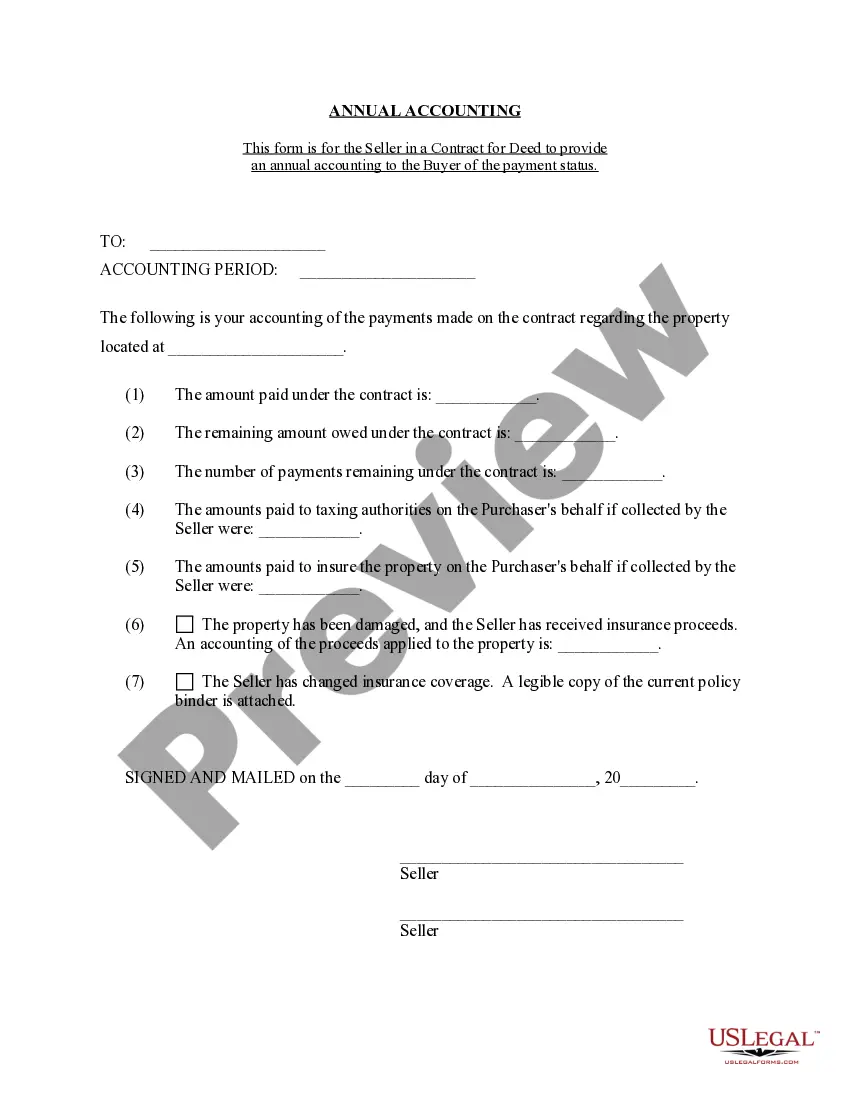

The Nassau New York Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed account of the financial transactions and activities related to the contract for deed agreement in Nassau, New York. This statement serves as a formal record of the seller's financial performance and ensures transparency between the parties involved in the contract. The Nassau New York Contract for Deed Seller's Annual Accounting Statement covers various aspects of the agreement, including the payments received from the buyer, expenses incurred by the seller, and any outstanding balances. It aims to provide an accurate representation of the financial position and income generated from the contract for deed. Keywords: Nassau New York, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, activities, financial performance, transparency, payments received, expenses incurred, outstanding balances, accurate representation, income generated. Different types of Nassau New York Contract for Deed Seller's Annual Accounting Statement may include: 1. Basic Accounting Statement: This type of statement includes essential financial information, such as total payments received, total expenses, and outstanding balances. 2. Detailed Expense Statement: This statement provides a breakdown of the expenses incurred by the seller, including property taxes, maintenance costs, insurance premiums, and any other related expenses. 3. Payment Schedule Statement: This statement focuses on the payment schedule and includes information about the buyer's monthly installments, interest rates, and principal payments. 4. Delinquency Statement: In cases where the buyer has missed payments or is in default, this statement highlights the overdue amounts, penalties, or any additional charges associated with the delinquency. 5. Additional Income Statement: If the seller has additional income generated from other sources, such as rental income or other investments related to the property, this statement includes details about those earnings. 6. Modification or Amendment Statement: In situations where the original contract for deed has been modified or amended, this statement outlines the changes made, including any adjustments to payments or terms. Overall, the Nassau New York Contract for Deed Seller's Annual Accounting Statement is an important financial document that ensures transparency and accountability in a contract for deed agreement.

Nassau New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Nassau New York Contract For Deed Seller's Annual Accounting Statement?

If you are searching for a valid form template, it’s extremely hard to choose a more convenient service than the US Legal Forms website – probably the most considerable online libraries. With this library, you can get a large number of document samples for organization and individual purposes by categories and regions, or keywords. With the high-quality search function, finding the latest Nassau New York Contract for Deed Seller's Annual Accounting Statement is as easy as 1-2-3. Moreover, the relevance of every record is verified by a team of expert lawyers that regularly check the templates on our website and update them in accordance with the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Nassau New York Contract for Deed Seller's Annual Accounting Statement is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the form you want. Look at its description and use the Preview option to see its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the needed file.

- Confirm your selection. Click the Buy now button. Following that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Select the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Nassau New York Contract for Deed Seller's Annual Accounting Statement.

Every form you save in your profile does not have an expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you need to receive an extra copy for editing or creating a hard copy, feel free to return and download it once more at any moment.

Make use of the US Legal Forms extensive catalogue to get access to the Nassau New York Contract for Deed Seller's Annual Accounting Statement you were looking for and a large number of other professional and state-specific templates in one place!