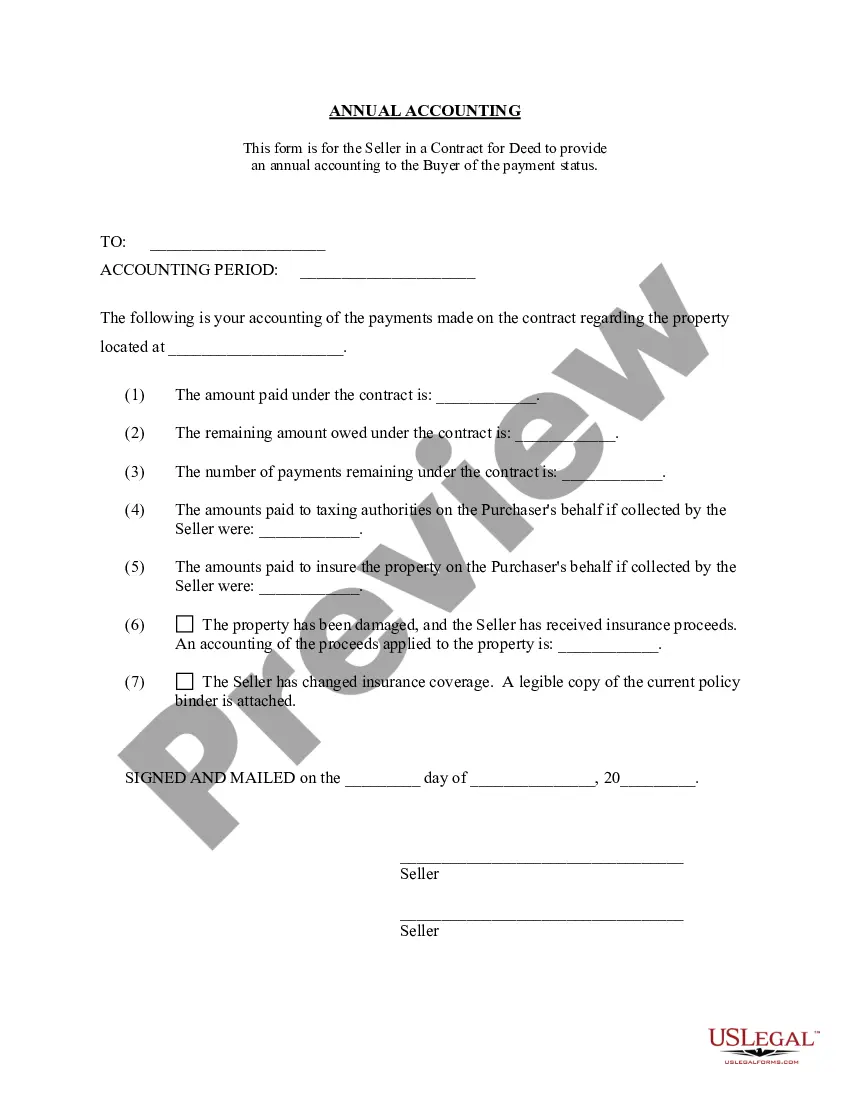

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is a crucial legal document that outlines the financial transactions and obligations between the seller and the buyer in a real estate contract for deed agreement. This statement acts as an official record of all income, expenses, and expenses related to the property in question throughout the year. In Cuyahoga County, Ohio, there are several types of Contract for Deed Seller's Annual Accounting Statements, each serving a specific purpose and tailored to different situations. These include: 1. Residential Property Accounting Statement: This type of statement is used when the contract for deed pertains to residential properties, such as single-family homes, townhouses, or condominiums. It details the income generated from the property, including rental payments, and itemizes the expenses incurred towards maintenance, repairs, property taxes, insurance, and other related costs. 2. Commercial Property Accounting Statement: This statement is specifically designed for contract for deed agreements involving commercial properties, such as office buildings, retail spaces, or warehouses. It accounts for the diverse income sources, such as rent, leases, or other business activities, and provides a comprehensive overview of the property's financial performance. Expenses such as utilities, property management fees, advertising costs, and repairs are also included. 3. Agricultural Property Accounting Statement: This statement applies to contract for deed agreements involving agricultural properties, including farms, ranches, or vineyards. It outlines the income generated from cash crops, livestock sales, or any other agricultural activities. Additionally, it includes expenses related to farm management, equipment maintenance, fertilizers, seeds, livestock feed, and other agricultural inputs. Regardless of the specific type, the Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is important for both the seller and the buyer to maintain transparency and ensure compliance with the contract terms. It enables the seller to account for the financial aspects of the property and provides the buyer with an accurate record of their financial commitments and rights. By regularly reviewing and preparing this statement, the parties involved can track the financial progress of the contract for deed agreement, address any discrepancies, and ensure a fair and transparent relationship throughout the contract term.The Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is a crucial legal document that outlines the financial transactions and obligations between the seller and the buyer in a real estate contract for deed agreement. This statement acts as an official record of all income, expenses, and expenses related to the property in question throughout the year. In Cuyahoga County, Ohio, there are several types of Contract for Deed Seller's Annual Accounting Statements, each serving a specific purpose and tailored to different situations. These include: 1. Residential Property Accounting Statement: This type of statement is used when the contract for deed pertains to residential properties, such as single-family homes, townhouses, or condominiums. It details the income generated from the property, including rental payments, and itemizes the expenses incurred towards maintenance, repairs, property taxes, insurance, and other related costs. 2. Commercial Property Accounting Statement: This statement is specifically designed for contract for deed agreements involving commercial properties, such as office buildings, retail spaces, or warehouses. It accounts for the diverse income sources, such as rent, leases, or other business activities, and provides a comprehensive overview of the property's financial performance. Expenses such as utilities, property management fees, advertising costs, and repairs are also included. 3. Agricultural Property Accounting Statement: This statement applies to contract for deed agreements involving agricultural properties, including farms, ranches, or vineyards. It outlines the income generated from cash crops, livestock sales, or any other agricultural activities. Additionally, it includes expenses related to farm management, equipment maintenance, fertilizers, seeds, livestock feed, and other agricultural inputs. Regardless of the specific type, the Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is important for both the seller and the buyer to maintain transparency and ensure compliance with the contract terms. It enables the seller to account for the financial aspects of the property and provides the buyer with an accurate record of their financial commitments and rights. By regularly reviewing and preparing this statement, the parties involved can track the financial progress of the contract for deed agreement, address any discrepancies, and ensure a fair and transparent relationship throughout the contract term.