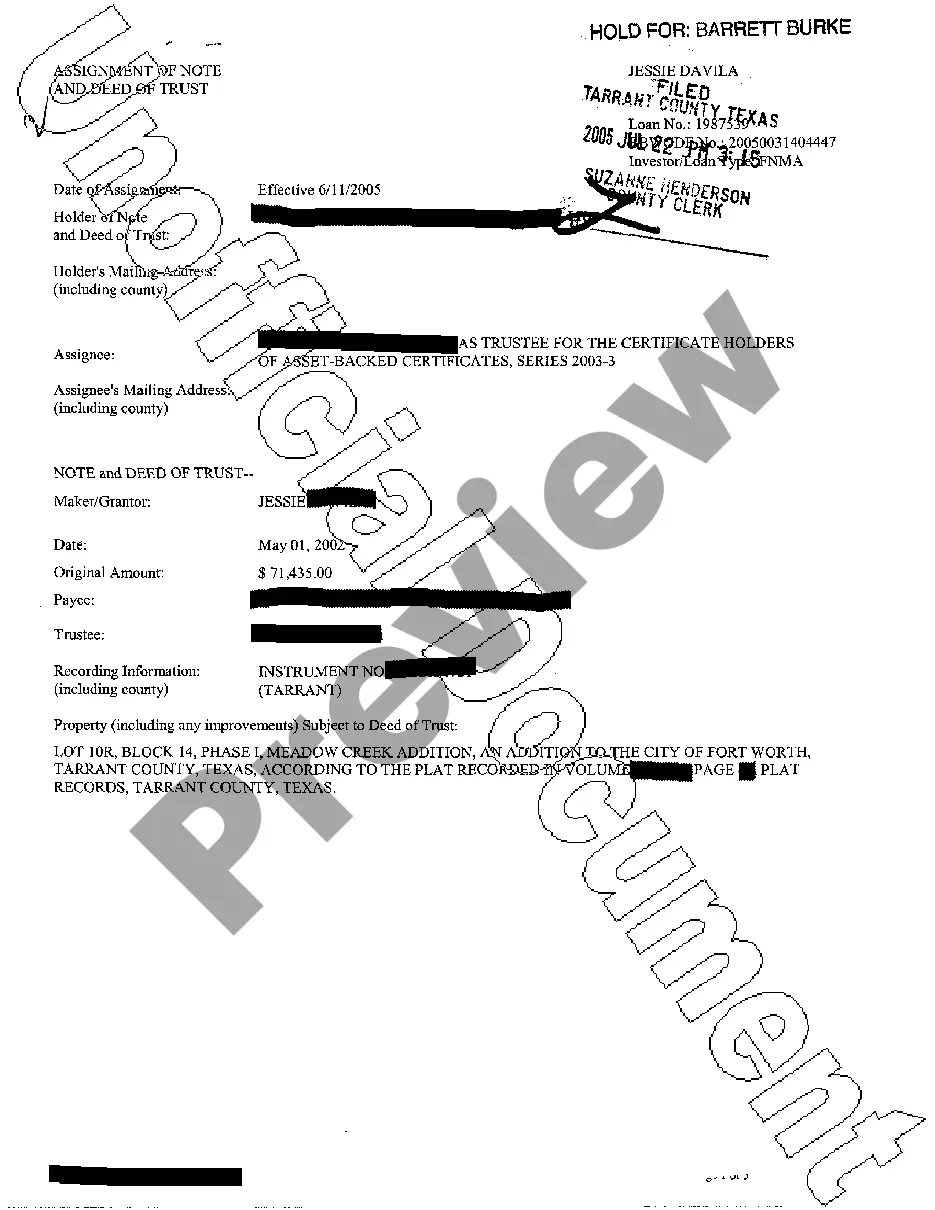

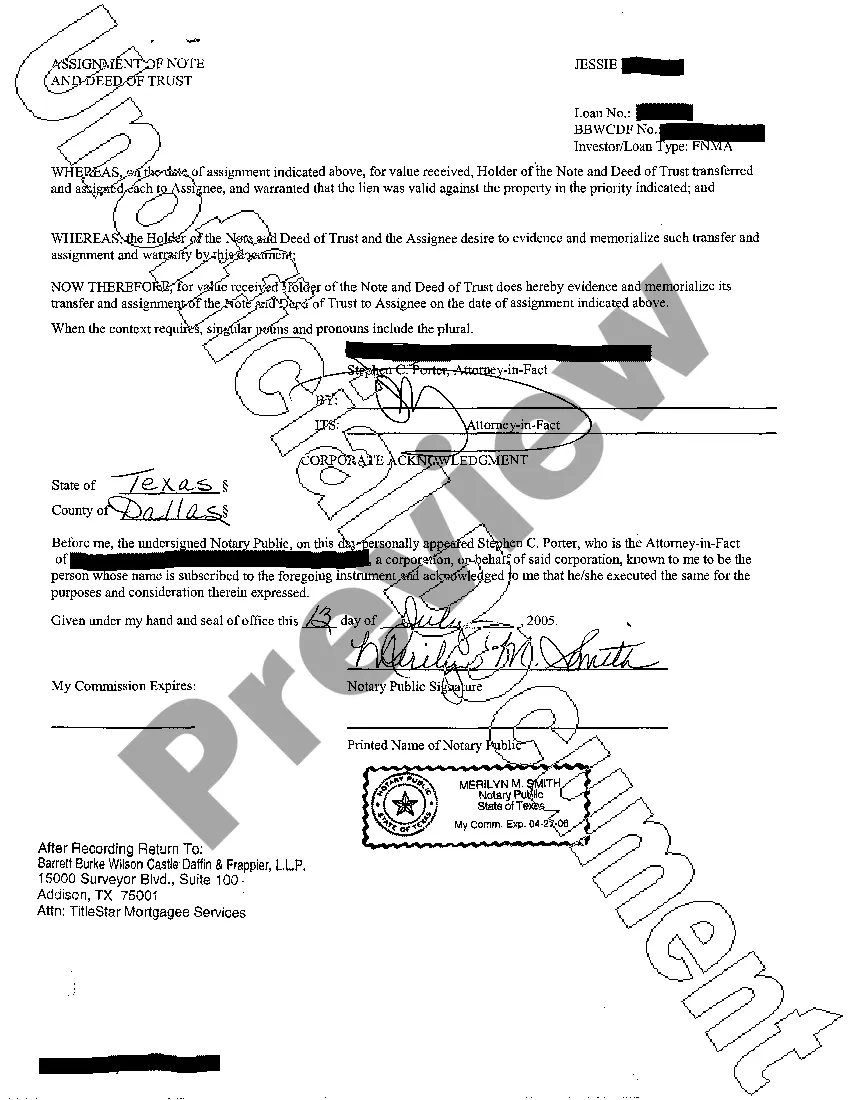

Title: Understanding Frisco, Texas Assignment of Note and Deed of Trust: Types and Features Introduction: In the real estate market of Frisco, Texas, the Assignment of Note and Deed of Trust is a crucial legal document that plays a significant role in property transactions. It involves the transfer of rights and obligations related to a loan and a mortgage, respectively. This article aims to provide a detailed description of what the Frisco Texas Assignment of Note and Deed of Trust entails, including various types that exist. 1. What is a Frisco Texas Assignment of Note? The Assignment of Note is a legal instrument used when the original lender transfers its rights and interests in a promissory note to another party, referred to as the assignee. This document ensures that the assignee now holds the legal authority to collect payments from the borrower and enforce the terms of the loan. It allows for the transfer of the debt owed to the original lender, ensuring a seamless transition of loan ownership. 2. Understanding the Frisco Texas Deed of Trust: On the other hand, a Deed of Trust is a legal contract that secures the loan by using the property itself as collateral. It involves three parties: the borrower (trust or), the lender (beneficiary), and a third-party trustee who holds the deed until the loan is repaid. If the borrower defaults on the loan, the trustee can initiate foreclosure proceedings on behalf of the lender. 3. Frisco Texas Assignment of Note and Deed of Trust Types: a. Partial Assignment: In some cases, lenders may choose to assign only a portion of the outstanding debt to a new holder. This partial assignment allows for the transfer of a fraction of the loan, while the original lender retains the remaining share. b. Absolute Assignment: An absolute assignment refers to the complete transfer of both the promissory note and the Deed of Trust to a new creditor. This type of assignment effectively transfers all rights and interests, including the ability to collect payments and initiate foreclosure proceedings. c. Assignment with Recourse: When an assignment is