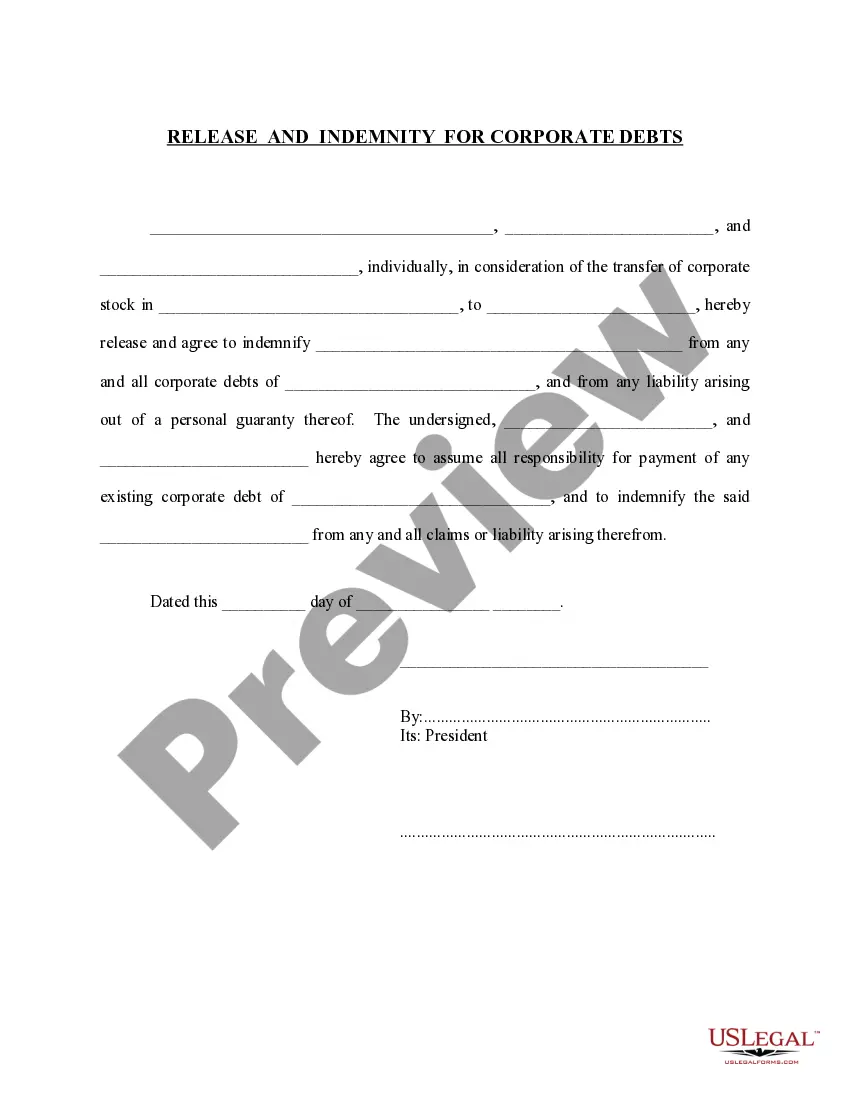

This form is a release and indemnity agreement for Corporate debts in exchange for a transfer of corporate stock. The form is available in both word and word perfect formats.

