offering a comprehensive overview of the financial picture of the contract for deed transaction. 3. Transaction-Specific Accounting Statement: In some cases, multiple contract for deed arrangements may be in progress simultaneously. This type of statement offers a transaction-specific breakdown of income, expenses, and financial obligations for each separate contract for deed agreement. It helps sellers keep track of individual financial transactions effectively. 4. Annual Tax Planning Statement: This type of accounting statement focuses on the tax-related aspects of contract for deed arrangements. It provides a detailed analysis of tax implications, deductibles, potential tax benefits, and tax planning strategies connected to the seller's income and expenses related to the contract for deed transactions. 5. Buyer Payment Schedule Statement: Although not strictly an accounting statement, this document complements the overall understanding of the financial aspects of the contract for deed arrangement. It outlines the payment schedule agreed upon by the buyer and seller, specifying principal, interest, and any additional costs, facilitating accurate tracking of income and outgoing payments. In summary, the King Washington Contract for Deed Seller's Annual Accounting Statement is an essential document that enables sellers to monitor their income, expenses, and various financial obligations associated with contract for deed transactions. Whether opting for a basic statement or a more detailed breakdown, these statements help sellers maintain accurate records and make informed financial decisions throughout the year.