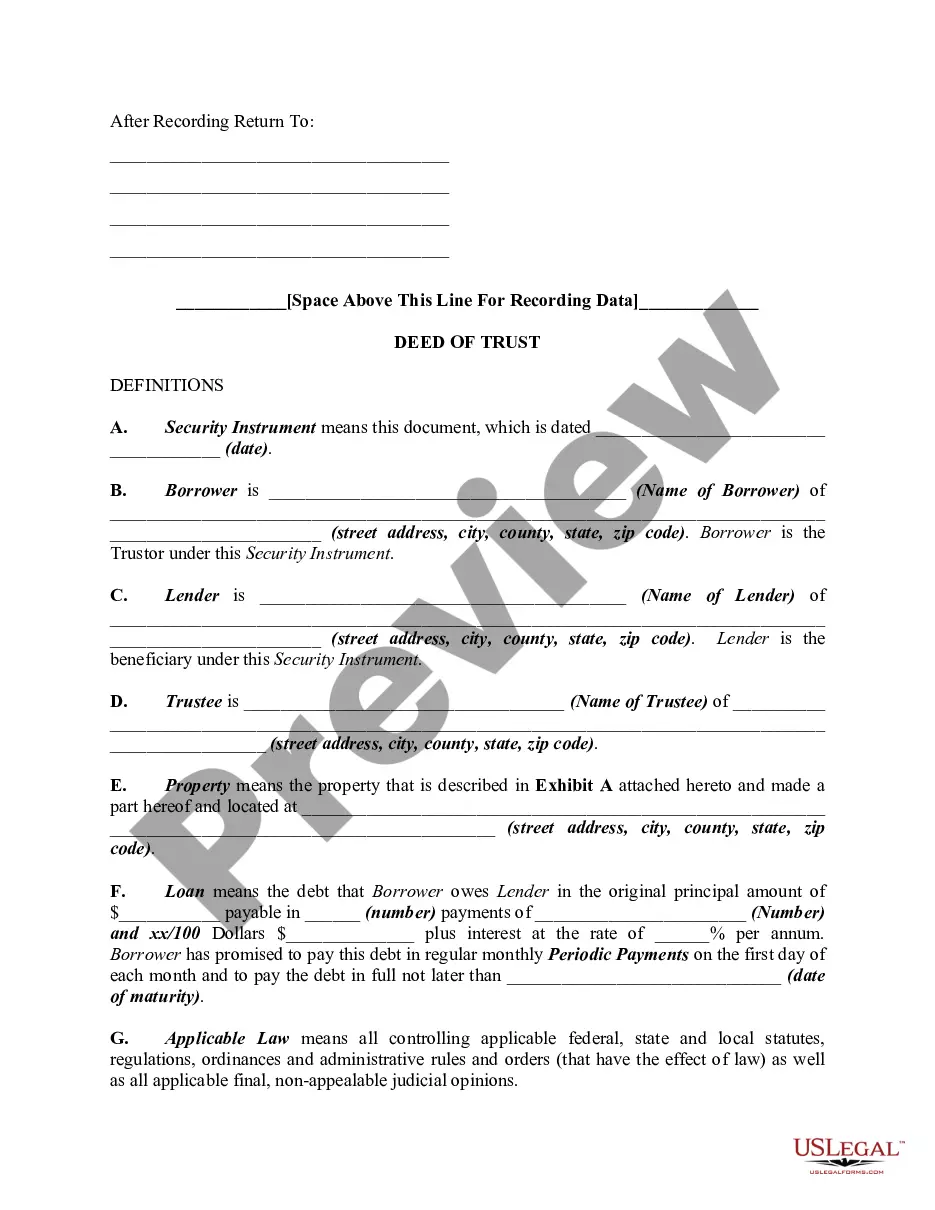

This form is a generic example. It is for illustrative purposes only.

