The Oregon Limited Liability Company Act provides in part as follows:

63.249 Assignment of membership interest; effect of assignment. Except as provided in the articles of organization or any operating agreement:

(1) A membership interest is assignable in whole or in part.

(5) The assignor of all or a portion of a membership interest ceases to be a member with respect to the interest assigned, but is not released from liability as a member accruing or arising prior to assignment solely as a result of the assignment, and is not relieved of any fiduciary duties the assignor otherwise may continue to owe the limited liability company or its remaining members.

(6) Any otherwise permissible assignment of a membership interest shall be effective as to and binding on the limited liability company only after reasonable notice of and proof of the assignment have been provided to the managers of the limited liability company.

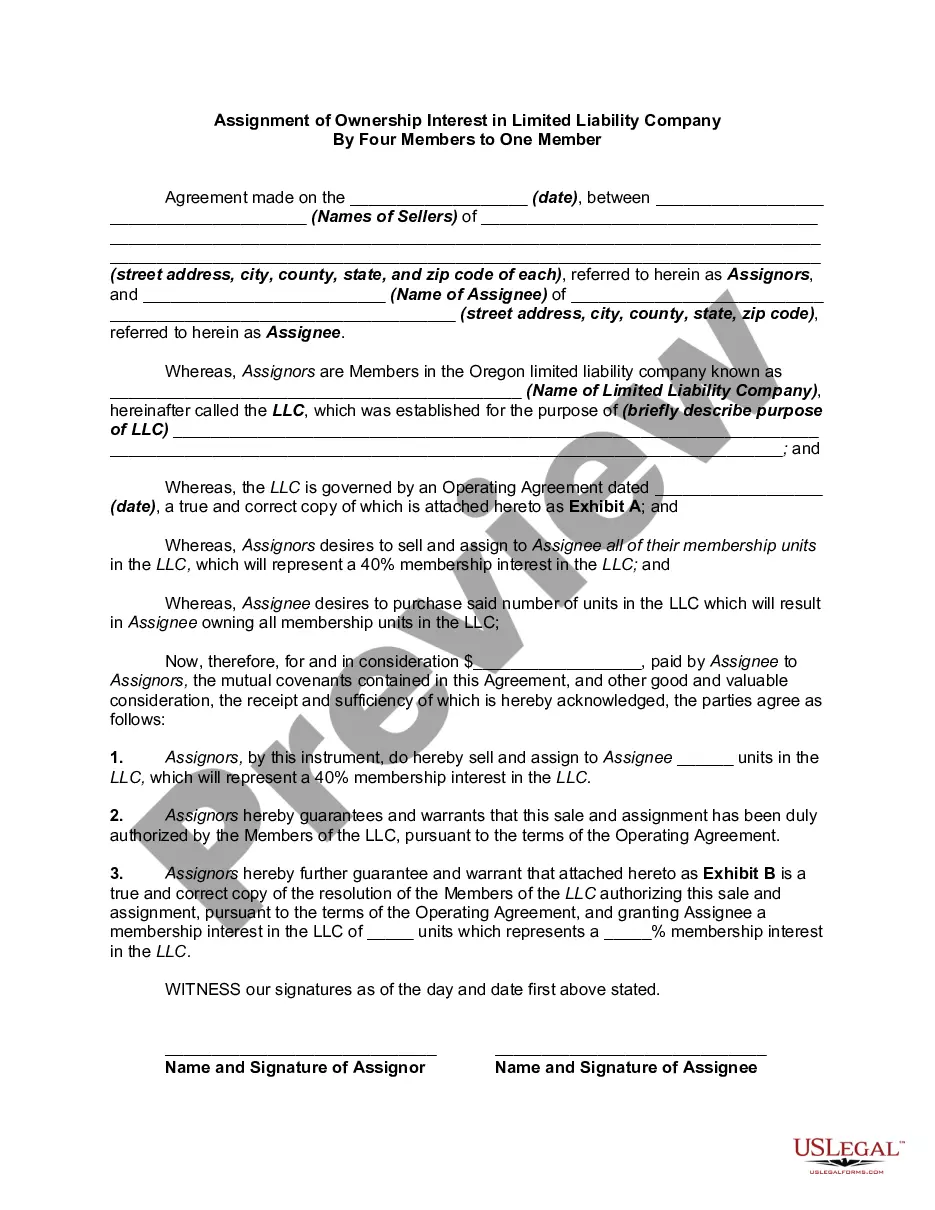

Title: Hillsboro Oregon Assignment of Ownership Interest in Limited Liability Company: An In-depth Guide Introduction: In Hillsboro, Oregon, the Assignment of Ownership Interest in a Limited Liability Company (LLC) by Four Members to One Member is a legal process whereby the ownership shares within an LLC are transferred from four existing members to a single member. This comprehensive guide provides a detailed explanation of this assignment, including its importance, process, and potential variations. Keywords: Hillsboro Oregon, Assignment of Ownership Interest, Limited Liability Company, Four Members, One Member I. Understanding the Assignment of Ownership Interest: 1. Definition: What is an Assignment of Ownership Interest in a Limited Liability Company? 2. Importance: Reasons for Assigning Ownership Interest in Hillsboro Oregon LCS. 3. Legal Implications and Protections for LLC Members. II. The Process of Assigning Ownership Interest in Hillsboro Oregon LCS: 1. Member Consensus: Obtaining Agreement from All Involved Parties. 2. Drafting an Assignment Agreement: Key Elements and Considerations. 3. Notarization and Documentation: Ensuring Legal Validity. 4. Filing with the Oregon Secretary of State: Regulatory Requirements. III. Types of Assignment of Ownership Interest in Hillsboro Oregon LCS: 1. Voluntary Assignments: When Members Voluntarily Transfer Ownership Interests. 2. Involuntary Assignments: Scenarios Triggering Forced Ownership Transfers. 3. Complete Assignments: Transferring Full Ownership Interest. 4. Partial Assignments: Partial Transfers of Ownership Interest. IV. Important Factors and Considerations: 1. Valuation of Ownership Interest: Determining Each Member's Share. 2. Purchase Price and Funding: Arranging Financial Transactions. 3. Tax Implications: Income, Capital Gains, and Reporting Requirements. 4. Operating Agreement Provisions: Impact on Ownership Interest Assignments. V. Legal Assistance and Professional Guidance: 1. Importance of Consulting Legal Experts: Seeking Professional Advice. 2. Role of Attorneys in Drafting Assignment Agreements. 