The Virgin Islands Cash Disbursements Journal is a crucial accounting tool used to record all cash payments made by a business or organization operating in the Virgin Islands. This journal serves as a detailed record of all outgoing cash transactions, providing an accurate breakdown of how funds are being disbursed. With the aim of maintaining financial transparency and accountability, the Virgin Islands Cash Disbursements Journal includes comprehensive information of each payment. This includes the date of the transaction, the name of the payee, the purpose of the payment, the amount disbursed, and the relevant account(s) affected by the transaction. Such meticulous recording of cash disbursements helps businesses keep track of their expenses and provides a clear view of their financial health. In the Virgin Islands, while the basic structure and purpose of the Cash Disbursements Journal remain the same, there may be variations based on the specific needs of different businesses or organizations. Some common types of Virgin Islands Cash Disbursements Journals include: 1. General Cash Disbursements Journal: This is the most common type used by businesses in the Virgin Islands. It records all outgoing cash payments, ranging from utility bills and office supplies to employee salaries and vendor payments. The purpose is to provide a comprehensive overview of all expenses. 2. Payroll Cash Disbursements Journal: This specific journal focuses solely on recording salaries, wages, and related payroll expenses. It helps businesses track payroll disbursements accurately and simplifies the payroll management process. 3. Accounts Payable Cash Disbursements Journal: This journal primarily records payments made to vendors, suppliers, and other accounts payable. It ensures that businesses can efficiently manage their outstanding payables and maintain healthy relationships with their creditors. 4. Petty Cash Disbursements Journal: This specialized journal is used to record small, day-to-day cash payments, typically funded through a petty cash fund. Petty cash is commonly employed for minor expenses like office supplies, employee reimbursements, or small emergency purchases. Regardless of the specific type of Virgin Islands Cash Disbursements Journal employed, its main purpose is to provide an organized and detailed record of all cash payments made by an entity. This journal is not only essential for internal bookkeeping and auditing purposes but also assists in preparing accurate financial statements, analyzing expenses, and making informed business decisions.

Virgin Islands Cash Disbursements Journal

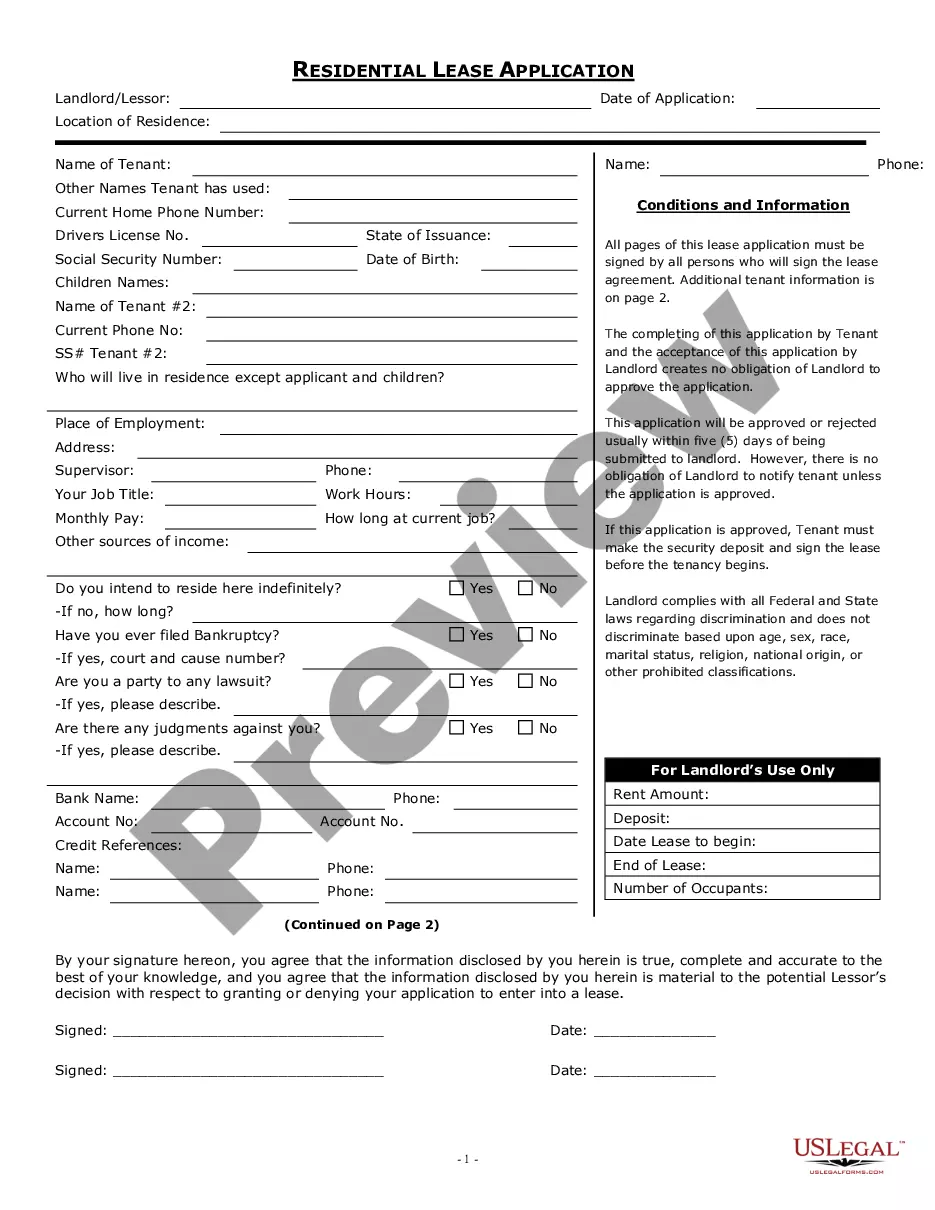

Description

How to fill out Virgin Islands Cash Disbursements Journal?

If you have to total, down load, or produce legal document layouts, use US Legal Forms, the biggest collection of legal forms, that can be found on-line. Utilize the site`s simple and easy practical search to obtain the files you want. A variety of layouts for business and specific purposes are sorted by categories and states, or search phrases. Use US Legal Forms to obtain the Virgin Islands Cash Disbursements Journal in a number of clicks.

When you are presently a US Legal Forms buyer, log in to the account and click on the Down load key to obtain the Virgin Islands Cash Disbursements Journal. You may also gain access to forms you in the past acquired within the My Forms tab of your own account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the proper metropolis/country.

- Step 2. Make use of the Preview solution to look over the form`s content material. Do not forget about to see the explanation.

- Step 3. When you are unsatisfied with all the develop, utilize the Lookup industry near the top of the monitor to discover other versions from the legal develop template.

- Step 4. Once you have located the shape you want, click on the Purchase now key. Pick the pricing strategy you choose and include your references to register for the account.

- Step 5. Procedure the purchase. You may use your bank card or PayPal account to complete the purchase.

- Step 6. Select the file format from the legal develop and down load it on your own device.

- Step 7. Full, revise and produce or sign the Virgin Islands Cash Disbursements Journal.

Every single legal document template you purchase is the one you have permanently. You possess acces to every single develop you acquired within your acccount. Go through the My Forms portion and decide on a develop to produce or down load yet again.

Compete and down load, and produce the Virgin Islands Cash Disbursements Journal with US Legal Forms. There are thousands of professional and state-specific forms you may use for your business or specific requirements.