made with recourse, the assignee has the ability to seek compensation from the original lender in case the borrower defaults on the loan. d. Assignment without Recourse: In an assignment without recourse, the assignee assumes full responsibility and cannot seek compensation from the original lender if the borrower fails to fulfill their obligations. Conclusion: Understanding the Frisco Texas Assignment of Note and Deed of Trust is vital for all parties involved in real estate transactions. Whether it involves the assignment of a portion or the entire loan, or the presence of recourse or non-recourse provisions, these legal documents ensure the smooth transfer of rights and obligations between lenders and borrowers. It is essential to consult with legal professionals knowledgeable in Frisco, Texas real estate law to ensure compliance and protection of interests.

Frisco Texas Assignment of Note and Deed of Trust

Description

How to fill out Frisco Texas Assignment Of Note And Deed Of Trust?

Benefit from the US Legal Forms and obtain immediate access to any form sample you require. Our helpful website with a large number of document templates makes it easy to find and obtain almost any document sample you will need. You can save, fill, and sign the Frisco Texas Assignment of Note and Deed of Trust in a few minutes instead of browsing the web for several hours searching for the right template.

Using our collection is an excellent strategy to raise the safety of your form filing. Our experienced legal professionals on a regular basis check all the records to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Frisco Texas Assignment of Note and Deed of Trust? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the template you require. Ensure that it is the template you were hoping to find: check its headline and description, and utilize the Preview feature if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Frisco Texas Assignment of Note and Deed of Trust and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Frisco Texas Assignment of Note and Deed of Trust.

Feel free to benefit from our service and make your document experience as convenient as possible!