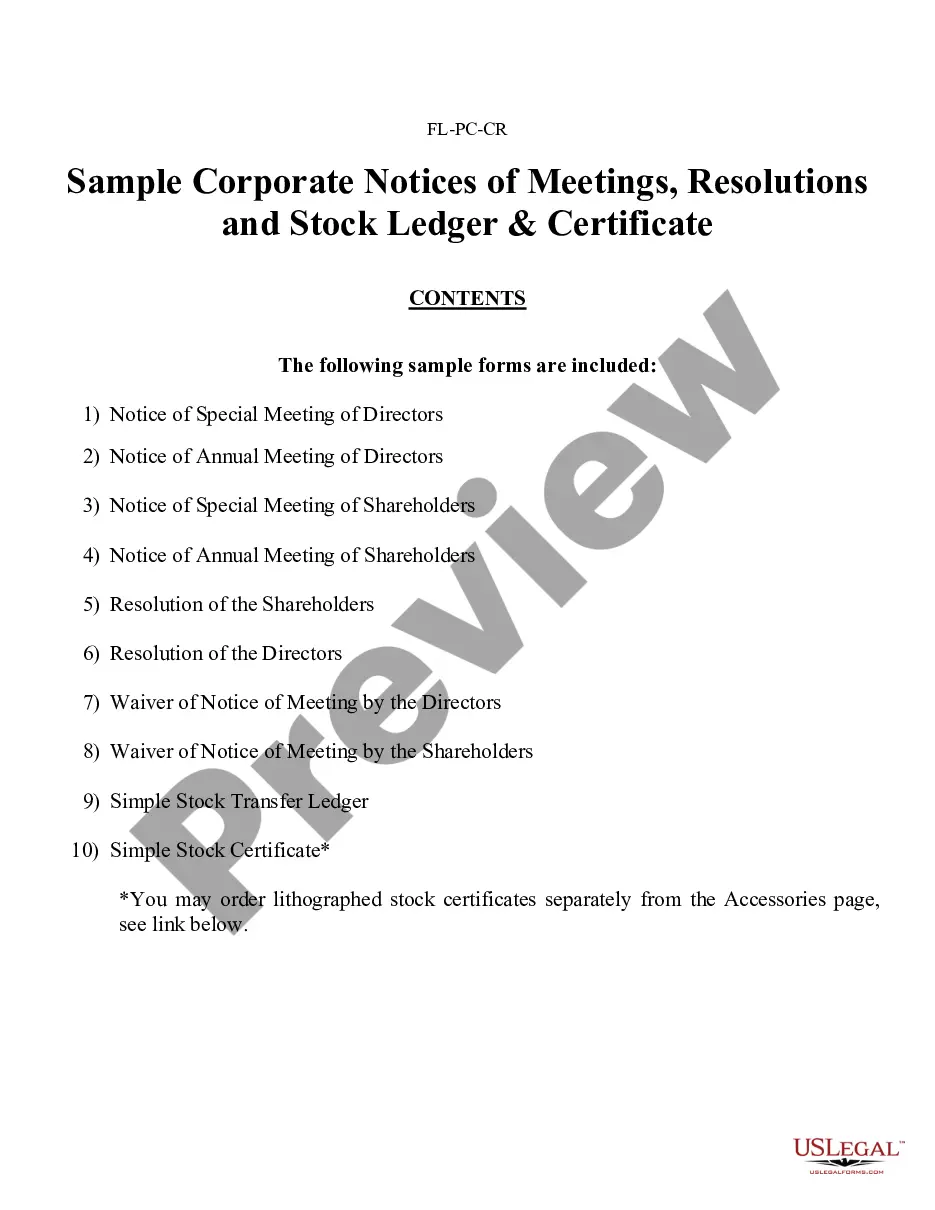

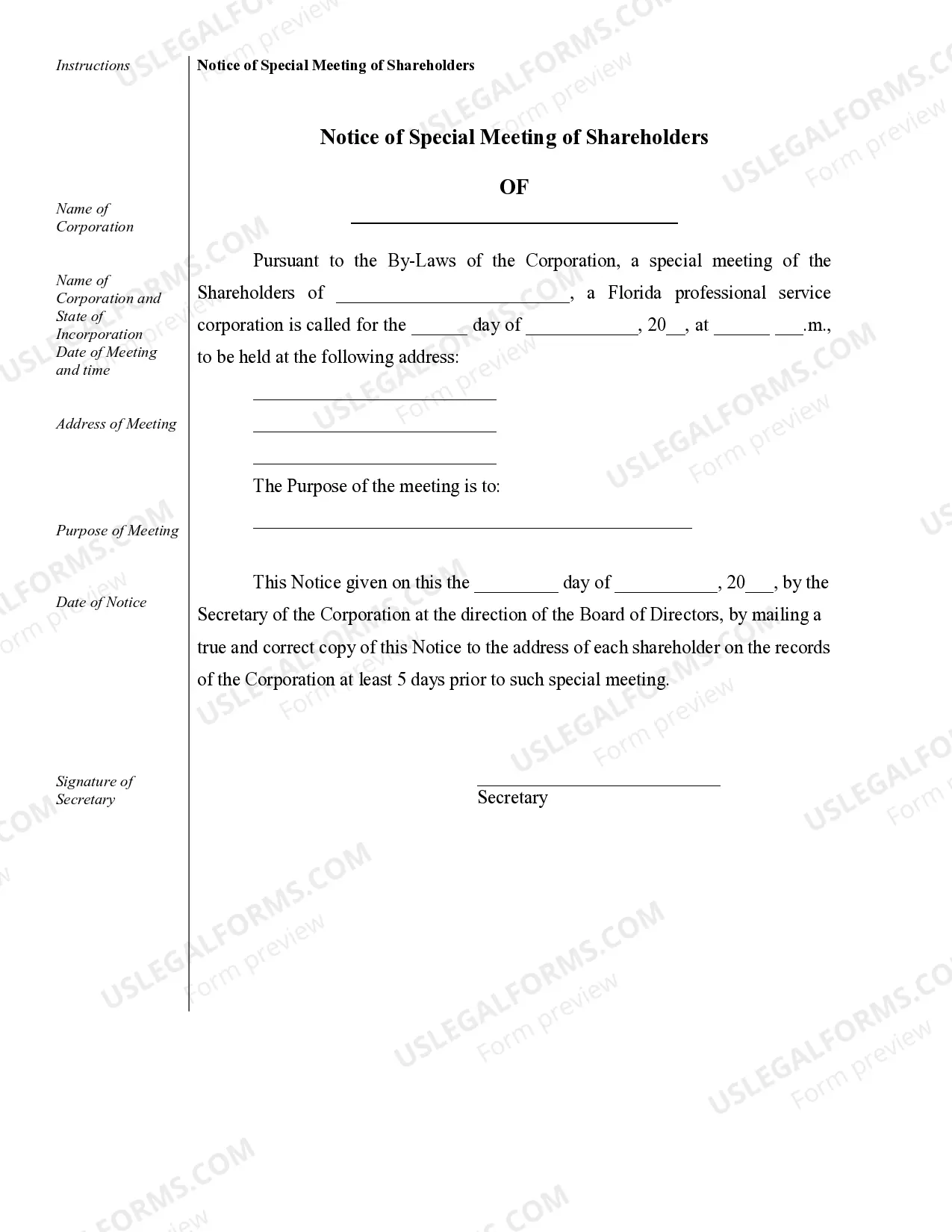

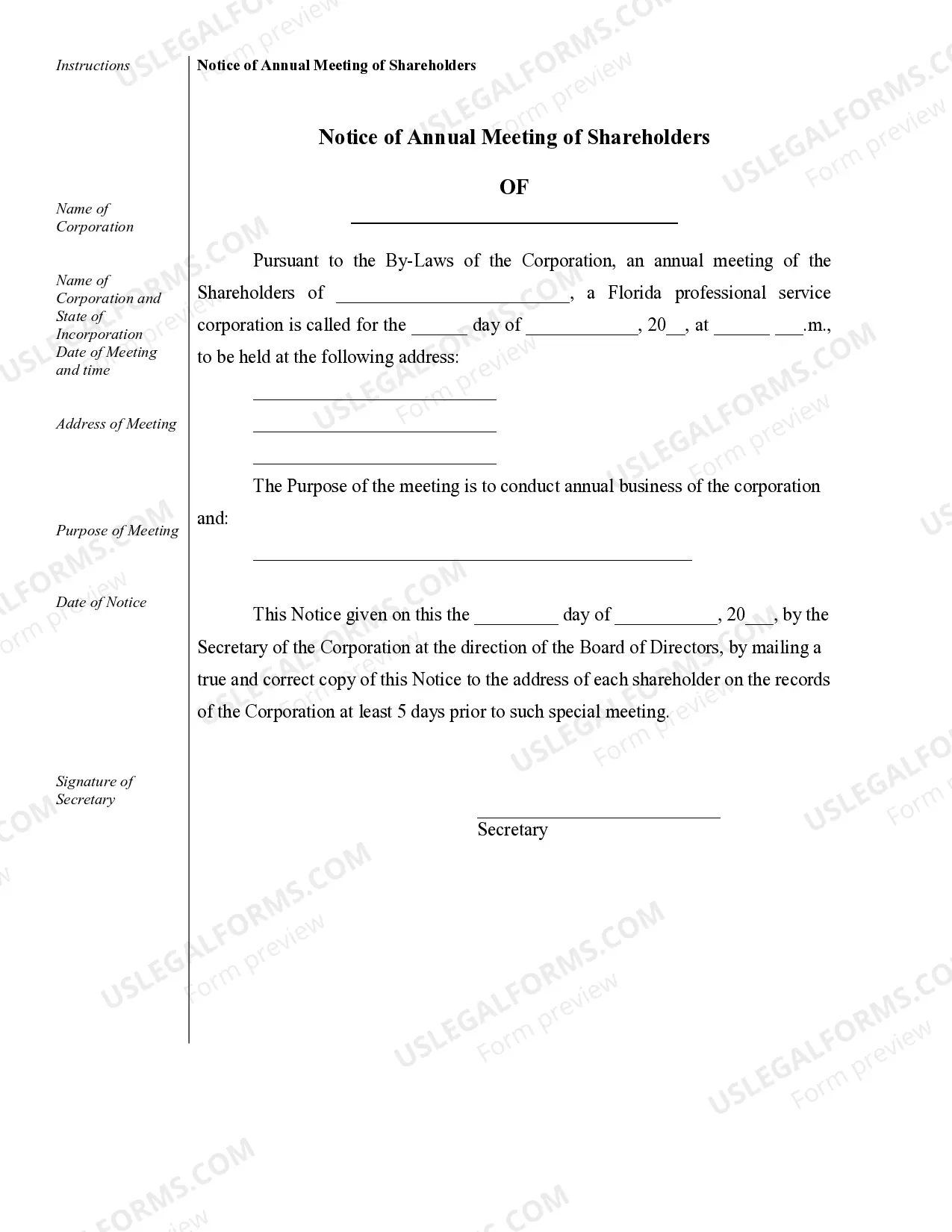

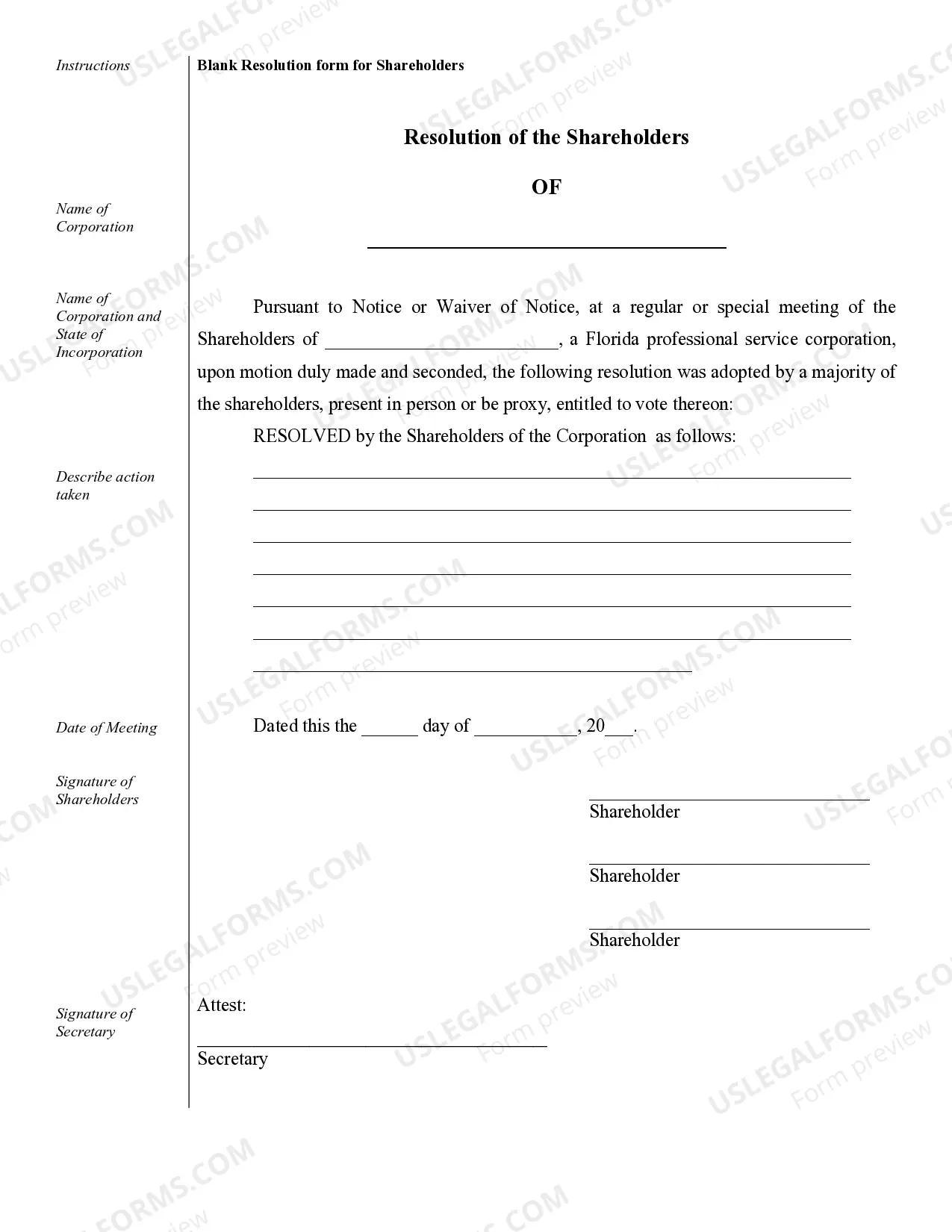

