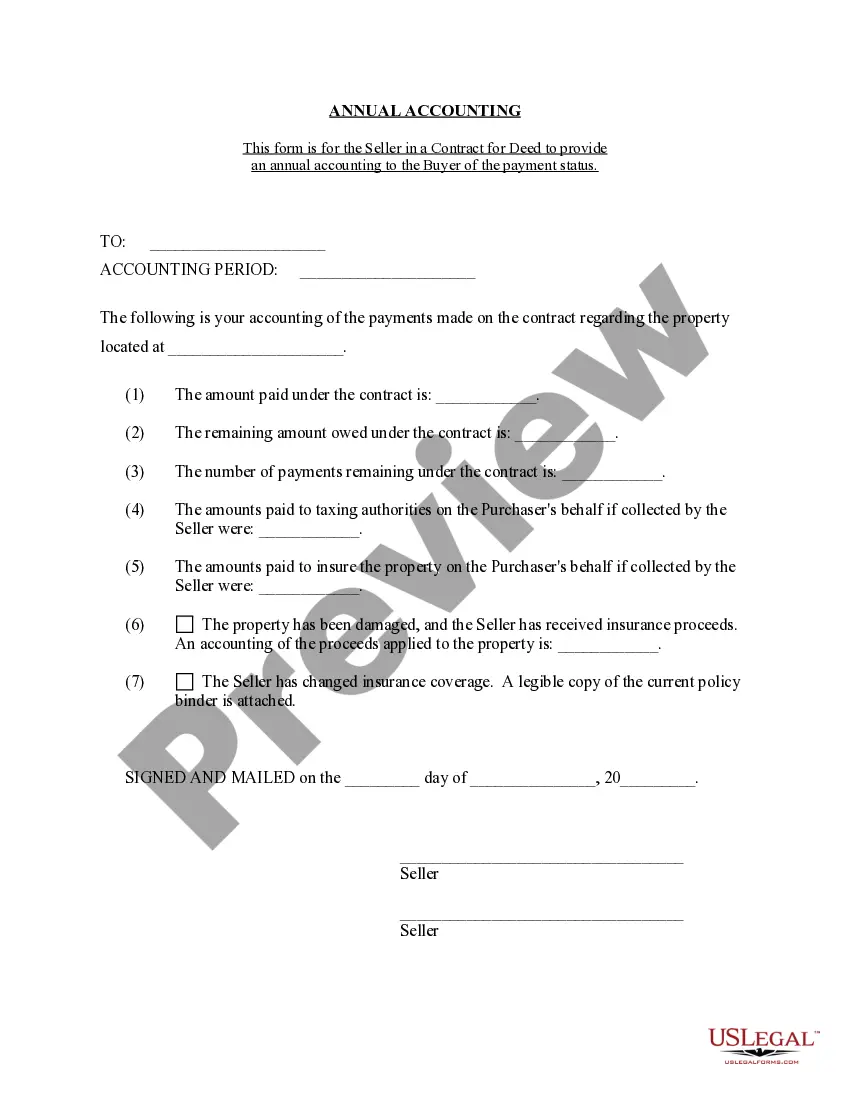

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Pembroke Pines, Florida Contract for Deed Seller's Annual Accounting Statement is a legal document that provides a detailed summary of financial transactions related to a seller's property sold under a contract for deed arrangement in Pembroke Pines, Florida. This statement includes comprehensive information regarding the income, expenses, and distributions associated with the property over the course of the year, with the aim of providing transparency and clarity to both the seller and the buyer. The Pembroke Pines Contract for Deed Seller's Annual Accounting Statement typically consists of the following key sections: 1. Property Details: This section outlines the specific details of the property sold under the contract for deed agreement, including the address, legal description, and relevant identification numbers. 2. Income: This section delineates the various sources of income generated by the property during the accounting period. It includes rental or lease payments, interest income, or any other income related to the property. 3. Expenses: This section provides a comprehensive breakdown of all expenses incurred in relation to the property. It includes mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, property management fees, and any other applicable expenses. 4. Distributions: This part details any distributions made to the seller during the accounting period. It may include payments towards the outstanding balance of the contract for deed, interest payments, or any other funds disbursed to the seller. 5. Statement of Account: This section summarizes the financial standing of the contract for deed at the end of the accounting period. It includes the remaining principal balance, interest accrued, outstanding payments, and any other relevant financial figures. Different types of Pembroke Pines Florida Contract for Deed Seller's Annual Accounting Statements may vary depending on the specific terms and conditions of the contract agreement. These can include variations in income sources, expenses, or distribution structures. However, the overall purpose of providing a detailed financial overview remains consistent across all types. In conclusion, the Pembroke Pines, Florida Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides an in-depth financial snapshot of a property sold under a contract for deed arrangement. It serves to ensure transparency and assists in maintaining a clear record of financial transactions throughout the year.Pembroke Pines, Florida Contract for Deed Seller's Annual Accounting Statement is a legal document that provides a detailed summary of financial transactions related to a seller's property sold under a contract for deed arrangement in Pembroke Pines, Florida. This statement includes comprehensive information regarding the income, expenses, and distributions associated with the property over the course of the year, with the aim of providing transparency and clarity to both the seller and the buyer. The Pembroke Pines Contract for Deed Seller's Annual Accounting Statement typically consists of the following key sections: 1. Property Details: This section outlines the specific details of the property sold under the contract for deed agreement, including the address, legal description, and relevant identification numbers. 2. Income: This section delineates the various sources of income generated by the property during the accounting period. It includes rental or lease payments, interest income, or any other income related to the property. 3. Expenses: This section provides a comprehensive breakdown of all expenses incurred in relation to the property. It includes mortgage payments, property taxes, insurance premiums, repairs and maintenance costs, property management fees, and any other applicable expenses. 4. Distributions: This part details any distributions made to the seller during the accounting period. It may include payments towards the outstanding balance of the contract for deed, interest payments, or any other funds disbursed to the seller. 5. Statement of Account: This section summarizes the financial standing of the contract for deed at the end of the accounting period. It includes the remaining principal balance, interest accrued, outstanding payments, and any other relevant financial figures. Different types of Pembroke Pines Florida Contract for Deed Seller's Annual Accounting Statements may vary depending on the specific terms and conditions of the contract agreement. These can include variations in income sources, expenses, or distribution structures. However, the overall purpose of providing a detailed financial overview remains consistent across all types. In conclusion, the Pembroke Pines, Florida Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides an in-depth financial snapshot of a property sold under a contract for deed arrangement. It serves to ensure transparency and assists in maintaining a clear record of financial transactions throughout the year.