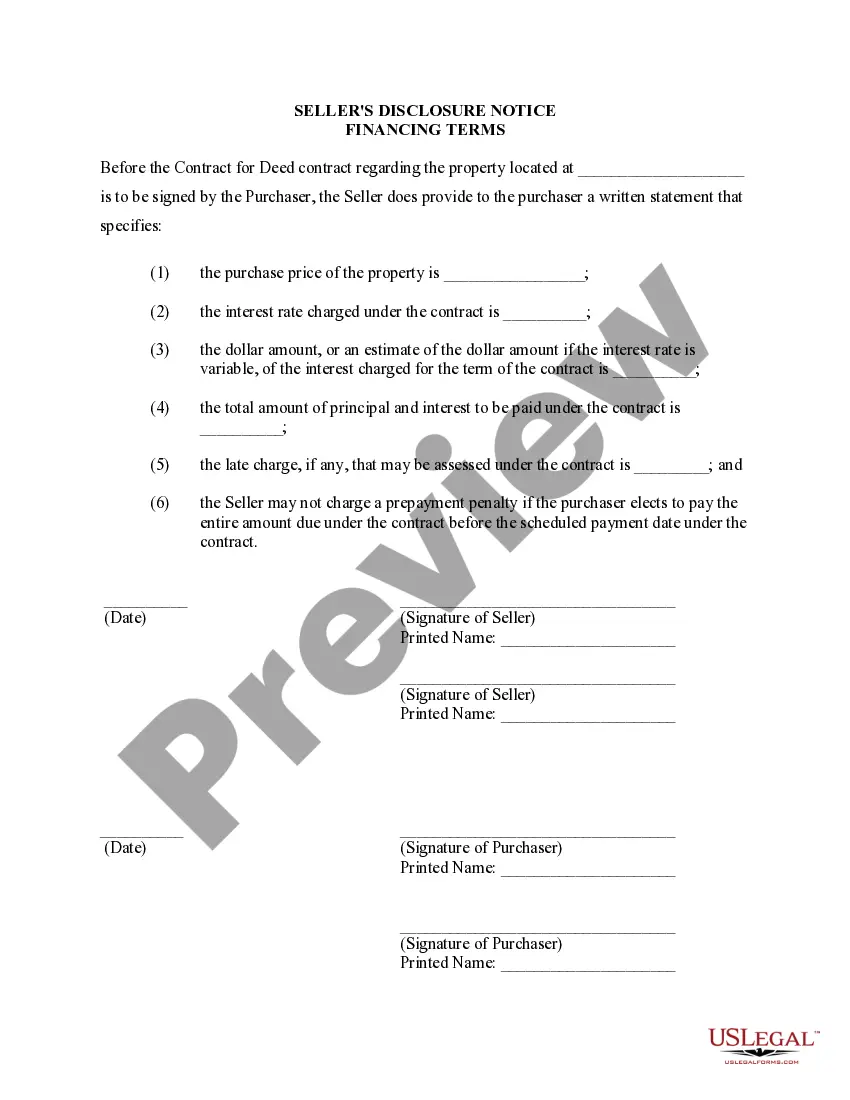

The Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is an important document that outlines the specific details and terms of financing for a property being sold through a Land Contract or Agreement for Deed. This disclosure provides transparency and protection for both the seller and the buyer, ensuring that both parties are fully aware of the financial obligations and conditions associated with the property transfer. This disclosure document is mandatory in Saint Paul, Minnesota and is designed to protect the rights and interests of all parties involved in the transaction. It ensures that the seller provides accurate information about the financing terms, allowing the buyer to make an informed decision about entering into a Land Contract or Agreement for Deed. When completing the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property, the following key information is typically included: 1. Purchase Price: The agreed-upon purchase price of the property being sold through the Land Contract or Agreement for Deed. 2. Down Payment: The initial amount paid by the buyer towards the purchase price at the time of signing the contract. 3. Monthly Payments: The amount the buyer is required to pay each month, including any interest or principal payments, as outlined in the contract. 4. Interest Rate: The annual percentage rate (APR) or interest rate agreed upon between the buyer and the seller. 5. Payment Schedule: The frequency of payments (e.g., monthly, quarterly) and the due date for each payment. 6. Late Payment Penalty: Any penalties or fees imposed by the seller for late or missed payments. 7. Balloon Payment: If applicable, the specific terms regarding a lump-sum payment due at a specified future date. 8. Default and Remedies: The consequences that may arise if the buyer fails to meet their payment obligations, including steps that may be taken by the seller to rectify the situation. 9. Prepayment Penalty: Any penalties or fees associated with paying off the contract early. 10. Additional Financing Terms: Any additional terms or conditions related to the financing of the property, such as insurance requirements or property taxes. It is important to note that the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property may vary depending on the specific terms agreed upon between the buyer and the seller. It is always advisable to consult with a qualified real estate attorney or professional to ensure compliance with local laws and to address any unique aspects of the transaction. Overall, this disclosure serves as a comprehensive guide for both parties involved in a Land Contract or Agreement for Deed, outlining the financial aspects of the property transfer and ensuring transparency throughout the process. It is a crucial document that protects the rights and interests of both buyers and sellers in Saint Paul, Minnesota.

Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Saint Paul Minnesota Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no law education to create such papers from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge library with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract quickly using our trustworthy service. In case you are presently a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Ensure the template you have found is specific to your area because the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if provided) of scenarios the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription option you prefer the best.

- with your login information or create one from scratch.

- Select the payment gateway and proceed to download the Saint Paul Minnesota Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract as soon as the payment is completed.

You’re good to go! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.