Limited liability LLC insurance is a crucial aspect of protecting a small business and its owners from potential financial risks. It offers liability coverage for LLC members and shareholders, shielding personal assets from being used to settle business-related debts or lawsuits. This type of insurance ensures that the financial interests of LLC members remain separate from the company’s liability obligations. Limited liability LLC insurance is essential for small businesses as it provides a safety net in case of unforeseen circumstances, such as legal disputes or claims. By obtaining this insurance, small business owners can protect their personal assets, such as homes, savings, or investments, from being seized to satisfy business-related liabilities. There are several types of limited liability LLC insurance available to cater to different business needs: 1. General Liability Insurance: This policy offers coverage for bodily injury, property damage, and any related medical expenses arising from accidents that occur on the business premises or as a result of business operations. 2. Professional Liability Insurance: Also known as Errors and Omissions insurance, this policy is specifically designed to protect professionals (e.g., doctors, lawyers, consultants) from claims related to professional negligence, errors, or mistakes in their services. 3. Product Liability Insurance: This policy is crucial for businesses involved in the manufacturing or distribution of products. It covers claims arising from injuries or damages caused by defective products. 4. Cyber Liability Insurance: In our digital age, this policy has become increasingly important. It provides coverage against cyber-related incidents, including data breaches, cyber-attacks, or unauthorized access to sensitive customer information. 5. Employment Practices Liability Insurance (EPL): This policy protects businesses from claims related to employment practices, such as wrongful termination, discrimination, harassment, or violation of employment laws. 6. Commercial Property Insurance: While not specific to LCS, this insurance is essential for small businesses, including LCS, as it protects the physical assets of the company, such as buildings, equipment, inventory, and furniture, against damage or loss due to fire, theft, or other covered perils. In conclusion, limited liability LLC insurance is crucial for small businesses to protect the personal assets of LLC members from being used to fulfill business obligations. By purchasing the right types of insurance coverage, such as general liability, professional liability, product liability, cyber liability, employment practices liability, and commercial property insurance, small business owners can safeguard their ventures and gain peace of mind in an unpredictable business environment.

Liability Llc Insurance

Description Limited Liability Llc Insurance

How to fill out Agreement Insurance Form?

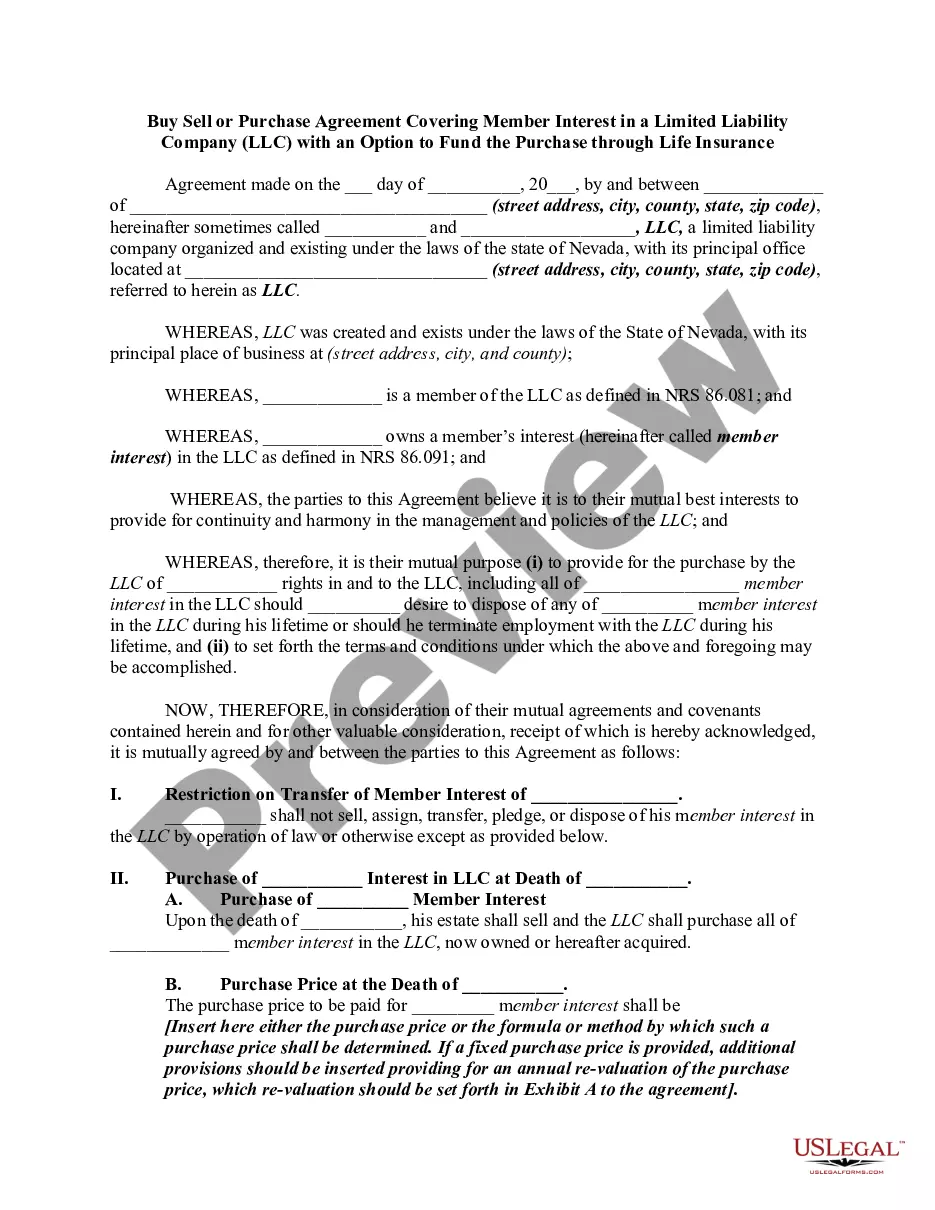

US Legal Forms is a unique system to find any legal or tax form for completing, such as Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance. If you’re tired of wasting time looking for ideal examples and spending money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s advantages, you don't need to download any software but simply pick a subscription plan and register an account. If you already have one, just log in and find the right sample, download it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance, check out the instructions listed below:

- make sure that the form you’re checking out applies in the state you need it in.

- Preview the form its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and keep on registering by providing some information.

- Select a payment method to finish the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain regarding your Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance sample, contact a lawyer to examine it before you send out or file it. Get started without hassles!