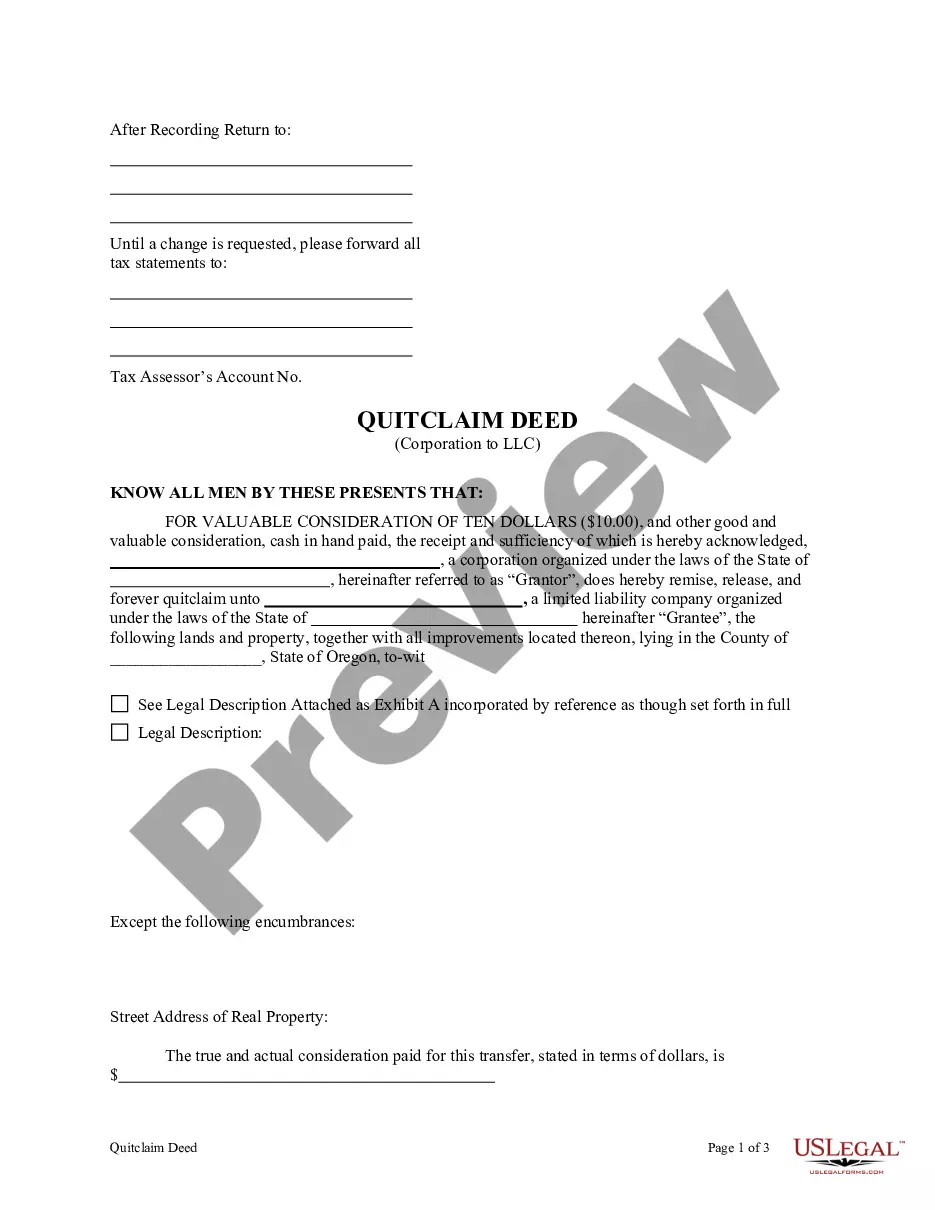

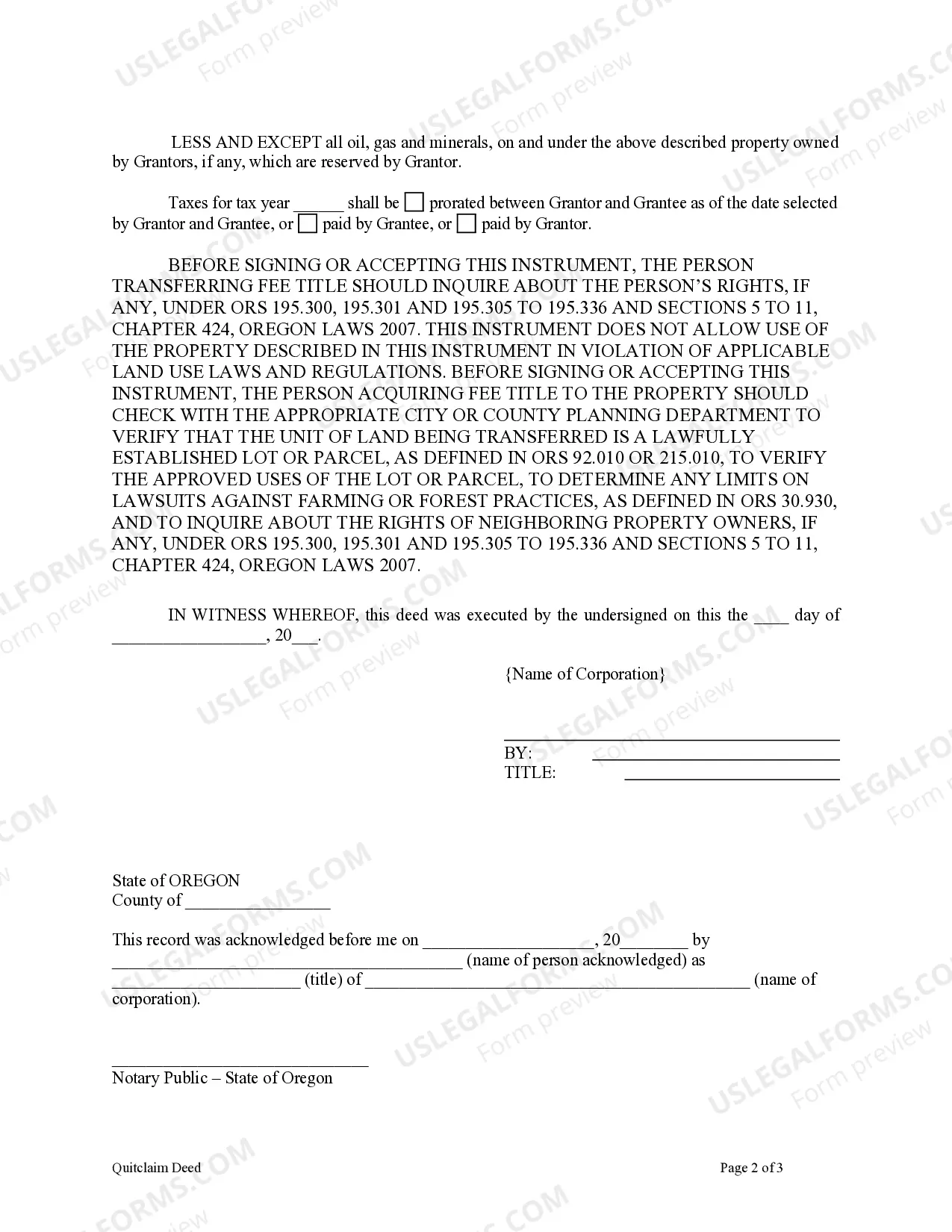

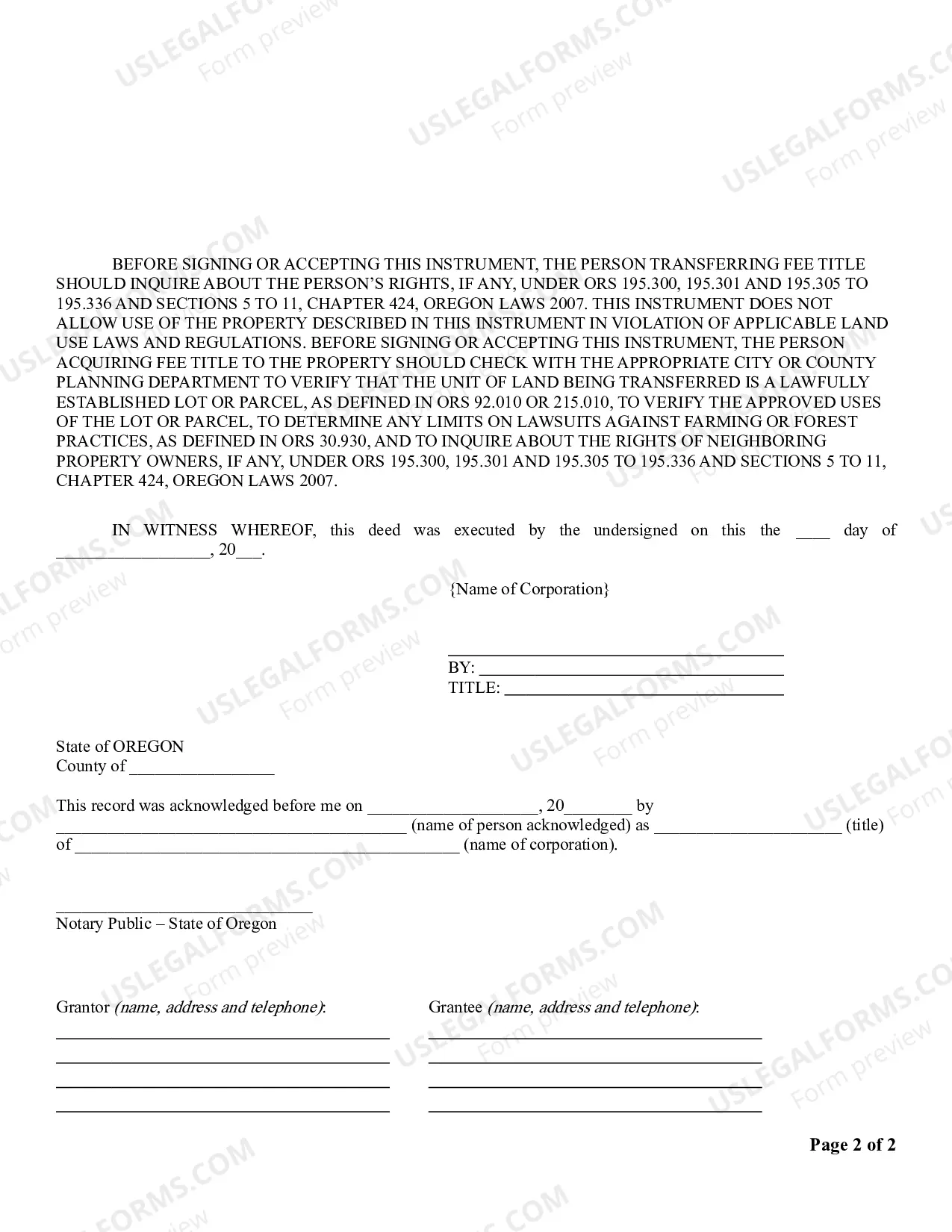

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Detailed Description of Gresham Oregon Quitclaim Deed from Corporation to LLC In Gresham, Oregon, a Quitclaim Deed from Corporation to LLC refers to the transfer of ownership of a property held by a corporation to a limited liability company (LLC). This legal document allows the corporation to quit any claims or interests it may have in the property, transferring them solely to the LLC. Keywords: Gresham Oregon, Quitclaim Deed, Corporation, LLC, transfer of ownership, property, legal document. This type of transfer can occur for various reasons, such as restructuring the ownership structure of a business entity, protecting the assets of the corporation, or facilitating a more flexible management and taxation structure offered by an LLC. The Gresham Oregon Quitclaim Deed from Corporation to LLC involves specific legal procedures to ensure a smooth and legally binding transfer. There are two primary types of Gresham Oregon Quitclaim Deed from Corporation to LLC: 1. Voluntary Transfer: This occurs when the corporation willingly chooses to transfer ownership of the property to an LLC. The corporation may do so to streamline operations, separate assets for different business activities, or reduce liability exposure. This transfer is usually initiated by the corporation's board of directors or shareholders, following the appropriate legal protocols. 2. Involuntary Transfer: In certain cases, such as bankruptcy or legal disputes, a court-mandated transfer of property from a corporation to an LLC may take place. This type of transfer often occurs to satisfy financial obligations, settle debts, or distribute assets among various stakeholders. In such situations, the