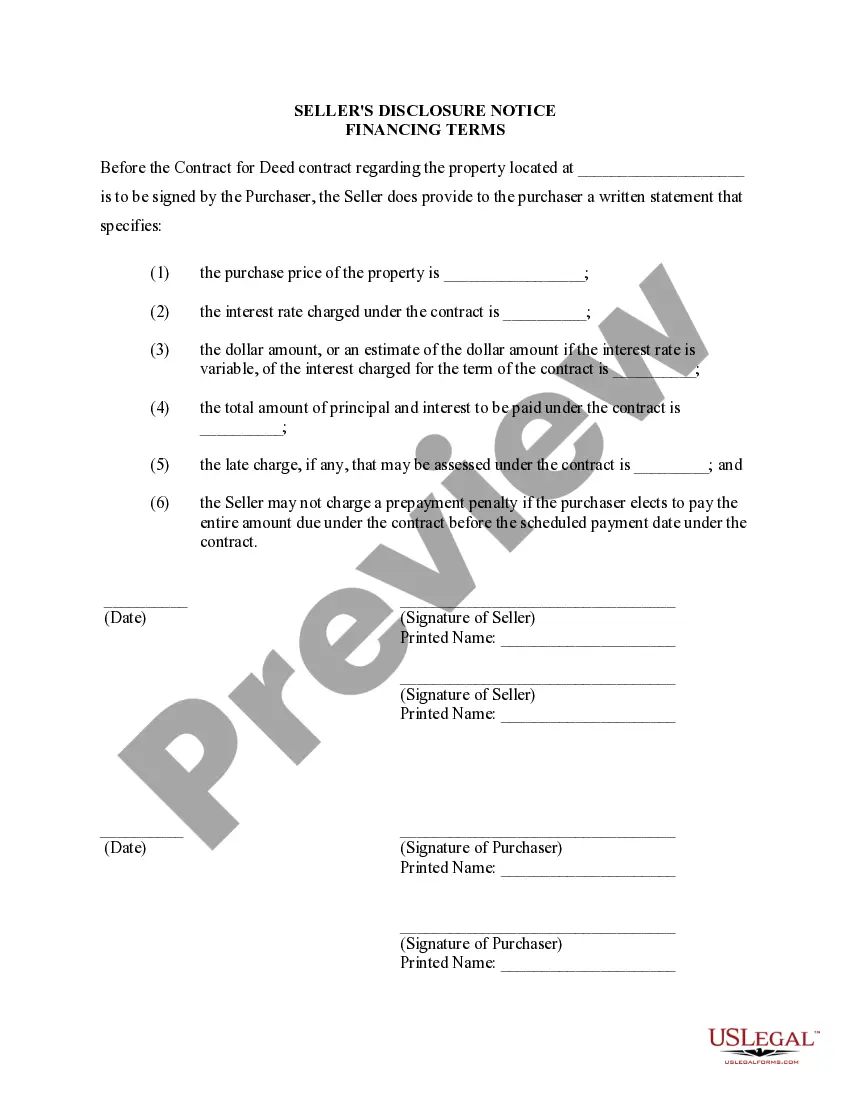

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally binding document that outlines the financial terms of the property purchase. This disclosure is essential for both the seller and the buyer to ensure transparency and understanding of the financial obligations associated with the transaction. Here are some relevant keywords related to the Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Seller's Disclosure: This document is provided by the seller to the buyer and includes all the necessary details about the financing terms associated with the property sale. 2. Residential Property: The disclosure pertains specifically to properties classified as residential, such as houses, condominiums, or townhouses. 3. Financing Terms: This refers to the specific conditions and arrangements agreed upon by the buyer and seller regarding the financial aspects of purchasing the property. 4. Contract or Agreement for Deed: Also known as a land contract, this agreement allows the buyer to occupy and use the property while making payments to the seller over a specified period. The buyer gains equitable title, but the seller retains legal title until all payments are complete. Different types of Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include: 1. Fixed Interest Rate: The disclosure will specify whether the financing terms come with a fixed interest rate, meaning that the interest rate remains constant throughout the loan term. 2. Adjustable Interest Rate: Alternatively, the financing terms may have an adjustable interest rate, meaning the interest rate can fluctuate based on the market conditions. 3. Amortization Schedule: The disclosure will provide information on the amortization schedule, which outlines how the loan principal and interest will be repaid over time. 4. Down Payment: The disclosure will outline the required down payment amount, which is the initial payment made by the buyer when signing the contract. 5. Late Payment Penalties: The document may include details about any penalties or fees that will be charged to the buyer in case of late or missed payments. 6. Prepayment Options: The disclosure might mention any provisions for prepaying the loan, such as whether there are penalties for early repayment or if there are any restrictions on paying off the loan before the specified term ends. 7. Payment Due Dates: The disclosure will indicate the due dates for regular installment payments, allowing the buyer to know when each payment is expected. 8. Total Purchase Price: This section will state the total price of the property, which includes the down payment and any interest charged over the contract term. In summary, the Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is a crucial document that outlines all the financial aspects of purchasing a property through a land contract. It ensures that both parties are aware and agree upon the financing terms, creating a transparent and legally binding agreement.Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally binding document that outlines the financial terms of the property purchase. This disclosure is essential for both the seller and the buyer to ensure transparency and understanding of the financial obligations associated with the transaction. Here are some relevant keywords related to the Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Seller's Disclosure: This document is provided by the seller to the buyer and includes all the necessary details about the financing terms associated with the property sale. 2. Residential Property: The disclosure pertains specifically to properties classified as residential, such as houses, condominiums, or townhouses. 3. Financing Terms: This refers to the specific conditions and arrangements agreed upon by the buyer and seller regarding the financial aspects of purchasing the property. 4. Contract or Agreement for Deed: Also known as a land contract, this agreement allows the buyer to occupy and use the property while making payments to the seller over a specified period. The buyer gains equitable title, but the seller retains legal title until all payments are complete. Different types of Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include: 1. Fixed Interest Rate: The disclosure will specify whether the financing terms come with a fixed interest rate, meaning that the interest rate remains constant throughout the loan term. 2. Adjustable Interest Rate: Alternatively, the financing terms may have an adjustable interest rate, meaning the interest rate can fluctuate based on the market conditions. 3. Amortization Schedule: The disclosure will provide information on the amortization schedule, which outlines how the loan principal and interest will be repaid over time. 4. Down Payment: The disclosure will outline the required down payment amount, which is the initial payment made by the buyer when signing the contract. 5. Late Payment Penalties: The document may include details about any penalties or fees that will be charged to the buyer in case of late or missed payments. 6. Prepayment Options: The disclosure might mention any provisions for prepaying the loan, such as whether there are penalties for early repayment or if there are any restrictions on paying off the loan before the specified term ends. 7. Payment Due Dates: The disclosure will indicate the due dates for regular installment payments, allowing the buyer to know when each payment is expected. 8. Total Purchase Price: This section will state the total price of the property, which includes the down payment and any interest charged over the contract term. In summary, the Clarksville Tennessee Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is a crucial document that outlines all the financial aspects of purchasing a property through a land contract. It ensures that both parties are aware and agree upon the financing terms, creating a transparent and legally binding agreement.