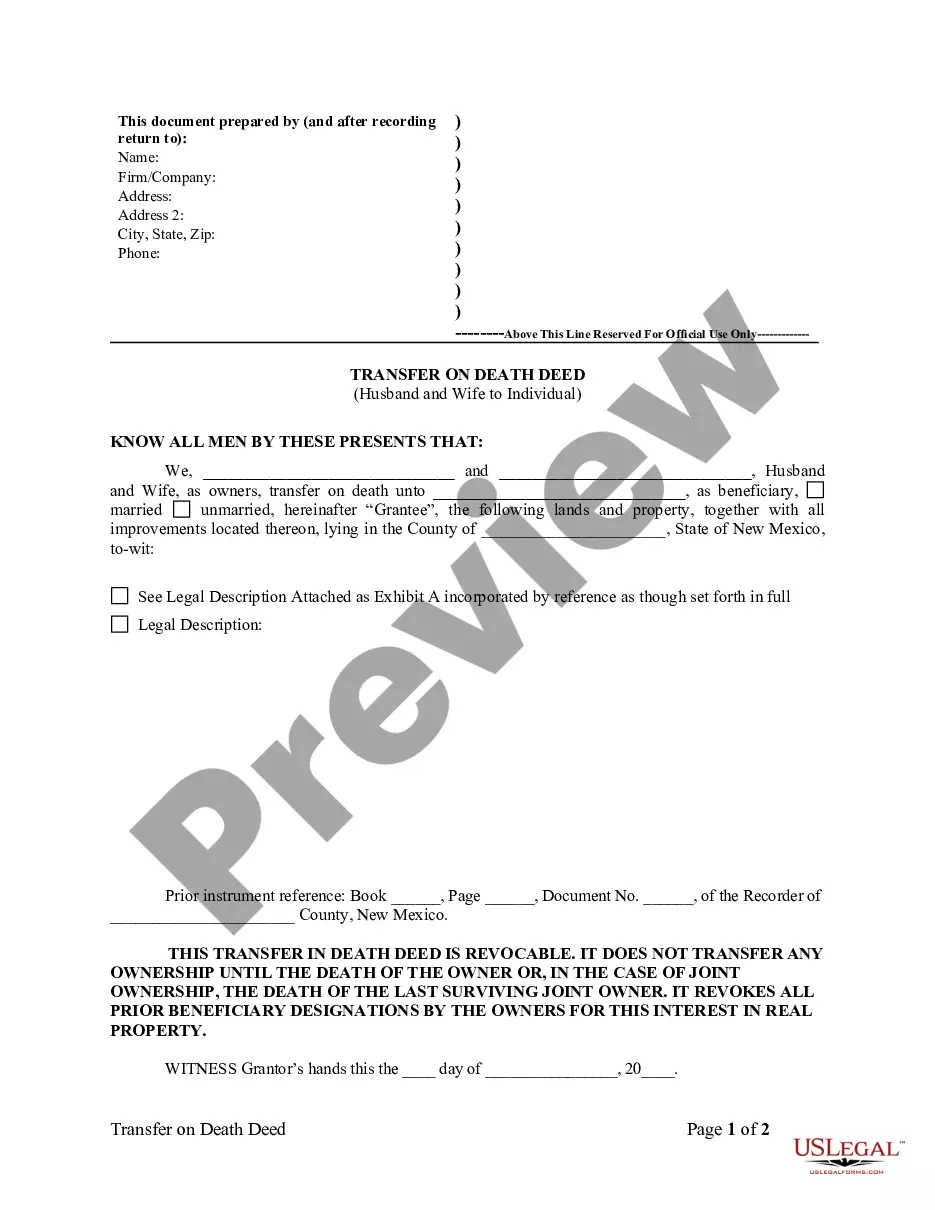

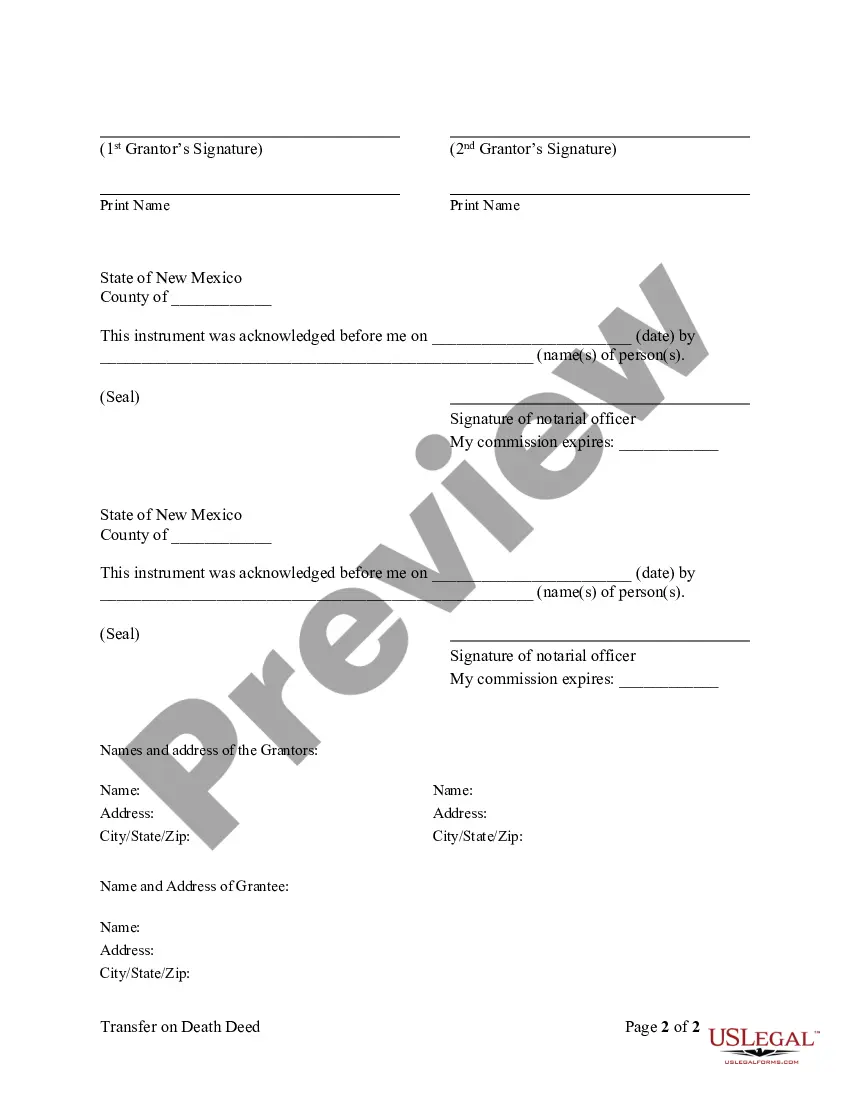

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantee is an individual. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. This deed complies with all state statutory laws.

Las Cruces, New Mexico Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Individual is a legal document that allows owners of real estate property in Las Cruces to transfer their property to a designated beneficiary upon their death, without the need for probate. This type of deed is specifically designed for married couples who wish to ensure a seamless transfer of their property to an individual beneficiary after both spouses have passed away. It provides a straightforward and efficient way to pass on real estate assets, avoiding the complexities and delays often associated with probate. There are different types of Las Cruces, New Mexico Transfer on Death Deeds or TOD — Beneficiary Deeds for Husband and Wife to Individual. Some of them include: 1. Joint Tenancy with Right of Survivorship: This type of deed allows owners to hold equal shares of the property, and when one spouse passes away, the property automatically passes on to the surviving spouse. The surviving spouse becomes the sole owner of the property without the need for any legal proceedings. 2. Tenancy in Common: This type of deed allows owners to hold unequal shares of the property, and upon the death of one spouse, their share passes on to the designated beneficiary. The surviving spouse retains their share of the property. 3. Community Property with Right of Survivorship: This type of deed is only available in states that recognize community property laws, including New Mexico. It allows married couples to own property together as community property, and upon the death of one spouse, their share automatically passes on to the surviving spouse. It is important to note that Las Cruces, New Mexico Transfer on Death Deeds or TOD — Beneficiary Deeds for Husband and Wife to Individual must comply with the specific laws and regulations of the