court oversees the transfer process to ensure fairness and adherence to applicable laws. Regardless of the type of transfer, the Gresham Oregon Quitclaim Deed from Corporation to LLC entails specific details, including: 1. Property Description: The deed should include a thorough and accurate description of the property being transferred, such as the legal description, address, and parcel number. This ensures clarity and avoids any ambiguity regarding the property's identity. 2. Parties Involved: The names and addresses of the corporation and the LLC, along with their respective representatives, should be clearly stated. Parties involved in the transfer must include all relevant stakeholders, including directors, officers, and trustees. 3. Consideration: The document should specify the consideration, i.e., the value or consideration exchanged for the property. It can be in the form of money, equity, shares, or any other asset of value. This ensures that the transfer is legally binding and establishes a fair exchange between the corporation and the LLC. 4. Signatures: The Quitclaim Deed must be signed by authorized representatives of both the corporation and the LLC. These signatures validate the transfer and imply consent from all involved parties. 5. Recording and Notarization: To make the transfer official and publicly known, the Quitclaim Deed must be recorded with the appropriate county office within Gresham, Oregon. Additionally, notarization of the document provides an extra layer of authentication and ensures enforceability in legal proceedings. It is essential to consult an experienced real estate attorney or legal professional specializing in business transactions when dealing with Gresham Oregon Quitclaim Deed from Corporation to LLC. They can guide you through the entire process, ensure compliance with Oregon laws, and