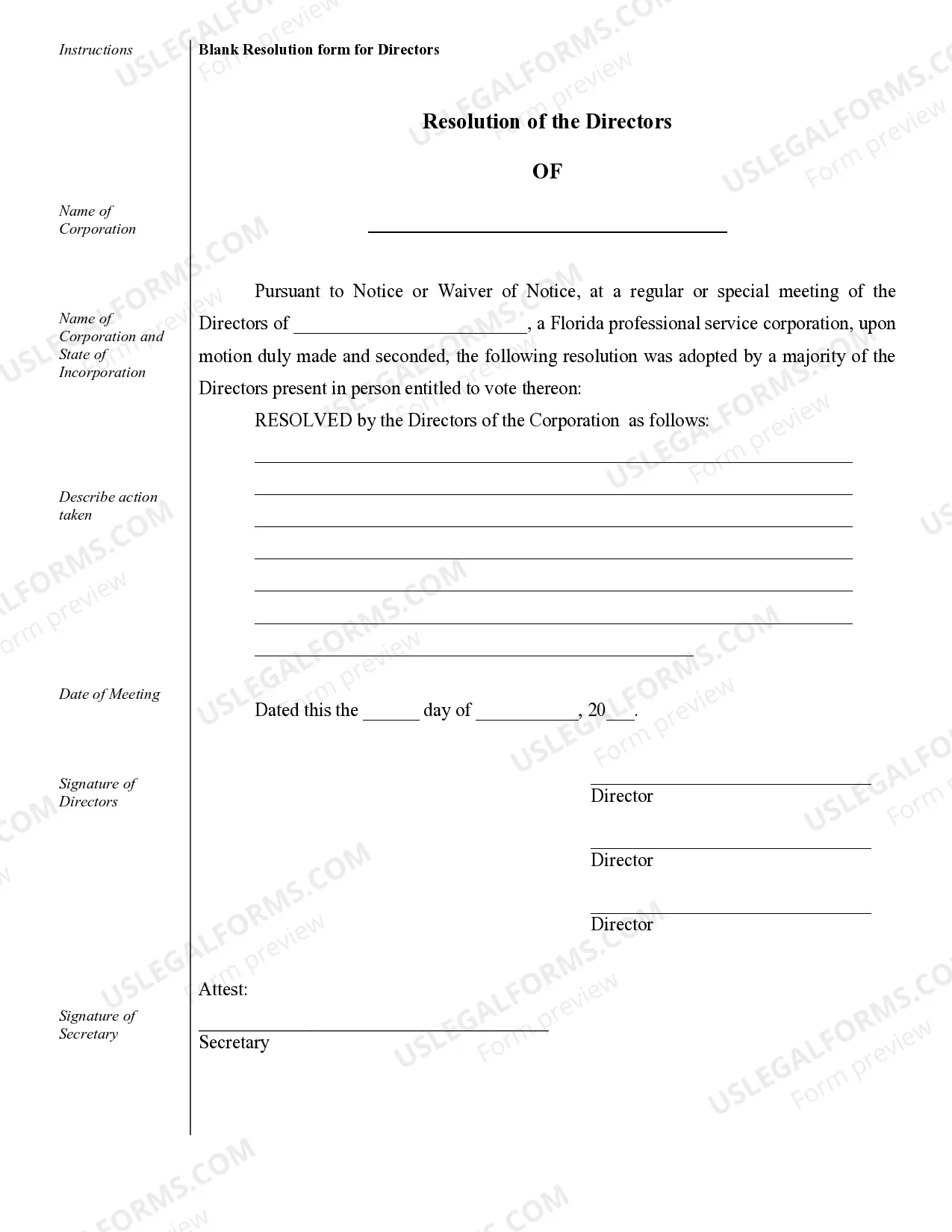

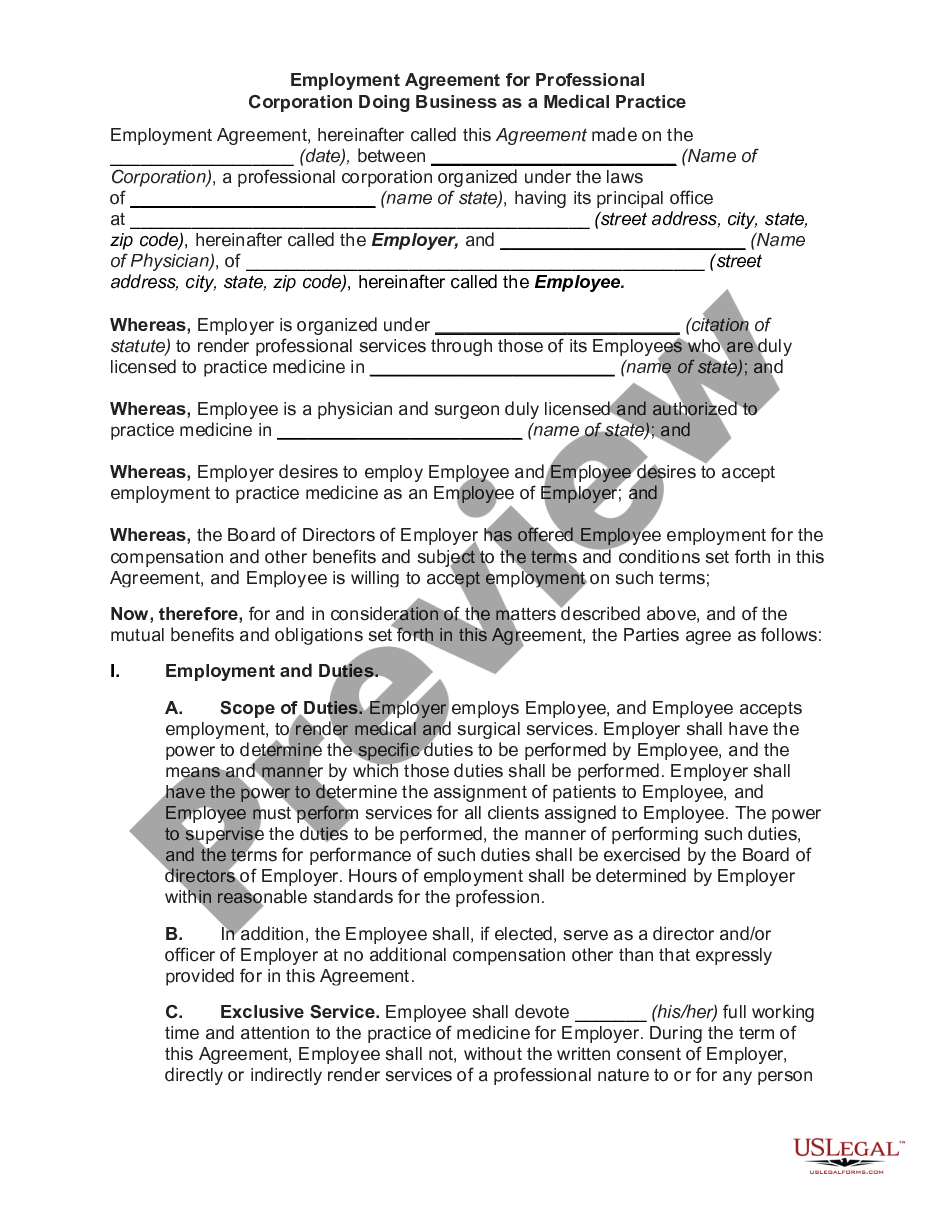

Orlando Sample Corporate Records for a Florida Professional Corporation

Description

How to fill out Sample Corporate Records For A Florida Professional Corporation?

Utilize the US Legal Forms and gain immediate access to any document you need. Our user-friendly site, featuring a vast array of paperwork, enables you to locate and acquire nearly any document template you seek.

You can export, fill out, and authenticate the Orlando Sample Corporate Records for a Florida Professional Corporation in just a few minutes instead of spending hours online searching for the right template.

Using our catalog is an excellent method to enhance the security of your document submission. Our knowledgeable legal experts routinely assess all the records to ensure that the templates are suitable for a specific locality and adhere to current laws and regulations.

