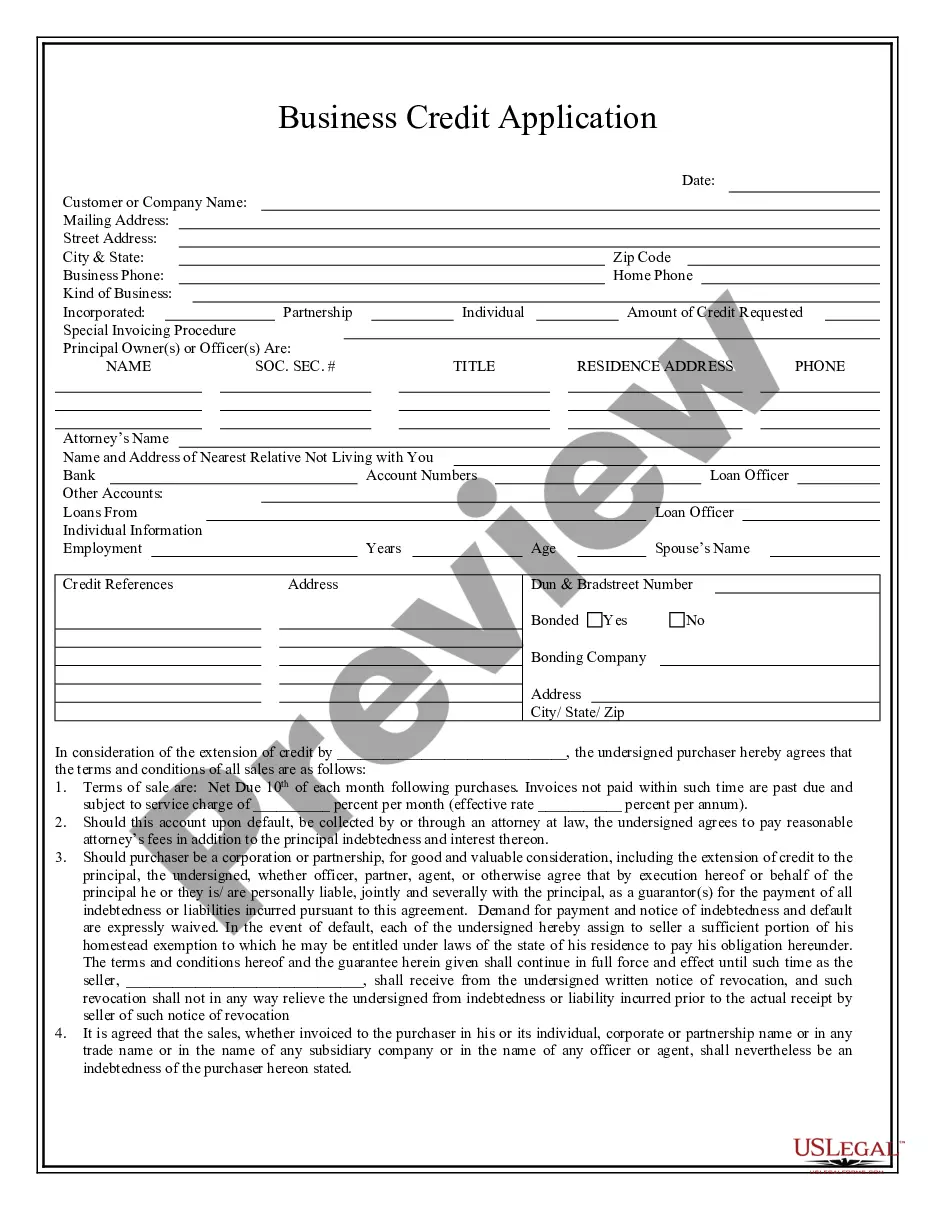

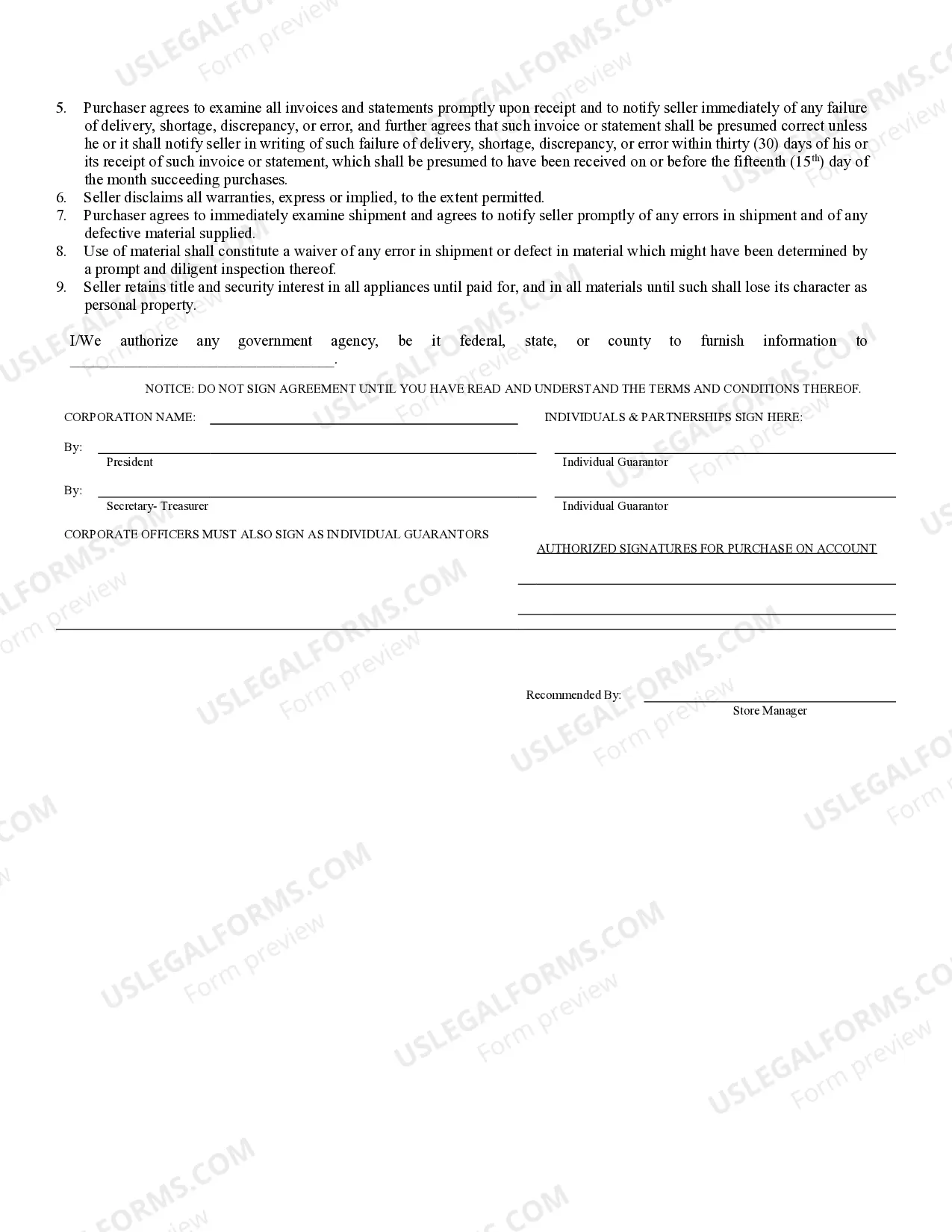

Coral Springs Florida Business Credit Application is a comprehensive process through which businesses in the Coral Springs area can apply for credit from financial institutions or lending agencies. This application assists businesses in obtaining credit to support their operations, expansion, or investment needs. The Coral Springs Florida Business Credit Application typically requires businesses to provide detailed information about their company, its financials, and credit history. This includes the business's legal name, address, type of business, tax identification number, and contact information for key personnel. In addition to the basic company details, the credit application also requires information about the business's financial health. This may include its revenues, expenses, assets, liabilities, and profitability ratios. It is common for businesses to attach relevant financial documents, such as balance sheets, income statements, and cash flow statements, to support their creditworthiness. To evaluate creditworthiness, lending institutions may also inquire about the business owner's personal credit history and financial standing. This helps lenders assess the risk associated with providing credit to the business. Apart from the standard Coral Springs Florida Business Credit Application, there might be various specialized credit applications available based on specific business needs. Some key types include: 1. Small Business Credit Application: Tailored specifically for small businesses, this application focuses on assessing the creditworthiness of small enterprises in Coral Springs, considering factors such as cash flow, financial stability, and business plans. 2. Commercial Real Estate Credit Application: Geared towards businesses or investors involved in commercial real estate projects, this application concentrates on evaluating the viability of real estate ventures in Coral Springs, including development plans, leasing agreements, and market analysis. 3. Equipment Financing Credit Application: Designed for companies seeking credit to acquire or lease equipment, this application analyzes the equipment's value, maintenance costs, and potential revenue generation to determine credit eligibility. 4. Vendor or Supplier Credit Application: Aimed at businesses looking to establish credit with their vendors or suppliers in Coral Springs, this application focuses on verifying trade references, financial stability, and payment history to establish credit terms between businesses. It is important for businesses in Coral Springs to carefully complete the credit application, ensuring all required information is accurately provided. By doing so, they enhance their chances of securing credit to meet their financial needs and grow their enterprises effectively.

Coral Springs Florida Business Credit Application

Description

How to fill out Coral Springs Florida Business Credit Application?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Coral Springs Florida Business Credit Application or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Coral Springs Florida Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Coral Springs Florida Business Credit Application would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!