create a legally valid and binding document tailored to your specific circumstances.A Detailed Description of Gresham Oregon Quitclaim Deed from Corporation to LLC In Gresham, Oregon, a Quitclaim Deed from Corporation to LLC refers to the transfer of ownership of a property held by a corporation to a limited liability company (LLC). This legal document allows the corporation to quit any claims or interests it may have in the property, transferring them solely to the LLC. Keywords: Gresham Oregon, Quitclaim Deed, Corporation, LLC, transfer of ownership, property, legal document. This type of transfer can occur for various reasons, such as restructuring the ownership structure of a business entity, protecting the assets of the corporation, or facilitating a more flexible management and taxation structure offered by an LLC. The Gresham Oregon Quitclaim Deed from Corporation to LLC involves specific legal procedures to ensure a smooth and legally binding transfer. There are two primary types of Gresham Oregon Quitclaim Deed from Corporation to LLC: 1. Voluntary Transfer: This occurs when the corporation willingly chooses to transfer ownership of the property to an LLC. The corporation may do so to streamline operations, separate assets for different business activities, or reduce liability exposure. This transfer is usually initiated by the corporation's board of directors or shareholders, following the appropriate legal protocols. 2. Involuntary Transfer: In certain cases, such as bankruptcy or legal disputes, a court-mandated transfer of property from a corporation to an LLC may take place. This type of transfer often occurs to satisfy financial obligations, settle debts, or distribute assets among various stakeholders. In such situations, the court oversees the transfer process to ensure fairness and adherence to applicable