Frisco Texas Real Estate Lien Note

Description

How to fill out Texas Real Estate Lien Note?

Regardless of one's social or professional rank, completing legal paperwork is a regrettable requirement in modern society.

Frequently, it’s nearly unfeasible for an individual without any legal education to draft such documents from the ground up, mainly due to the intricate language and legal subtleties they entail.

This is where US Legal Forms can be a game-changer.

Ensure that the template you have selected is appropriate for your locality since the regulations of one state or region may not apply to another.

Preview the document and review a brief overview (if available) of circumstances in which the document may be utilized.

- Our platform offers an extensive collection with more than 85,000 ready-to-use state-specific documents that cater to almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to save time by leveraging our DIY templates.

- Whether you need the Frisco Texas Real Estate Lien Note or any other paperwork applicable in your state or region, everything you need is available with US Legal Forms.

- Here’s how you can quickly obtain the Frisco Texas Real Estate Lien Note using our dependable platform.

- If you are already a subscriber, you can go ahead and Log In to your account to retrieve the necessary form.

- However, if you are new to our library, be sure to follow these steps before acquiring the Frisco Texas Real Estate Lien Note.

Form popularity

FAQ

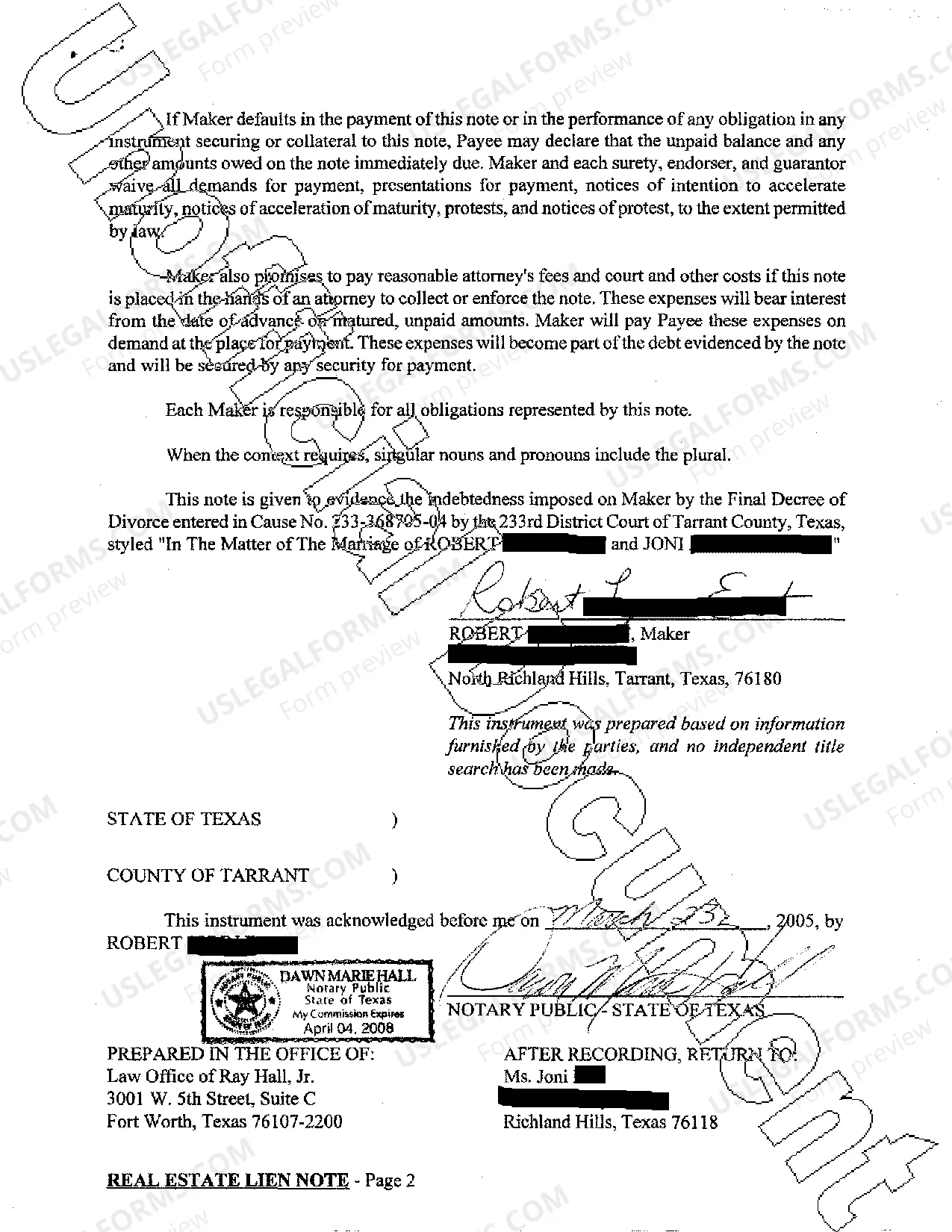

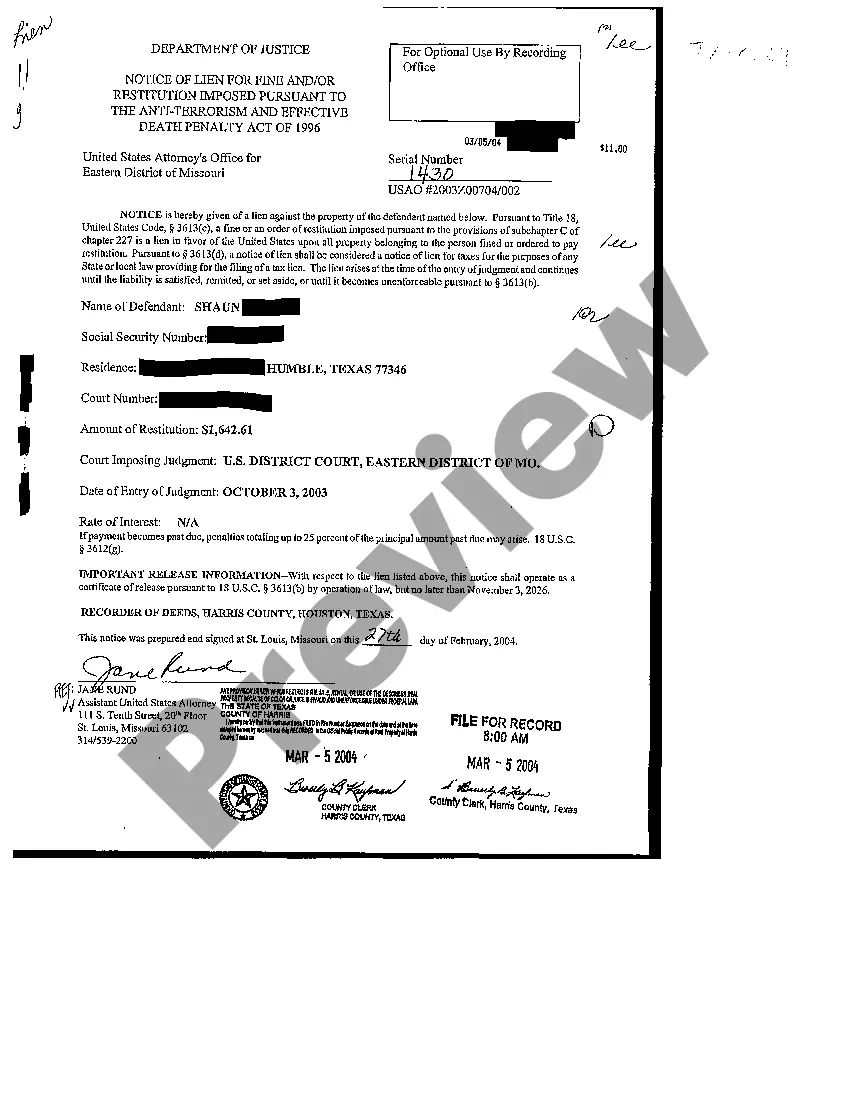

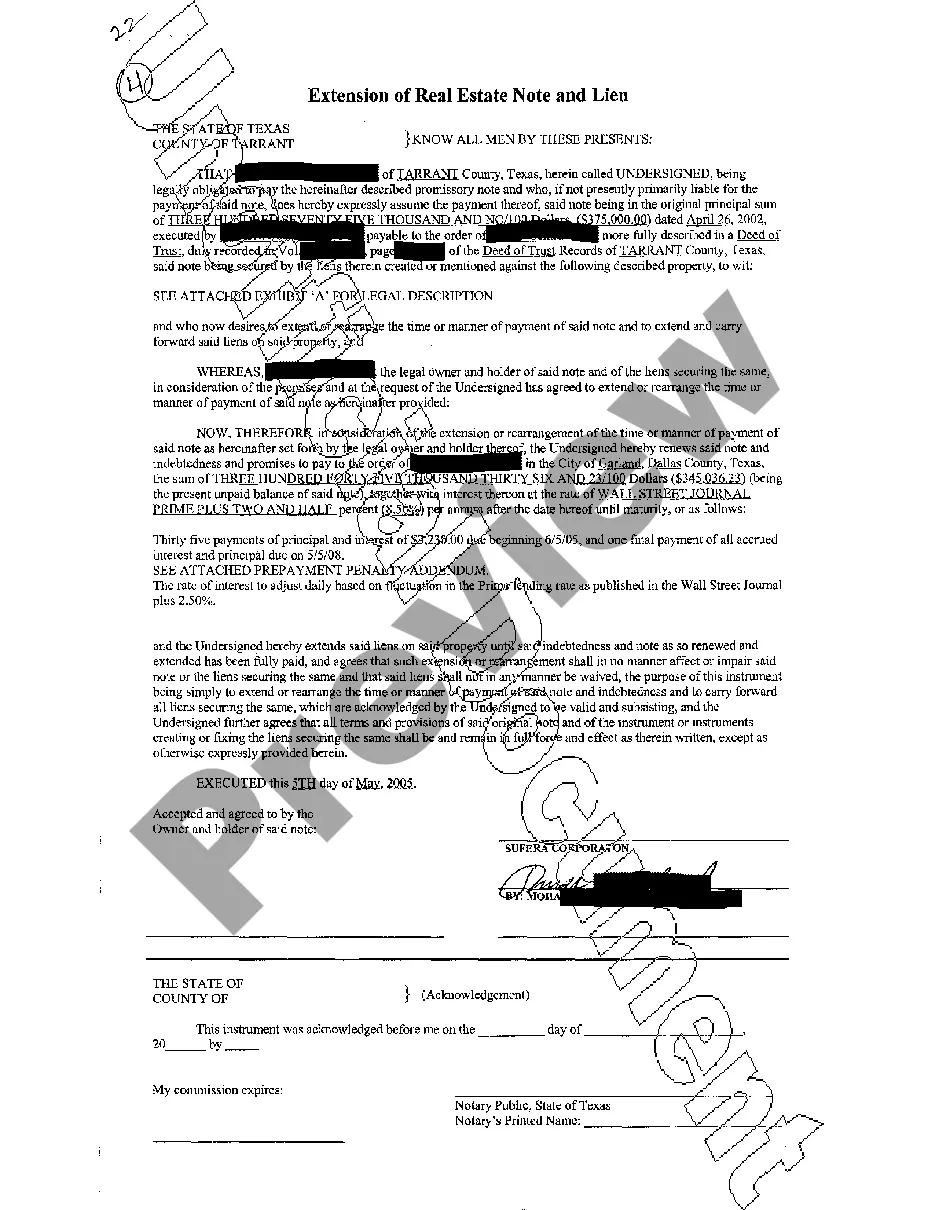

