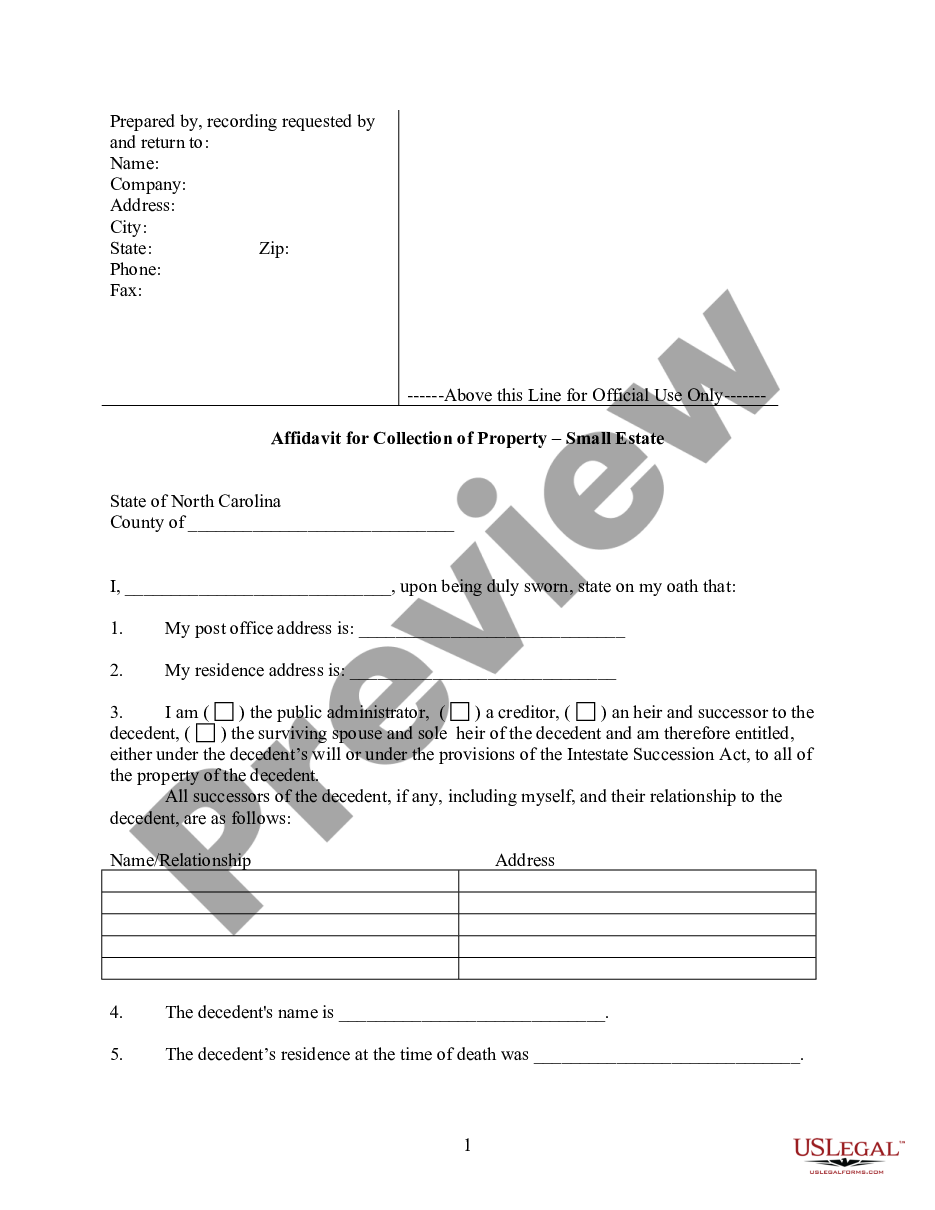

Small Estate Affidavit for North Carolina for estates not more than $20,000 - $30,000

Small Estates General Summary:

Small Estate laws were enacted in order to enable heirs to obtain property

of the deceased without probate, or with shortened probate proceedings,

provided certain conditions are met. Small estates can be administered

with less time and cost. If the deceased had conveyed most property

to a trust but there remains some property, small estate laws may also

be available. Small Estate procedures may generally be used regardless

of whether there was a Will. In general, two forms of small estate

procedures are recognized:

1.

