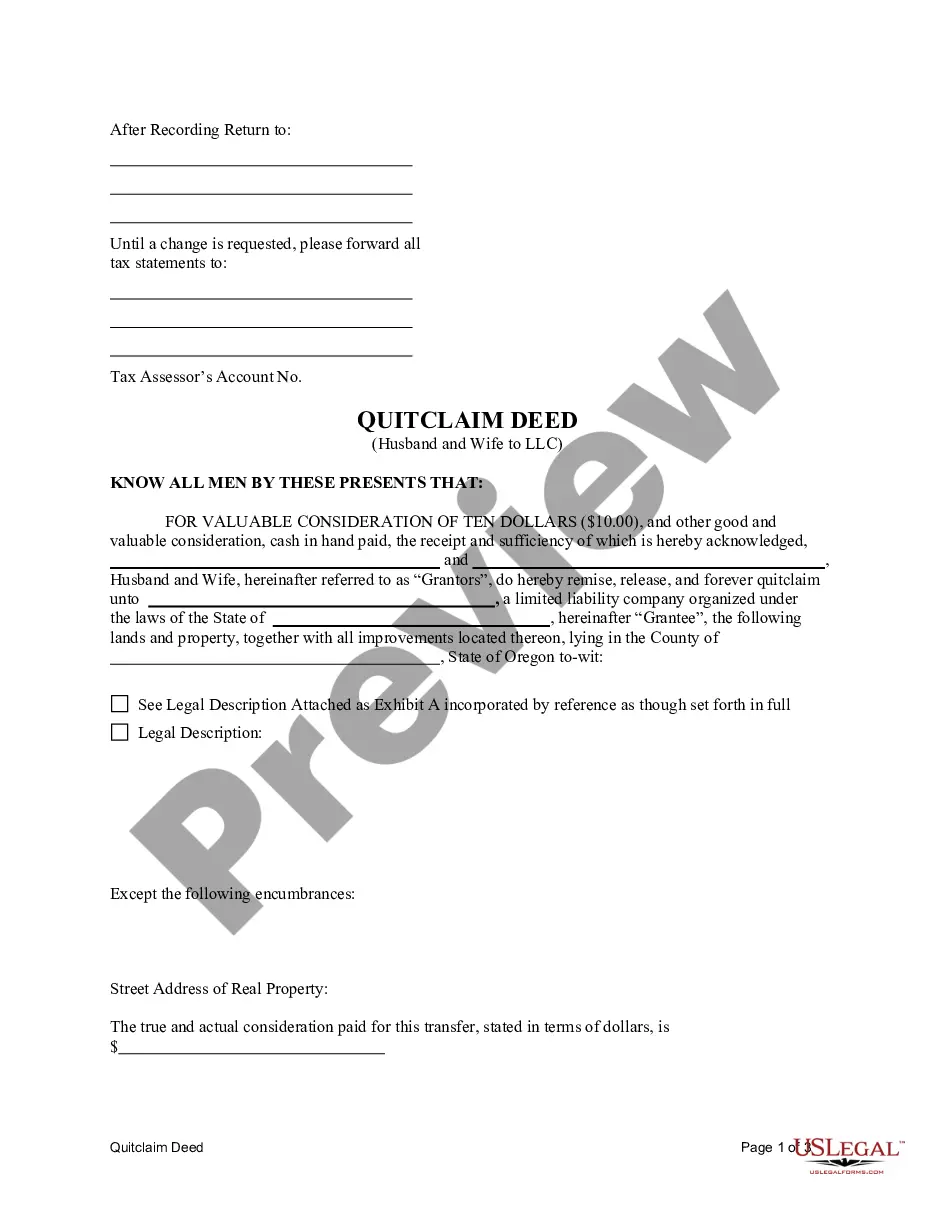

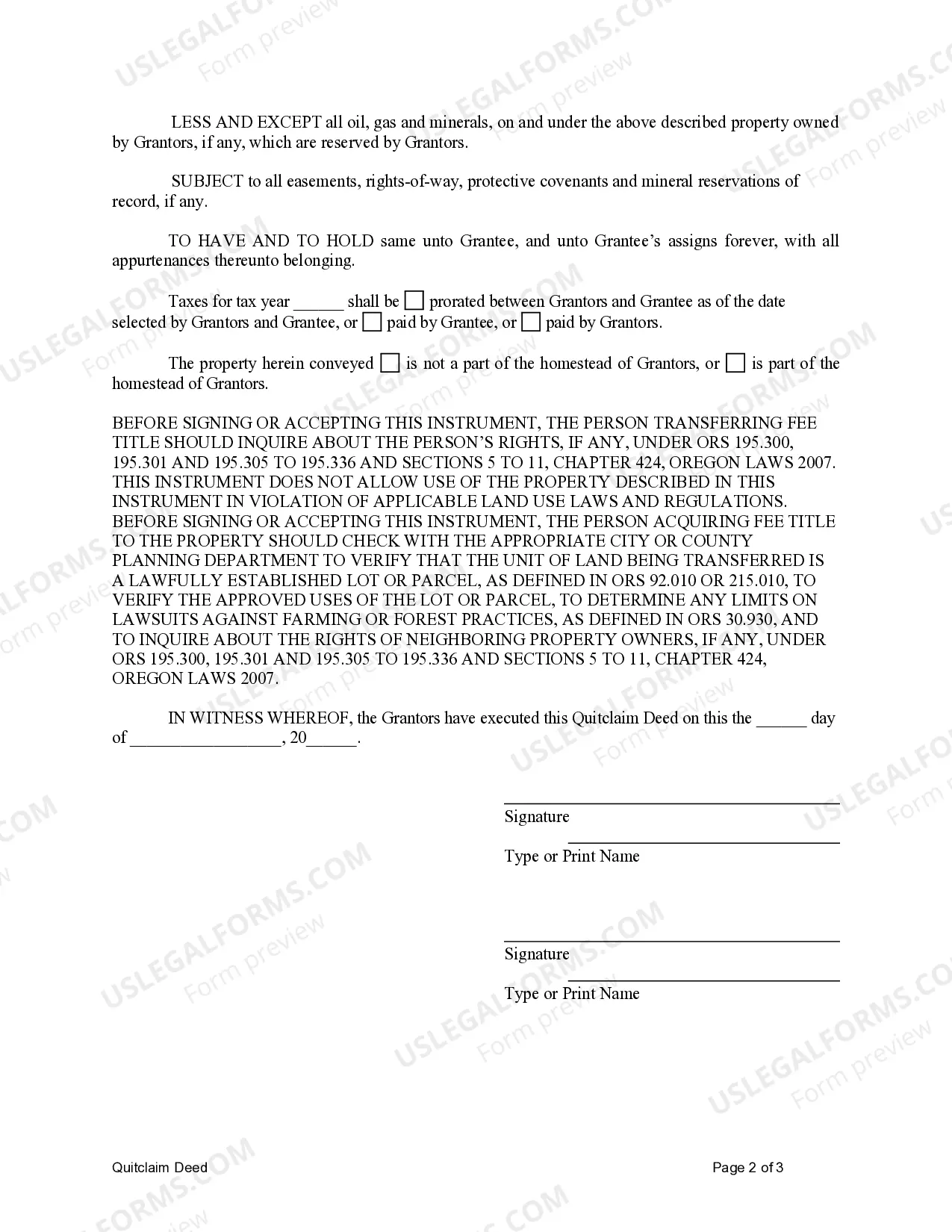

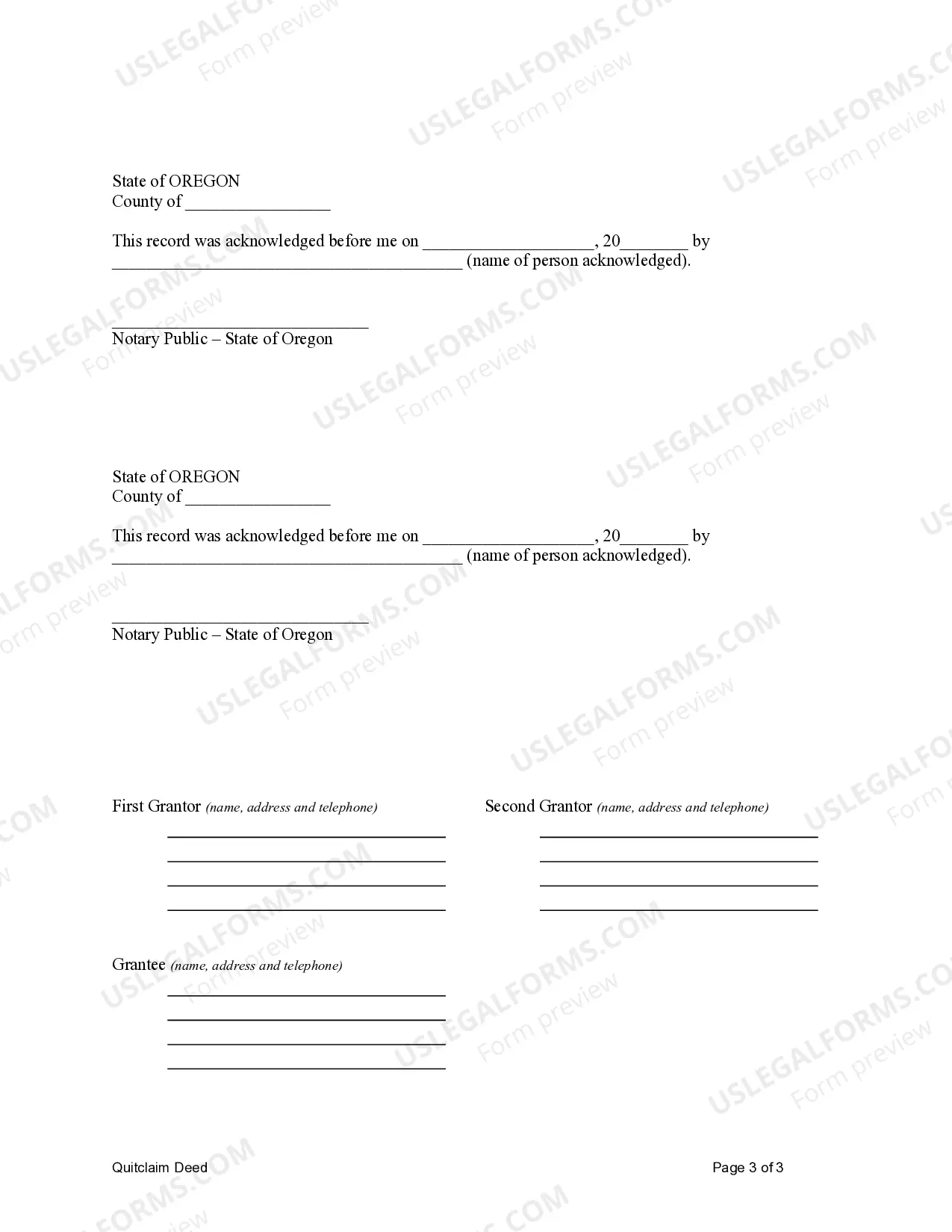

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership rights of a property from a married couple to a limited liability company (LLC) in Hillsboro, Oregon. This deed serves as a way for the couple to transfer their interest in the property to the LLC, effectively making the LLC the new owner. The purpose of such a transfer can vary. It could be for asset protection or liability purposes, estate planning reasons, or even to take advantage of certain tax benefits. By transferring ownership to an LLC, the couple is able to protect their personal assets and limit their personal liability in case any legal issues arise in relation to the property. There are a few different types of Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC that may exist: 1. Hillsboro Oregon Unilateral Quitclaim Deed from Husband and Wife to LLC: In this type of deed, only one spouse is transferring their ownership interest to the LLC. This means that the other spouse retains their ownership rights to the property. 2. Hillsboro Oregon Joint Quitclaim Deed from Husband and Wife to LLC: In this type of deed, both spouses are transferring their ownership rights to the LLC. This means that neither spouse retains any ownership interest in the property. 