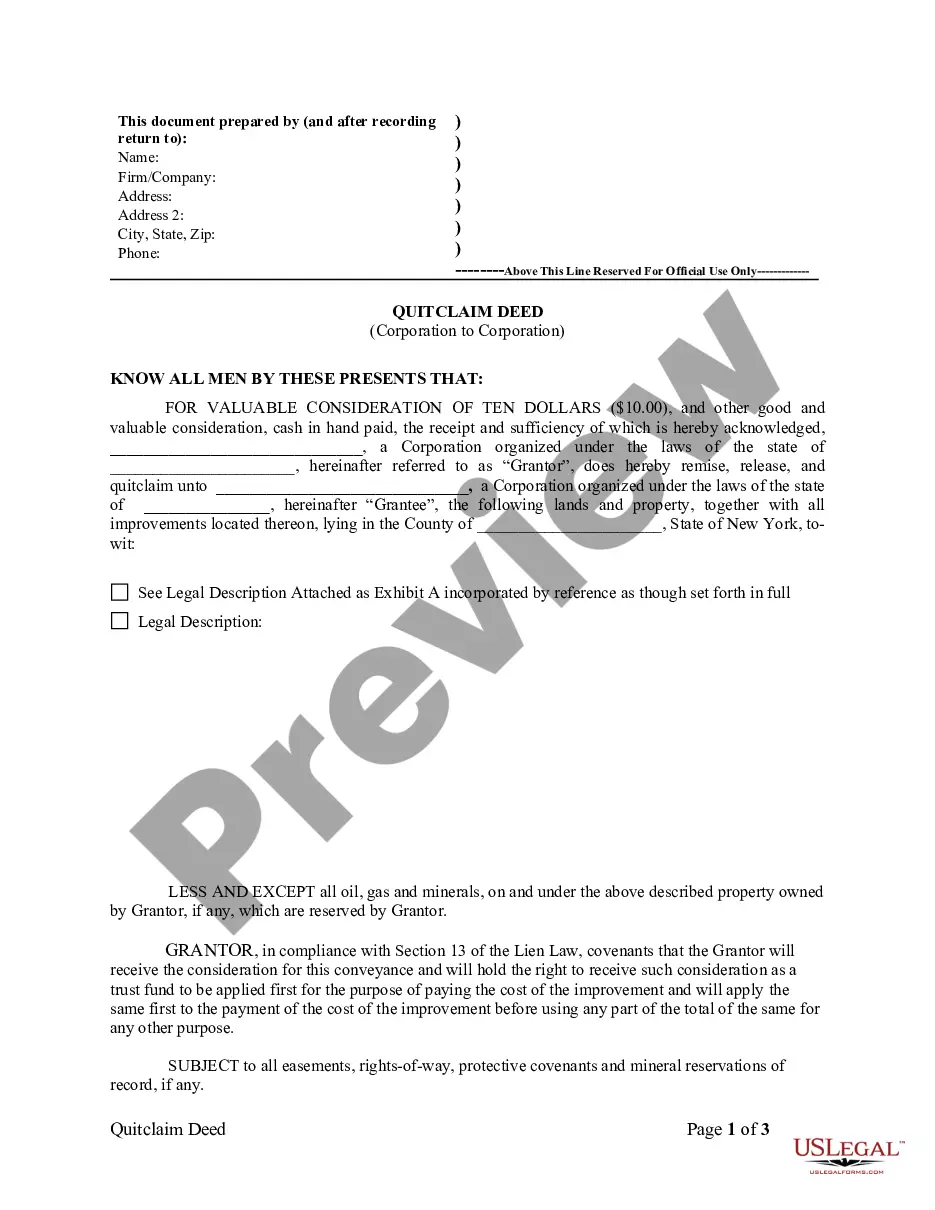

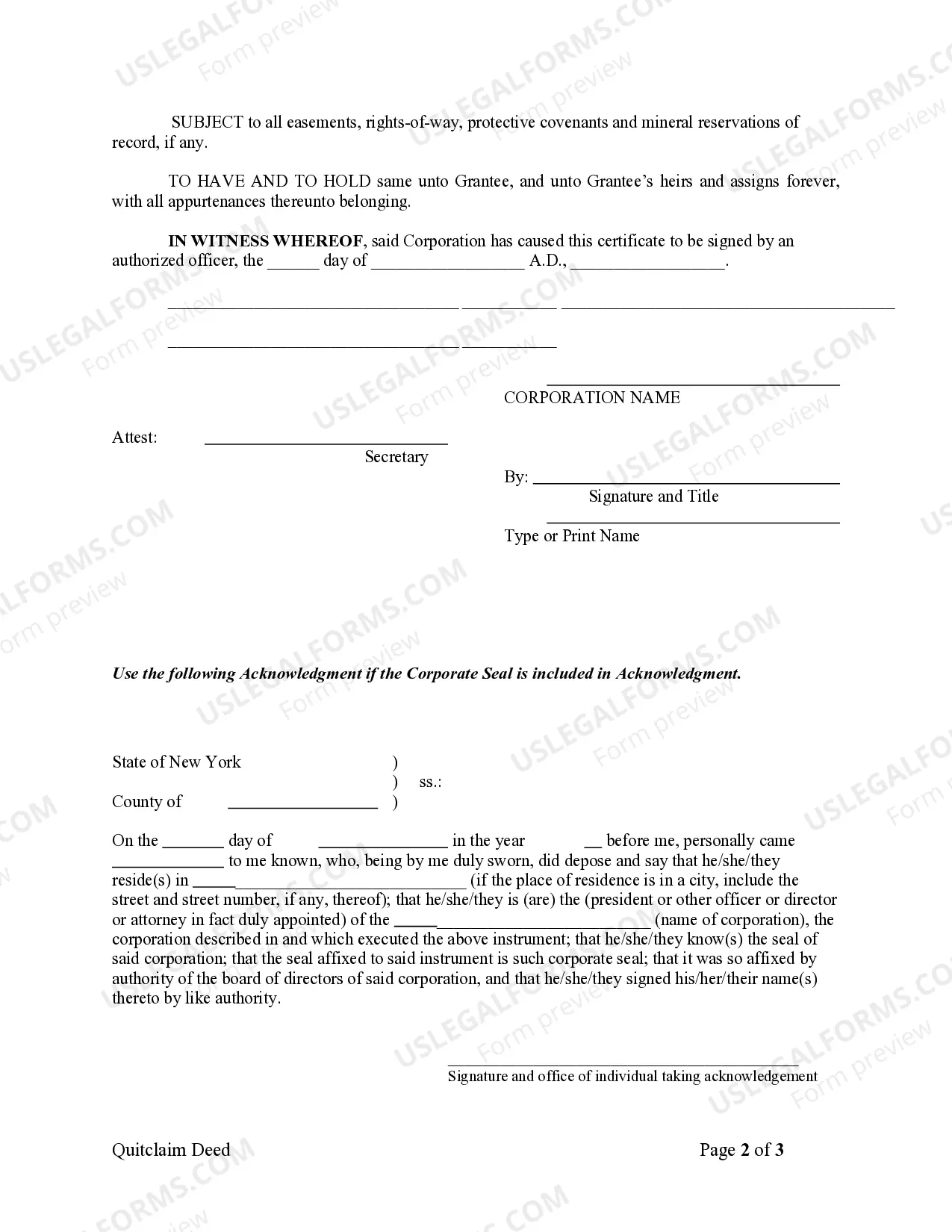

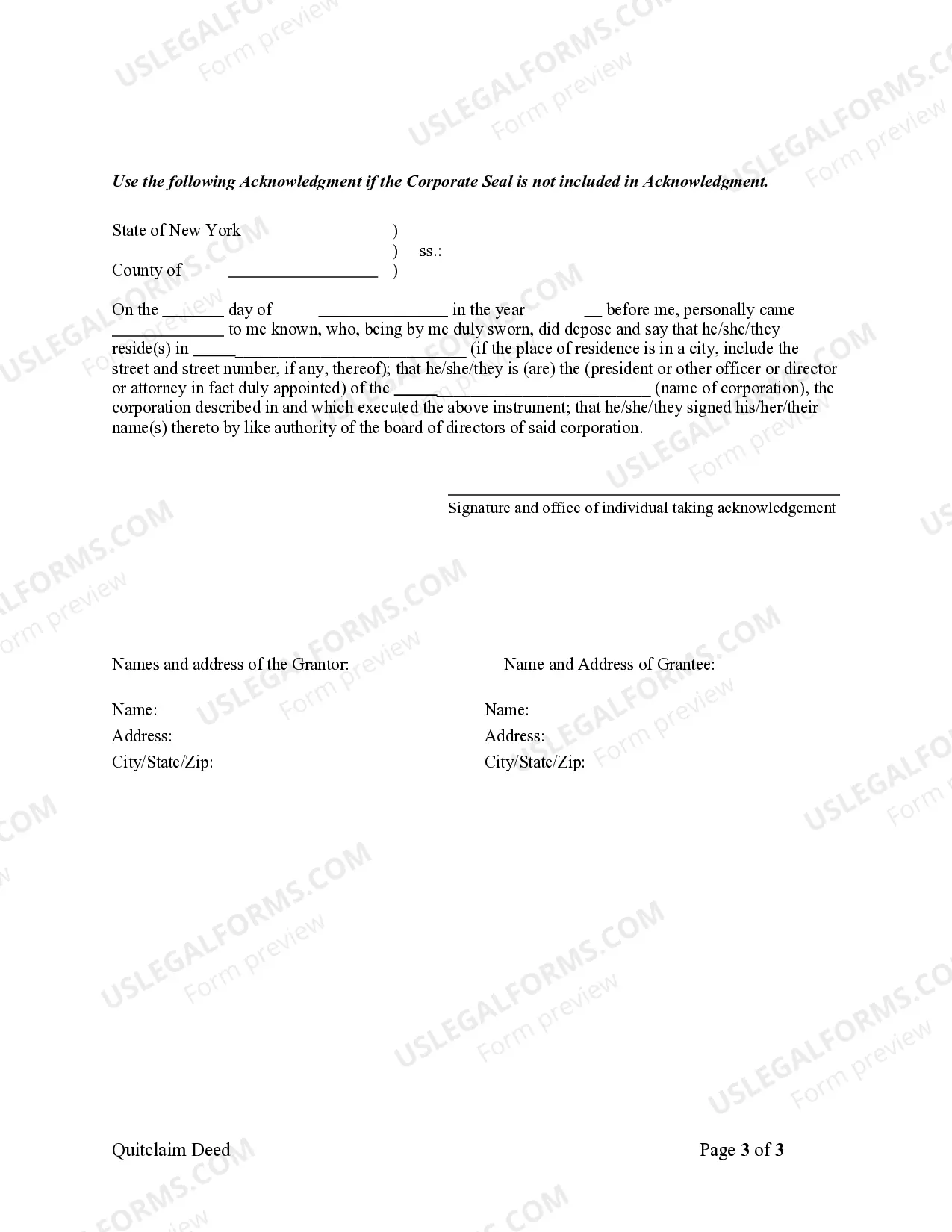

Nassau New York Quitclaim Deed from Corporation to Corporation is a legal document that transfers ownership rights of a property from one corporation to another. This type of deed is often used when there is a change in ownership between corporations, such as in a merger or acquisition. The Nassau New York Quitclaim Deed from Corporation to Corporation provides a clear and legally binding record of the transfer of property rights without making any guarantee of the property's title. It implies that the current corporation is releasing any interest or claim it may have on the property to the new corporation, but it does not assure that the property is free from any encumbrances or defects. When dealing with Nassau New York Quitclaim Deeds from Corporation to Corporation, there are certain variations and unique circumstances that can be encountered. Some notable types of these deeds are: 1. Inter-corporate Transfer: This refers to the transfer of property between two existing corporations. It could occur in cases of corporate restructuring, consolidation, or when subsidiaries are transferred between parent companies. 2. Merger/Acquisition Deed: This type of deed is used in situations where one corporation is merging with or acquiring another. The deed ensures a smooth transfer of assets, including real estate properties, from the acquired corporation to the acquiring corporation. 