Small Estate Affidavit -Some States allow an affidavit

to be executed by the spouse and/or heirs of the deceased and present the

affidavit to the holder of property such as a bank to obtain property of

the deceased. Other states require that the affidavit be filed with the

Court. The main requirement before you may use an affidavit is that

the value of the personal and/or real property of the estate not exceed

a certain value.

2.

Summary Administration -Some states allow a Summary

administration. Some States recognize both the Small Estate affidavit and

Summary Administration, basing the requirement of which one to use on the

value of the estate. Example: If the estate value is 10,000 or less an

affidavit is allowed but if the value is between 10,000 to 20,000 a summary

administration is allowed.

North Carolina Summary:

Under North Carolina statutes, where an

estate is valued at not more than $20,000, an interested party may, thirty

(30) days after the death of the decedent, issue a small estate affidavit

to collect any debts owed to the decedent. Prior to the recovery

of any assets of the decedent, a copy of the affidavit shall be filed in

the office of the clerk of superior court of the county where the decedent

had his domicile at the time of his death.

North Carolina Requirements:

North Carolina requirements are set forth in the statutes below.

ARTICLE 25. Small Estates.

§ 28A-25-1. Collection of property by affidavit when

decedent dies intestate.

(a) When a decedent dies intestate leaving personal

property, less liens and encumbrances thereon, not exceeding twenty thousand

dollars ($20,000) in value, at any time after 30 days from the date of

death, any person indebted to the decedent or having possession of tangible

personal property or an instrument evidencing a debt, obligation, stock

or chose in action belonging to the decedent shall make payment of the

indebtedness or deliver the tangible personal property or an instrument

evidencing a debt, obligation, stock or chose in action to a person claiming

to be the public administrator appointed pursuant to G.S. 28A-12-1, or

an heir or creditor of the decedent, not disqualified under G.S. 28A-4-2,

upon being presented a certified copy of an affidavit filed in accordance

with subsection (b) and made by or on behalf of the heir or creditor or

the public administrator stating:

(1) The name and address of the

affiant and the fact that he or she is the public administrator or an heir

or creditor of the decedent;

(5) That the value of all the personal property

owned by the estate of the decedent, less liens and encumbrances thereon,

does not exceed twenty thousand dollars ($20,000);

(6) That no application or petition for

appointment of a personal representative is pending or has been granted

in any jurisdiction;

(7) The names and addresses of those persons

who are entitled, under the provisions of the Intestate Succession Act,

to the personal property of the decedent and their relationship, if any,

to the decedent; and

(8) A description sufficient to identify

each tract of real property owned by the decedent at the time of his death.

In those cases in which the affiant is the surviving spouse and sole heir

of the decedent, not disqualified under G.S. 28A-4-2, the property described

in this subsection that may be collected pursuant to this section may exceed

twenty thousand dollars ($20,000) in value but shall not exceed thiry thousand

dollars ($30,000) in value. In such cases, the affidavit shall state:

(i) the name and address of the affiant and

the fact that he or she is the surviving spouse and is entitled, under

the provisions of the Intestate Succession Act, to all of the property

of the decedent;

(ii) that the value of all of the personal property owned by the

estate of the decedent, less liens and encumbrances thereon, does not exceed

thirty thousand dollars ($30,000); and

(iii) the information required under

subdivisions (2), (3), (4), (6), and (8) of this subsection.

