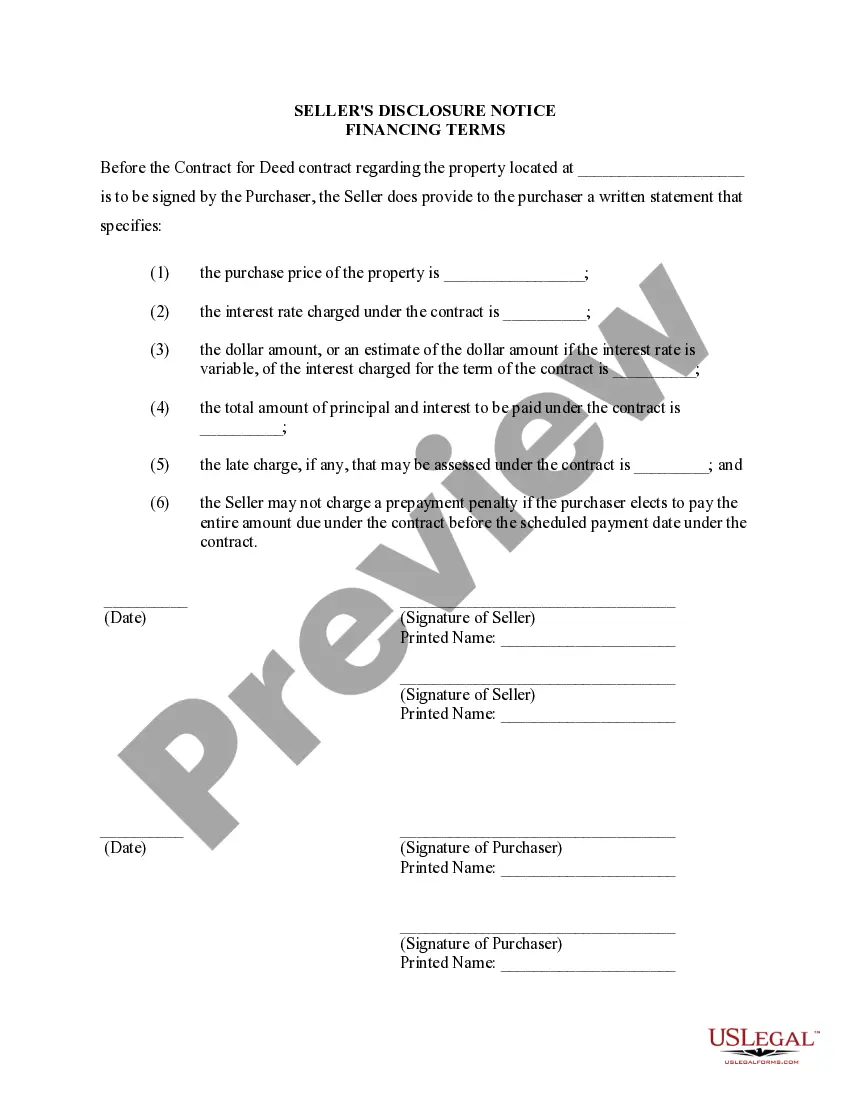

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Understanding Broken Arrow, Oklahoma Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Keywords: Broken Arrow, Oklahoma, seller's disclosure, financing terms, residential property, contract for deed, agreement for deed, land contract Introduction: When entering into a contract or agreement for deed (also known as a land contract) for a residential property in Broken Arrow, Oklahoma, both sellers and buyers must adhere to certain legal requirements. One crucial element of this process is the Seller's Disclosure of Financing Terms. This document outlines the terms and conditions related to the property's financing, providing transparency and protection for all parties involved. This article will delve into the details of this disclosure and its significance in Broken Arrow real estate transactions. 1. Broken Arrow Oklahoma Seller's Disclosure of Financing Terms for Residential Property: The Seller's Disclosure of Financing Terms is an essential legal document in Broken Arrow, Oklahoma, designed to ensure that buyers have a complete understanding of the financial aspects of their property purchase. It ensures clarity regarding the financing terms, including the interest rate, payment schedule, and any additional fees or costs associated with the land contract. 2. Role of the Seller: The seller is obligated to provide accurate and comprehensive financing information to the buyer in the Seller's Disclosure. The disclosure must include details such as the interest rate, duration of payments, any penalties for late payments or defaults, and any fees charged by the seller for financing the property. 3. Role of the Buyer: Buyers must carefully review the Seller's Disclosure of Financing Terms before finalizing the agreement. By thoroughly studying the disclosure, buyers can ensure they fully understand the financial obligations and terms associated with the land contract, enabling them to make an informed decision. 4. Other Types of Seller's Disclosures for Residential Property Financing in Broken Arrow, Oklahoma: Besides the general Seller's Disclosure of Financing Terms, there might be additional disclosures required, depending on the specific circumstances of the transaction. Here are a few examples: a. Seller's Disclosure of Financing Terms with Balloon Payment: If the land contract involves a balloon payment, wherein a large final payment is due at the end of the contract term, the seller must include this information in a separate disclosure. The disclosure should detail the amount, due date, and any specific instructions for the balloon payment. b. Seller's Disclosure of Adjustable Interest Rate Terms: In cases where the interest rate on the land contract is variable, sellers must provide a separate disclosure. This disclosure should clearly outline the terms of the adjustable rate, including any interest rate caps, adjustments intervals, and calculation methods. Conclusion: In Broken Arrow, Oklahoma, the Seller's Disclosure of Financing Terms for a residential property in connection with a contract or agreement for deed plays a crucial role in ensuring transparency and fairness in real estate transactions. By carefully reviewing this document, both sellers and buyers can protect their interests and achieve a successful property purchase or sale. It is essential to consult with a professional real estate agent or attorney to navigate the legal requirements and