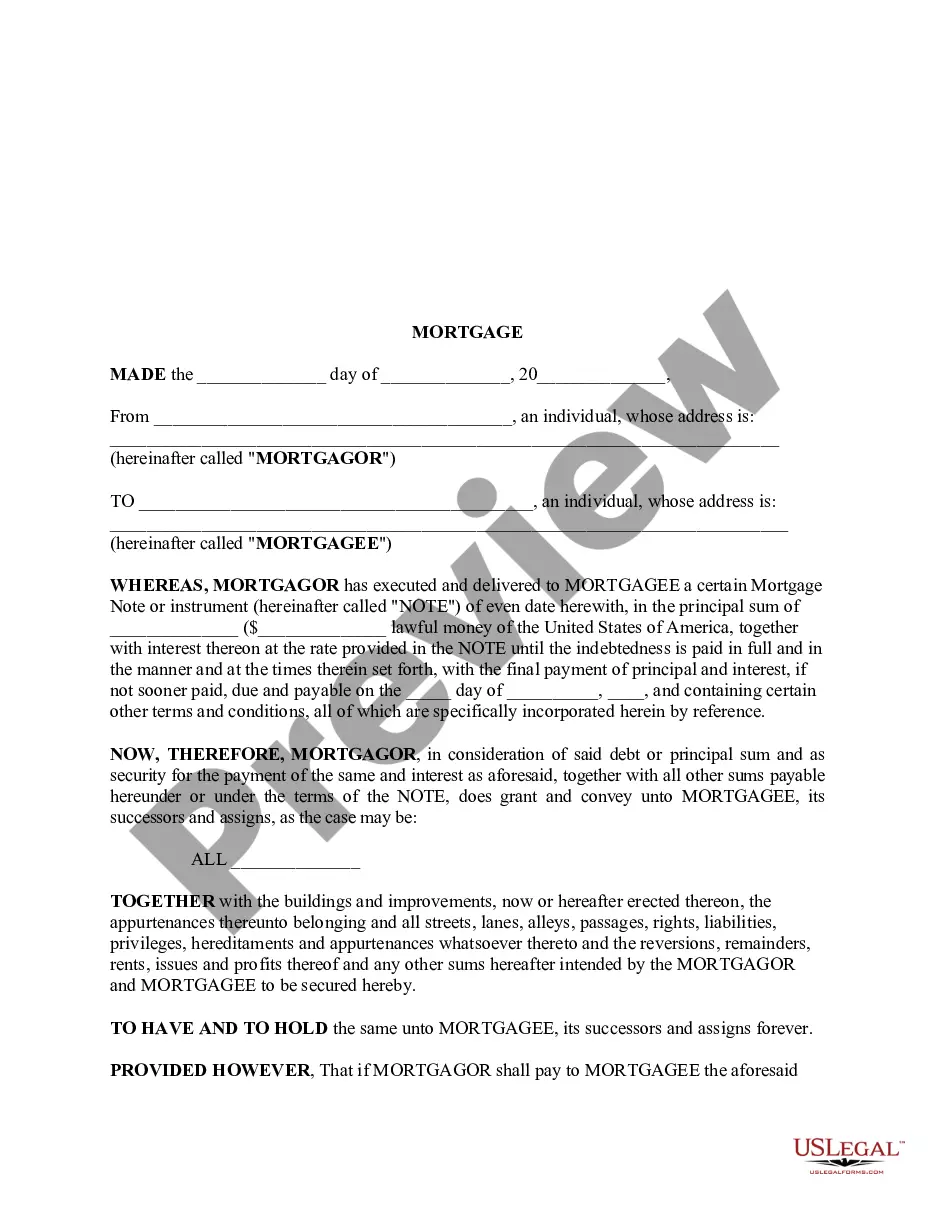

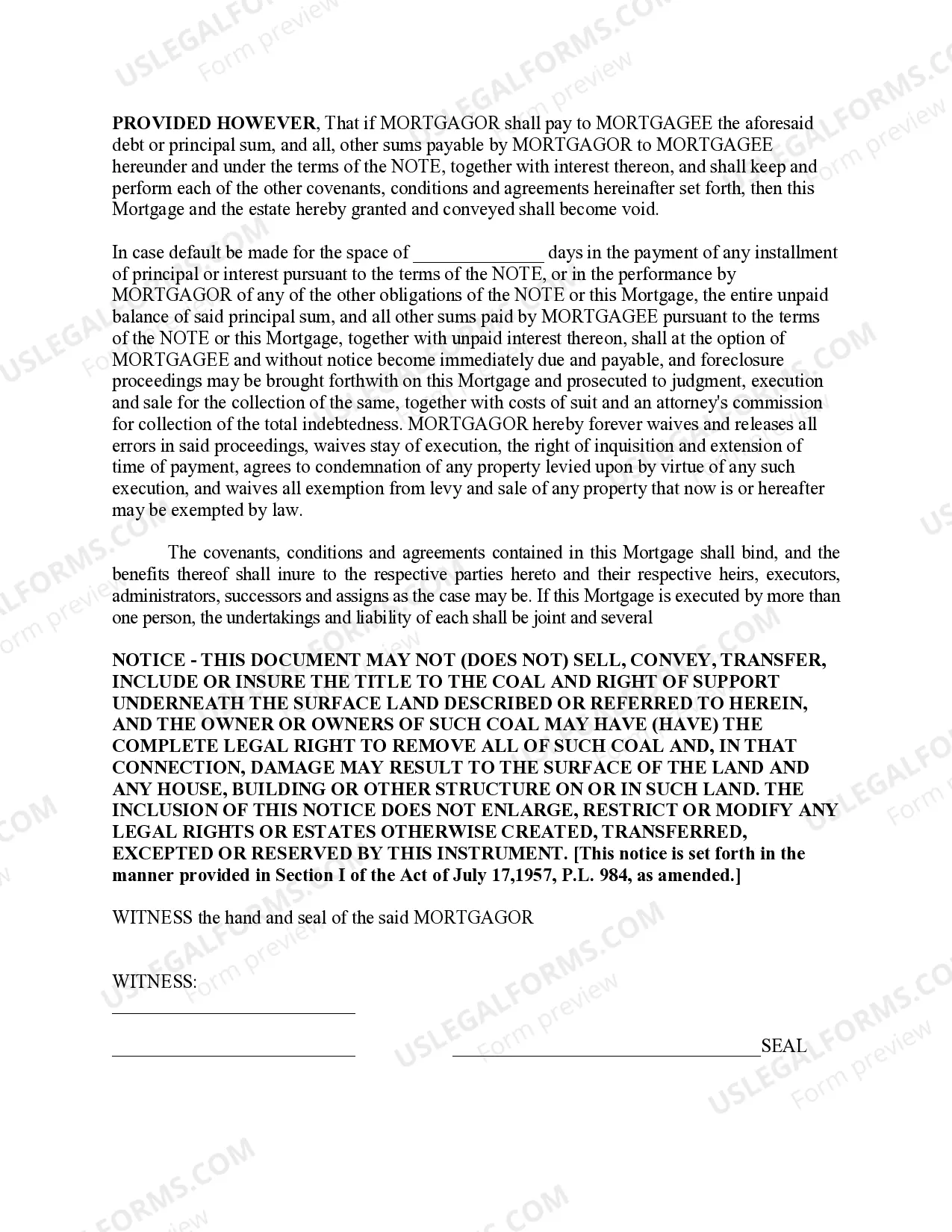

Pittsburgh Pennsylvania Mortgage — Short: A Comprehensive Overview If you are in the market for purchasing a property in Pittsburgh, Pennsylvania, but require a short-term financing solution, a Pittsburgh Pennsylvania Mortgage — Short might be the ideal option for you. This mortgage option caters to prospective homebuyers or property investors seeking immediate access to funds with a shorter repayment term. Pittsburgh Pennsylvania Mortgage — Short provides borrowers with the necessary capital to purchase real estate properties while ensuring a prompt repayment process. This type of mortgage can be divided into different subcategories, each offering unique advantages to suit various financial requirements. Let's explore some popular Pittsburgh Pennsylvania Mortgage — Short types: 1. Fixed-Rate Short-Term Mortgages: With this mortgage type, borrowers secure a loan with a fixed interest rate for the entire duration of the short repayment term. This option provides stability and predictability, allowing borrowers to budget their monthly payments without worrying about fluctuating interest rates. 2. Adjustable-Rate Short-Term Mortgages: Unlike fixed-rate mortgages, adjustable-rate mortgages (ARM's) offer an interest rate that may fluctuate periodically during the loan term. While this option carries some uncertainty, it often starts with a lower initial interest rate, making it an attractive choice for borrowers who anticipate selling or refinancing their property in the short term. 3. Balloon Short-Term Mortgages: Balloon mortgages offer borrowers a lower initial monthly payment, similar to an ARM. However, at the end of the agreed-upon term (typically five to seven years), the remaining balance becomes due in full. This type of mortgage is often suitable for buyers who plan to sell or refinance the property before the balloon payment is due. 4. Bridge Loans: A bridge loan is a short-term mortgage designed to bridge the financing gap while an individual sells their current property and transitions into a new home. This type of mortgage assists borrowers by providing temporary funds, allowing them to complete the purchase of a new property or cover the down payment until the sale of their existing property is finalized. Pittsburgh Pennsylvania Mortgage — Short provides flexibility to borrowers who require immediate funds without committing to long-term mortgage repayment plans. Whether you are a first-time homebuyer, an investor, or someone who needs to secure financing quickly, these mortgage options can help you achieve your goals without locking you into a lengthy financial commitment. When exploring Pittsburgh Pennsylvania Mortgage — Short, it is important to consult with experienced mortgage professionals who can assess your individual circumstances and recommend the best-suited mortgage type for your needs. With proper guidance, you can navigate the mortgage process seamlessly and ensure a successful real estate purchase in Pittsburgh, Pennsylvania.