3. Dissolution Deed: In cases where a corporation is dissolved or ceases to exist, a dissolution deed is used to transfer all the corporation's assets, including real estate, to another corporation or entity. This allows for the distribution of assets during the dissolution process. 4. Succession Deed: When a corporation undergoes a change in ownership due to succession planning, such as a transfer of ownership from one generation to another, a succession deed is used. This type of deed ensures a seamless transfer of property rights while maintaining the corporate structure. 5. Affiliate Transfer Deed: This type of deed is relevant when a corporation transfers ownership of a property to its affiliate or subsidiary. It enables corporations within the same corporate group to transfer assets without involving external entities. Nassau New York Quitclaim Deed from Corporation to Corporation plays a crucial role in documenting property transfers and ensuring legal compliance during corporate transactions. It is essential to consult with legal professionals well-versed in Nassau County's specific laws and regulations to ensure a smooth and lawful transfer of property rights.

Nassau New York Quitclaim Deed from Corporation to Corporation

Description

How to fill out Nassau New York Quitclaim Deed From Corporation To Corporation?

If you are looking for a valid form, it’s difficult to find a better place than the US Legal Forms site – probably the most considerable libraries on the web. With this library, you can find thousands of templates for organization and personal purposes by types and regions, or keywords. With our high-quality search option, discovering the latest Nassau New York Quitclaim Deed from Corporation to Corporation is as elementary as 1-2-3. Moreover, the relevance of every file is confirmed by a group of expert attorneys that regularly check the templates on our platform and revise them based on the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Nassau New York Quitclaim Deed from Corporation to Corporation is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the form you want. Look at its explanation and use the Preview feature (if available) to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate file.

- Confirm your selection. Click the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Nassau New York Quitclaim Deed from Corporation to Corporation.

Every form you add to your account does not have an expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to receive an extra version for enhancing or creating a hard copy, you can come back and export it again at any time.

Take advantage of the US Legal Forms extensive collection to get access to the Nassau New York Quitclaim Deed from Corporation to Corporation you were seeking and thousands of other professional and state-specific templates in one place!