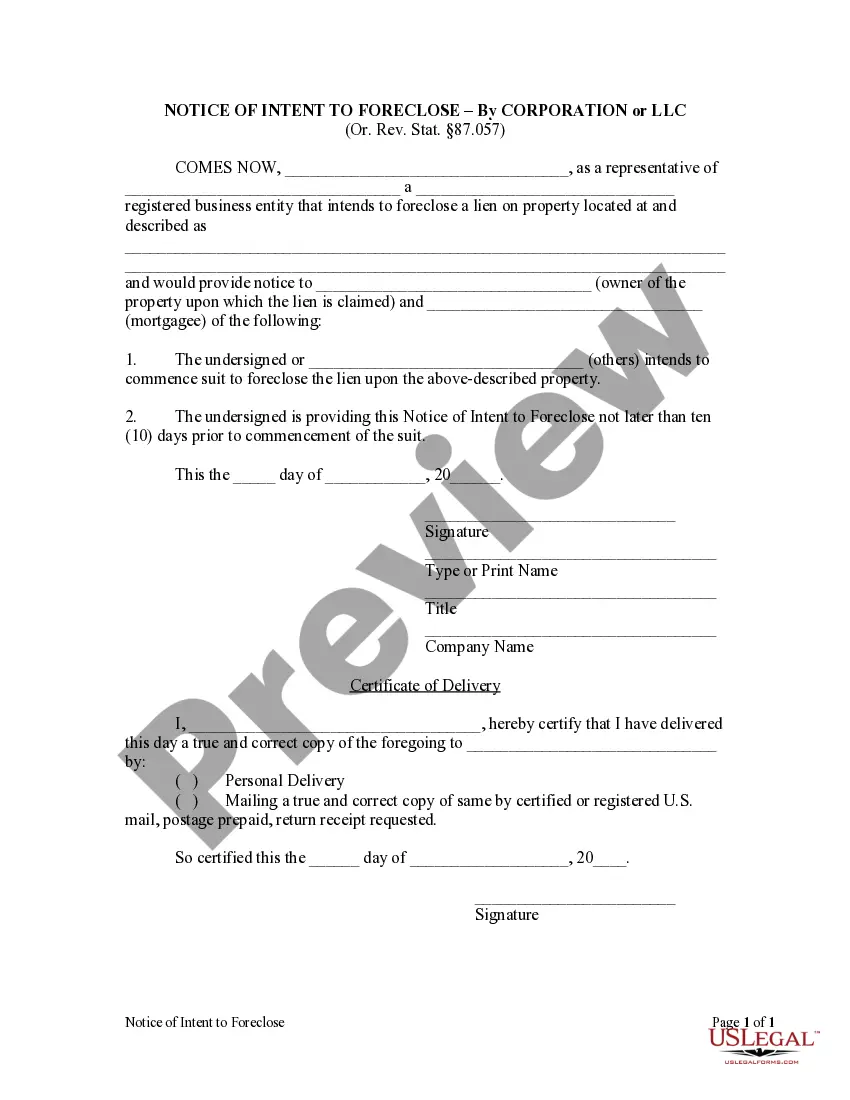

This Notice of Intent to Foreclose is for use by a corporation who intends to foreclose a lien on property to provide notice not later than ten days prior to commencement of the suit to the owner of the property upon which the lien is claimed and the mortgagee that the corporation intends to commence suit to foreclose the lien upon the described property.

The Hillsboro Oregon Notice of Intent to Foreclose is a legal document issued by the county assessor's office notifying a corporation or LLC that they are at risk of losing their property due to foreclosure. This notice serves as a warning to the property owner, allowing them a chance to address any outstanding issues with their mortgage or taxes before the foreclosure process begins. It is important for property owners to understand the implications of receiving such a notice and take immediate action to prevent the loss of their property. There are different types of Hillsboro Oregon Notice of Intent to Foreclose — Corporation or LLC, which may include: 1. Tax Foreclosure Notice: This notice is sent to corporations or LCS when they fail to meet their property tax obligations. It typically outlines the outstanding taxes owed, penalties, interest, and a deadline for payment. If the taxes remain unpaid within the specified timeframe, the property could be foreclosed upon. 2. Mortgage Foreclosure Notice: This type of notice is issued by a lender when a corporation or LLC fails to make regular mortgage payments. It will typically state the amount of unpaid mortgage debt, any fees or penalties incurred, and a deadline for payment or resolution. Failure to respond to this notice may result in the initiation of foreclosure proceedings. 3. Liens and Judgments Foreclosure Notice: In some cases, a corporation or LLC may receive a notice of intent to foreclose as a result of outstanding liens or judgments against the property. This can occur when the property owner fails to satisfy financial obligations, such as unpaid contractor fees, court judgments, or other outstanding debts. The notice will outline the specific liens or judgments and provide a deadline to address and resolve them. Receiving a Hillsboro Oregon Notice of Intent to Foreclose — Corporation or LLC should be taken seriously, as failure to act promptly can result in the loss of the property. Property owners should consult with legal professionals experienced in foreclosure matters to understand their rights and explore potential options to prevent foreclosure. It is vital to address any outstanding issues, such as overdue taxes, mortgage payments, or liens, to avoid the potentially dire consequences of foreclosure.The Hillsboro Oregon Notice of Intent to Foreclose is a legal document issued by the county assessor's office notifying a corporation or LLC that they are at risk of losing their property due to foreclosure. This notice serves as a warning to the property owner, allowing them a chance to address any outstanding issues with their mortgage or taxes before the foreclosure process begins. It is important for property owners to understand the implications of receiving such a notice and take immediate action to prevent the loss of their property. There are different types of Hillsboro Oregon Notice of Intent to Foreclose — Corporation or LLC, which may include: 1. Tax Foreclosure Notice: This notice is sent to corporations or LCS when they fail to meet their property tax obligations. It typically outlines the outstanding taxes owed, penalties, interest, and a deadline for payment. If the taxes remain unpaid within the specified timeframe, the property could be foreclosed upon. 2. Mortgage Foreclosure Notice: This type of notice is issued by a lender when a corporation or LLC fails to make regular mortgage payments. It will typically state the amount of unpaid mortgage debt, any fees or penalties incurred, and a deadline for payment or resolution. Failure to respond to this notice may result in the initiation of foreclosure proceedings. 3. Liens and Judgments Foreclosure Notice: In some cases, a corporation or LLC may receive a notice of intent to foreclose as a result of outstanding liens or judgments against the property. This can occur when the property owner fails to satisfy financial obligations, such as unpaid contractor fees, court judgments, or other outstanding debts. The notice will outline the specific liens or judgments and provide a deadline to address and resolve them. Receiving a Hillsboro Oregon Notice of Intent to Foreclose — Corporation or LLC should be taken seriously, as failure to act promptly can result in the loss of the property. Property owners should consult with legal professionals experienced in foreclosure matters to understand their rights and explore potential options to prevent foreclosure. It is vital to address any outstanding issues, such as overdue taxes, mortgage payments, or liens, to avoid the potentially dire consequences of foreclosure.