How can you obtain the Orlando Sample Corporate Records for a Florida Professional Corporation? If you have an account, simply sign in to your profile. The Download button will be activated for all the samples you browse. Furthermore, you can access all previously saved documents in the My documents section.

US Legal Forms is one of the largest and most trustworthy document repositories online. We are always ready to assist you with any legal matter, even if it is merely downloading the Orlando Sample Corporate Records for a Florida Professional Corporation.

Feel free to take full advantage of our service and streamline your document experience as much as possible!

- Locate the template you need. Ensure that it is the template you were searching for: check its title and description, and use the Preview option if available. If not, use the Search feature to find the desired one.

- Initiate the downloading process. Click Buy Now and choose the pricing option you wish. Then, create an account and pay for your purchase using a credit card or PayPal.

- Download the document. Choose the format to receive the Orlando Sample Corporate Records for a Florida Professional Corporation and modify and complete it, or sign it as needed.

Form popularity

FAQ

Finding original Articles of Incorporation involves checking with the Florida Division of Corporations, where these documents are filed. You can search their database online or request assistance from a representative. For those looking to streamline this process, US Legal Forms can provide you with Orlando Sample Corporate Records for a Florida Professional Corporation, making it simple to access the originals you seek.

You can retrieve a copy of your Articles of Incorporation by using the online search tool provided by the Florida Division of Corporations. You will need to input your corporation's name or registration number. For an easier experience, check out US Legal Forms, which provides quick access to Orlando Sample Corporate Records for a Florida Professional Corporation, allowing you to find the documents you need without hassle.

To obtain a copy of Articles of Incorporation in Florida, you can visit the Division of Corporations' website and request documents online. Alternatively, you may also contact them directly to request physical copies. If you prefer convenience, US Legal Forms offers a straightforward way to access Orlando Sample Corporate Records for a Florida Professional Corporation, helping simplify your search.

The process of obtaining Articles of Incorporation in Florida typically takes between two and four weeks. This timeframe can vary based on factors such as the volume of applications and whether additional information is needed. To expedite your process, consider using professional services like US Legal Forms, which provide access to Orlando Sample Corporate Records for a Florida Professional Corporation, ensuring you meet all requirements smoothly.

Corporate Filings LLC is a service provider that helps businesses manage the filing of corporate documents and compliance matters. They specialize in maintaining Orlando Sample Corporate Records for a Florida Professional Corporation, ensuring that all necessary paperwork is filed timely and accurately.

To form a PLLC in Florida, begin by choosing a suitable name and ensuring it is distinguishable from other entities. Then, file your Articles of Organization with the Florida Division of Corporations. Maintaining accurate Orlando Sample Corporate Records for a Florida Professional Corporation during this process will help streamline operations.

To start a PLLC in Florida, you need a unique name, the necessary licensing for your profession, and the Articles of Organization filed with the state. Additionally, it's helpful to prepare a comprehensive operating agreement. This will aid in organizing your Orlando Sample Corporate Records for a Florida Professional Corporation.

In Florida, professionals licensed in certain fields, such as law, medicine, or accounting, can own a Professional Limited Liability Company (PLLC). This structure allows them to combine liability protection with professional services. If you are considering forming a PLLC, it is wise to organize your Orlando Sample Corporate Records for a Florida Professional Corporation properly.

Your Florida Corp filings include various documents related to the formation and operation of your corporation. These can be accessed through the Florida Division of Corporations. Keeping up-to-date Orlando Sample Corporate Records for a Florida Professional Corporation ensures you meet all legal requirements.

Forming a Professional Limited Liability Company (PLLC) in Florida involves several steps. First, you need to choose a unique name that complies with state regulations. After that, you should file Articles of Organization with the Florida Division of Corporations and prepare to maintain Orlando Sample Corporate Records for a Florida Professional Corporation.