To file a lien on a property in Texas, you need to prepare a lien document that includes your claim and the specifics of the debt. Once the document is ready, submit it to the appropriate county clerk's office where the property resides. For assistance with this process, utilizing USLegalForms can streamline your experience, especially when dealing with a Frisco Texas Real Estate Lien Note.

In Texas, a promissory note does not require notarization to be valid. However, notarizing the note can provide additional assurances and may reinforce its enforceability. If you are establishing a Frisco Texas Real Estate Lien Note, consider having it notarized to safeguard your interests during any potential disputes.

To file a notice of lien in Texas, you must complete the necessary lien form and submit it to the county clerk where the property is located. Ensure you include all required information, including the details specific to your Frisco Texas Real Estate Lien Note. It's often beneficial to consult with a legal expert or use platforms like USLegalForms to navigate this process effectively.

In Texas, a lien release does not necessarily need to be notarized to be effective. However, having the document notarized can help ensure its legitimacy and provide an additional level of protection. If you are dealing with a Frisco Texas Real Estate Lien Note, filing a notarized release may simplify future transactions and clear any potential disputes.

To eliminate a lien from your property in Texas, you must first clear the debt associated with that lien. Once the debt is settled, request a lien release from the lienholder and file it with the county clerk. If difficulties arise, using platforms like US Legal Forms can provide the necessary forms and guidance for resolving any issues related to a Frisco Texas Real Estate Lien Note.