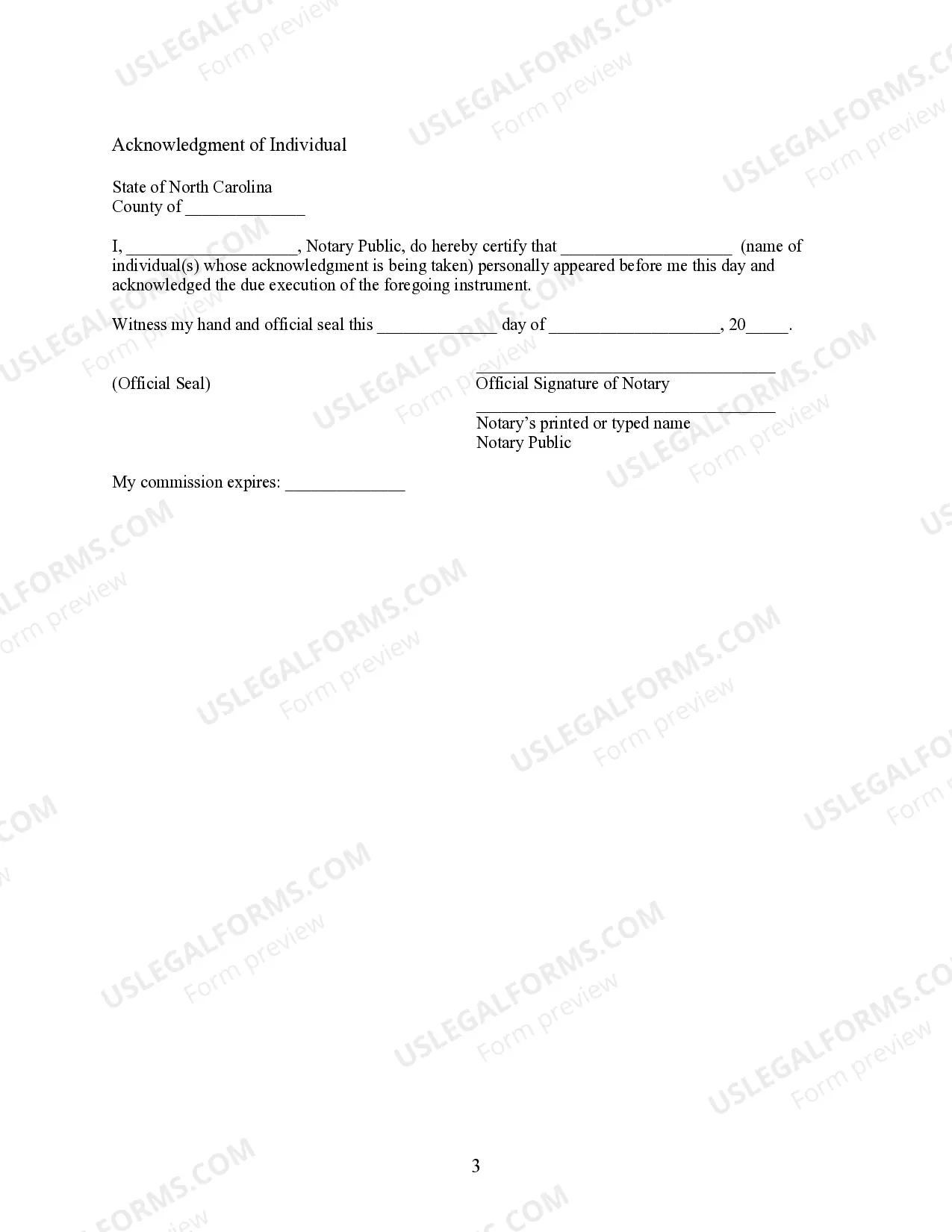

(b) Prior to the recovery of any assets of the decedent, a copy

of the affidavit described in subsection (a) shall be filed in the office

of the clerk of superior court of the county where the decedent had his

domicile at the time of his death. The affidavit shall be filed by the

clerk upon payment of the fee provided in G.S. 7A-307, shall be indexed

in the index to estates, and a copy thereof shall be mailed by the clerk

to the persons shown in the affidavit as entitled to the personal property.

(c) The presentation of an affidavit as provided in subsection

(a) shall be sufficient to require the transfer to the affiant or his designee

of the title and license to a motor vehicle registered in the name of the

decedent owner; the ownership rights of a savings account or checking account

in a bank in the name of the decedent owner; the ownership rights of a

savings account or share certificate in a credit union, building and loan

association, or savings and loan association in the name of the decedent

owner; the ownership rights in any stock or security registered on the

books of a corporation in the name of a decedent owner; or any other property

or contract right owned by decedent at the time of his death.

§ 28A-25-1.1. Collection of property by affidavit when

decedent dies testate.

(a) When a decedent dies testate leaving personal

property, less liens and encumbrances thereon, not exceeding twenty thousand

dollars ($20,000) in value, at any time after 30 days from the date of

death, any person indebted to the decedent or having possession of tangible

personal property or an instrument evidencing a debt, obligation, stock

or chose in action belonging to the decedent shall make payment of the

indebtedness or deliver the tangible personal property or an instrument

evidencing a debt, obligation, stock or chose in action to a person claiming

to be the public administrator appointed pursuant to G.S. 28A-12-1, a person

named or designated as executor in the will, devisee, heir or creditor,

of the decedent, not disqualified under G.S. 28A-4-2, upon being presented

a certified copy of an affidavit filed in accordance with subsection (b)

and made by or on behalf of the heir, the person named or designated as

executor in the will of the decedent, the creditor, the public administrator,

or the devisee, stating:

(1) The name and address of the

affiant and the fact that he is the public administrator, a person named

or designated as executor in the will, devisee, heir or creditor, of the

decedent;

(5) That the decedent died testate leaving

personal property, less liens and encumbrances thereon, not exceeding twenty

thousand dollars ($20,000) in value;

(6) That the decedent's will has been admitted

to probate in the court of the proper county and a duly certified copy

of the will has been recorded in each county in which is located any real

property owned by the decedent at the time of his death;

(8) That no application or petition for

appointment of a personal representative is pending or has been granted

in any jurisdiction;

(9) The names and addresses of those persons

who are entitled, under the provisions of the will, or if applicable, of

the Intestate Succession Act, to the property of the decedent; and their

relationship, if any, to the decedent; and

(10) A description sufficient to identify

each tract of real property owned by the decedent at the time of his death.

In those cases in which the affiant is the surviving spouse, is entitled

to all of the property of the decedent, and is not disqualified under G.S.

28A-4-2, the property described in this subsection that may be collected

pursuant to this section may exceed twenty thousand dollars ($20,000) in value

but shall not exceed thirty thousand dollars ($30,000) in value. In such

cases, the affidavit shall state:

(i) the name and address of the affiant and the fact that

he or she is the surviving spouse and is entitled, under the provisions

of the decedent's will, or if applicable, of the Intestate Succession Act,

to all of the property of the decedent;

(ii) that the decedent died testate leaving personal property, less

liens and encumbrances thereon, not exceeding twenty thousand dollars ($30,000);

and

(iii) the information required under subdivisions (2), (3), (4),

(6), (7), (8), and (10) of this subsection.

(b) Prior to the recovery of any assets of the decedent, a copy

of the affidavit described in subsection (a) shall be filed in the office

of the clerk of superior court of the county where the decedent had his

domicile at the time of his death. The affidavit shall be filed by the

clerk upon payment of the fee provided in G.S. 7A-307, shall be indexed

in the index to estates, and a copy shall be mailed by the clerk to the

persons shown in the affidavit as entitled to the property.

(c) The presentation of an affidavit as provided in subsection

(a) shall be sufficient to require the transfer to the affiant or his designee

of the title and license to a motor vehicle registered in the name of the

decedent owner; the ownership rights of a savings account or checking account

in a bank in the name of the decedent owner; the ownership rights of a

savings account or share certificate in a credit union, building and loan

association, or savings and loan association in the name of the decedent

owner; the ownership rights in any stock or security registered on the

books of a corporation in the name of a decedent owner; or any other property

or contract right owned by decedent at the time of his death.

§ 28A-25-2. Effect of affidavit.

The person paying, delivering, transferring, or issuing personal

property or the evidence thereof pursuant to an affidavit meeting the requirements

of G.S. 28A-25-1(a) or 28A-25-1.1(a) is discharged and released to the

same extent as if he dealt with a duly qualified personal representative

of the decedent. He is not required to see to the application of the personal

property or evidence thereof or to inquire into the truth of any statement

in the affidavit. If any person to whom an affidavit is delivered refuses

to pay, deliver, transfer, or issue any personal property or evidence thereof,

it may be recovered or its payment, delivery, transfer, or issuance compelled

upon proof of their right in an action brought for that purpose by or on

behalf of the persons entitled thereto. The court costs and attorney's

fee incident to the action shall be taxed against the person whose refusal

to comply with the provisions of G.S. 28A-25-1(a) or 28A-25-1.1(a) made

the action necessary. The heir or creditor to whom payment, delivery, transfer

or issuance is made is answerable and accountable therefor to any duly

qualified personal representative or collector of the decedent's estate

or to any other person having an interest in the estate.

§ 28A-25-3. Disbursement and distribution of property collected

by affidavit.

(a) If there has been no personal representative or collector

appointed by the clerk of superior court, the affiant who has collected

personal property of the decedent by affidavit pursuant to G.S. 28A-25-1

or G.S. 28A-25-1.1 shall:

(2) File an affidavit with the clerk

of superior court that he has collected the personal property of the decedent

and the manner in which he has disbursed and distributed the same. This

final affidavit shall be filed within 90 days of the date of filing of

the qualifying affidavit provided for in G.S. 28A-25-1 or G.S. 28A-25-1.1.

If the affiant cannot file the final affidavit within 90 days, he

shall file a report with the clerk within that time period stating his

reasons. Upon determining that the affiant has good reason not to

file the final affidavit within 90 days, the clerk may extend the time

for filing up to one year from the date of filing the qualifying affidavit.

