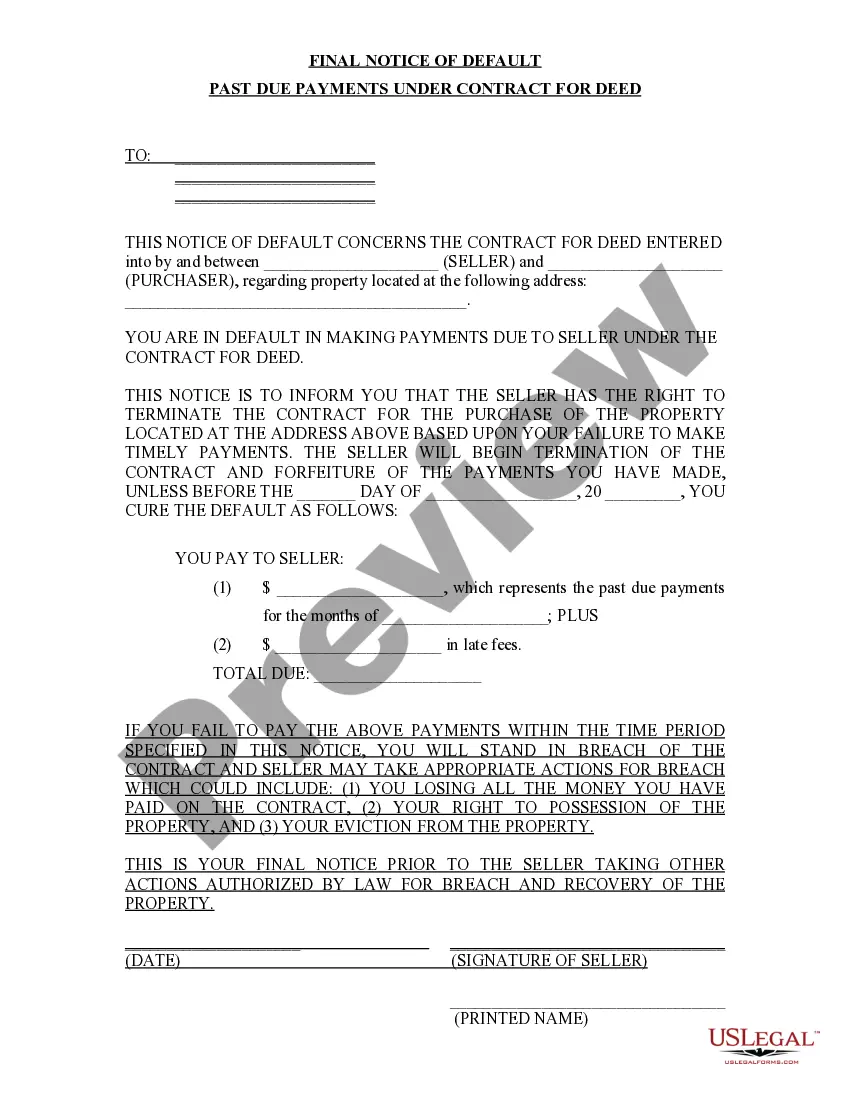

Queens, New York Final Notice of Default for Past Due Payments in Connection with Contract for Deed In Queens, New York, if you have entered into a Contract for Deed to purchase property and are experiencing difficulties in making your payments, you may receive a Final Notice of Default for Past Due Payments. This notice serves as a legal warning that you have fallen behind on your agreed-upon payments and must take immediate action to resolve the outstanding debt. A Final Notice of Default is an official communication that notifies the property buyer of their current delinquency status. It is issued by the seller or their representative and details specific information regarding the outstanding balance, late fees, and the time frame within which the buyer must rectify the situation. The Final Notice of Default typically includes the following key elements: 1. Description of Parties Involved: It identifies both the buyer (purchaser) and the seller (vendor) involved in the Contract for Deed, along with their respective contact information and legal representation, if applicable. 2. Property Details: The notice should describe the property in question, including the address, lot number, and any relevant legal descriptions to ensure accuracy. 3. Account Summary: A breakdown of the current outstanding balance, including any late fees, penalties, or interest accrued since the missed payment, should be clearly stated. This gives the buyer a comprehensive understanding of the financial obligations they need to meet. 4. Notification of Default: The purpose of the notice is to inform the buyer that they are now in default due to non-payment or insufficient payment. It emphasizes the seriousness of the situation and highlights potential consequences if the delinquency is not addressed promptly. 5. Steps to Rectify the Default: The notice outlines the necessary actions the buyer must take to cure the default. This often includes submitting the outstanding payment within a specified timeframe, along with any late fees or penalties levied. 6. Repercussions of Non-Compliance: The notice warns the buyer of the potential consequences if they fail to resolve the past due payments promptly. These consequences may involve the initiation of legal proceedings, termination of the contract, foreclosure of the property, or the imposition of additional financial penalties. Different types of Final Notices of Default for Past Due Payments may vary based on specific circumstances of the Contract for Deed. For example: 1. Non-Payment Notice: This type of final notice is typically issued when the buyer has completely failed to make their scheduled payment(s), leading to a default. It emphasizes the urgent need to fulfill the payment requirement promptly to avoid further legal actions. 2. Insufficient Payment Notice: If the buyer has made a partial payment, but the amount does not meet the agreed-upon payment terms, an insufficient payment notice may be sent. This notice will indicate the shortfall and demand the remaining balance within a specific timeframe. 3. Late Payment Notice: In situations where the buyer consistently makes delayed payments, the seller may opt to issue a late payment notice. This serves as a warning that continued delays may result in default and outlines the steps required to rectify the situation. In conclusion, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Queens, New York is a formal communication that notifies the buyer of their delinquency status and the necessary actions they need to take to cure the default. Understanding the specifics of the notice and complying with its requirements is crucial in avoiding potential legal consequences and protecting one's property rights.

Queens New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Queens New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Are you looking for a trustworthy and affordable legal forms provider to get the Queens New York Final Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to solution.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Queens New York Final Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Restart the search in case the template isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Queens New York Final Notice of Default for Past Due Payments in connection with Contract for Deed in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online for good.