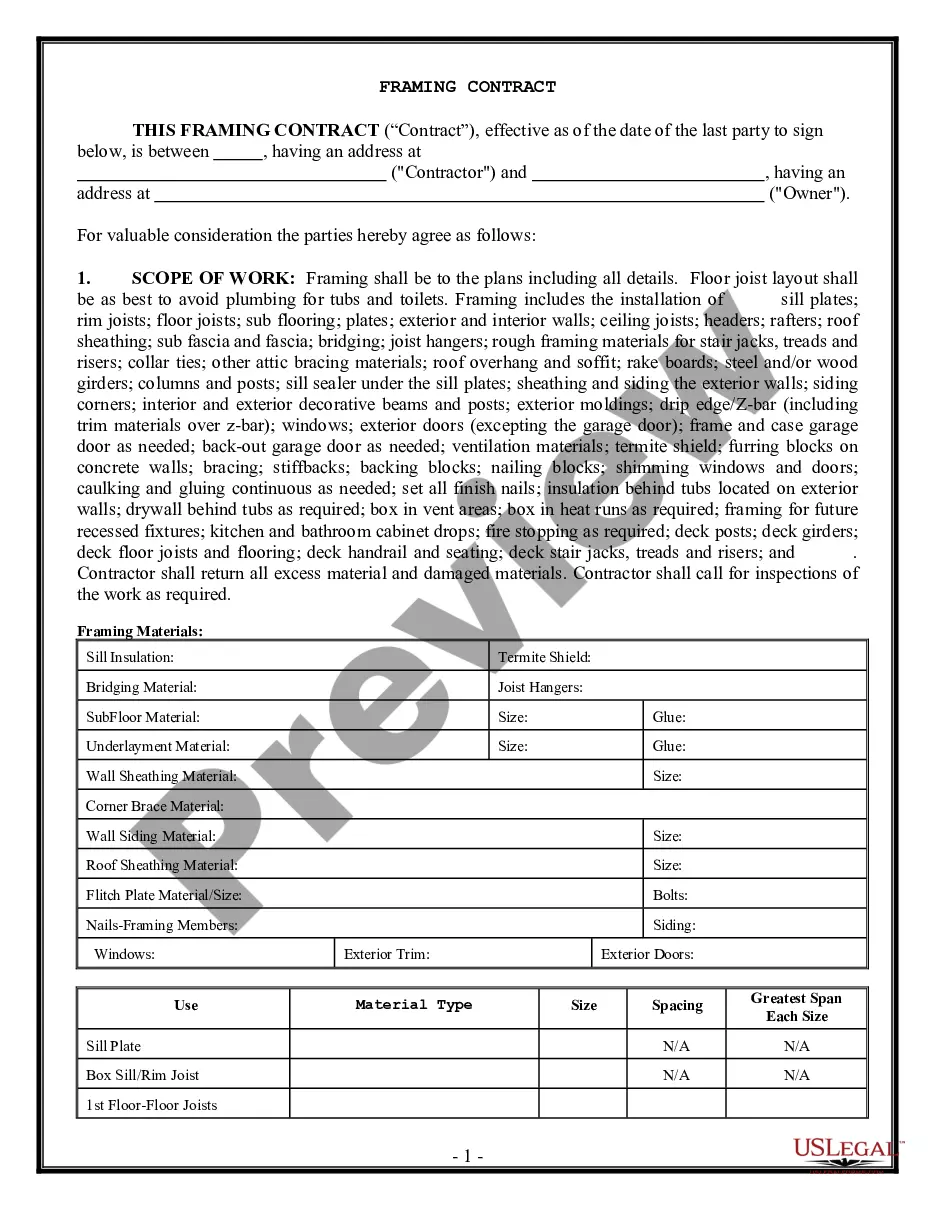

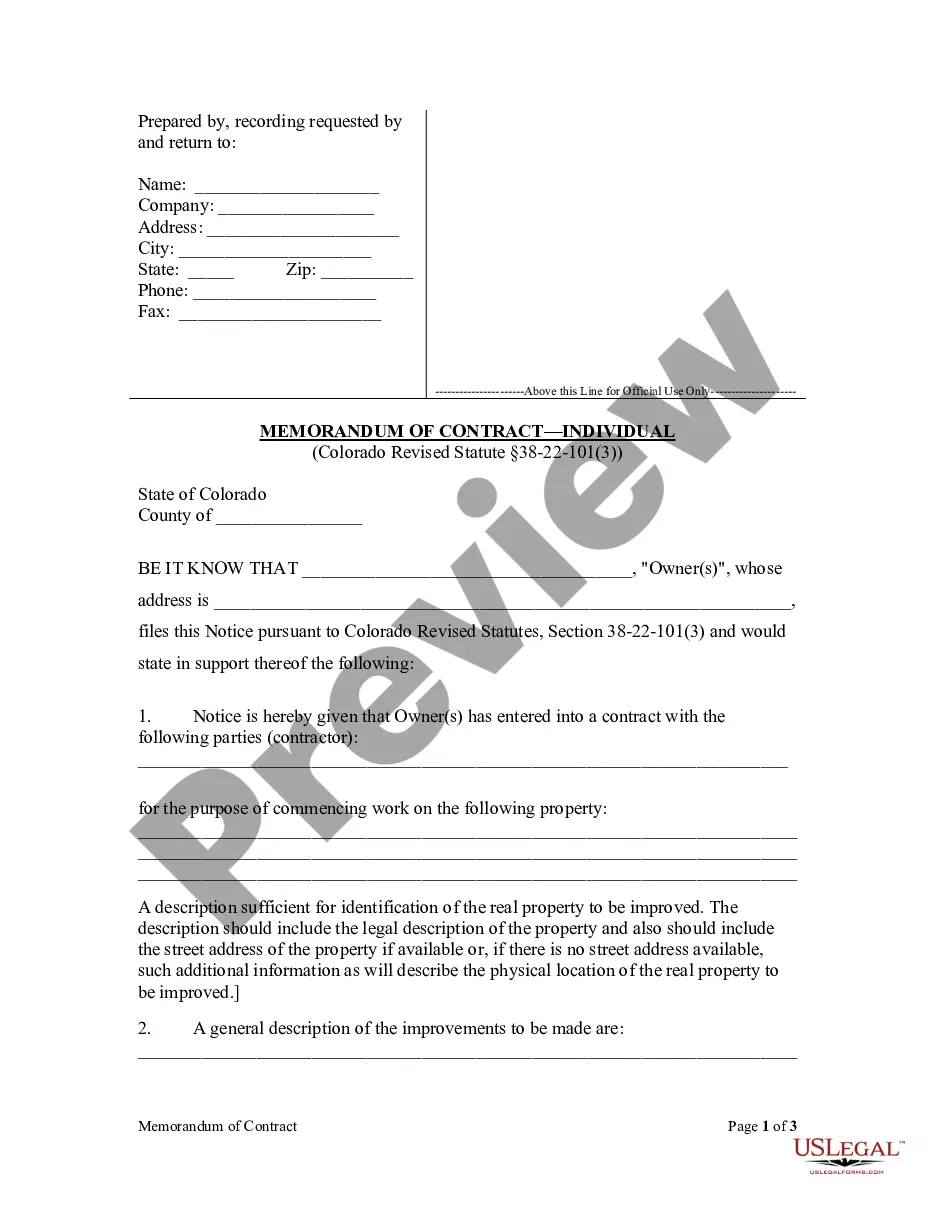

A Kings New York Bill of Sale Issued Shares is a legal document used to transfer ownership of shares in a company located in New York. It is a binding agreement between the seller and the buyer, outlining the terms and conditions of the sale transaction. This document is crucial for establishing proof of ownership and protecting the rights and interests of both parties involved. Keywords: Kings New York, Bill of Sale, Issued Shares, transfer of ownership, legal document, seller, buyer, terms and conditions, sale transaction, proof of ownership, rights and interests. There are different types of Kings New York Bill of Sale Issued Shares: 1. Common Shares Bill of Sale — This type of bill of sale concerns the transfer of ordinary/common shares in a company. Common shares typically represent ownership in a company, entitling the shareholder to voting rights and a share of the company's profits. The document will specify the number of common shares being sold, their par value if any, and any conditions or restrictions attached to them. 2. Preferred Shares Bill of Sale — In some cases, a company may issue preferred shares, which offer certain advantages over common shares, such as priority in dividend payments or liquidation proceedings. A preferred shares bill of sale will outline the details of the preferred shares being sold, including any specific rights or preferences associated with them. 3. Restricted Shares Bill of Sale — Restricted shares refer to shares that have specific limitations on their transferability or sale. These restrictions are typically imposed by the company or relevant securities regulations. A restricted shares bill of sale will define the scope of these restrictions and ensure compliance with applicable laws. 4. Treasury Shares Bill of Sale — Treasury shares are shares that have been repurchased by the company and are held in its own treasury. These shares may be sold or transferred to other parties, and a treasury shares bill of sale will ensure their lawful transfer and conveyance of ownership rights. 5. Convertible Shares Bill of Sale — Convertible shares are a type of equity investment that can be converted into another form of security, such as common shares or preferred shares. A convertible shares bill of sale will specify the terms and conditions under which the conversion can occur, protecting the interests of both the buyer and the seller. In summary, a Kings New York Bill of Sale Issued Shares is a vital legal document used to transfer ownership of various types of shares in a company. Whether it involves common shares, preferred shares, restricted shares, treasury shares, or convertible shares, this document ensures a transparent and legally sound transaction, safeguarding the rights and interests of all parties involved.

Kings New York Bill of Sale Issued Shares

Description

How to fill out Kings New York Bill Of Sale Issued Shares?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Kings Bill of Sale Issued Shares without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Kings Bill of Sale Issued Shares on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Kings Bill of Sale Issued Shares:

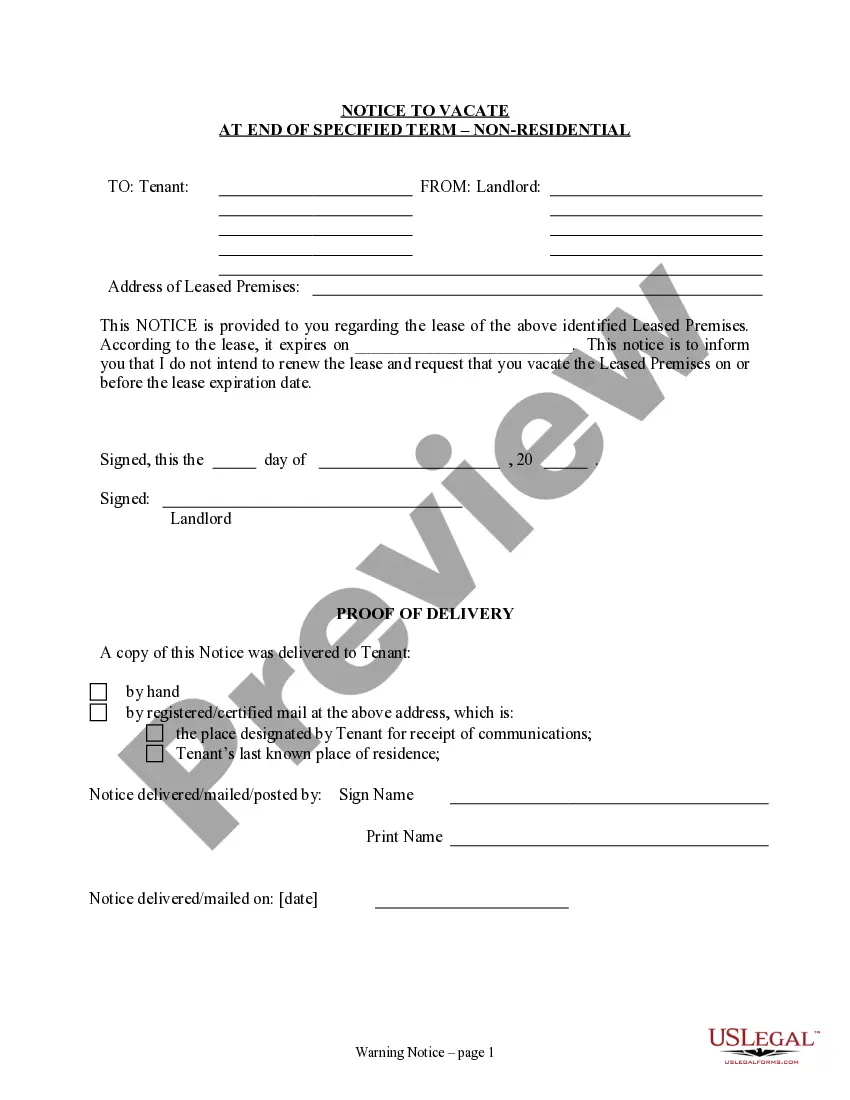