state. Consulting with an experienced real estate attorney is highly recommended ensuring the deed is drafted accurately and legally-binding.Las Cruces, New Mexico Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Individual is a legal document that allows owners of real estate property in Las Cruces to transfer their property to a designated beneficiary upon their death, without the need for probate. This type of deed is specifically designed for married couples who wish to ensure a seamless transfer of their property to an individual beneficiary after both spouses have passed away. It provides a straightforward and efficient way to pass on real estate assets, avoiding the complexities and delays often associated with probate. There are different types of Las Cruces, New Mexico Transfer on Death Deeds or TOD — Beneficiary Deeds for Husband and Wife to Individual. Some of them include: 1. Joint Tenancy with Right of Survivorship: This type of deed allows owners to hold equal shares of the property, and when one spouse passes away, the property automatically passes on to the surviving spouse. The surviving spouse becomes the sole owner of the property without the need for any legal proceedings. 2. Tenancy in Common: This type of deed allows owners to hold unequal shares of the property, and upon the death of one spouse, their share passes on to the designated beneficiary. The surviving spouse retains their share of the property. 3. Community Property with Right of Survivorship: This type of deed is only available in states that recognize community property laws, including New Mexico. It allows married couples to own property together as community property, and upon the death of one spouse, their share automatically passes on to the surviving spouse. It is important to note that Las Cruces, New Mexico Transfer on Death Deeds or TOD — Beneficiary Deeds for Husband and Wife to Individual must comply with the specific laws and regulations of the state. Consulting with an experienced real estate attorney is highly recommended ensuring the deed is drafted accurately and legally-binding.