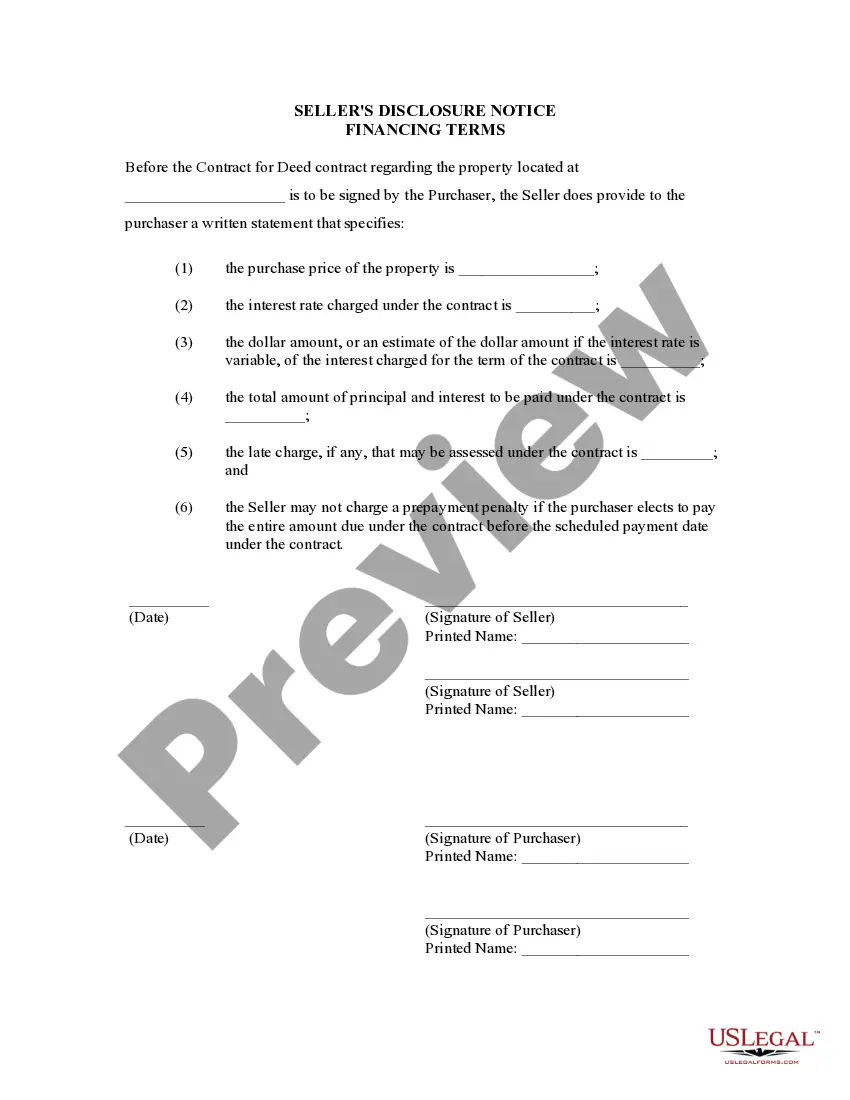

This document serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. It should be completed by Seller of property and provided to Purchaser at or before the signing of the contract for deed.

The South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (also known as a Land Contract) is an important legal document that outlines the specific terms and conditions of the financing arrangement between the seller and the buyer. This disclosure provides crucial information about the financial aspects of the transaction, ensuring transparency and protection for both parties involved. Below, we will explore the essential components covered in a typical South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, using the relevant keywords: 1. Purchase Price and Down Payment: The disclosure will specify the total purchase price of the property, which includes the down payment amount required from the buyer. This section will outline the terms and conditions regarding the down payment, including the deadline for payment and possible consequences of non-payment. 2. Interest Rate and Payment Schedule: The document will clearly state the agreed-upon interest rate for the financing arrangement, along with the frequency and due dates of the payments. It may also include information about any penalties or late fees associated with missed or delayed payments. 3. Loan Term and Balance: The disclosure will indicate the length of the loan term, which is the duration within which the buyer is expected to repay the loan in full. Additionally, it will outline the remaining balance on the property after the down payment is made. 4. Balloon Payment: In some cases, a balloon payment may be included in the financing terms. This means that a lump sum payment will be required at a specific point during the loan term. The disclosure will provide details regarding the due date and amount of this payment. 5. Prepayment and Acceleration: This section covers the buyer's rights and limitations regarding prepayment (paying off the loan before the agreed-upon term) as well as the seller's rights for accelerating the repayment schedule due to default or breach of contract. 6. Insurance and Taxes: The disclosure may include information about the responsibility for property insurance and taxes. It may specify whether the buyer or seller is responsible for ensuring the property is adequately insured and for paying property taxes. Other types of South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may focus on specific additional details such as: 7. Escrow Account: This type of disclosure will outline the buyer's obligation to deposit money into an escrow account, which the seller will use to pay property taxes and insurance premiums. 8. Due-on-Sale Clause: The disclosure may include a due-on-sale clause, which allows the seller to accelerate repayment if the property is sold to a third party. It is crucial for both buyers and sellers in South Bend, Indiana, to carefully review and understand the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed to ensure a smooth and fair transaction. Seek professional legal advice if required to fully comprehend the implications of the disclosed terms.The South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (also known as a Land Contract) is an important legal document that outlines the specific terms and conditions of the financing arrangement between the seller and the buyer. This disclosure provides crucial information about the financial aspects of the transaction, ensuring transparency and protection for both parties involved. Below, we will explore the essential components covered in a typical South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, using the relevant keywords: 1. Purchase Price and Down Payment: The disclosure will specify the total purchase price of the property, which includes the down payment amount required from the buyer. This section will outline the terms and conditions regarding the down payment, including the deadline for payment and possible consequences of non-payment. 2. Interest Rate and Payment Schedule: The document will clearly state the agreed-upon interest rate for the financing arrangement, along with the frequency and due dates of the payments. It may also include information about any penalties or late fees associated with missed or delayed payments. 3. Loan Term and Balance: The disclosure will indicate the length of the loan term, which is the duration within which the buyer is expected to repay the loan in full. Additionally, it will outline the remaining balance on the property after the down payment is made. 4. Balloon Payment: In some cases, a balloon payment may be included in the financing terms. This means that a lump sum payment will be required at a specific point during the loan term. The disclosure will provide details regarding the due date and amount of this payment. 5. Prepayment and Acceleration: This section covers the buyer's rights and limitations regarding prepayment (paying off the loan before the agreed-upon term) as well as the seller's rights for accelerating the repayment schedule due to default or breach of contract. 6. Insurance and Taxes: The disclosure may include information about the responsibility for property insurance and taxes. It may specify whether the buyer or seller is responsible for ensuring the property is adequately insured and for paying property taxes. Other types of South Bend Indiana Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may focus on specific additional details such as: 7. Escrow Account: This type of disclosure will outline the buyer's obligation to deposit money into an escrow account, which the seller will use to pay property taxes and insurance premiums. 8. Due-on-Sale Clause: The disclosure may include a due-on-sale clause, which allows the seller to accelerate repayment if the property is sold to a third party. It is crucial for both buyers and sellers in South Bend, Indiana, to carefully review and understand the Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed to ensure a smooth and fair transaction. Seek professional legal advice if required to fully comprehend the implications of the disclosed terms.