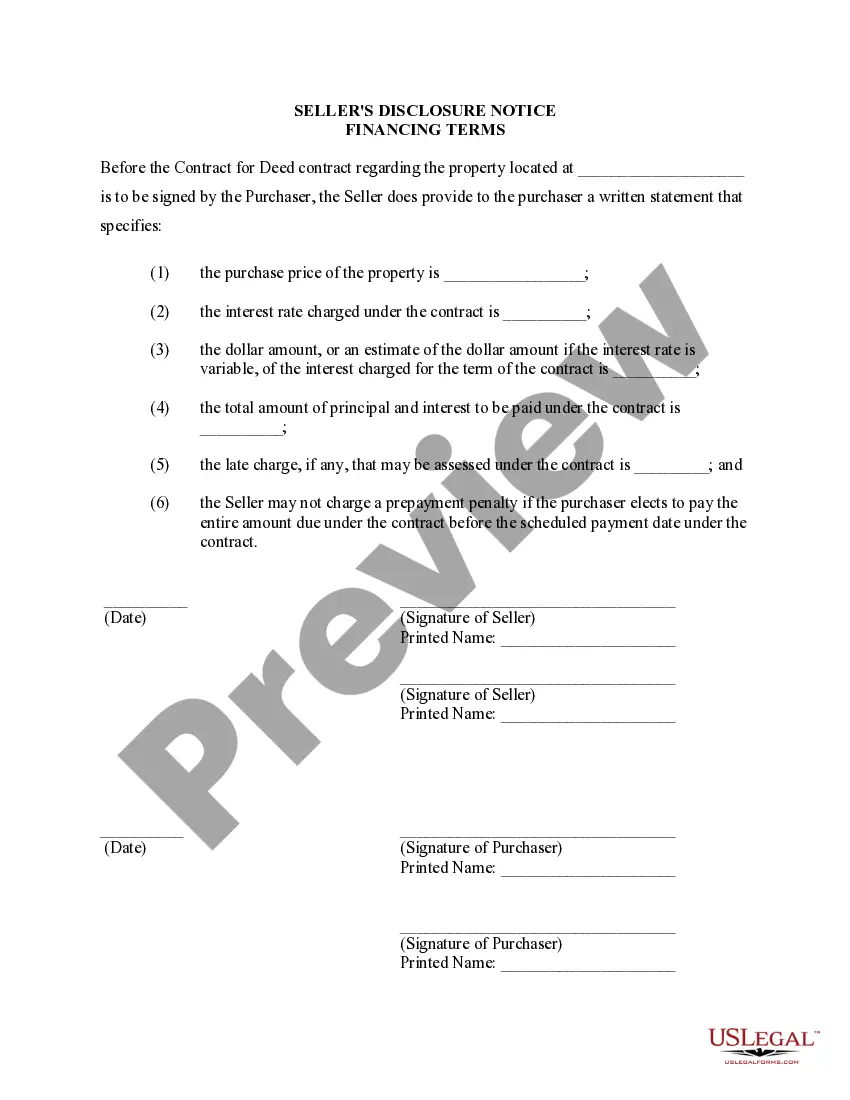

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

In Everett, Washington, when entering into a Contract or Agreement for Deed, commonly referred to as a Land Contract, sellers are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This document ensures transparency between the buyer and seller, outlining the specific terms and conditions related to the financing of the property. By disclosing all relevant financing information, this enables the buyer to make an informed decision regarding their purchase. While the contents of the Seller's Disclosure of Financing Terms for Residential Property may vary based on individual circumstances, there are several key elements that are typically included. These aspects help to protect both parties involved in the transaction and ensure a smooth and fair agreement: 1. Purchase Price: The disclosure will state the agreed-upon purchase price for the residential property. This is the amount that the buyer is obligated to pay over the course of the agreement. 2. Down Payment: The document will specify whether a down payment is required and the amount agreed upon. It will outline the due date for the down payment and any consequences for failing to provide it on time. 3. Interest Rate: The disclosure will detail the interest rate that will apply to the amount financed. This is an important factor for the buyer, as it determines the total amount of interest they will pay over the term of the contract. 4. Amortization Schedule: The disclosure will outline the repayment schedule, including the number of installments, the frequency of payments, and the due date for each payment. This schedule ensures that both parties are aware of their financial obligations and provides clarity on the payment process. 5. Late Payment Penalties: The Seller's Disclosure of Financing Terms for Residential Property may include information about any penalties or fees that will be imposed if the buyer fails to make payments on time. This helps maintain accountability and encourages timely payments. 6. Balloon Payment: In some cases, the disclosure will note if a balloon payment is required. This means that at a specific point during the agreement, the buyer will be required to make a lump-sum payment to finalize the purchase. The disclosure will outline the due date and amount of the balloon payment. 7. Default and Remedies: This section addresses the consequences should the buyer default on the terms of the agreement. It may include information about potential penalties, foreclosure procedures, or any other remedies available to the seller. Different types of Everett Washington Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may vary depending on the specific terms negotiated by both parties. It's important to carefully review and understand all the terms outlined in the disclosure before proceeding with the land contract. Consulting with a real estate attorney or a trusted professional can provide additional guidance to ensure the buyer and seller are fully informed and protected throughout the transaction.In Everett, Washington, when entering into a Contract or Agreement for Deed, commonly referred to as a Land Contract, sellers are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This document ensures transparency between the buyer and seller, outlining the specific terms and conditions related to the financing of the property. By disclosing all relevant financing information, this enables the buyer to make an informed decision regarding their purchase. While the contents of the Seller's Disclosure of Financing Terms for Residential Property may vary based on individual circumstances, there are several key elements that are typically included. These aspects help to protect both parties involved in the transaction and ensure a smooth and fair agreement: 1. Purchase Price: The disclosure will state the agreed-upon purchase price for the residential property. This is the amount that the buyer is obligated to pay over the course of the agreement. 2. Down Payment: The document will specify whether a down payment is required and the amount agreed upon. It will outline the due date for the down payment and any consequences for failing to provide it on time. 3. Interest Rate: The disclosure will detail the interest rate that will apply to the amount financed. This is an important factor for the buyer, as it determines the total amount of interest they will pay over the term of the contract. 4. Amortization Schedule: The disclosure will outline the repayment schedule, including the number of installments, the frequency of payments, and the due date for each payment. This schedule ensures that both parties are aware of their financial obligations and provides clarity on the payment process. 5. Late Payment Penalties: The Seller's Disclosure of Financing Terms for Residential Property may include information about any penalties or fees that will be imposed if the buyer fails to make payments on time. This helps maintain accountability and encourages timely payments. 6. Balloon Payment: In some cases, the disclosure will note if a balloon payment is required. This means that at a specific point during the agreement, the buyer will be required to make a lump-sum payment to finalize the purchase. The disclosure will outline the due date and amount of the balloon payment. 7. Default and Remedies: This section addresses the consequences should the buyer default on the terms of the agreement. It may include information about potential penalties, foreclosure procedures, or any other remedies available to the seller. Different types of Everett Washington Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may vary depending on the specific terms negotiated by both parties. It's important to carefully review and understand all the terms outlined in the disclosure before proceeding with the land contract. Consulting with a real estate attorney or a trusted professional can provide additional guidance to ensure the buyer and seller are fully informed and protected throughout the transaction.