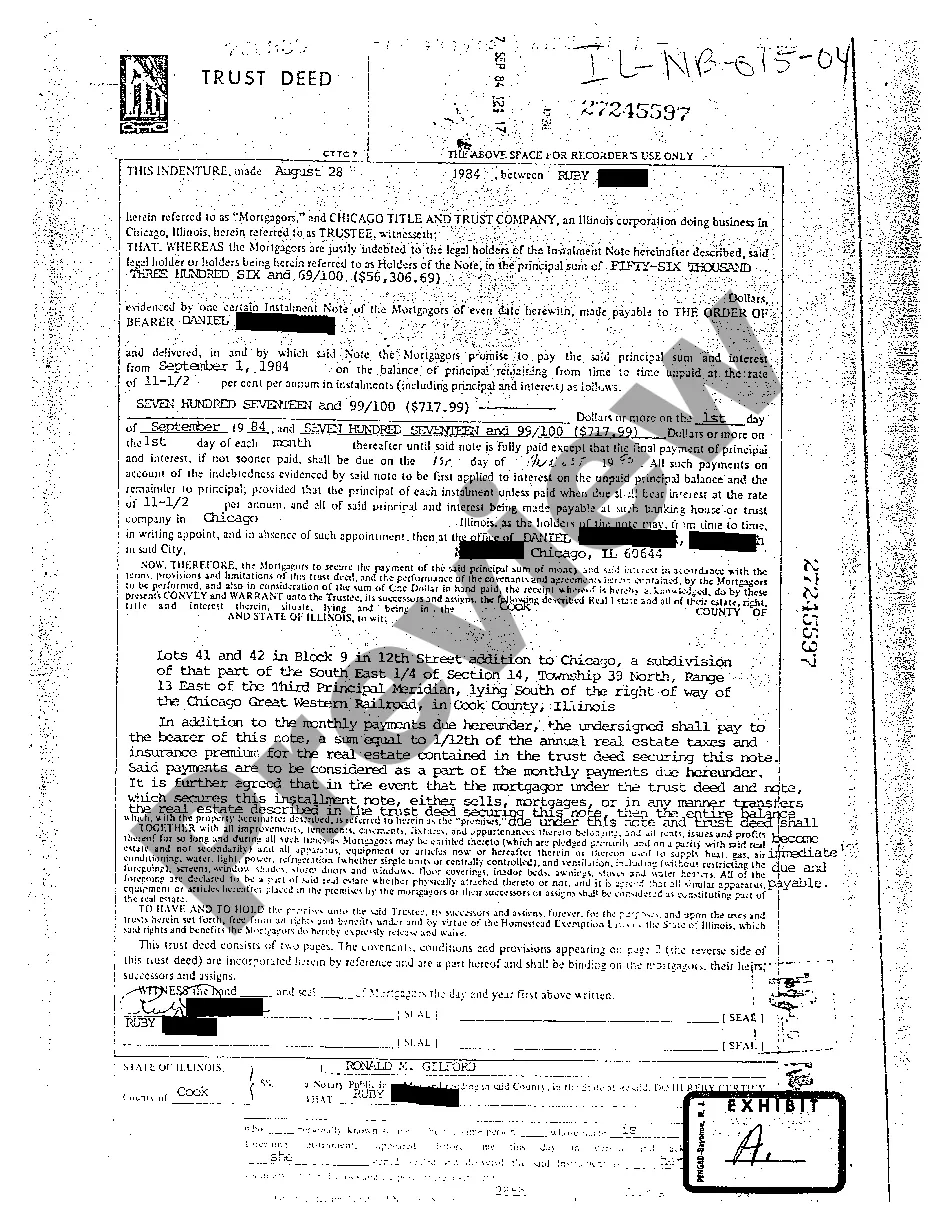

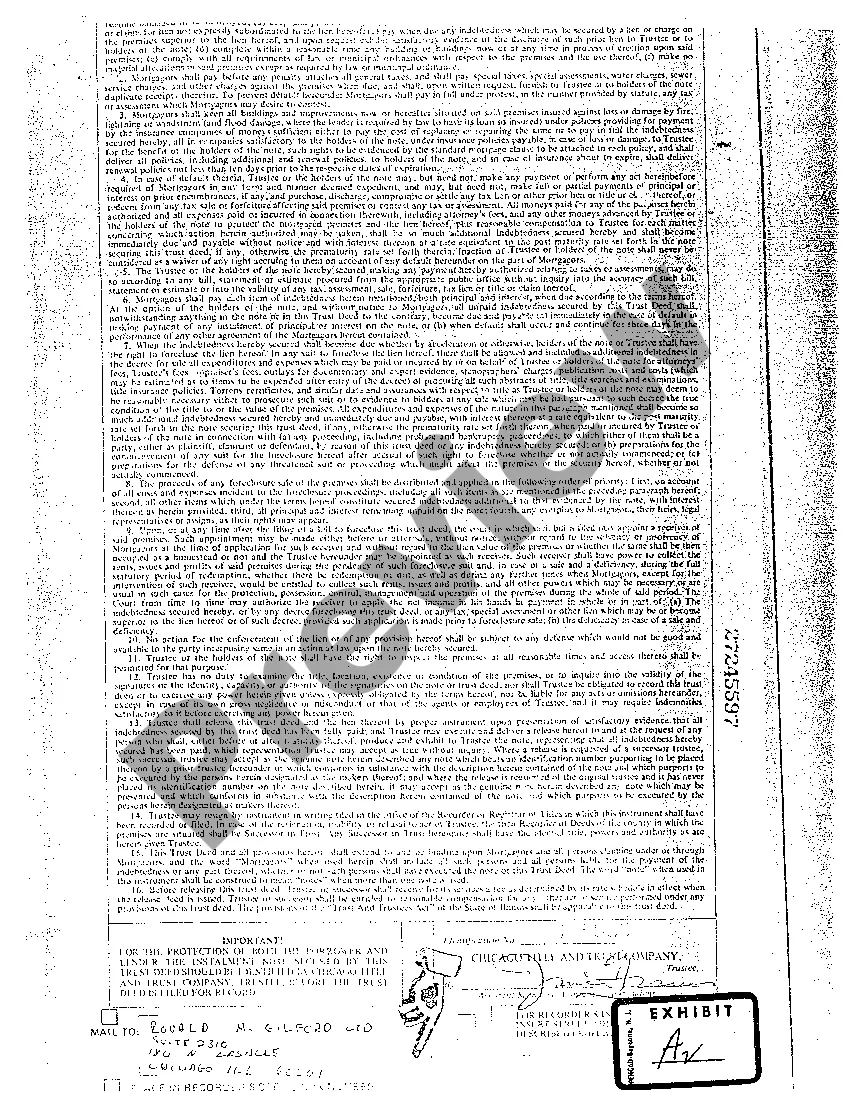

A Joliet Illinois Trust Deed is a legal document that serves as a form of security for a loan, typically in the context of purchasing or refinancing real estate in Joliet, Illinois. It provides the lender with a lien on the property, allowing them to foreclose and sell the property if the borrower defaults on the loan. The Joliet Illinois Trust Deed is a common method of financing real estate transactions in the area, offering benefits for both lenders and borrowers. It provides lenders with added security and recourse in case of default, while borrowers can often benefit from easier qualification requirements and potentially lower interest rates. There are different types of Joliet Illinois Trust Deeds that borrowers and lenders may encounter: 1. Deed of Trust: This is the most common type of trust deed used in Joliet, Illinois. It involves three parties: the borrower or trust or, the lender or beneficiary, and a neutral third party known as the trustee. The trustee holds the legal title to the property until the loan is repaid, at which point the trustee conveys the title to the borrower. 2. Purchase Money Trust Deed: This type of trust deed is used when the seller of the property finances the purchase for the buyer. The seller becomes the lender, and the trust deed serves as security for the loan. If the buyer defaults, the seller can initiate foreclosure proceedings. 3. Home Equity Trust Deed: Also known as a second trust deed or junior trust deed, this type of trust deed is used when a homeowner takes out a second loan or home equity line of credit (HELOT), with the original mortgage being the first trust deed. The home equity trust deed ranks second in priority behind the first trust deed and provides the lender with a lien on the equity in the property. 