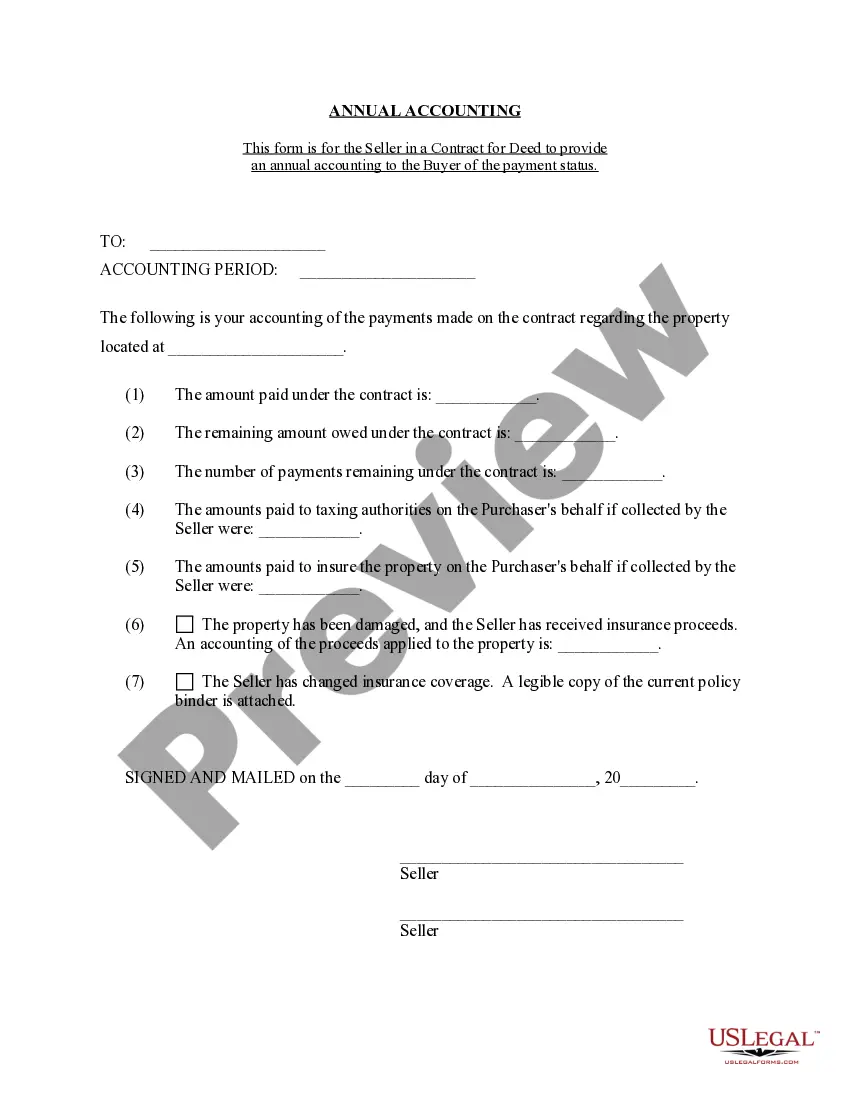

The Suffolk New York Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. This statement serves as a detailed record of the income, expenses, and overall financial status of the contract for deed, ensuring transparency and accountability. The Suffolk New York Contract for Deed Seller's Annual Accounting Statement includes various key elements and relevant information. It provides a comprehensive breakdown of all payments made by the buyer, including the principal amount, interest, and any additional fees or charges. Additionally, it documents any escrow deposits or reserves held by the seller that pertain to property taxes or insurance payments. The statement also covers the seller's expenses related to the property, such as mortgage payments, property taxes, insurance premiums, and maintenance costs. This transparency ensures that the buyer has a clear understanding of how their payments and contributions are being utilized. Furthermore, the Suffolk New York Contract for Deed Seller's Annual Accounting Statement may include a summary of any outstanding balances, late fees, or penalties accrued by the buyer. This helps to track the financial obligations and responsibilities of both parties and ensures that any delinquencies or discrepancies are addressed promptly. Different types or variations of the Suffolk New York Contract for Deed Seller's Annual Accounting Statement may exist based on specific contractual terms, property types, or individual preferences. However, the core purpose of this document remains consistent across all variations — maintaining accurate financial records and providing a comprehensive overview of the contract for deed agreement. In conclusion, the Suffolk New York Contract for Deed Seller's Annual Accounting Statement is an essential document that ensures financial transparency and accountability in contract for deed agreements. By documenting all relevant income, expenses, and obligations, it allows both parties to monitor the financial aspects of the contract and ensures a fair and transparent transaction.

Suffolk New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Suffolk New York Contract For Deed Seller's Annual Accounting Statement?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal solutions that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Suffolk New York Contract for Deed Seller's Annual Accounting Statement or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Suffolk New York Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Suffolk New York Contract for Deed Seller's Annual Accounting Statement is suitable for you, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!