The District of Columbia Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legally binding contract that outlines the terms and conditions when selling a company's assets, specifically when there is an agreement to retain certain employees. This agreement is specific to the District of Columbia jurisdiction and ensures a smooth transition for both the buyer and seller in a business acquisition. The following are some relevant keywords and variations that can be used when discussing the District of Columbia Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction: 1. Sale of Business: This refers to the process of transferring ownership of a company's assets to another party. It involves various legal and financial considerations, such as contracts, due diligence, and valuation. 2. Retained Employees Agreement: This term refers to an agreement between the buyer and seller that specifies which employees of the selling company will be retained by the buyer after the sale. It outlines the terms of employment, such as salary, benefits, and job responsibilities. 3. Asset Purchase Transaction: This refers to the acquisition of a company's assets, rather than the entire company itself. It allows the buyer to select specific assets they want to purchase, such as machinery, inventory, intellectual property, or customer contracts. Types of District of Columbia Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction: 1. Full Asset Purchase Transaction: In this type of transaction, the buyer acquires all the assets of the selling company, including physical and intangible assets, such as equipment, inventory, patents, trademarks, and customer contracts. This type of agreement typically involves the retention of key employees who are critical for the smooth transition of the business. 2. Partial Asset Purchase Transaction: In this scenario, the buyer only acquires specific assets of the selling company, excluding others, such as liabilities or unprofitable divisions. The retained employees' agreement will specify the employees related to the purchased assets who will be retained by the buyer. 3. Employee Transition Agreement: This is a specific type of agreement that focuses primarily on the transition of employees from the selling company to the buyer. It outlines the terms of employment, job roles, compensation, benefits, and any conditions that need to be met for continued employment. 4. Asset Purchase Agreement with Retained Employees Addendum: This refers to an additional document or addendum that is attached to the standard asset purchase agreement. It specifically addresses the retention of employees, ensuring that the buyer and seller agree on the terms and conditions related to the retained employees. By using these relevant keywords and variations, you can effectively describe and categorize the different types of District of Columbia Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions.

District of Columbia Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

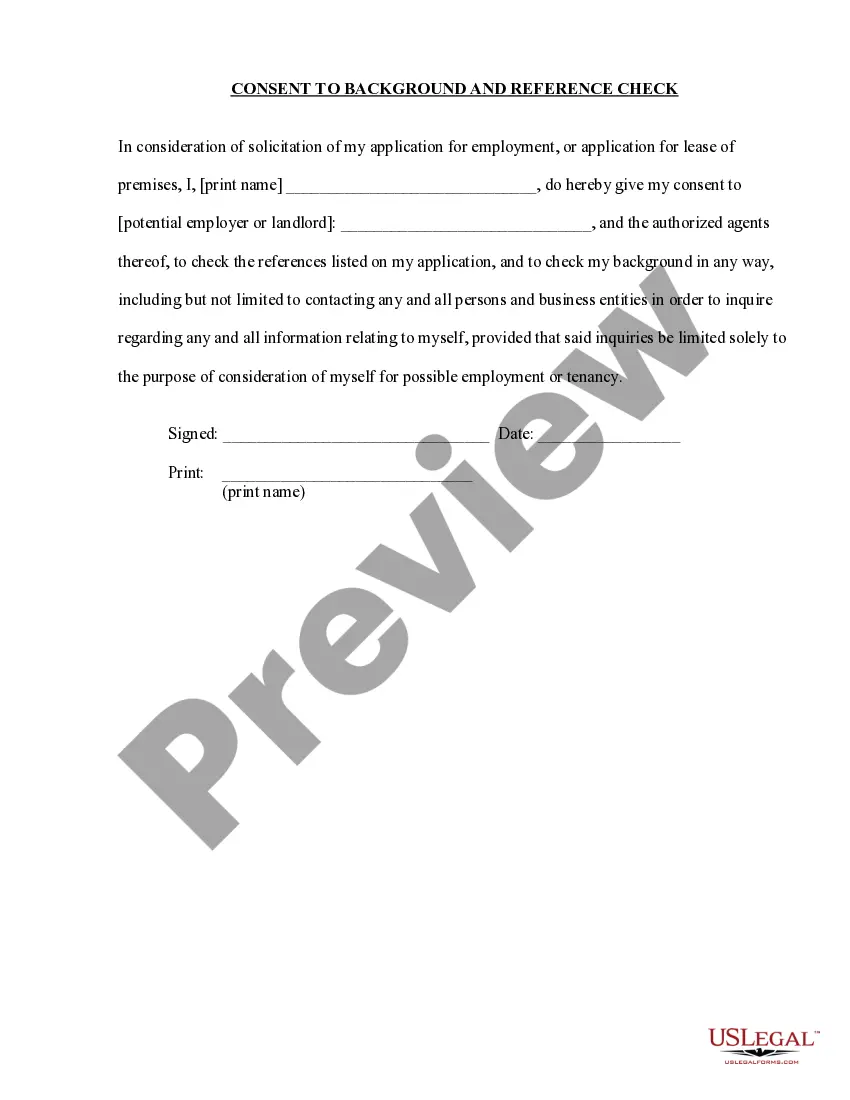

How to fill out District Of Columbia Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

Finding the right legal file template might be a struggle. Naturally, there are tons of templates available online, but how do you get the legal develop you need? Make use of the US Legal Forms site. The assistance provides a huge number of templates, for example the District of Columbia Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, which can be used for company and personal requirements. All the forms are checked out by specialists and satisfy federal and state demands.

When you are already signed up, log in to the accounts and then click the Acquire key to get the District of Columbia Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. Make use of your accounts to appear through the legal forms you have ordered earlier. Check out the My Forms tab of your own accounts and get yet another version of the file you need.

When you are a whole new customer of US Legal Forms, listed here are basic directions that you can comply with:

- Initially, make certain you have selected the appropriate develop to your area/area. You are able to look through the form making use of the Preview key and look at the form explanation to guarantee this is the right one for you.

- In the event the develop is not going to satisfy your requirements, utilize the Seach area to get the appropriate develop.

- When you are certain that the form is acceptable, click the Get now key to get the develop.

- Opt for the rates strategy you would like and enter the essential information and facts. Make your accounts and buy the order making use of your PayPal accounts or credit card.

- Select the data file file format and down load the legal file template to the device.

- Complete, revise and print out and sign the attained District of Columbia Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

US Legal Forms is the biggest catalogue of legal forms that you can find various file templates. Make use of the company to down load appropriately-produced documents that comply with status demands.