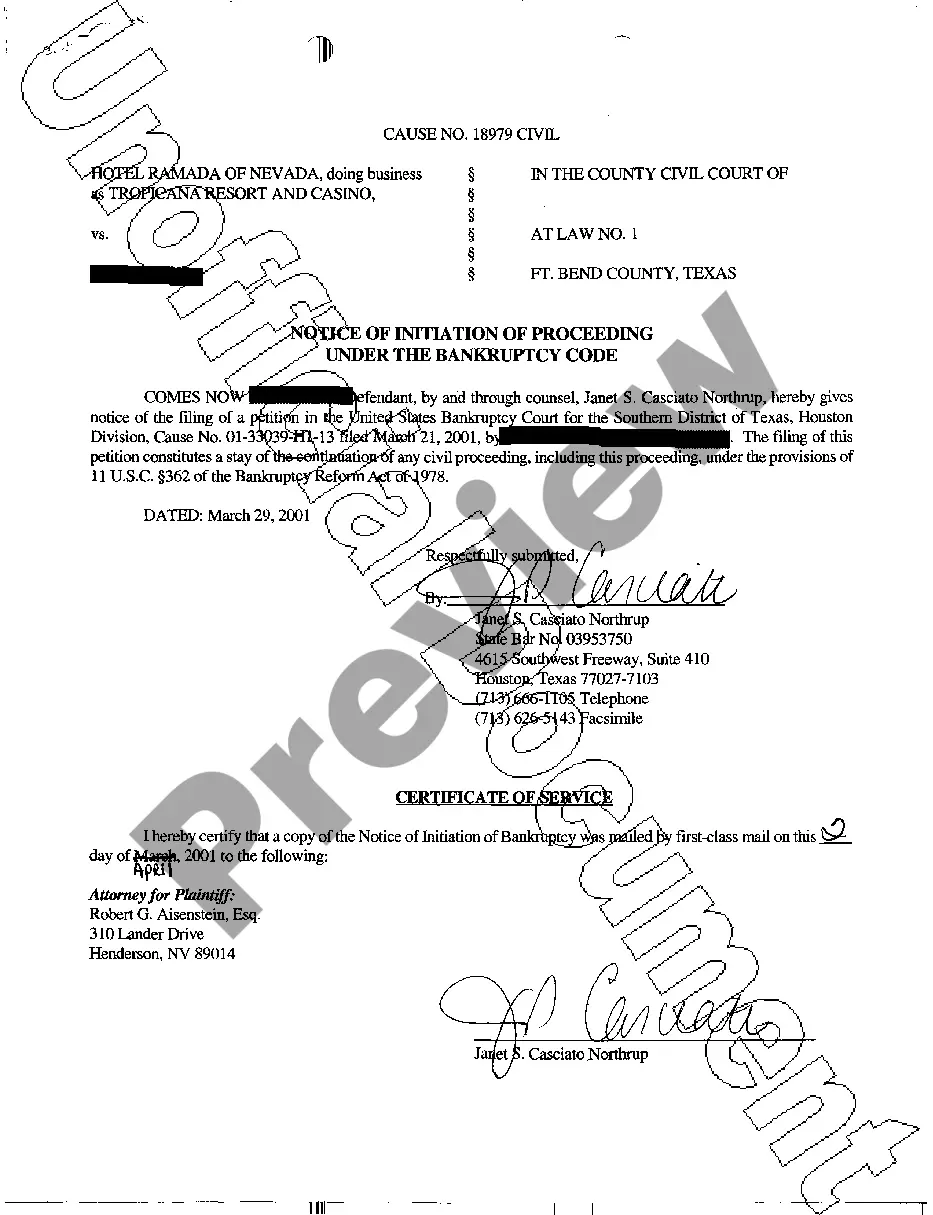

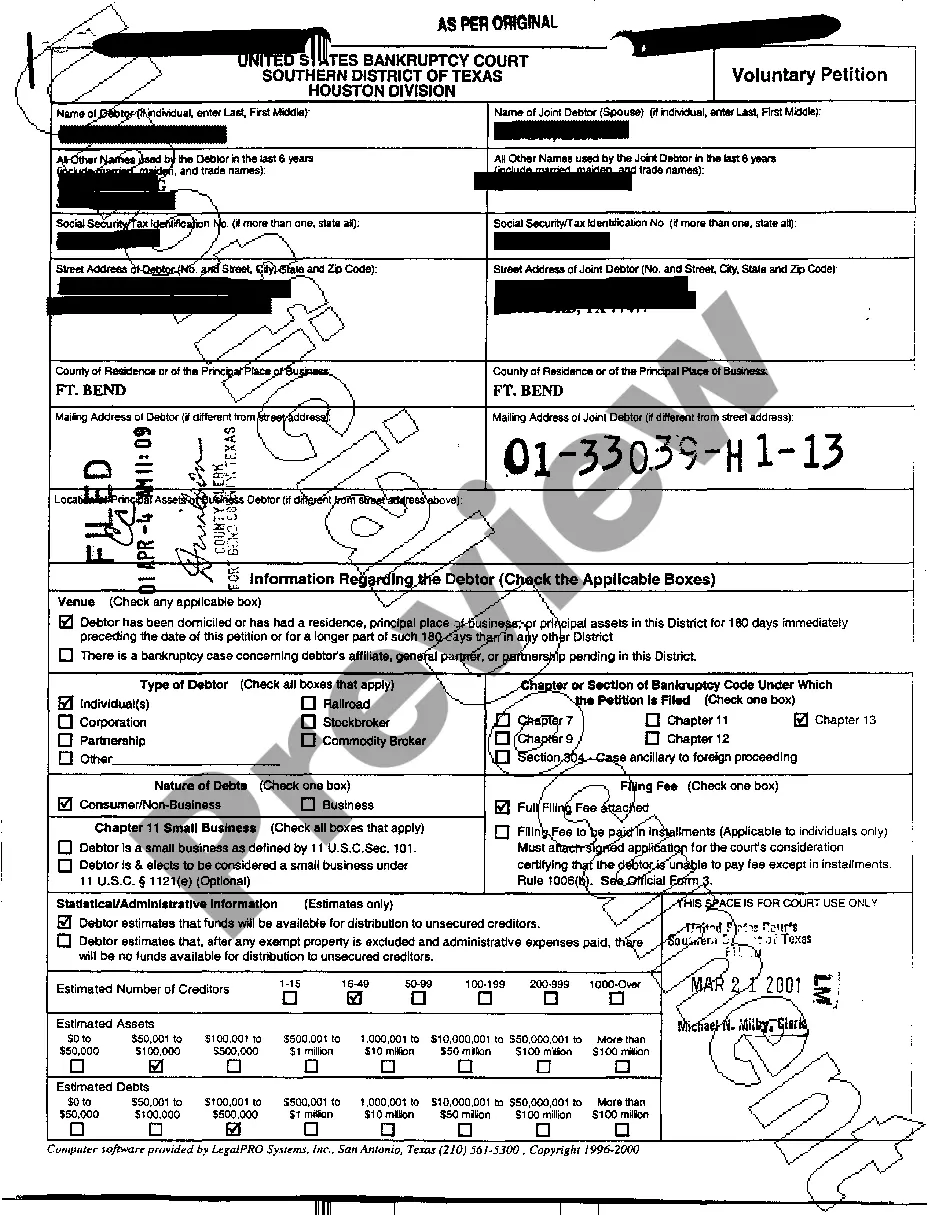

Keywords: Sugar Land Texas, Notice of Bankruptcy, types Description: The Sugar Land Texas Notice of Bankruptcy is a legal document that declares the financial insolvency of an individual or a business entity located in Sugar Land, Texas. This notice is filed in the local bankruptcy court and serves as an official statement to creditors, stakeholders, and the community about the debtor's inability to repay outstanding debts. There are different types of Sugar Land Texas Notice of Bankruptcy, each representing a specific bankruptcy chapter under which the debtor has filed. These chapters include: 1. Chapter 7 Bankruptcy Notice: This type of bankruptcy is also known as liquidation bankruptcy. When a debtor files Chapter 7, it means they are unable to pay their debts and opt for a complete liquidation of their non-exempt assets to repay creditors. 2. Chapter 13 Bankruptcy Notice: This type of bankruptcy is also known as reorganization bankruptcy or debt adjustment. Debtors who file Chapter 13 have a regular income and want to propose a repayment plan to their creditors. This allows them to reorganize their debts and make affordable monthly payments over a period of three to five years. 3. Chapter 11 Bankruptcy Notice: This type of bankruptcy is primarily meant for businesses, both large and small, seeking to reorganize their debts. Debtors filing Chapter 11 intend to continue operations and propose a plan to pay off their creditors while keeping the business running. Regardless of the specific type of Sugar Land Texas Notice of Bankruptcy, the purpose remains the same — to notify all interested parties about the debtor's financial situation and initiate the legal process of resolving outstanding debts. Bankruptcy filings can have significant implications on the debtor's future financial opportunities and creditworthiness, making it essential for all parties involved to be aware of the situation. If you receive a Notice of Bankruptcy as a creditor or stakeholder, it is advisable to consult legal counsel to understand your rights and navigate the complex bankruptcy proceedings.

Sugar Land Texas Notice of Bankruptcy

Description

How to fill out Sugar Land Texas Notice Of Bankruptcy?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any legal background to create such papers from scratch, mainly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Sugar Land Texas Notice of Bankruptcy or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Sugar Land Texas Notice of Bankruptcy quickly employing our trustworthy service. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, if you are new to our platform, ensure that you follow these steps prior to obtaining the Sugar Land Texas Notice of Bankruptcy:

- Ensure the template you have chosen is suitable for your location since the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if available) of cases the paper can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Sugar Land Texas Notice of Bankruptcy as soon as the payment is completed.

You’re good to go! Now you can proceed to print the form or fill it out online. Should you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.