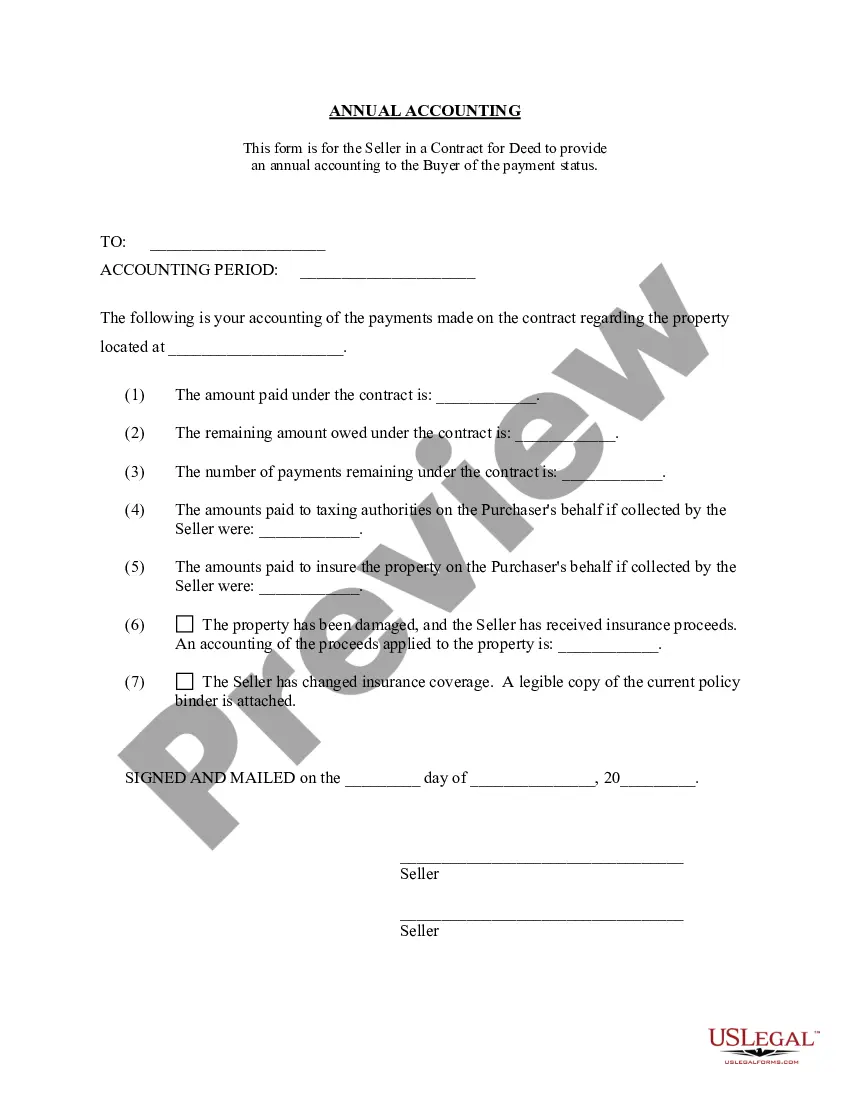

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement serves as a comprehensive document that outlines the financial transactions and obligations between the seller and buyer of a property under a contract for deed arrangement. This statement is essential for transparency and accountability, providing a detailed breakdown of the financial transactions and property-related expenses throughout a year. The Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement helps both parties track the progress of their agreement, ensuring compliance and proper recording of all financial activities. It plays a crucial role in maintaining a clear record of payments, property taxes, insurance, and any other expenses associated with the property. There are several types of Toledo, Ohio Contract for Deed Seller's Annual Accounting Statements, each catering to specific scenarios and requirements. These may include: 1. Basic Annual Accounting Statement: This type of statement includes essential financial information, such as the total payments received from the buyer, along with any deductions for taxes, insurance, or other expenses directly related to the property. 2. Detailed Expense Breakdown: This statement provides a comprehensive breakdown of all expenses incurred throughout the year, including property maintenance costs, repairs, utilities, and any other relevant expenses. It allows for a thorough understanding of the property's financial performance. 3. Tax Deduction Statement: For sellers who qualify for tax deductions on specific expenses related to the property, this statement includes a detailed breakdown of eligible deductions, such as mortgage interest, property taxes, and insurance premiums, helping them optimize their tax returns. 4. Late Payment Notice: In cases where the buyer has failed to make timely payments, this type of statement highlights the outstanding balance, late payment fees, and any other penalties incurred due to non-compliance with the contract terms. 5. Termination Accounting Statement: This statement is prepared when the contract for deed is terminated, either due to successful completion or other circumstances. It provides a final overview of all financial transactions, remaining outstanding balances, and any necessary adjustments before concluding the agreement. In conclusion, the Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement is an essential tool for maintaining financial transparency in the contractual relationship between the seller and buyer. By providing a comprehensive breakdown of expenses and payments, it ensures both parties are aware of their financial obligations and helps establish a strong foundation of trust and accountability.Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement serves as a comprehensive document that outlines the financial transactions and obligations between the seller and buyer of a property under a contract for deed arrangement. This statement is essential for transparency and accountability, providing a detailed breakdown of the financial transactions and property-related expenses throughout a year. The Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement helps both parties track the progress of their agreement, ensuring compliance and proper recording of all financial activities. It plays a crucial role in maintaining a clear record of payments, property taxes, insurance, and any other expenses associated with the property. There are several types of Toledo, Ohio Contract for Deed Seller's Annual Accounting Statements, each catering to specific scenarios and requirements. These may include: 1. Basic Annual Accounting Statement: This type of statement includes essential financial information, such as the total payments received from the buyer, along with any deductions for taxes, insurance, or other expenses directly related to the property. 2. Detailed Expense Breakdown: This statement provides a comprehensive breakdown of all expenses incurred throughout the year, including property maintenance costs, repairs, utilities, and any other relevant expenses. It allows for a thorough understanding of the property's financial performance. 3. Tax Deduction Statement: For sellers who qualify for tax deductions on specific expenses related to the property, this statement includes a detailed breakdown of eligible deductions, such as mortgage interest, property taxes, and insurance premiums, helping them optimize their tax returns. 4. Late Payment Notice: In cases where the buyer has failed to make timely payments, this type of statement highlights the outstanding balance, late payment fees, and any other penalties incurred due to non-compliance with the contract terms. 5. Termination Accounting Statement: This statement is prepared when the contract for deed is terminated, either due to successful completion or other circumstances. It provides a final overview of all financial transactions, remaining outstanding balances, and any necessary adjustments before concluding the agreement. In conclusion, the Toledo, Ohio Contract for Deed Seller's Annual Accounting Statement is an essential tool for maintaining financial transparency in the contractual relationship between the seller and buyer. By providing a comprehensive breakdown of expenses and payments, it ensures both parties are aware of their financial obligations and helps establish a strong foundation of trust and accountability.