The Suffolk New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt is an official document that certifies the formation of a nonprofit corporation in Suffolk County, New York. This certificate is specifically designed for nonprofit organizations seeking tax-exempt status. Nonprofit organizations play a crucial role in serving communities and fulfilling philanthropic missions. In order to establish a solid legal foundation, organizations must file the Suffolk New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt to gain recognition from the state government and to be eligible for tax exemptions. The keywords that are relevant to this document include: 1. Suffolk New York: This refers to the specific jurisdiction where the certificate is issued, which is in Suffolk County, New York. Suffolk County is located on Long Island and is the easternmost county in New York State. 2. Articles of Incorporation: These are legal documents that outline the initial formation of a corporation. In the case of the Suffolk New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt, it specifically pertains to nonprofit organizations. 3. Certificate: This is an official document issued by the state government that serves as proof of a nonprofit organization's compliance with the necessary legal requirements for incorporation and tax-exempt status. 4. Nonprofit Corporation: Refers to an organization that operates for educational, charitable, religious, scientific, or other public purposes. Nonprofit corporations have a mission to serve the public good rather than generating profits for shareholders. 5. Tax Exempt: In the context of nonprofit corporations, tax-exempt status allows organizations to be exempted from paying federal or state income taxes on their qualifying activities and funds generated from donations, grants, and fundraising efforts. Different types of Suffolk New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt may include variations based on the specific needs of the nonprofit organization. For example: — Religious/Spiritual Organizations: These nonprofits focus on promoting religious or spiritual practices, providing community services, and supporting religious education. — Charitable Organizations: These nonprofits aim to support and improve the well-being of individuals or communities by providing various charitable services, such as healthcare, disaster relief, poverty alleviation, or educational support. — Scientific/Research Organizations: These nonprofits focus on scientific research, advancements, and education. They typically invest in research studies and contribute to the overall progress of scientific knowledge. — Educational Organizations: These nonprofits focus on education and may include schools, colleges, universities, or other educational institutions dedicated to providing quality education and fostering learning opportunities. Each type of nonprofit organization would have specific requirements and provisions outlined in their respective Suffolk New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt. It is essential for organizations to carefully define their purpose, goals, and activities to appropriately classify themselves while adhering to the relevant legal frameworks.

Suffolk New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

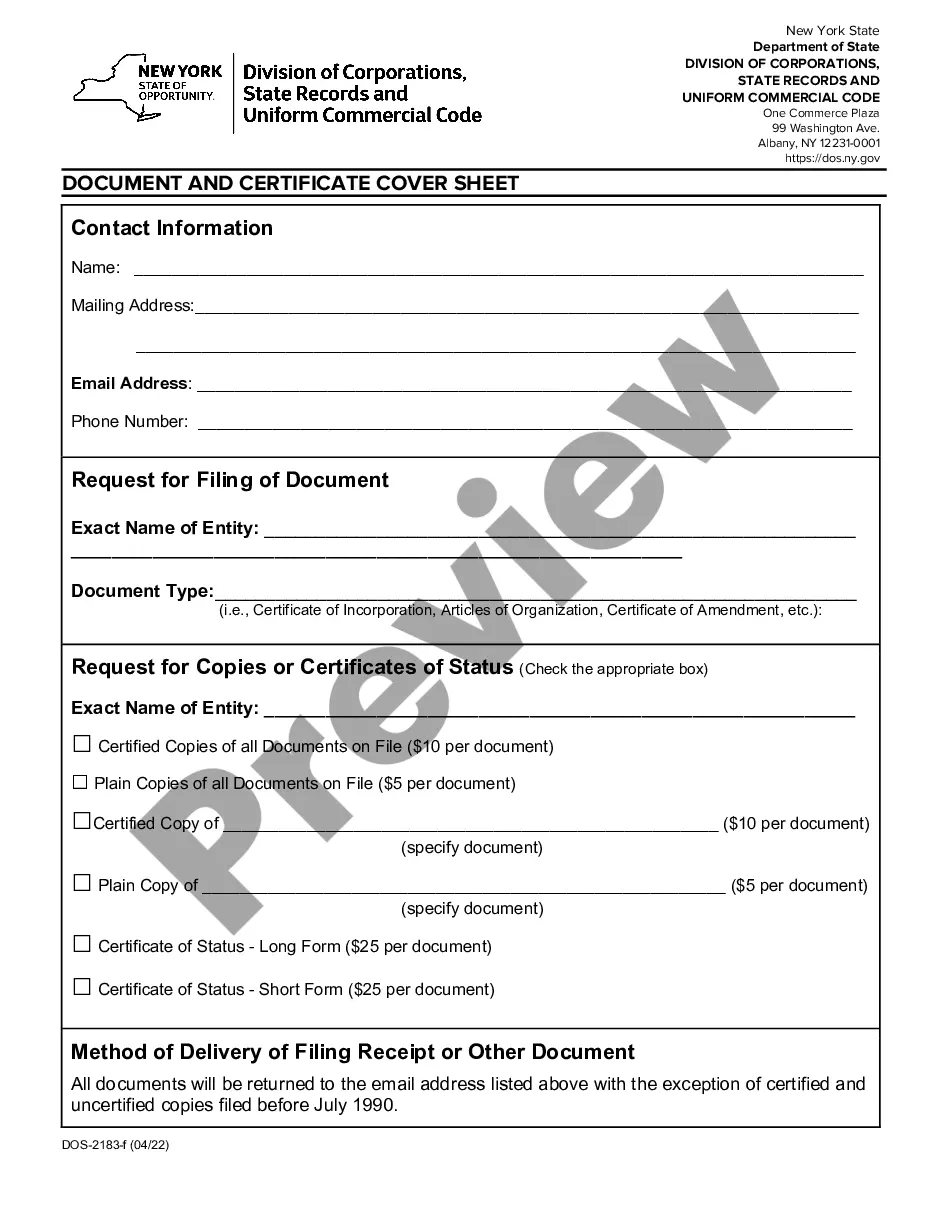

How to fill out Suffolk New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Suffolk New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Suffolk New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Suffolk New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt would work for you, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!