3. Hiring a Certified Public Accountant (CPA) for Tax Planning and Assistance. Conclusion: The Assignment of Ownership Interest in a Limited Liability Company by Four Members to One Member is a crucial legal process in Hillsboro, Oregon. This comprehensive guide has provided a detailed understanding of this procedure, including its significance, steps involved, and various types. It is always advisable to seek professional guidance from attorneys and certified public accountants to ensure a smooth and legally compliant transfer of ownership interest within an LLC. Keywords: Hillsboro Oregon, Assignment of Ownership Interest, Limited Liability Company, Four Members, One Member, voluntary assignments, involuntary assignments, complete assignments, partial assignments, valuation, purchase price, tax implications, legal assistance.Title: Hillsboro Oregon Assignment of Ownership Interest in Limited Liability Company: An In-depth Guide Introduction: In Hillsboro, Oregon, the Assignment of Ownership Interest in a Limited Liability Company (LLC) by Four Members to One Member is a legal process whereby the ownership shares within an LLC are transferred from four existing members to a single member. This comprehensive guide provides a detailed explanation of this assignment, including its importance, process, and potential variations. Keywords: Hillsboro Oregon, Assignment of Ownership Interest, Limited Liability Company, Four Members, One Member I. Understanding the Assignment of Ownership Interest: 1. Definition: What is an Assignment of Ownership Interest in a Limited Liability Company? 2. Importance: Reasons for Assigning Ownership Interest in Hillsboro Oregon LCS. 3. Legal Implications and Protections for LLC Members. II. The Process of Assigning Ownership Interest in Hillsboro Oregon LCS: 1. Member Consensus: Obtaining Agreement from All Involved Parties. 2. Drafting an Assignment Agreement: Key Elements and Considerations. 3. Notarization and Documentation: Ensuring Legal Validity. 4. Filing with the Oregon Secretary of State: Regulatory Requirements. III. Types of Assignment of Ownership Interest in Hillsboro Oregon LCS: 1. Voluntary Assignments: When Members Voluntarily Transfer Ownership Interests. 2. Involuntary Assignments: Scenarios Triggering Forced Ownership Transfers. 3. Complete Assignments: Transferring Full Ownership Interest. 4. Partial Assignments: Partial Transfers of Ownership Interest. IV. Important Factors and Considerations: 1. Valuation of Ownership Interest: Determining Each Member's Share. 2. Purchase Price and Funding: Arranging Financial Transactions. 3. Tax Implications: Income, Capital Gains, and Reporting Requirements. 4. Operating Agreement Provisions: Impact on Ownership Interest Assignments. V. Legal Assistance and Professional Guidance: 1. Importance of Consulting Legal Experts: Seeking Professional Advice. 2. Role of Attorneys in Drafting Assignment Agreements. 3. Hiring a Certified Public Accountant (CPA) for Tax Planning and Assistance. Conclusion: The Assignment of Ownership Interest in a Limited Liability Company by Four Members to One Member is a crucial legal process in Hillsboro, Oregon. This comprehensive guide has provided a detailed understanding of this procedure, including its significance, steps involved, and various types. It is always advisable to seek professional guidance from attorneys and certified public accountants to ensure a smooth and legally compliant transfer of ownership interest within an LLC. Keywords: Hillsboro Oregon, Assignment of Ownership Interest, Limited Liability Company, Four Members, One Member, voluntary assignments, involuntary assignments, complete assignments, partial assignments, valuation, purchase price, tax implications, legal assistance.