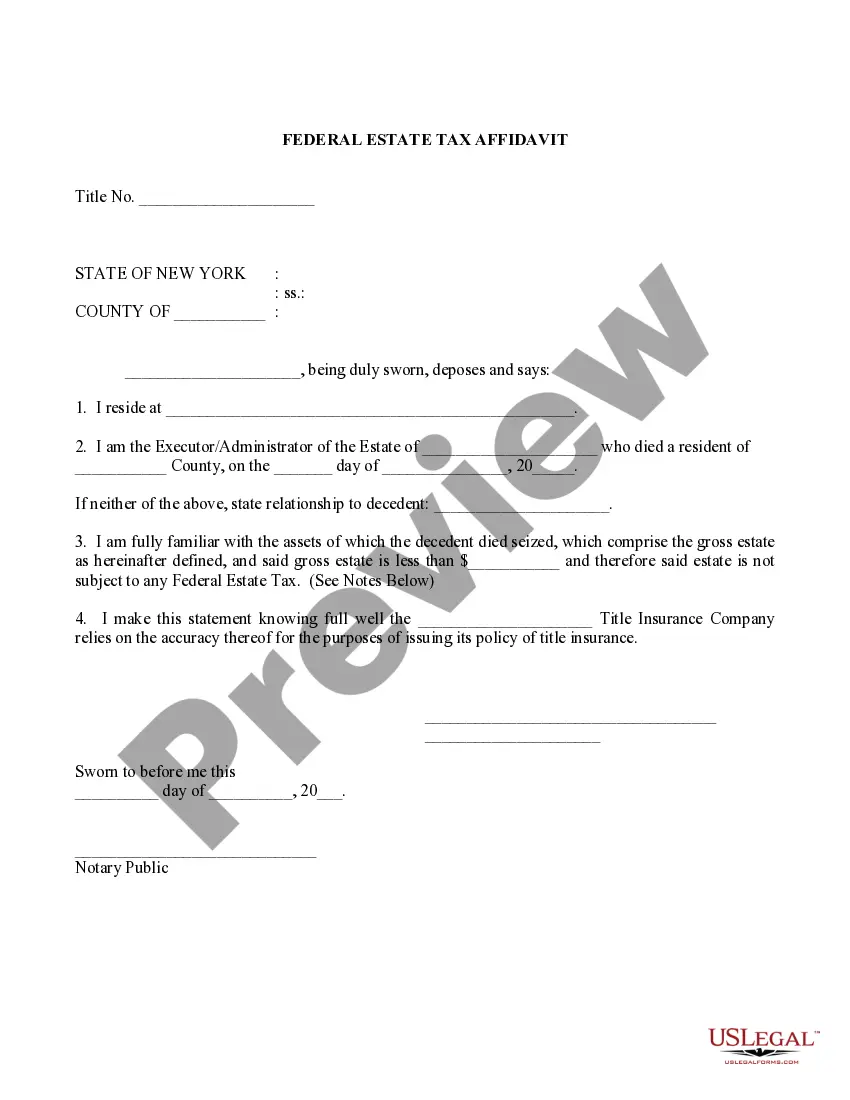

The New York Federal Estate Tax Affidavit is a legal document used to provide the IRS with information about the decedent’s estate and the taxes owed. It is required for estates with a gross value of more than $5.45 million. The affidavit must be completed and filed by the executor of the estate. There are two types of New York Federal Estate Tax Affidavit: Form ET-706 and Form ET-706-NA. Form ET-706 is used when the decedent was domiciled in New York at the time of death and Form ET-706-NA is used when the decedent was a non-resident of New York. Both forms require detailed information about the decedent’s assets, liabilities, and taxes owed.

New York Federal Estate Tax Affidavit

Description

How to fill out New York Federal Estate Tax Affidavit?

US Legal Forms is the most easy and cost-effective way to find suitable legal templates. It’s the most extensive online library of business and individual legal documentation drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your New York Federal Estate Tax Affidavit.

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New York Federal Estate Tax Affidavit if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one meeting your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Federal Estate Tax Affidavit and download it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reliable assistant in obtaining the required official documentation. Try it out!