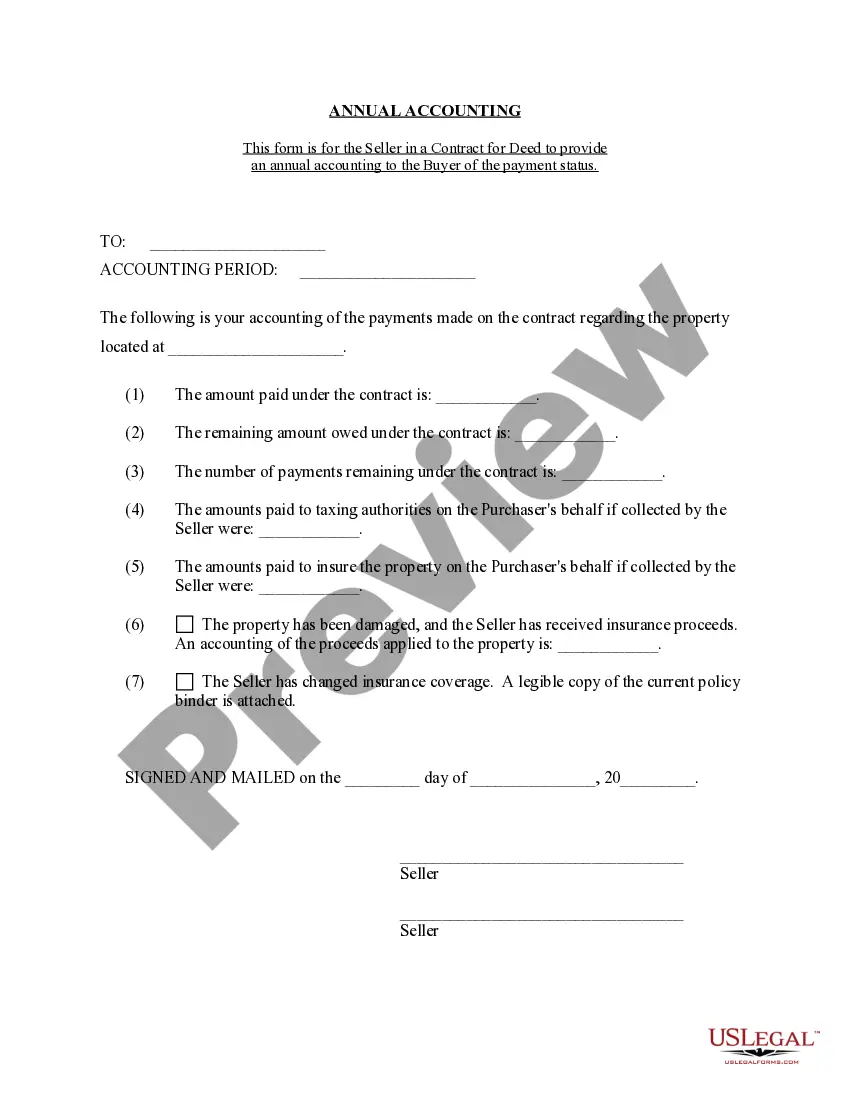

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement serves as a vital document that provides a comprehensive overview of the financial transactions and records relating to the contract for deed agreement. This statement outlines various financial aspects associated with the agreement between the seller and buyer, enabling both parties to have a transparent understanding of the transactions conducted throughout the year. The Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement contains several essential elements, including: 1. Account Details: The statement includes specific details related to the seller's account, such as the account holder's name, address, contact information, and contract for deed agreement number. 2. Transaction Summary: It offers a comprehensive summary of all financial transactions conducted during the year, such as loan payments received from the buyer, interest accrued, principal balance, and any additional fees or charges assessed. 3. Payment Breakdown: This section provides a detailed breakdown of buyer's payments received, including the principal amount, interest paid, and any outstanding fees or charges associated with the contract for deed agreement. 4. Interest Calculation: The statement outlines how the interest on the contract for deed agreement is calculated, specifying the interest rate, compounding frequency, and any adjustments made during the year. 5. Escrow Account Details: If an escrow account is established to handle property taxes, insurance, or other expenses, the statement includes a detailed summary of all transactions conducted through the escrow account. 6. Outstanding Balances: It highlights any outstanding principal balance, interest due, or fees owed by the buyer, ensuring clarity regarding the current financial standing of the contract for deed agreement. 7. Late Payments and Penalties: In the case of late payments or default, the statement outlines any applicable late payment penalties, foreclosure procedures, or legal actions that may be taken by the seller. 8. Additional Information: The statement may also include important information regarding changes in the contract for deed terms, property inspections, insurance updates, or any other relevant details relating to the agreement. Different types or variations of the Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement may include specific state regulations, additional sections for escrow account management, or tailored clauses based on individual contract requirements. By providing a detailed and transparent account of all financial aspects related to the contract for deed agreement, the Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement ensures both the seller and buyer have a clear understanding of the financial obligations and rights associated with the agreement. This document promotes a professional and cooperative relationship between the parties involved, fostering trust and accountability throughout the duration of the contract for deed agreement.Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement serves as a vital document that provides a comprehensive overview of the financial transactions and records relating to the contract for deed agreement. This statement outlines various financial aspects associated with the agreement between the seller and buyer, enabling both parties to have a transparent understanding of the transactions conducted throughout the year. The Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement contains several essential elements, including: 1. Account Details: The statement includes specific details related to the seller's account, such as the account holder's name, address, contact information, and contract for deed agreement number. 2. Transaction Summary: It offers a comprehensive summary of all financial transactions conducted during the year, such as loan payments received from the buyer, interest accrued, principal balance, and any additional fees or charges assessed. 3. Payment Breakdown: This section provides a detailed breakdown of buyer's payments received, including the principal amount, interest paid, and any outstanding fees or charges associated with the contract for deed agreement. 4. Interest Calculation: The statement outlines how the interest on the contract for deed agreement is calculated, specifying the interest rate, compounding frequency, and any adjustments made during the year. 5. Escrow Account Details: If an escrow account is established to handle property taxes, insurance, or other expenses, the statement includes a detailed summary of all transactions conducted through the escrow account. 6. Outstanding Balances: It highlights any outstanding principal balance, interest due, or fees owed by the buyer, ensuring clarity regarding the current financial standing of the contract for deed agreement. 7. Late Payments and Penalties: In the case of late payments or default, the statement outlines any applicable late payment penalties, foreclosure procedures, or legal actions that may be taken by the seller. 8. Additional Information: The statement may also include important information regarding changes in the contract for deed terms, property inspections, insurance updates, or any other relevant details relating to the agreement. Different types or variations of the Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement may include specific state regulations, additional sections for escrow account management, or tailored clauses based on individual contract requirements. By providing a detailed and transparent account of all financial aspects related to the contract for deed agreement, the Clarksville Tennessee Contract for Deed Seller's Annual Accounting Statement ensures both the seller and buyer have a clear understanding of the financial obligations and rights associated with the agreement. This document promotes a professional and cooperative relationship between the parties involved, fostering trust and accountability throughout the duration of the contract for deed agreement.