Title: Birmingham Alabama Release and Indemnity Agreement for Corporate Debts: Explained with Various Types and Keywords Introduction: Understanding the intricacies of legal documentation is crucial for businesses, especially when dealing with corporate debts. In Birmingham, Alabama, companies often utilize a Release and Indemnity Agreement to manage and resolve outstanding debts. This article provides a detailed description of what the Birmingham Alabama Release and Indemnity Agreement for Corporate Debts entails, including its definition, purpose, and various types. Definition: A Birmingham Alabama Release and Indemnity Agreement for Corporate Debts is a legal agreement between a debtor corporation and a creditor. This agreement serves as a formal document allowing the debtor to relinquish any claims, demands, and responsibilities related to outstanding debts, while the creditor agrees to indemnify and hold the debtor harmless against any future debts or liabilities arising from the agreed-upon settlement. Purpose: The primary objective of the Release and Indemnity Agreement is to create a legally binding agreement that finalizes the resolution of corporate debts. It enables both parties to reach a mutually acceptable compromise wherein the debtor is absolved of its financial obligations, and the creditor is assured future indemnification against potential claims. Keywords: Birmingham Alabama, Release and Indemnity Agreement, Corporate Debts, legal agreement, debtor corporation, creditor, claims, demands, responsibilities, indemnify, liabilities, settlement, resolution, compromise, financial obligations, absolved, indemnification. Types of Birmingham Alabama Release and Indemnity Agreement for Corporate Debts: 1. General Release and Indemnity Agreement: This type of agreement is the most commonly used, encompassing a broad range of debts, obligations, and claims between the debtor corporation and creditor. It is designed to address various types of corporate debts, providing a comprehensive approach to resolving outstanding obligations. Keywords: General Release and Indemnity Agreement, debts, obligations, claims, comprehensive approach. 2. Specific Release and Indemnity Agreement: In certain instances, businesses may require a more targeted approach to address specific debts or obligations. A specific Release and Indemnity Agreement focuses on a particular subset of corporate debts, providing a customized solution for the parties involved. Keywords: Specific Release and Indemnity Agreement, targeted approach, subset, customized solution. 3. Partial Release and Indemnity Agreement: When a debtor corporation is unable to fulfill its entire outstanding debt, a Partial Release and Indemnity Agreement can be utilized. This agreement releases the debtor from a portion of its debt, while the creditor indemnifies the debtor against further claims related to that particular portion. Keywords: Partial Release and Indemnity Agreement, unable to fulfill, outstanding debt, releases, portion, further claims. Conclusion: The Birmingham Alabama Release and Indemnity Agreement for Corporate Debts is a significant legal tool that allows debtor corporations and creditors to resolve financial obligations while mitigating future liabilities. Whether utilizing a General, Specific, or Partial Release and Indemnity Agreement, businesses can customize their approach based on the nature and extent of the corporate debts involved, ensuring a fair and comprehensive resolution.Title: Birmingham Alabama Release and Indemnity Agreement for Corporate Debts: Explained with Various Types and Keywords Introduction: Understanding the intricacies of legal documentation is crucial for businesses, especially when dealing with corporate debts. In Birmingham, Alabama, companies often utilize a Release and Indemnity Agreement to manage and resolve outstanding debts. This article provides a detailed description of what the Birmingham Alabama Release and Indemnity Agreement for Corporate Debts entails, including its definition, purpose, and various types. Definition: A Birmingham Alabama Release and Indemnity Agreement for Corporate Debts is a legal agreement between a debtor corporation and a creditor. This agreement serves as a formal document allowing the debtor to relinquish any claims, demands, and responsibilities related to outstanding debts, while the creditor agrees to indemnify and hold the debtor harmless against any future debts or liabilities arising from the agreed-upon settlement. Purpose: The primary objective of the Release and Indemnity Agreement is to create a legally binding agreement that finalizes the resolution of corporate debts. It enables both parties to reach a mutually acceptable compromise wherein the debtor is absolved of its financial obligations, and the creditor is assured future indemnification against potential claims. Keywords: Birmingham Alabama, Release and Indemnity Agreement, Corporate Debts, legal agreement, debtor corporation, creditor, claims, demands, responsibilities, indemnify, liabilities, settlement, resolution, compromise, financial obligations, absolved, indemnification. Types of Birmingham Alabama Release and Indemnity Agreement for Corporate Debts: 1. General Release and Indemnity Agreement: This type of agreement is the most commonly used, encompassing a broad range of debts, obligations, and claims between the debtor corporation and creditor. It is designed to address various types of corporate debts, providing a comprehensive approach to resolving outstanding obligations. Keywords: General Release and Indemnity Agreement, debts, obligations, claims, comprehensive approach. 2. Specific Release and Indemnity Agreement: In certain instances, businesses may require a more targeted approach to address specific debts or obligations. A specific Release and Indemnity Agreement focuses on a particular subset of corporate debts, providing a customized solution for the parties involved. Keywords: Specific Release and Indemnity Agreement, targeted approach, subset, customized solution. 3. Partial Release and Indemnity Agreement: When a debtor corporation is unable to fulfill its entire outstanding debt, a Partial Release and Indemnity Agreement can be utilized. This agreement releases the debtor from a portion of its debt, while the creditor indemnifies the debtor against further claims related to that particular portion. Keywords: Partial Release and Indemnity Agreement, unable to fulfill, outstanding debt, releases, portion, further claims. Conclusion: The Birmingham Alabama Release and Indemnity Agreement for Corporate Debts is a significant legal tool that allows debtor corporations and creditors to resolve financial obligations while mitigating future liabilities. Whether utilizing a General, Specific, or Partial Release and Indemnity Agreement, businesses can customize their approach based on the nature and extent of the corporate debts involved, ensuring a fair and comprehensive resolution.