Pittsburgh Pennsylvania Commercial Lease: A Comprehensive Guide for Businesses In Pittsburgh, Pennsylvania, commercial leases are legal agreements between landlords and businesses that outline the terms and conditions for the rental of commercial properties. These leases are specifically designed to meet the specific needs of businesses and provide a solid foundation for successful operations. The city of Pittsburgh offers various types of commercial leases, each catering to different business requirements. Let's explore some key types of commercial lease options available in Pittsburgh: 1. Gross Lease: A gross lease, also known as a full-service lease, is a common type of commercial lease in Pittsburgh. Under this agreement, tenants pay a fixed monthly rent that encompasses all costs associated with the property, including property taxes, insurance, maintenance fees, and utilities. This type of lease provides businesses with predictable and inclusive expenses, simplifying financial planning. 2. Net Lease: Unlike a gross lease, a net lease requires tenants to pay a base rent along with a portion or all of the property expenses. The most prevalent types of net leases in Pittsburgh are single net leases (where tenants pay property taxes), double net leases (where tenants pay property taxes and insurance), and triple net leases (where tenants pay property taxes, insurance, and maintenance costs). Net leases give businesses more control over expenses but may require added financial responsibility. 3. Percentage Lease: A percentage lease is commonly used in the retail sector. It involves tenants paying a base rent plus a percentage of their sales revenue. This type of lease allows landlords to share in a business's success while providing tenants with an opportunity to align their rent with their actual performance. 4. Short-Term Lease: Short-term leases, often referred to as temporary leases or pop-up leases, cater to businesses seeking flexibility with a limited commitment. These leases typically span a few months to a year, making them ideal for seasonal businesses, startups, or those testing a new market. Short-term leases are useful in promoting innovation and minimizing risks for budding entrepreneurs. 5. Build-to-Suit Lease: In some cases, businesses may require custom-built space to meet their specific needs. A build-to-suit lease offers a solution where the landlord constructs or renovates a property to fit the tenant's specifications. This type of lease provides businesses with highly tailored spaces optimized to enhance productivity and operational efficiency. When entering into a Pittsburgh Pennsylvania Commercial Lease, businesses must carefully evaluate their requirements and negotiate favorable terms. Key considerations include lease duration, rental escalation clauses, security deposits, maintenance responsibilities, and the option for lease renewal. It's essential for both landlords and tenants to seek legal counsel to ensure compliance with local regulations and protect their rights throughout the lease term. In summary, a Pittsburgh Pennsylvania Commercial Lease is a legally binding agreement that enables businesses to secure commercial properties for their operations. By understanding the different types of leases available, businesses can select the most suitable option that aligns with their financial goals, operational needs, and growth plans.

Pittsburgh Pennsylvania Commercial Lease

Description

How to fill out Pittsburgh Pennsylvania Commercial Lease?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Pittsburgh Pennsylvania Commercial Lease gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Pittsburgh Pennsylvania Commercial Lease takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