obligations associated with these financing terms.Title: Understanding Broken Arrow, Oklahoma Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Keywords: Broken Arrow, Oklahoma, seller's disclosure, financing terms, residential property, contract for deed, agreement for deed, land contract Introduction: When entering into a contract or agreement for deed (also known as a land contract) for a residential property in Broken Arrow, Oklahoma, both sellers and buyers must adhere to certain legal requirements. One crucial element of this process is the Seller's Disclosure of Financing Terms. This document outlines the terms and conditions related to the property's financing, providing transparency and protection for all parties involved. This article will delve into the details of this disclosure and its significance in Broken Arrow real estate transactions. 1. Broken Arrow Oklahoma Seller's Disclosure of Financing Terms for Residential Property: The Seller's Disclosure of Financing Terms is an essential legal document in Broken Arrow, Oklahoma, designed to ensure that buyers have a complete understanding of the financial aspects of their property purchase. It ensures clarity regarding the financing terms, including the interest rate, payment schedule, and any additional fees or costs associated with the land contract. 2. Role of the Seller: The seller is obligated to provide accurate and comprehensive financing information to the buyer in the Seller's Disclosure. The disclosure must include details such as the interest rate, duration of payments, any penalties for late payments or defaults, and any fees charged by the seller for financing the property. 3. Role of the Buyer: Buyers must carefully review the Seller's Disclosure of Financing Terms before finalizing the agreement. By thoroughly studying the disclosure, buyers can ensure they fully understand the financial obligations and terms associated with the land contract, enabling them to make an informed decision. 4. Other Types of Seller's Disclosures for Residential Property Financing in Broken Arrow, Oklahoma: Besides the general Seller's Disclosure of Financing Terms, there might be additional disclosures required, depending on the specific circumstances of the transaction. Here are a few examples: a. Seller's Disclosure of Financing Terms with Balloon Payment: If the land contract involves a balloon payment, wherein a large final payment is due at the end of the contract term, the seller must include this information in a separate disclosure. The disclosure should detail the amount, due date, and any specific instructions for the balloon payment. b. Seller's Disclosure of Adjustable Interest Rate Terms: In cases where the interest rate on the land contract is variable, sellers must provide a separate disclosure. This disclosure should clearly outline the terms of the adjustable rate, including any interest rate caps, adjustments intervals, and calculation methods. Conclusion: In Broken Arrow, Oklahoma, the Seller's Disclosure of Financing Terms for a residential property in connection with a contract or agreement for deed plays a crucial role in ensuring transparency and fairness in real estate transactions. By carefully reviewing this document, both sellers and buyers can protect their interests and achieve a successful property purchase or sale. It is essential to consult with a professional real estate agent or attorney to navigate the legal requirements and obligations associated with these financing terms.