3. Hillsboro Oregon Partial Quitclaim Deed from Husband and Wife to LLC: In this type of deed, the couple may choose to transfer only a portion of their ownership interest in the property to the LLC. This allows them to maintain partial ownership while still benefiting from the LLC structure in terms of liability protection and taxation. It is important to consult with a qualified attorney or real estate professional when dealing with a Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC. They can provide guidance, ensure all necessary legal requirements are met, and advise on any potential risks or implications associated with the transfer.A Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership rights of a property from a married couple to a limited liability company (LLC) in Hillsboro, Oregon. This deed serves as a way for the couple to transfer their interest in the property to the LLC, effectively making the LLC the new owner. The purpose of such a transfer can vary. It could be for asset protection or liability purposes, estate planning reasons, or even to take advantage of certain tax benefits. By transferring ownership to an LLC, the couple is able to protect their personal assets and limit their personal liability in case any legal issues arise in relation to the property. There are a few different types of Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC that may exist: 1. Hillsboro Oregon Unilateral Quitclaim Deed from Husband and Wife to LLC: In this type of deed, only one spouse is transferring their ownership interest to the LLC. This means that the other spouse retains their ownership rights to the property. 2. Hillsboro Oregon Joint Quitclaim Deed from Husband and Wife to LLC: In this type of deed, both spouses are transferring their ownership rights to the LLC. This means that neither spouse retains any ownership interest in the property. 3. Hillsboro Oregon Partial Quitclaim Deed from Husband and Wife to LLC: In this type of deed, the couple may choose to transfer only a portion of their ownership interest in the property to the LLC. This allows them to maintain partial ownership while still benefiting from the LLC structure in terms of liability protection and taxation. It is important to consult with a qualified attorney or real estate professional when dealing with a Hillsboro Oregon Quitclaim Deed from Husband and Wife to LLC. They can provide guidance, ensure all necessary legal requirements are met, and advise on any potential risks or implications associated with the transfer.