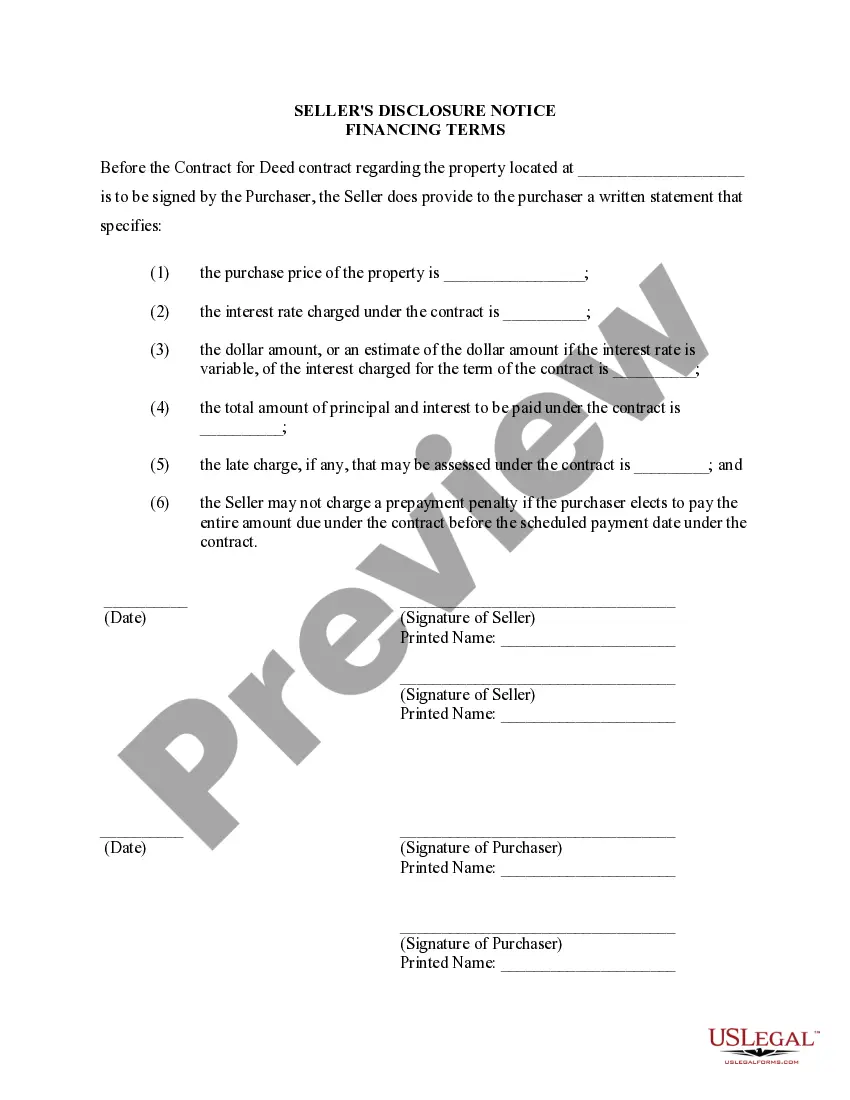

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a document that outlines the specific financing terms and conditions associated with the sale of a residential property in the Meridian area. This disclosure is essential for both the seller and the buyer, as it provides transparency and clarity regarding the financial aspects of the agreement. Here are some important points to consider when discussing this topic: 1. Definitions and Overview: The disclosure form will typically begin with a clear definition of important terms such as "Contract for Deed" or "Land Contract," ensuring that all parties involved have a shared understanding of the agreement. 2. Purchase Price: The financing terms section will specify the total purchase price of the property, including any down payment or initial deposit required by the seller. 3. Interest Rate: The disclosure will outline the interest rate to be applied to the outstanding balance, ensuring that both parties are aware of the cost of financing and repayment obligations. 4. Payment Schedule: The disclosure will detail the payment schedule, including the frequency (monthly, quarterly, etc.), due date, and the method of payment (check, direct deposit, etc.). This section will also specify any penalties for late or missed payments. 5. Amortization & Balloon Payment: If applicable, the document will disclose whether the financing is amortized over a specific period or if a balloon payment is required at the end of the term. This information is crucial for the buyer to understand the payment structure. 6. Default & Remedies: This section outlines the consequences of defaulting on payments and the remedies available to the seller. It may include provisions such as late fees, acceleration of the full amount due, or the possibility of foreclosure. 7. Fees & Expenses: The disclosure will inform the buyer of any additional fees or expenses associated with the financing, such as origination fees, closing costs, or attorney fees. It is important for the buyer to have a clear understanding of all financial obligations. 8. Right of Inspection: The disclosure should include provisions allowing the buyer to inspect the property, ensuring that they are satisfied with its condition before finalizing the agreement. 9. Dispute Resolution: This section may outline the process for resolving disputes that may arise during the course of the agreement, such as arbitration or mediation. Different types of Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property may exist, depending on the specific circumstances or variations in agreements. For example, there might be separate disclosures for commercial properties or specific disclosure forms for properties located in different geographic areas within Meridian or Idaho. In summary, the Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is a vital document that ensures transparency and clarity between the seller and the buyer when it comes to the financial aspects of the agreement. It covers important information such as purchase price, interest rate, payment schedule, default remedies, and other essential terms. Having a thorough understanding of these terms before entering into a land contract is crucial for both parties to protect their interests and maintain a fair and equitable agreement.Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a document that outlines the specific financing terms and conditions associated with the sale of a residential property in the Meridian area. This disclosure is essential for both the seller and the buyer, as it provides transparency and clarity regarding the financial aspects of the agreement. Here are some important points to consider when discussing this topic: 1. Definitions and Overview: The disclosure form will typically begin with a clear definition of important terms such as "Contract for Deed" or "Land Contract," ensuring that all parties involved have a shared understanding of the agreement. 2. Purchase Price: The financing terms section will specify the total purchase price of the property, including any down payment or initial deposit required by the seller. 3. Interest Rate: The disclosure will outline the interest rate to be applied to the outstanding balance, ensuring that both parties are aware of the cost of financing and repayment obligations. 4. Payment Schedule: The disclosure will detail the payment schedule, including the frequency (monthly, quarterly, etc.), due date, and the method of payment (check, direct deposit, etc.). This section will also specify any penalties for late or missed payments. 5. Amortization & Balloon Payment: If applicable, the document will disclose whether the financing is amortized over a specific period or if a balloon payment is required at the end of the term. This information is crucial for the buyer to understand the payment structure. 6. Default & Remedies: This section outlines the consequences of defaulting on payments and the remedies available to the seller. It may include provisions such as late fees, acceleration of the full amount due, or the possibility of foreclosure. 7. Fees & Expenses: The disclosure will inform the buyer of any additional fees or expenses associated with the financing, such as origination fees, closing costs, or attorney fees. It is important for the buyer to have a clear understanding of all financial obligations. 8. Right of Inspection: The disclosure should include provisions allowing the buyer to inspect the property, ensuring that they are satisfied with its condition before finalizing the agreement. 9. Dispute Resolution: This section may outline the process for resolving disputes that may arise during the course of the agreement, such as arbitration or mediation. Different types of Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property may exist, depending on the specific circumstances or variations in agreements. For example, there might be separate disclosures for commercial properties or specific disclosure forms for properties located in different geographic areas within Meridian or Idaho. In summary, the Meridian Idaho Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed is a vital document that ensures transparency and clarity between the seller and the buyer when it comes to the financial aspects of the agreement. It covers important information such as purchase price, interest rate, payment schedule, default remedies, and other essential terms. Having a thorough understanding of these terms before entering into a land contract is crucial for both parties to protect their interests and maintain a fair and equitable agreement.