(b) Nothing in this section shall be construed as changing

the rule of G.S. 28A-15-1 and G.S. 28A-15-5 rendering both real and personal

property, without preference or priority, available for the discharge of

debts and other claims against the estate of the decedent. If it appears

that it may be in the best interest of the estate to sell, lease, or mortgage

any real property to obtain money for the payment of debts or other claims

against the decedent's estate, the affiant shall petition the clerk of

superior court for the appointment of a personal representative to conclude

the administration of the decedent's estate pursuant to G.S. 28A-25-5.

§ 28A-25-4. Clerk may compel compliance.

If any affiant who has collected personal property of the decedent

by affidavit pursuant to G.S. 28A-25-1 or G.S. 28A-25-1.1 shall fail to

make distribution or file affidavit as required by G.S. 28A-25-3, the clerk

of superior court may, upon his own motion or at the request of any interested

person, issue an attachment against him for a contempt and commit him until

he makes proper distribution and files the affidavit. In addition

to or in lieu of filing this attachment, the clerk may require the affiant

to post a bond conditioned as provided in G.S. 28A-8-2.

§ 28A-25-5. Subsequently appointed personal representative

or collector.

Nothing in this Article shall preclude any interested person, including

the affiant, from petitioning the clerk of superior court for the appointment

of a personal representative or collector to conclude the administration

of the decedent's estate. If such is done, the affiant who has been collecting

personal property by affidavit shall cease to do so, shall deliver all

assets in his possession to the personal representative, and shall render

a proper accounting to the personal representative or collector. A copy

of the accounting shall also be filed with the clerk having jurisdiction

over the personal representative or collector.

§ 28A-25-6. Payment to clerk of money owed decedent.

(a) As an alternative to the small estate settlement procedures

of this Article, any person indebted to a decedent may satisfy such indebtedness

by paying the amount of the debt to the clerk of the superior court of

the county of the domicile of the decedent:

(1) If no administrator has been

appointed, and

(2) If the amount owed by such person does

not exceed five thousand dollars ($5,000), and

(3) If the sum tendered to the clerk would

not make the aggregate sum which has come into the clerk's hands belonging

to the decedent exceed five thousand dollars ($5,000).

(b) Such payments may not be made to the clerk if the

total amount paid or tendered with respect to any one decedent would exceed

five thousand dollars ($5,000), even though disbursements have been made

so that the aggregate amount in the clerk's hands at any one time would

not exceed five thousand dollars ($5,000).

(c) If the sum tendered pursuant to this section would make

the aggregate sum coming into the clerk's hands with respect to any one

decedent exceed five thousand dollars ($5,000) the clerk shall appoint

an administrator, or the sum may be administered under the preceding sections

of this Article.

(d) If it appears to the clerk after making a preliminary

survey that disbursements pursuant to this section would not exhaust funds

received pursuant to this section, he may, in his discretion, appoint an

administrator, or the funds may be administered under the preceding sections

of this Article.

(e) The receipt from the clerk of the superior court of a

payment purporting to be made pursuant to this section is a full release

to the debtor for the payment so made.

(f) If no administrator has been appointed, the clerk of superior

court shall disburse the money received under this section for the following

purposes and in the following order:

(1) To pay the surviving spouse's

year's allowance and children's year's allowance assigned in accordance

with law;

(2), (3) Repealed by Session Laws 1981, c. 383, s. 3.

Notwithstanding the foregoing provisions of this subsection, the

clerk shall pay, out of funds provided the deceased pursuant to G.S. 111-18

and Part 3 of Article 2 of Chapter 108A of the General Statutes of North

Carolina, any lawful claims for care provided by an adult care home to

the deceased, incurred not more than 90 days prior to his death. After

the death of a spouse who died intestate and after the disbursements have

been made in accordance with this subsection, the balance in the clerk's

hands belonging to the estate of the decedent shall be paid to the surviving

spouse, and if there is no surviving spouse, the clerk shall pay it to

the heirs in proportion to their respective interests.

(g) The clerk shall not be required to publish notice to creditors.

(h) Whenever an administrator is appointed after a clerk of

superior court has received any money pursuant to this section, the clerk

shall pay to the administrator all funds which have not been disbursed.

The clerk shall receive no commissions for payments made to the administrator,

and the administrator shall receive no commissions for receiving such payments.