Kings New York Tax Work Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between the Kings New York Tax Agency and a self-employed individual who is engaged as an independent contractor for tax-related services. This agreement aims to establish a clear understanding of the rights, responsibilities, and obligations for both parties involved in the contractual relationship. The Kings New York Tax Work Agreement is designed specifically for self-employed individuals who wish to work with the tax agency as independent contractors. It provides a comprehensive framework that covers various aspects necessary for a successful collaboration, including project scope, compensation, work schedule, confidentiality, termination rights, and dispute resolution. This agreement defines the scope of work to be performed by the independent contractor, which may include tax preparation, tax planning, financial consultation, or other related tax services. It specifies the required deliverables, deadlines, and quality standards that the contractor must adhere to. Compensation terms are also extensively covered in the Kings New York Tax Work Agreement. It outlines methods, frequency, and conditions for payment, ensuring transparency and fairness in the financial aspect of the relationship. Additionally, this agreement might encompass provisions related to reimbursement of authorized expenses incurred during the engagement. Confidentiality is a crucial aspect when dealing with sensitive tax and financial information. The agreement includes provisions that enforce the contractor's duty to maintain strict confidentiality and safeguard any proprietary or confidential information obtained during the course of their engagement. In case of disputes or disagreements, the Kings New York Tax Work Agreement provides a mechanism for resolving conflicts. It may involve mediation or arbitration, depending on the parties' preferences, to ensure a fair and unbiased resolution process. Moreover, there might be different types of Kings New York Tax Work Agreement — Self-Employed Independent Contractor depending on the specific services or industry niche. For instance, specialized agreements could exist for independent contractors offering services like bookkeeping, payroll management, business entity formation, or tax compliance consulting. These agreements would tailor the terms and conditions to align with the specific requirements and obligations associated with those distinct services. Overall, the Kings New York Tax Work Agreement — Self-Employed Independent Contractor serves as a crucial legal document that establishes a mutually beneficial working relationship between the Kings New York Tax Agency and the self-employed independent contractor. Its purpose is to protect the interests of both parties, ensure compliance with applicable laws, and provide clarity and structure for a successful collaboration in the tax industry.