laws. Regardless of the type of transfer, the Gresham Oregon Quitclaim Deed from Corporation to LLC entails specific details, including: 1. Property Description: The deed should include a thorough and accurate description of the property being transferred, such as the legal description, address, and parcel number. This ensures clarity and avoids any ambiguity regarding the property's identity. 2. Parties Involved: The names and addresses of the corporation and the LLC, along with their respective representatives, should be clearly stated. Parties involved in the transfer must include all relevant stakeholders, including directors, officers, and trustees. 3. Consideration: The document should specify the consideration, i.e., the value or consideration exchanged for the property. It can be in the form of money, equity, shares, or any other asset of value. This ensures that the transfer is legally binding and establishes a fair exchange between the corporation and the LLC. 4. Signatures: The Quitclaim Deed must be signed by authorized representatives of both the corporation and the LLC. These signatures validate the transfer and imply consent from all involved parties. 5. Recording and Notarization: To make the transfer official and publicly known, the Quitclaim Deed must be recorded with the appropriate county office within Gresham, Oregon. Additionally, notarization of the document provides an extra layer of authentication and ensures enforceability in legal proceedings. It is essential to consult an experienced real estate attorney or legal professional specializing in business transactions when dealing with Gresham Oregon Quitclaim Deed from Corporation to LLC. They can guide you through the entire process, ensure compliance with Oregon laws, and create a legally valid and binding document tailored to your specific circumstances.