Title: Portland Oregon Deed of Trust on Residential Property Explained: Securing Loans Made by Individuals Introduction: In Portland, Oregon, a Deed of Trust on Residential Property is a legal document that allows an individual to secure a loan made by another individual or a group of individuals. By signing this deed, the borrower agrees to use their residential property as collateral, offering a sense of security to the lender. In this article, we will delve into the details of Portland Oregon Deed of Trust on Residential Property, highlighting its importance and various types available. Key Points: 1. Purpose of a Deed of Trust on Residential Property: — This document ensures that the lender has a legal claim over the borrower's residential property as security against the loan. — It provides a lien against the property, allowing the lender to initiate foreclosure proceedings if the borrower fails to repay the loan as agreed. 2. Importance of a Deed of Trust on Residential Property: — Offers both parties a level of protection: It protects the lender's interests by guaranteeing repayment through collateral, and the borrower can secure financing they may not qualify for otherwise. — Simplifies foreclosure process: With a Deed of Trust, lenders have an easier and quicker route to take legal action if the borrower defaults, compared to traditional mortgages that require judicial foreclosure. Types of Portland Oregon Deed of Trust on Residential Property: 1. Fixed-Rate Deed of Trust: — A fixed-rate Deed of Trust guarantees that the loan's interest rate remains constant throughout the repayment term. — Borrowers benefit from predictable monthly payments, allowing for easy budgeting. 2. Adjustable-Rate Deed of Trust: — With an adjustable-rate Deed of Trust, the interest rate may change periodically over the loan's lifespan, typically influenced by market conditions. — Borrowers may have an initial fixed-rate period before the interest starts adjusting, providing flexibility and potentially lower initial payments. 3. Wrap-around Deed of Trust: — In this type of Deed of Trust, an existing loan is combined or "wrapped around" by a new loan. — It enables the borrower to obtain additional financing while keeping the original loan intact. Conclusion: Understanding the Portland Oregon Deed of Trust on Residential Property is crucial for individuals involved in borrowing or lending transactions. This legally binding agreement establishes the terms and conditions under which a loan is secured, offering reassurance to both parties. The various types of Deeds of Trust mentioned, such as fixed-rate, adjustable-rate, and wrap-around, provide flexibility and cater to different financial situations. It is essential to consult with legal professionals to ensure compliance with the local regulations and protect your interests.Title: Portland Oregon Deed of Trust on Residential Property Explained: Securing Loans Made by Individuals Introduction: In Portland, Oregon, a Deed of Trust on Residential Property is a legal document that allows an individual to secure a loan made by another individual or a group of individuals. By signing this deed, the borrower agrees to use their residential property as collateral, offering a sense of security to the lender. In this article, we will delve into the details of Portland Oregon Deed of Trust on Residential Property, highlighting its importance and various types available. Key Points: 1. Purpose of a Deed of Trust on Residential Property: — This document ensures that the lender has a legal claim over the borrower's residential property as security against the loan. — It provides a lien against the property, allowing the lender to initiate foreclosure proceedings if the borrower fails to repay the loan as agreed. 2. Importance of a Deed of Trust on Residential Property: — Offers both parties a level of protection: It protects the lender's interests by guaranteeing repayment through collateral, and the borrower can secure financing they may not qualify for otherwise. — Simplifies foreclosure process: With a Deed of Trust, lenders have an easier and quicker route to take legal action if the borrower defaults, compared to traditional mortgages that require judicial foreclosure. Types of Portland Oregon Deed of Trust on Residential Property: 1. Fixed-Rate Deed of Trust: — A fixed-rate Deed of Trust guarantees that the loan's interest rate remains constant throughout the repayment term. — Borrowers benefit from predictable monthly payments, allowing for easy budgeting. 2. Adjustable-Rate Deed of Trust: — With an adjustable-rate Deed of Trust, the interest rate may change periodically over the loan's lifespan, typically influenced by market conditions. — Borrowers may have an initial fixed-rate period before the interest starts adjusting, providing flexibility and potentially lower initial payments. 3. Wrap-around Deed of Trust: — In this type of Deed of Trust, an existing loan is combined or "wrapped around" by a new loan. — It enables the borrower to obtain additional financing while keeping the original loan intact. Conclusion: Understanding the Portland Oregon Deed of Trust on Residential Property is crucial for individuals involved in borrowing or lending transactions. This legally binding agreement establishes the terms and conditions under which a loan is secured, offering reassurance to both parties. The various types of Deeds of Trust mentioned, such as fixed-rate, adjustable-rate, and wrap-around, provide flexibility and cater to different financial situations. It is essential to consult with legal professionals to ensure compliance with the local regulations and protect your interests.