To place a lien on a property in Texas, you must file a lien affidavit with the county clerk's office where the property is located. This affidavit needs to include details about the debt and the property. Using resources like US Legal Forms can help you navigate this process efficiently and secure your interests, particularly regarding any Frisco Texas Real Estate Lien Note.

In Texas, a lien can remain on your property until the underlying debt is satisfied or the lien is officially released. Typically, if the debt is not addressed, a lien might last for several years, impacting your property’s title. To mitigate issues with any Frisco Texas Real Estate Lien Note, always address debts timely and seek lien removal guidance.

Requesting a lien removal typically begins with contacting the lienholder. You need to ask for a formal release document after fulfilling your payment obligations. If you encounter difficulties, consider using legal resources or templates from platforms like US Legal Forms, which can help streamline the process for any Frisco Texas Real Estate Lien Note.

Filing a release of a lien in Texas involves preparing the lien release document and filing it with your local county clerk's office. Ensure all necessary information is included, such as the lienholder's and property owner's details. Filing this document officially updates public records, reflecting that the Frisco Texas Real Estate Lien Note has been released.

To obtain a lien release in Texas, you must contact the lienholder and request a release document. Once you settle the debt tied to the lien, the lienholder will issue a lien release form. After you receive it, file it with the county clerk where your property is located. This step is crucial for clearing any Frisco Texas Real Estate Lien Note associated with your property.