Kings New York Tax Work Agreement - Self-Employed Independent Contractor

Description

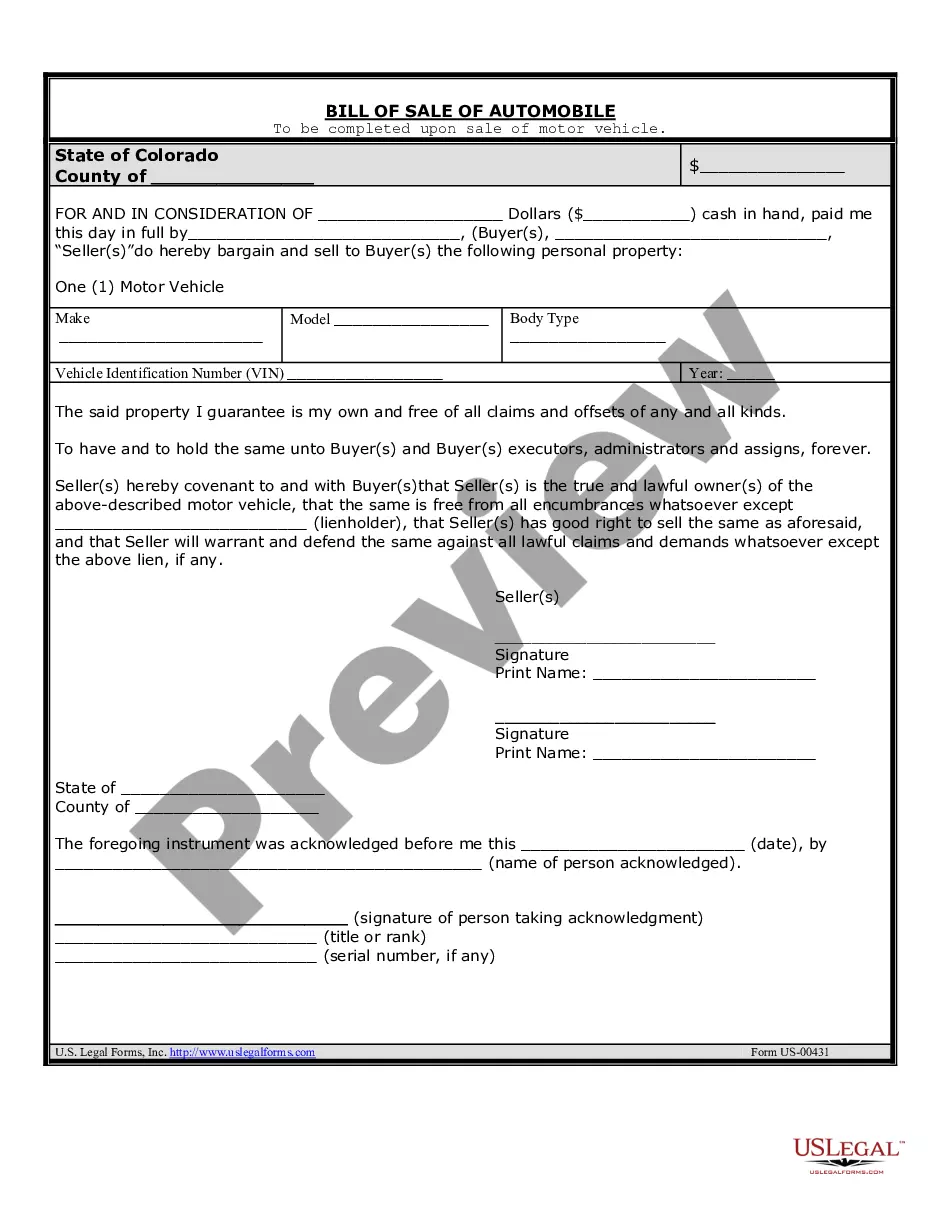

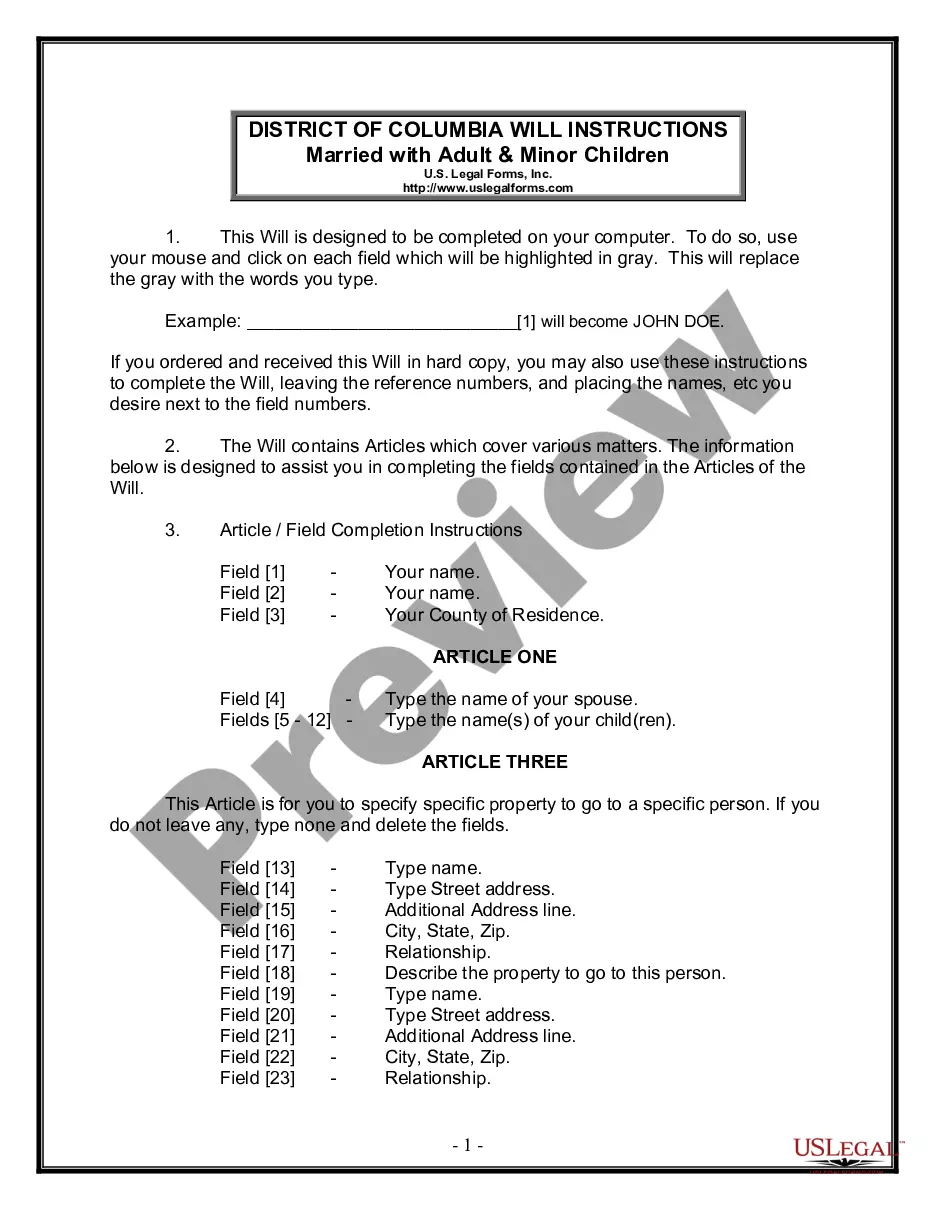

How to fill out Kings New York Tax Work Agreement - Self-Employed Independent Contractor?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Kings Tax Work Agreement - Self-Employed Independent Contractor is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Kings Tax Work Agreement - Self-Employed Independent Contractor. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Kings Tax Work Agreement - Self-Employed Independent Contractor in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!