Pittsburgh Pennsylvania Mortgage - Short

Description

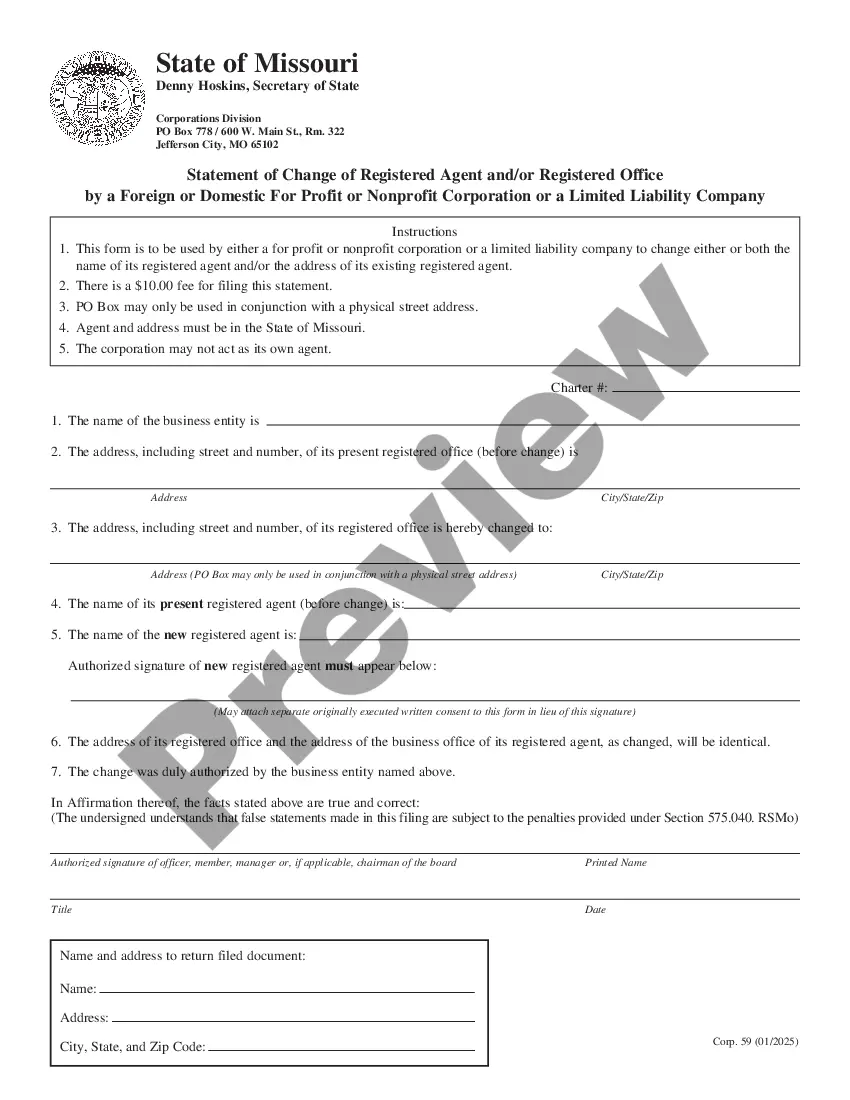

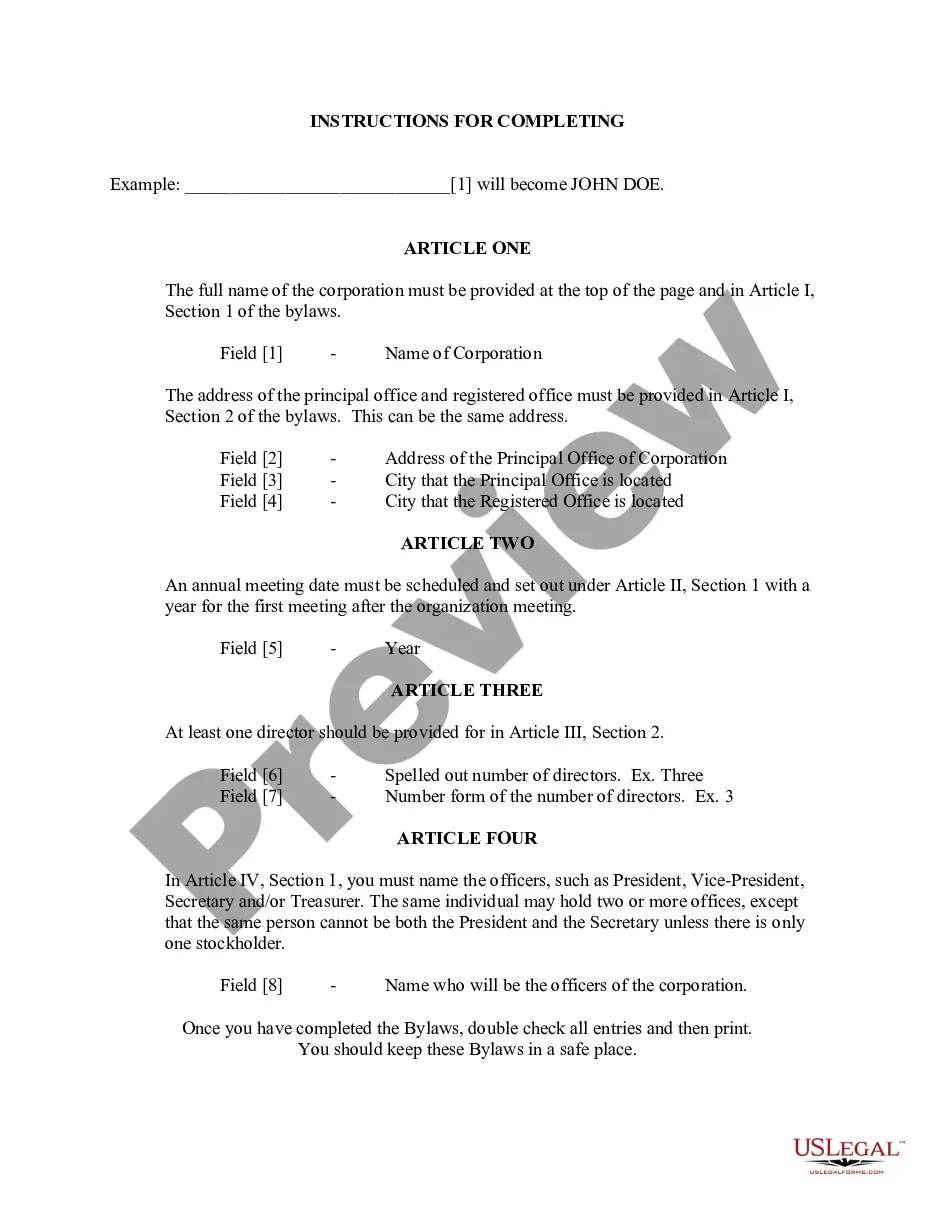

How to fill out Pittsburgh Pennsylvania Mortgage - Short?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no legal education to create such paperwork from scratch, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service provides a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Pittsburgh Pennsylvania Mortgage - Short or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Pittsburgh Pennsylvania Mortgage - Short in minutes employing our reliable service. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps prior to downloading the Pittsburgh Pennsylvania Mortgage - Short:

- Ensure the form you have found is good for your location because the rules of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of scenarios the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Select the payment method and proceed to download the Pittsburgh Pennsylvania Mortgage - Short as soon as the payment is done.

You’re all set! Now you can proceed to print out the document or fill it out online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.