4. Reverse Mortgage Trust Deed: This trust deed is used in relation to reverse mortgages, allowing homeowners aged 62 or older to convert a portion of their home equity into cash. The reverse mortgage trust deed provides the lender with a lien on the property, and the loan is typically repaid when the borrower sells the home, moves out, or passes away. In summary, a Joliet Illinois Trust Deed is a legal document used to secure a loan for purchasing or refinancing real estate in the Joliet area. Different types of trust deeds, such as the Deed of Trust, Purchase Money Trust Deed, Home Equity Trust Deed, and Reverse Mortgage Trust Deed, exist to accommodate various financial situations and offer different rights and safeguards to lenders and borrowers.

Joliet Illinois Trust Deed

Description

How to fill out Joliet Illinois Trust Deed?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any law education to draft such papers cfrom the ground up, mostly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you want the Joliet Illinois Trust Deed or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Joliet Illinois Trust Deed quickly employing our trustworthy service. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps prior to obtaining the Joliet Illinois Trust Deed:

- Be sure the form you have chosen is suitable for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if provided) of scenarios the paper can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and look for the suitable document.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Select the payment method and proceed to download the Joliet Illinois Trust Deed as soon as the payment is completed.

You’re all set! Now you can go ahead and print the document or fill it out online. If you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.