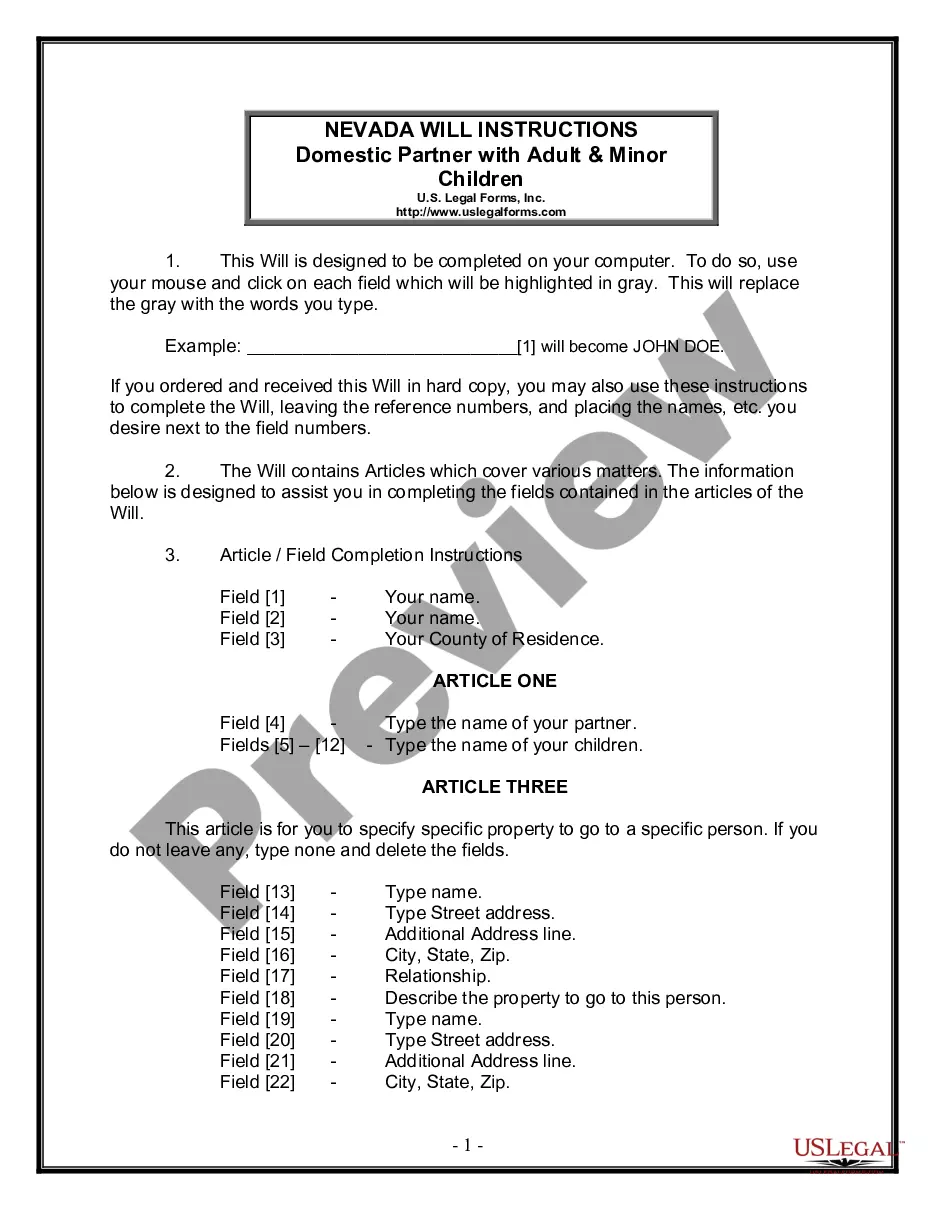

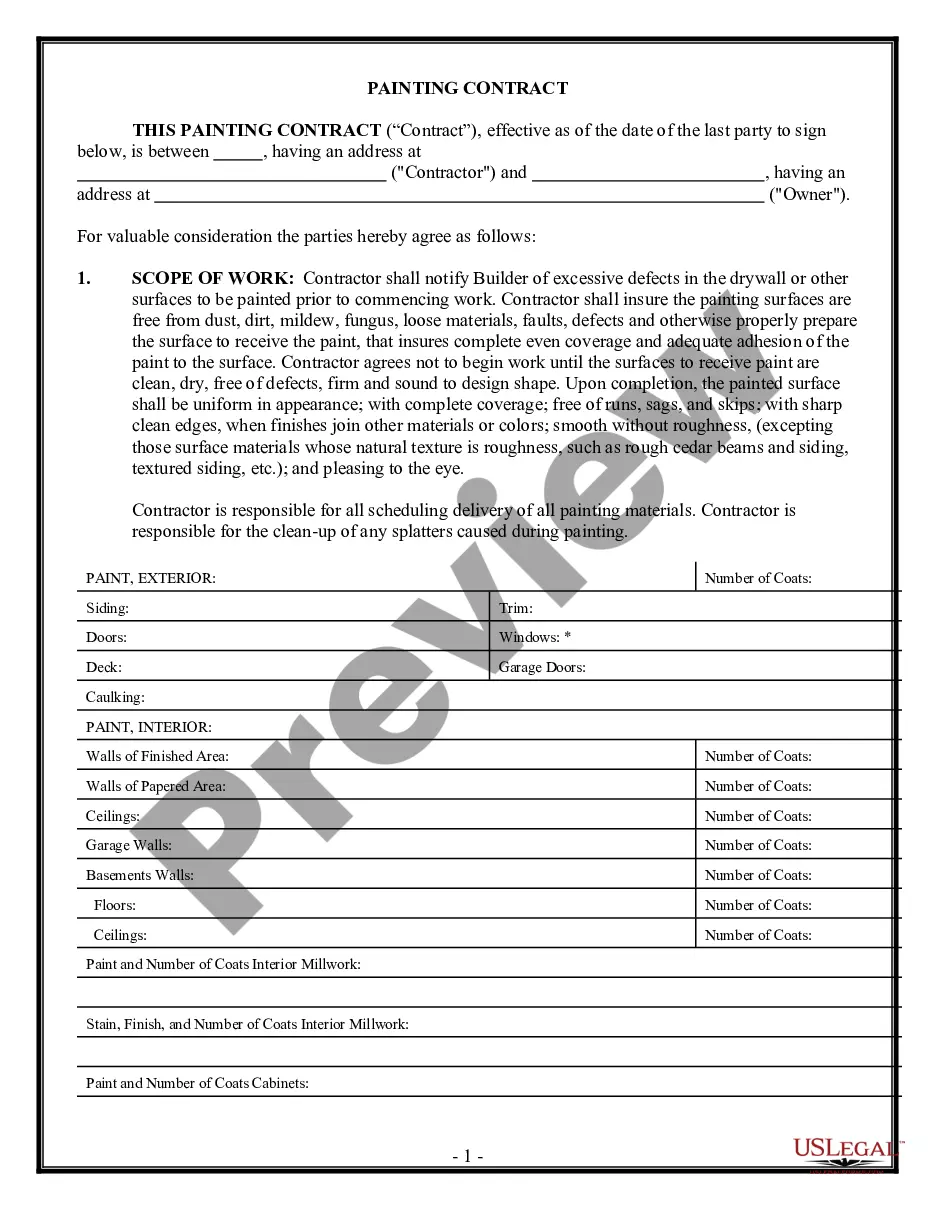

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!