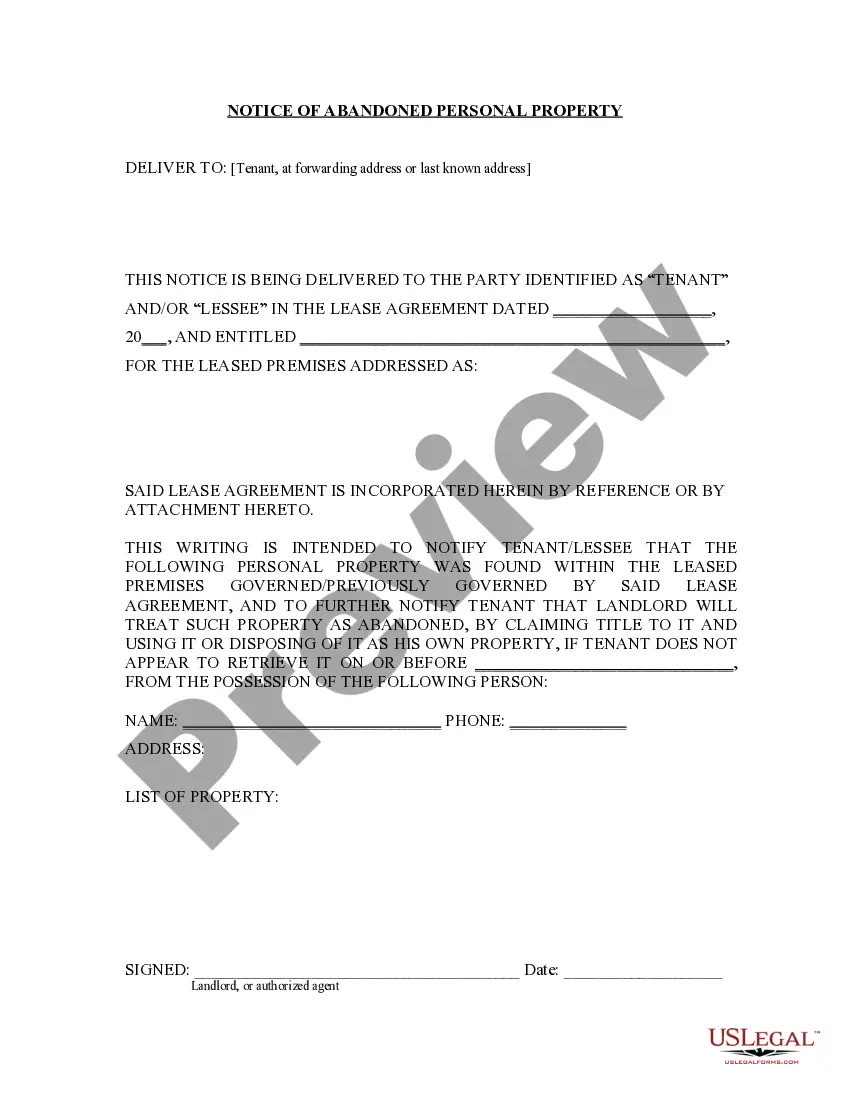

This is an official notice from the Landlord to the Tenant. This Notice to Tenant sets out specific directions to either retrieve items of personal property left behind by tenant, or have items be confiscated by landlord. This form conforms to applicable state statutory law.

Abandoned property is property left behind intentionally and permanently, often by a tenant, when it appears that the former owner or tenant has no intent to reclaim or use it. Examples may include possessions left in a house after the tenant has moved out or autos left beside a road for a long period of time.

Abandoned personal property is that to which the owner has voluntarily relinquished all right, title, claim and possession, with the intention of terminating his ownership, but without vesting ownership in any other person, and without the intention of reclaiming any future rights therein, such as reclaiming future possession or resuming ownership, possession, or enjoyment of the property.

Tennessee Abandoned Property Law Withholding Tax: A Detailed Description In Tennessee, the Abandoned Property Law Withholding Tax is an essential aspect of the state's commitment to protecting the rights of both property owners and the government. This law ensures that abandoned property can be accounted for, safeguarded, and utilized for the benefit of the public. In line with this, the state has outlined several types of abandoned property law withholding taxes to regulate different scenarios and ensure compliance. Let's delve into the specifics of this law and explore the various tax types associated with it. 1. Tennessee Abandoned Property Law: The Tennessee Abandoned Property Law, often referred to as the Unclaimed Property Law, grants the state authority over unclaimed or abandoned property. This includes any financial assets, such as bank accounts, utility deposits, insurance policies, stocks, dividends, unwashed checks, and more. The primary goal of this law is to ensure that such property is returned to the rightful owners or beneficiaries, and if that's not possible, the state holds it in trust. 2. Abandoned Property Law Withholding Tax: Under the umbrella of the Tennessee Abandoned Property Law, the Abandoned Property Law Withholding Tax is applied when the rightful owner cannot be located or if the property remains unclaimed by the owner for a specific period. This tax allows the state to collect revenue from the abandoned property for public use and development. The withholding tax is typically a percentage of the value of the abandoned property. 3. Different Types of Abandoned Property Law Withholding Tax: a. Banking Institutions: One prominent type of abandoned property law withholding tax is imposed on financial institutions, including banks and credit unions. These institutions are legally obligated to report and remit unclaimed funds to the Tennessee Department of Treasury. The state then applies the withholding tax to these funds. b. Holder Reporting: In addition to banking institutions, various entities or "holders" are required to report abandoned property to the state. This includes insurance companies, utility companies, corporations, governmental agencies, and more. The abandoned property law withholding tax is enforced on these holders when the unclaimed accounts are transferred to the state's custody. c. Voluntary Compliance: Tennessee offers a voluntary compliance program, particularly for holders that have not previously reported unclaimed property or have outstanding liabilities. This program allows holders to report their abandoned property voluntarily, often with reduced penalties or interest fees. The withholding tax is applied following the voluntary compliance process. d. Enchantment: Enchantment refers to the process of transferring abandoned property to the state when the owner cannot be located. If all reasonable attempts to find the owner fail, the property "BS cheats" to the state. The state then administers the withholding tax on these BS cheated properties. By implementing the Abandoned Property Law Withholding Tax, Tennessee ensures proper governance over abandoned property, prevents misuse, and generates revenue for essential public services. Whether in the form of banking institution taxes, holder reporting taxes, voluntary compliance taxes, or enchantment, this withholding tax plays a crucial role in balancing the rights of property owners and the public interest.