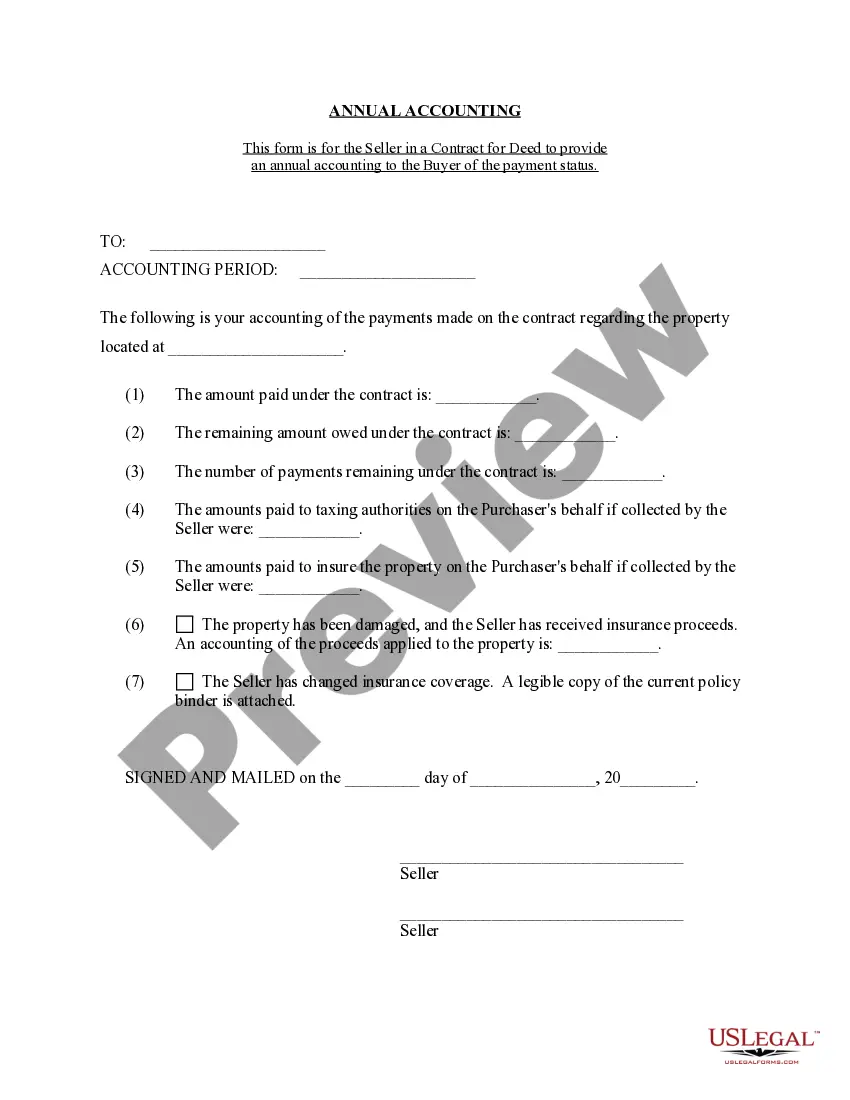

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Lansing Michigan Contract for Deed Seller's Annual Accounting Statement is an important document that serves as a summary of financial information for sellers involved in a contract for deed transaction within the Lansing, Michigan area. This statement provides an overview of the financial aspects of the contract, ensuring transparency and accountability between the seller and the buyer. Keywords: Lansing Michigan, Contract for Deed, Seller's Annual Accounting Statement, financial information, contract, transparency, accountability. There are various types of Lansing Michigan Contract for Deed Seller's Annual Accounting Statements that may include: 1. Cash Flow Statement: This type of statement outlines the seller's incoming and outgoing cash flow related to the contract for deed transaction. It highlights the seller's revenue, expenses, and any proceeds from the sale, providing an overview of the financial health of the contract. 2. Profit and Loss Statement: Also known as an Income Statement, this document showcases the seller's revenues, costs, and expenses during a specific period. It presents a comprehensive breakdown of the financial performance related to the Lansing Michigan Contract for Deed, highlighting the seller's profitability. 3. Balance Sheet: This statement represents the seller's financial position at a specific point in time. It outlines the seller's assets, liabilities, and equity related to the contract for deed. The balance sheet demonstrates the seller's net worth and helps assess their financial stability. 4. Statement of Equity: This type of statement provides an overview of the seller's equity position in the contract for deed transaction. It includes details regarding previous equity contributions, changes in equity, and any distribution or withdrawal of equity during the accounting period. 5. Statement of Receivables and Payables: This statement tracks the seller's accounts receivable and accounts payable related to the contract for deed. It shows the amounts owed to the seller by the buyer and any outstanding payments owed by the seller to third parties. 6. Statement of Depreciation and Amortization: This statement accounts for the depreciation and amortization of any assets related to the contract for deed. It helps track the decrease in the value of long-term assets over time and includes relevant adjustments in the seller's annual accounting statement. By utilizing these various types of Lansing Michigan Contract for Deed Seller's Annual Accounting Statements, sellers can provide comprehensive and accurate financial information to buyers and maintain a transparent and trustworthy relationship throughout the contract period.The Lansing Michigan Contract for Deed Seller's Annual Accounting Statement is an important document that serves as a summary of financial information for sellers involved in a contract for deed transaction within the Lansing, Michigan area. This statement provides an overview of the financial aspects of the contract, ensuring transparency and accountability between the seller and the buyer. Keywords: Lansing Michigan, Contract for Deed, Seller's Annual Accounting Statement, financial information, contract, transparency, accountability. There are various types of Lansing Michigan Contract for Deed Seller's Annual Accounting Statements that may include: 1. Cash Flow Statement: This type of statement outlines the seller's incoming and outgoing cash flow related to the contract for deed transaction. It highlights the seller's revenue, expenses, and any proceeds from the sale, providing an overview of the financial health of the contract. 2. Profit and Loss Statement: Also known as an Income Statement, this document showcases the seller's revenues, costs, and expenses during a specific period. It presents a comprehensive breakdown of the financial performance related to the Lansing Michigan Contract for Deed, highlighting the seller's profitability. 3. Balance Sheet: This statement represents the seller's financial position at a specific point in time. It outlines the seller's assets, liabilities, and equity related to the contract for deed. The balance sheet demonstrates the seller's net worth and helps assess their financial stability. 4. Statement of Equity: This type of statement provides an overview of the seller's equity position in the contract for deed transaction. It includes details regarding previous equity contributions, changes in equity, and any distribution or withdrawal of equity during the accounting period. 5. Statement of Receivables and Payables: This statement tracks the seller's accounts receivable and accounts payable related to the contract for deed. It shows the amounts owed to the seller by the buyer and any outstanding payments owed by the seller to third parties. 6. Statement of Depreciation and Amortization: This statement accounts for the depreciation and amortization of any assets related to the contract for deed. It helps track the decrease in the value of long-term assets over time and includes relevant adjustments in the seller's annual accounting statement. By utilizing these various types of Lansing Michigan Contract for Deed Seller's Annual Accounting Statements, sellers can provide comprehensive and accurate financial information to buyers and maintain a transparent and trustworthy relationship throughout the contract period.