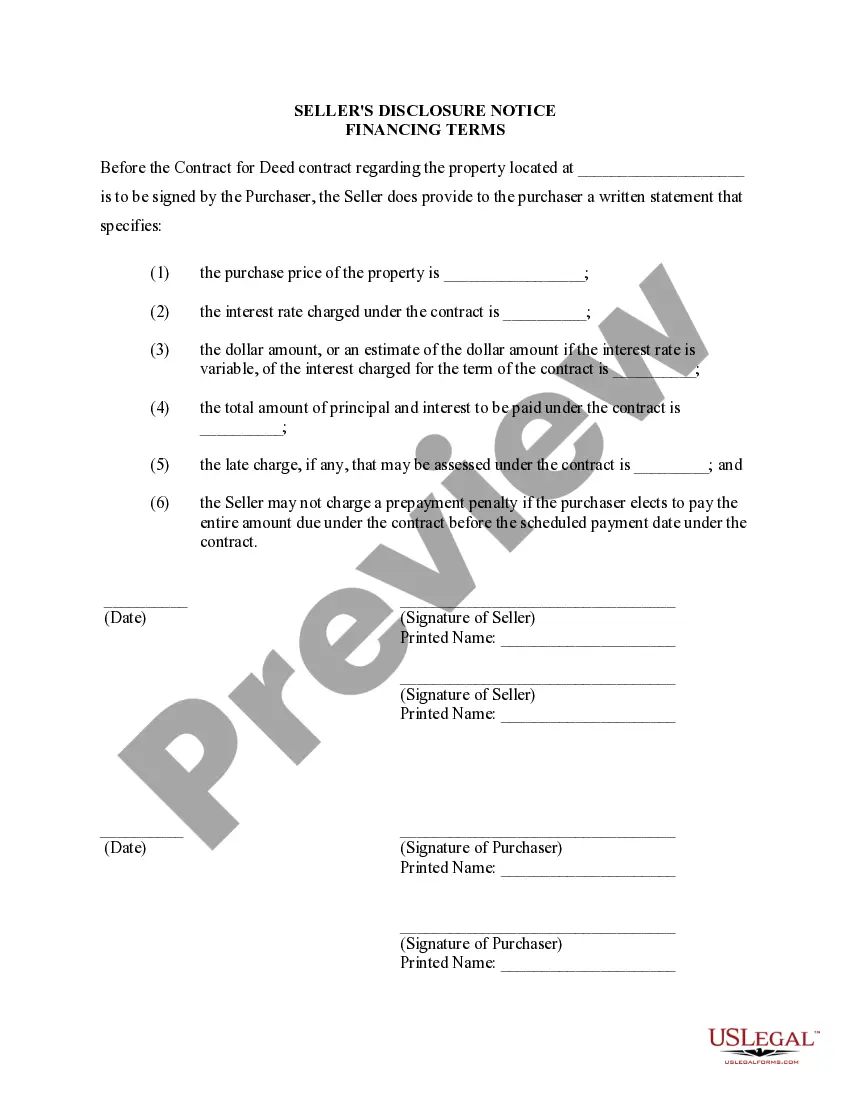

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Murfreesboro Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract In Murfreesboro, Tennessee, sellers providing financing through a Contract or Agreement for Deed, also known as a Land Contract, are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This disclosure is crucial as it outlines the terms and conditions of the financing arrangement, ensuring transparency and protecting the rights of both the buyer and the seller. The Seller's Disclosure of Financing Terms for Residential Property covers various aspects related to the financing agreement. It typically includes important details such as the purchase price of the property, the down payment required, the interest rate, and any additional fees or charges involved in the transaction. The disclosure may also mention any prepayment penalties or late payment fees, providing a comprehensive understanding of the financial obligations tied to the agreement. Additionally, the disclosure may outline the duration of the financing arrangement, including the specified term and whether there are any options for renewals or extensions. It may also specify the payment schedule, whether it is monthly, quarterly, or annually, and provide details on the accepted payment methods. Furthermore, the disclosure may address the implications of defaulting on payments. It may describe the consequences of failure to pay, such as potential foreclosure or repossession of the property, and explain the steps and procedures involved in the event of default. While the content of the Seller's Disclosure of Financing Terms for Residential Property may vary depending on the specific agreement, it is essential that all relevant information related to the financing arrangement is clearly disclosed upfront. This helps prevent misunderstandings, protects both parties, and promotes a fair and smooth transaction. Different types of Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include: 1. Standard Financing Terms Disclosure: This type of disclosure covers the basic terms and conditions of the financing arrangement, including purchase price, down payment, interest rate, and payment schedule. 2. Extended Financing Terms Disclosure: In some cases, sellers may offer more flexible financing options, such as longer repayment terms or lower interest rates. The extended financing terms disclosure would outline these additional options and any accompanying terms and conditions. 3. Special Considerations Financing Terms Disclosure: This type of disclosure may be necessary when there are specific considerations or contingencies associated with the financing agreement. For example, if the property has certain restrictions or existing legal obligations, these would be addressed in the disclosure to ensure clarity for the buyer. Overall, the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed provides vital information regarding the financing arrangement between the seller and the buyer. It is important for both parties to thoroughly review and understand the disclosure before entering into the agreement, ensuring a transparent and mutually beneficial transaction.Murfreesboro Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract In Murfreesboro, Tennessee, sellers providing financing through a Contract or Agreement for Deed, also known as a Land Contract, are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This disclosure is crucial as it outlines the terms and conditions of the financing arrangement, ensuring transparency and protecting the rights of both the buyer and the seller. The Seller's Disclosure of Financing Terms for Residential Property covers various aspects related to the financing agreement. It typically includes important details such as the purchase price of the property, the down payment required, the interest rate, and any additional fees or charges involved in the transaction. The disclosure may also mention any prepayment penalties or late payment fees, providing a comprehensive understanding of the financial obligations tied to the agreement. Additionally, the disclosure may outline the duration of the financing arrangement, including the specified term and whether there are any options for renewals or extensions. It may also specify the payment schedule, whether it is monthly, quarterly, or annually, and provide details on the accepted payment methods. Furthermore, the disclosure may address the implications of defaulting on payments. It may describe the consequences of failure to pay, such as potential foreclosure or repossession of the property, and explain the steps and procedures involved in the event of default. While the content of the Seller's Disclosure of Financing Terms for Residential Property may vary depending on the specific agreement, it is essential that all relevant information related to the financing arrangement is clearly disclosed upfront. This helps prevent misunderstandings, protects both parties, and promotes a fair and smooth transaction. Different types of Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include: 1. Standard Financing Terms Disclosure: This type of disclosure covers the basic terms and conditions of the financing arrangement, including purchase price, down payment, interest rate, and payment schedule. 2. Extended Financing Terms Disclosure: In some cases, sellers may offer more flexible financing options, such as longer repayment terms or lower interest rates. The extended financing terms disclosure would outline these additional options and any accompanying terms and conditions. 3. Special Considerations Financing Terms Disclosure: This type of disclosure may be necessary when there are specific considerations or contingencies associated with the financing agreement. For example, if the property has certain restrictions or existing legal obligations, these would be addressed in the disclosure to ensure clarity for the buyer. Overall, the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed provides vital information regarding the financing arrangement between the seller and the buyer. It is important for both parties to thoroughly review and understand the disclosure before entering into the agreement, ensuring a transparent and mutually beneficial transaction.