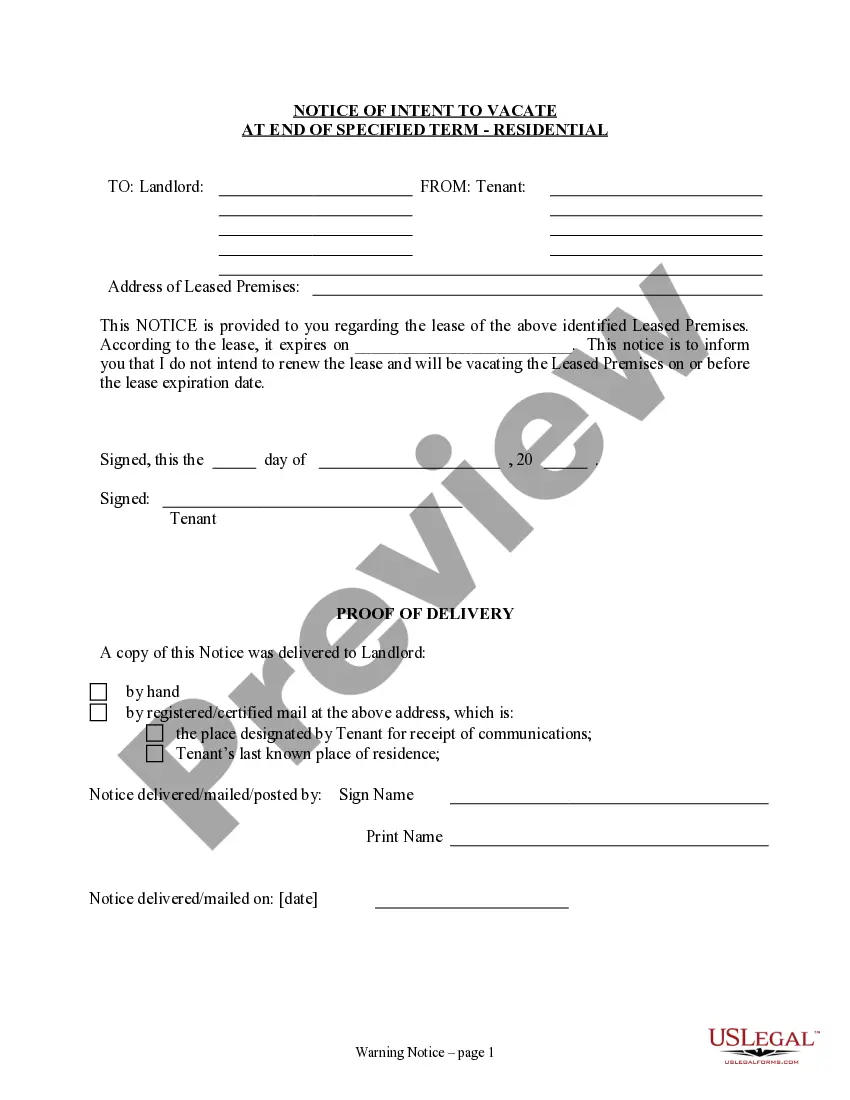

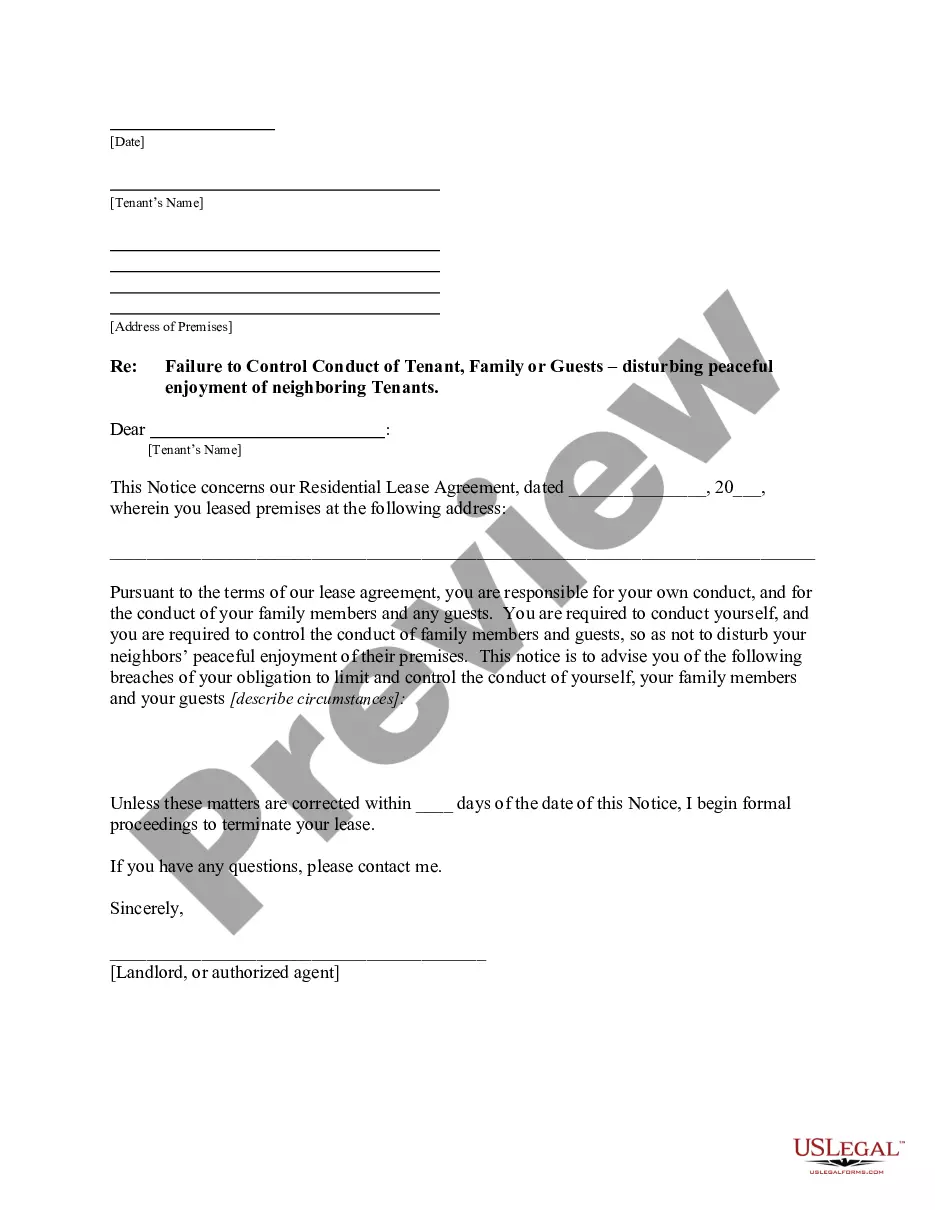

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Pittsburgh Pennsylvania Commercial Lease. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!